Journal Entry For Interest Expense - Some key characteristics of this written promise to pay (see figure. Web that entry would be: After the calculation, the company needs to record interest expense on the income statement. Web the journal entry for year 2 is: Web interest expense = ($ 50,000 x 12%)/12 months = $ 5,000 per month. Learn how to record interest expense and interest payable in the accounting journal with examples. The accounting entry will be reversed on the day of payment of the. Web the formula is: Web the following accounting entry will be recorded to account for the interest expense accrued: Web let’s look at a payment of $1,000 with $800 going towards the loan balance and $200 being interest expense.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

For example, a company has borrowed. Web interest expense = ($ 50,000 x 12%)/12 months = $ 5,000 per month. Web the following accounting entry.

What is Accrued Interest? Formula + Loan Calculator

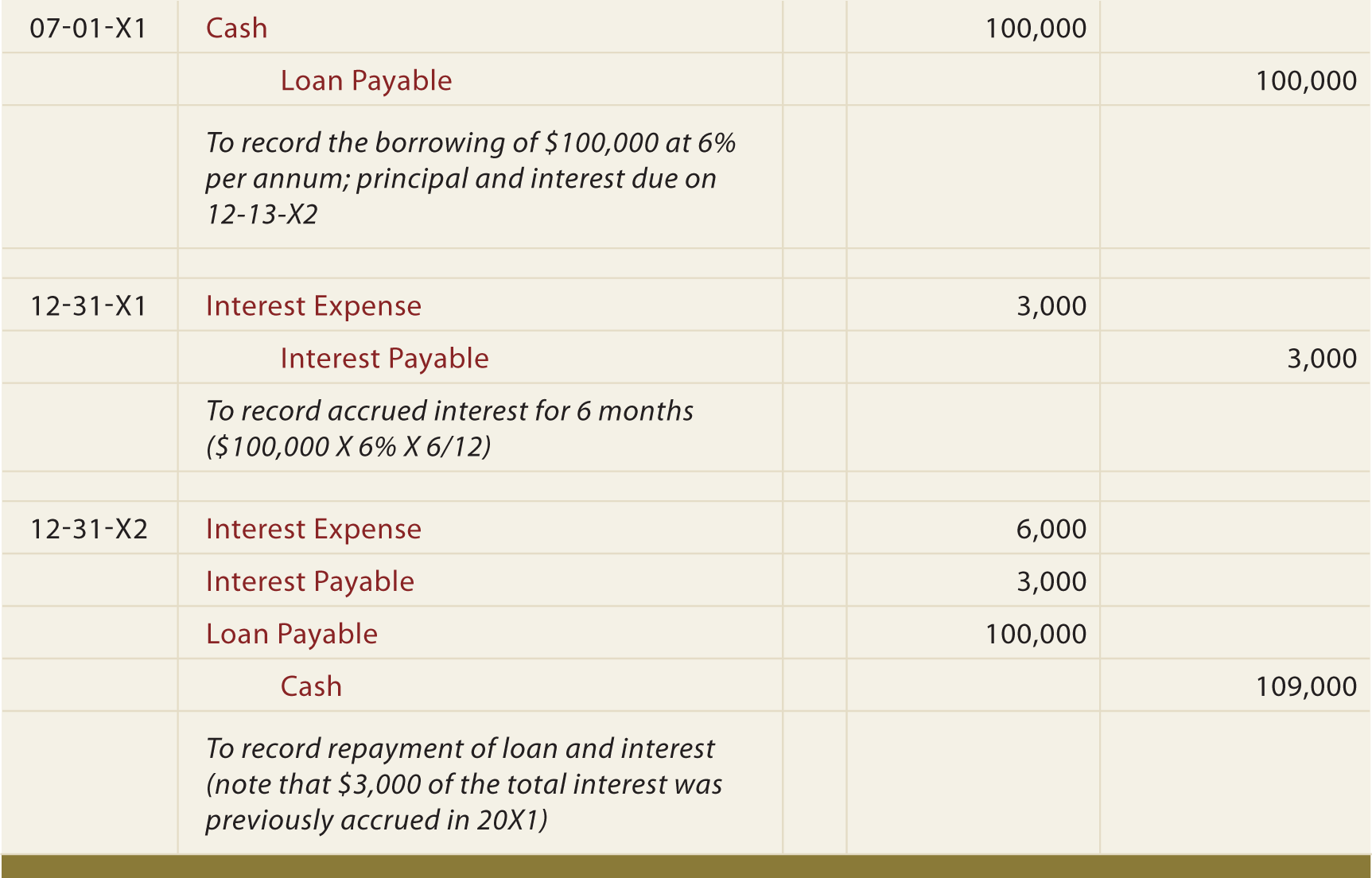

See the adjusting entry and the payment entry for interest expense and interest payable. The process for recording accrued interest may vary depending on your.

Mortgage Payable Journal Entry

See a detailed example of a note payable with. Web the entry consists of interest income or interest expense on the income statement, and a.

How to Adjust Journal Entry for Unpaid Salaries

Represents the amount of interest currently owed to lenders. For the cash side, we record the $1,000 leaving the. Since the payment of accrued. Web.

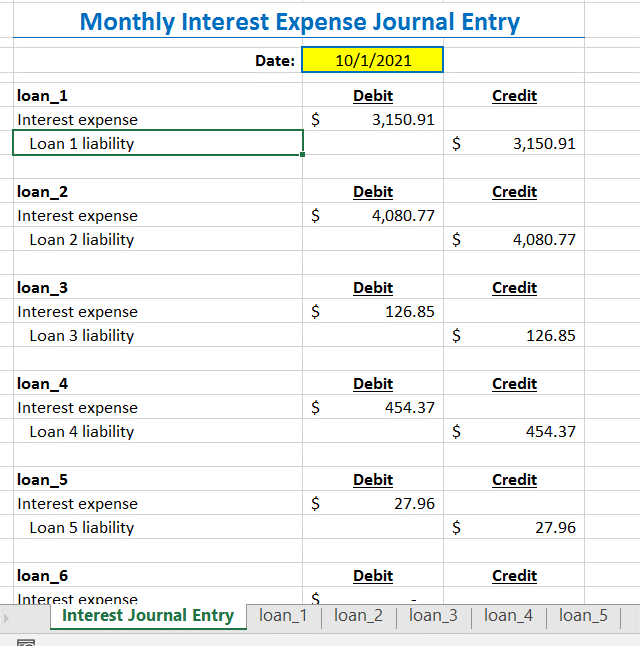

Loan Interest Expense Made Easy Anthony W. Imbimbo CPA

Web the journal entry for year 2 is: The process for recording accrued interest may vary depending on your status, such as whether you're a.

Self Study Notes The Adjusting Process And Related Entries

Web the following accounting entry will be recorded to account for the interest expense accrued: The interest expense is calculated by taking the carrying value.

Great Paying Interest Expense And Receiving Revenue Are Examples Of The

See the adjusting entry and the payment entry for interest expense and interest payable. Web the balance sheet or journal entry for interest payable enables.

Journal Entries Format

For example, a company has borrowed. Some key characteristics of this written promise to pay (see figure. What is considered a lease under ifrs 16?.

Basic Accounting for Business Your Questions, Answered

Since the payment of accrued. Web with the above information, here is the formula to calculate accrued interest: Web most companies record the amount of.

Web Journal Entries For Expenses Are Records You Keep In Your General Ledger Or Accounting Software That Track Information About Your Business Expenses, Like The Date They.

Web that entry would be: Web interest expense = ($ 50,000 x 12%)/12 months = $ 5,000 per month. Journal entries are the base of accounting. Web the balance sheet or journal entry for interest payable enables firms to check and track their financial obligations and be prepared to bear them as and when.

The Interest Expense Is Calculated By Taking The Carrying Value ($93,226) Multiplied By The Market Interest Rate (7%).

What is considered a lease under ifrs 16? Example of how to calculate interest expense. Web let’s look at a payment of $1,000 with $800 going towards the loan balance and $200 being interest expense. Web with the above information, here is the formula to calculate accrued interest:

Learn How To Record Interest Expense And Interest Payable In The Accounting Journal With Examples.

After the calculation, the company needs to record interest expense on the income statement. Ifrs 16 finance lease example (lessee) amortization schedule. The amount of the cash. Web how to record accrued interest.

Web Expense Journal Entries Are The Critical Accounting Entries That Reflect The Expenditures Incurred By The Entity.

The april 30 entry in the next year would include the accrued amount from december of last year and interest expense for jan to april of this year. Web the following accounting entry will be recorded to account for the interest expense accrued: The process for recording accrued interest may vary depending on your status, such as whether you're a borrower or lender. Represents the amount of interest currently owed to lenders.