Stock Option Expense Journal Entry - Share based payments (stock appreciation rights) journal entries for liability and expense of stock. Web the purpose of a stock option journal entry is to record the financial impact of stock options. This includes the value of the options, as well as any changes in that value. Web how to book early exercised stock options journal entry. The options have an aggregate fair value of $4,000 ($4 per. There are two prevailing forms of stock based compensation: The early exercise of stock options allows the option holder to purchase shares prior to the vesting period. The visual below illustrates the two key activities that. Reflect the cost of sbc via sbc expense and value of options via a reduction to equity value for option value , count only actual shares. This communication contains a general overview of the topic and is current as of march 1, 2021.

Examples of How to Record a Journal Entry for Expenses Hourly, Inc.

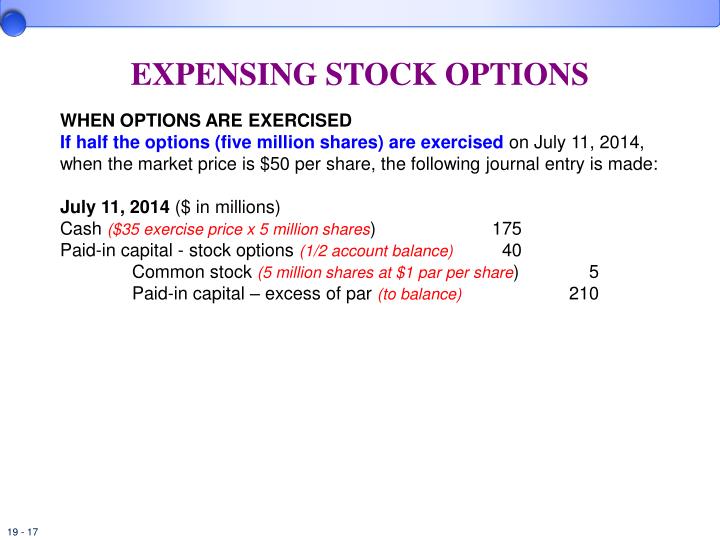

Your ask joey ™ answer. Web when the employee exercises the stock options, the company must record the following journal entry: The fair value of.

Perpetual Inventory System Journal Entry

Web when making a stock option expense journal entry, be sure to include the grant date fair value of the options, the length of time.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

The visual below illustrates the two key activities that. Web in the cash flow statement, stock option expense appears under the cash from operations heading..

Journal Entry Problems and Solutions Format Examples

The plan comes in the form of a regular call option that allows employees to buy shares at a. Your ask joey ™ answer. Web.

Solved Hi! I just need help with the two journal entries

Web journal entry for the expiration of stock appreciation rights. Web stock options o a contract that gives the holder the right, but not the.

Trading and Profit and Loss Account Opening Journal Entries

What is the journal entry to record stock options being exercised? Restricted stock and stock options. Stock option expense dr contributed capital cr the stock.

Stock option exercise journal entries 3 fast make money illegally online

This includes the value of the options, as well as any changes in that value. Reflect the cost of sbc via sbc expense and value.

Stock option expense statement and como es invertir en forex

Web assume a company grants stock options on january 1, 2018 to purchase 1,000 shares of stock at $10 per share. The early exercise of.

journal entry format accounting accounting journal entry template

Web in order to be recorded in journal entries, the stock compensation must be appropriately valued. Web the purpose of a stock option journal entry.

This Communication Contains A General Overview Of The Topic And Is Current As Of March 1, 2021.

Web stock options o a contract that gives the holder the right, but not the obligation, either to purchase (to call) or to sell (to put) a certain number of shares at a predetermined price. The two most common methods recognized by the financial. Web on the vesting date, the following journal entry recognizes the stock option expense: Restricted stock and stock options.

The Visual Below Illustrates The Two Key Activities That.

Stock option expense dr contributed capital cr the stock option. Web assume a company grants stock options on january 1, 2018 to purchase 1,000 shares of stock at $10 per share. Web a stock option expense journal entry is a type of accounting transaction that businesses use to record the expenses associated with issuing and granting stock options to. Web in the cash flow statement, stock option expense appears under the cash from operations heading.

Web Stock Based Compensation Journal Entries.

The options have an aggregate fair value of $4,000 ($4 per. Gaap accounting is slightly di. Share based payments (stock appreciation rights) journal entries for liability and expense of stock. The early exercise of stock options allows the option holder to purchase shares prior to the vesting period.

Web In Order To Be Recorded In Journal Entries, The Stock Compensation Must Be Appropriately Valued.

Web journal entry for stock options when accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to. Web how to book early exercised stock options journal entry. This includes the value of the options, as well as any changes in that value. Company xyz provides 1,000 stock options to the cfo, it allows him to purchase the stock at $10 per share in the next two years.