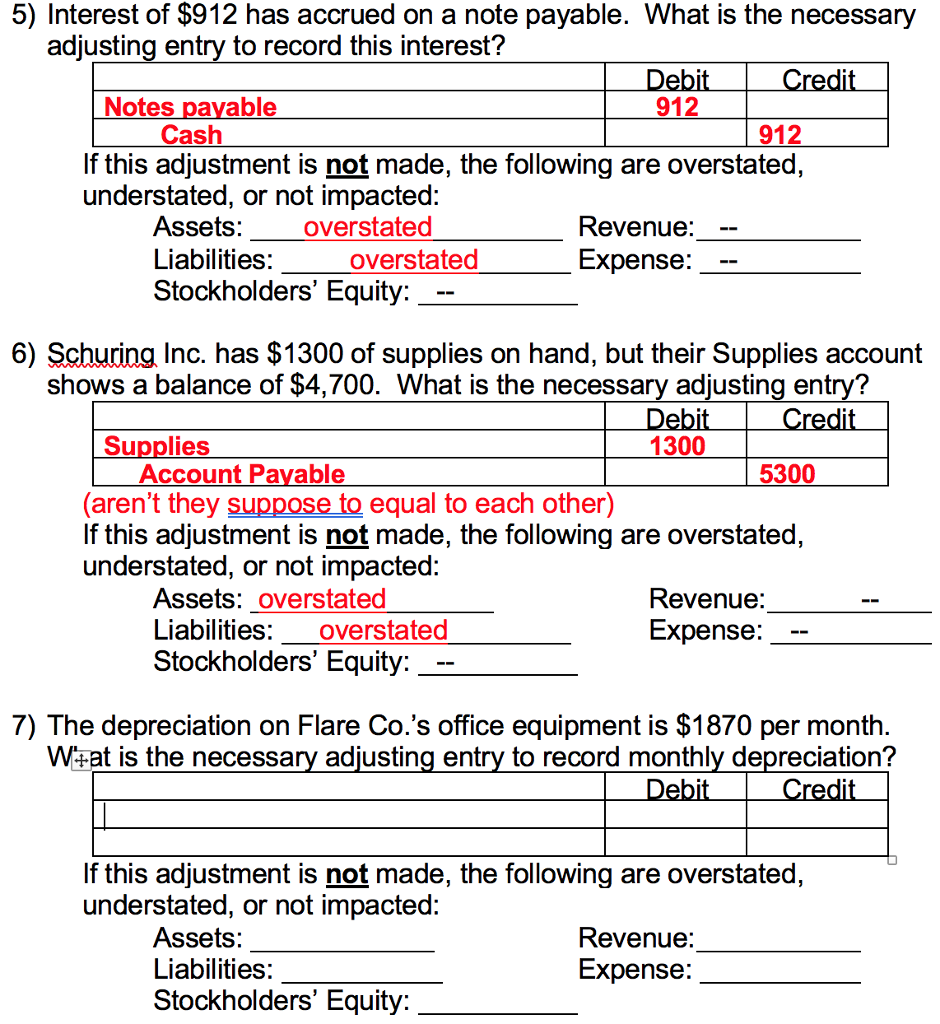

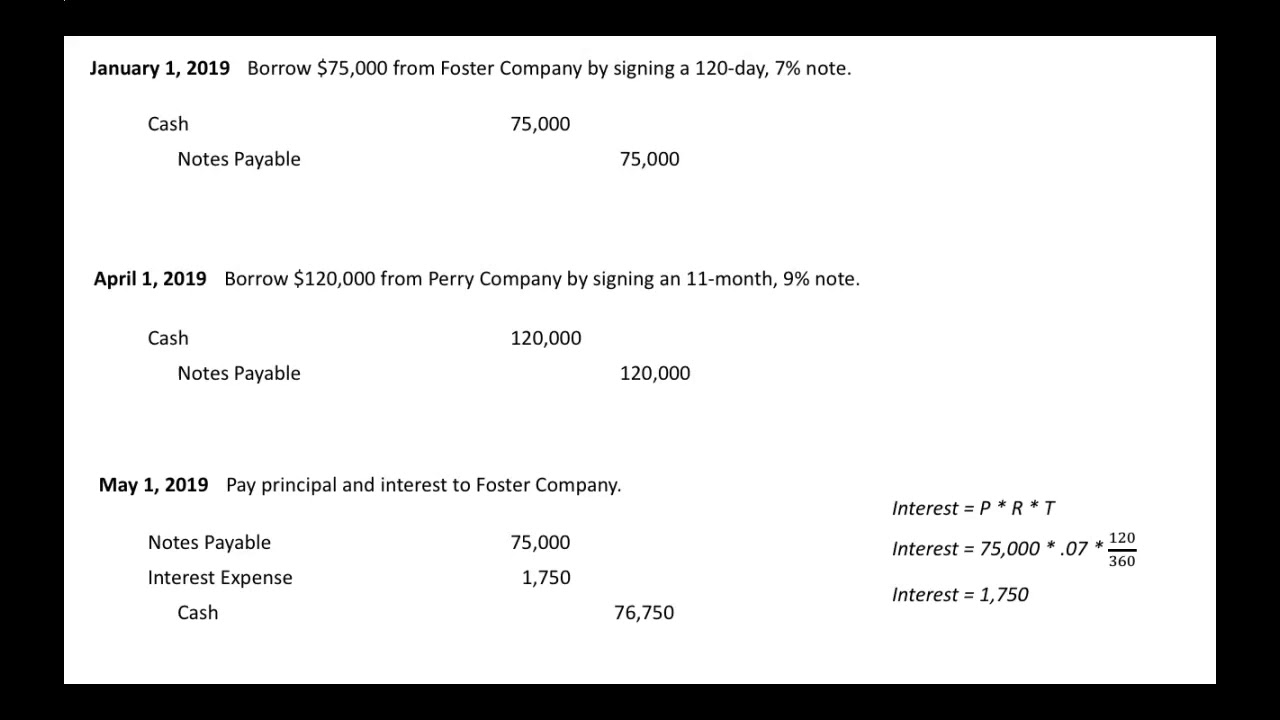

Paid Interest On Note Payable Journal Entry - Web in notes payable accounting there are a number of journal entries needed to record the note payable itself, accrued interest, and finally the repayment. The debit side of the journal entry should include. Interest payable on balance sheet; Web this journal entry of the borrowing on note payable will increase total assets as a result of receiving cash from the borrowing as well as increasing total liabilities on the balance. Web journal entry to accrue interest payable; Web each payment of $6,245 is divided between interest and principal. Web non interest bearing notes payable are issued by a business for cash, and are liabilities representing amounts owed by the business to a third party. Web this journal entry will increase total expenses on the income statement by $500 as a result of promising to pay a 10% interest on the note payable on june 30. Web interest payable is the payment obligation that the company owes to its bank or creditor for the borrowing or note payable that it has. Web the journal entry for the interest payable should include the amount of interest that is owed and the period in which it was incurred.

Note Payable Calculating Maturity date and Journal Entries (MOM

Some key characteristics of this written promise to pay (see figure. Web this journal entry will increase total expenses on the income statement by $500.

Notes Payable Journal Entries YouTube

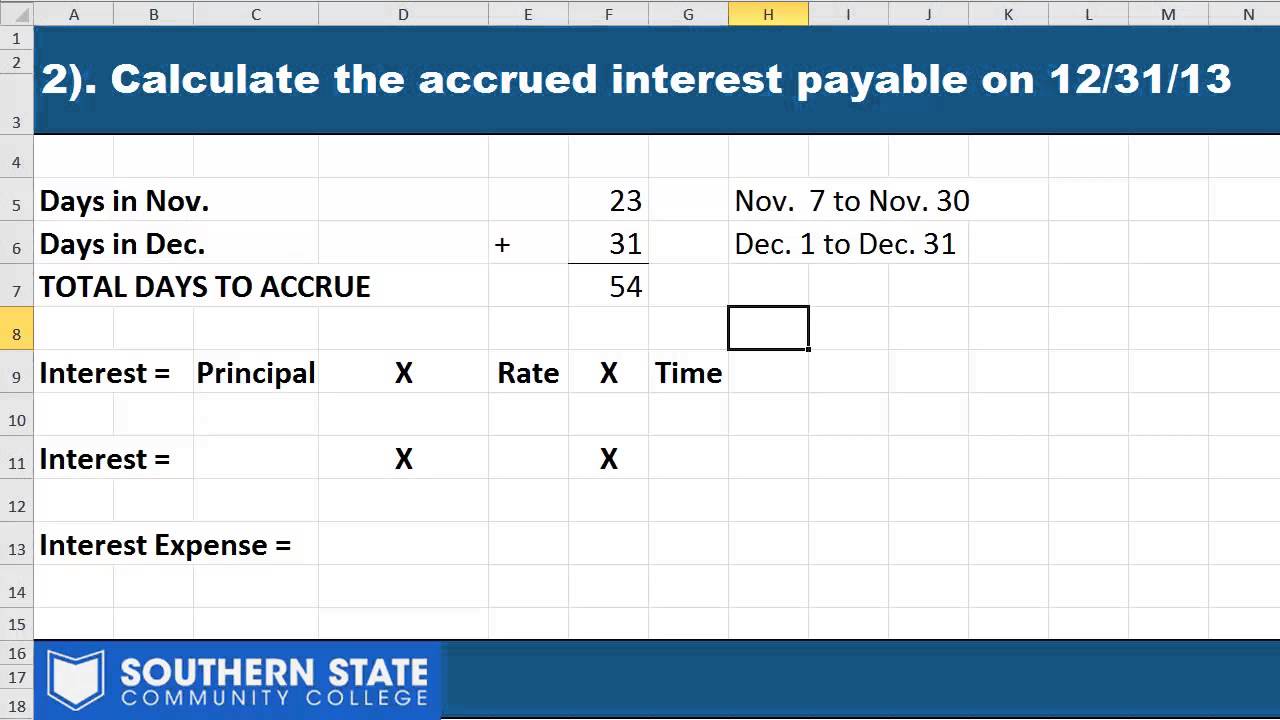

Yourco borrows $100,000 from the bank on december 1 of 20x1 at 12% interest (compounded. Web journal entry to accrue interest payable; Let’s discuss the.

Mortgage Payable Journal Entry

Issued notes payable for cash. Web journal entry to accrue interest payable; The company can calculate the interest on note payable by multiplying the face.

Casual Adjusting Entry For Notes Payable Cash Flow Indirect Method Template

Web in this case, we can make the journal entry for the accrued interest on the notes payable by debiting the interest expense account and.

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

Web journal entry to accrue interest payable; Web interest payable is the payment obligation that the company owes to its bank or creditor for the.

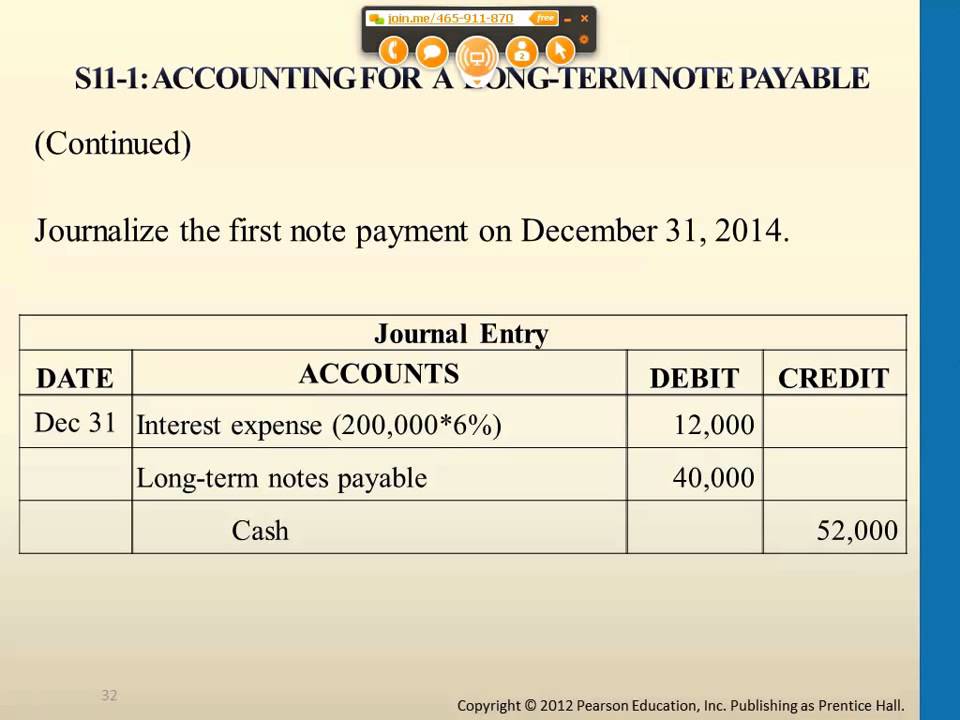

Accounting for a Long Term Note Payable YouTube

Some key characteristics of this written promise to pay (see figure. Interest payable on balance sheet; Web this journal entry of the borrowing on note.

Mortgage Note Payable (Journal Entries) YouTube

Web journal entries for notes payable. Issued notes payable for cash. Web non interest bearing notes payable are issued by a business for cash, and.

Notes Payable (Journal Entries) YouTube

The company can calculate the interest on note payable by multiplying the face value of the note payable with the interest rate and the. Interest.

Notes Payable

Web notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. Interest payable.

Issued Notes Payable For Cash.

The interest portion is 12% of the note's carrying value at the beginning of each year. Interest payable is an entity’s debt or lease. As the amount of interest accumulated. Web calculate interest on note payable.

Web The Journal Entry For The Interest Payable Should Include The Amount Of Interest That Is Owed And The Period In Which It Was Incurred.

Web this journal entry of the borrowing on note payable will increase total assets as a result of receiving cash from the borrowing as well as increasing total liabilities on the balance. When the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting the cash account. Some key characteristics of this written promise to pay (see figure. Web journal entry to accrue interest payable;

Let’s Discuss The Various Instances Of Notes Payable With Examples In Each Of The Following Circumstances:

Web in this case, we can make the journal entry for the accrued interest on the notes payable by debiting the interest expense account and crediting the interest payable account at. Web each payment of $6,245 is divided between interest and principal. Web record journal entries related to notes payable. The company receives from the bank the principal borrowed;

Web Interest Payable Is The Payment Obligation That The Company Owes To Its Bank Or Creditor For The Borrowing Or Note Payable That It Has.

Note payable scenarios also play a role. Interest expense increases (a debit) for $4,500 (calculated as $150,000. Web journal entries for notes payable. For example, on january 1, 2016, fbk company acquired a computer for $30,000 in cash and a $75,000 note due on.