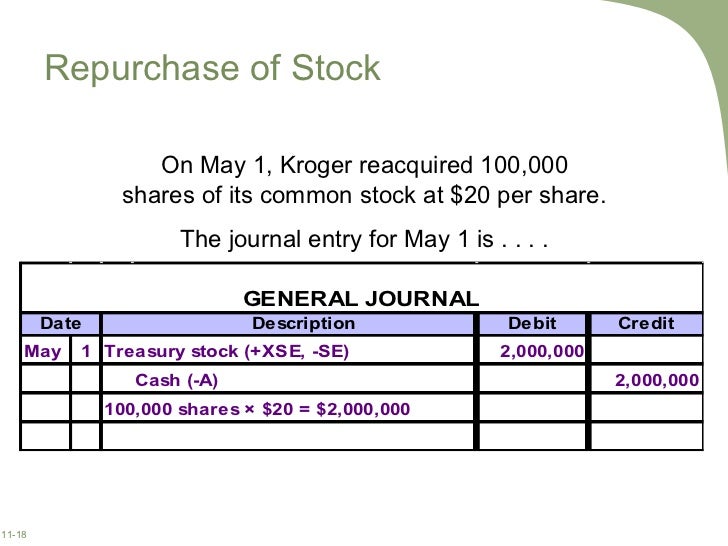

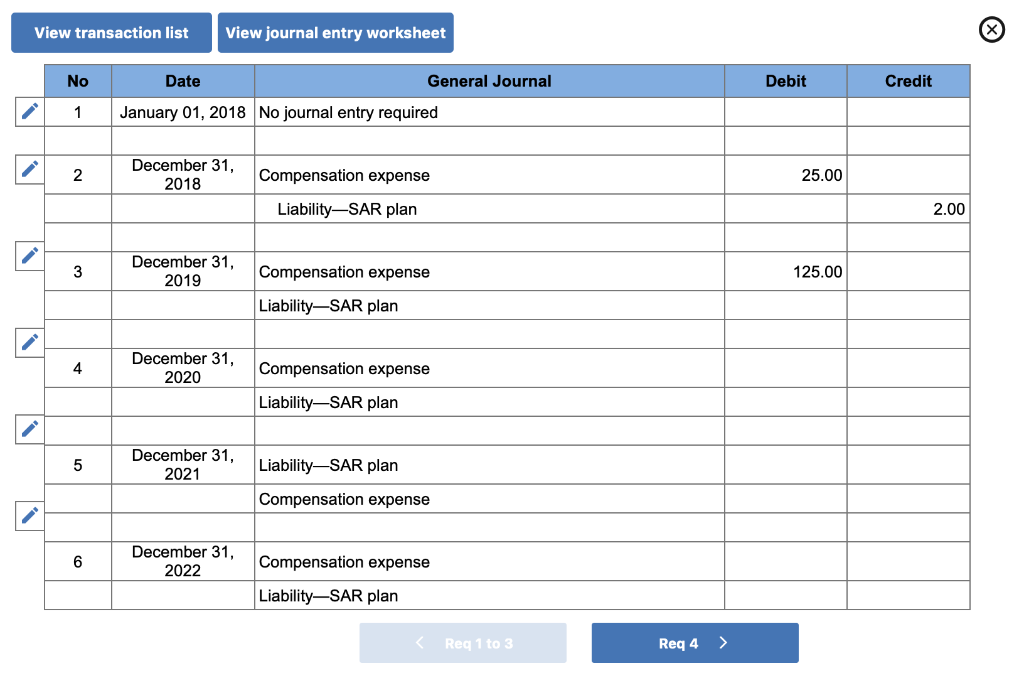

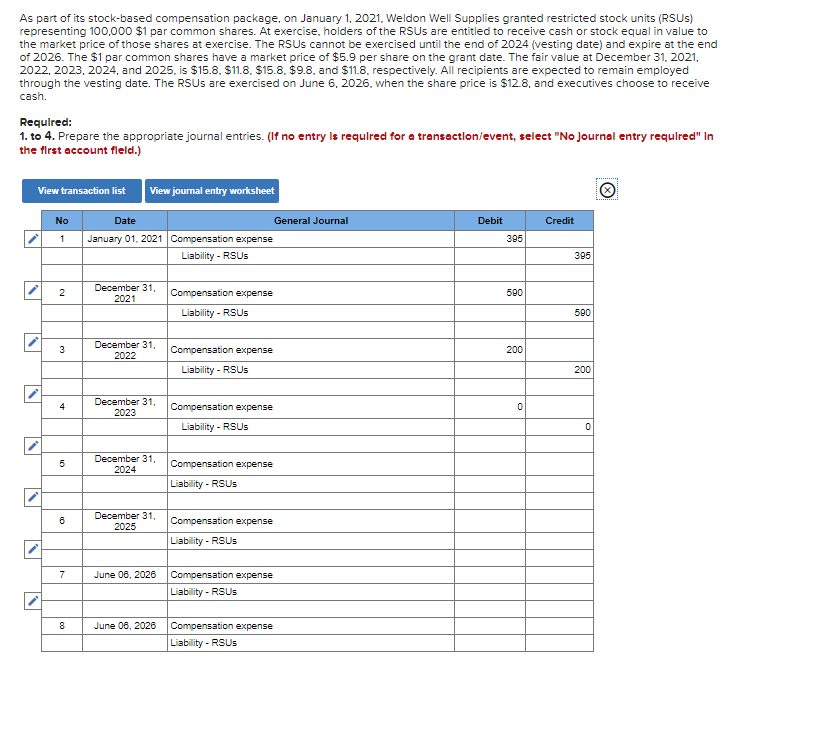

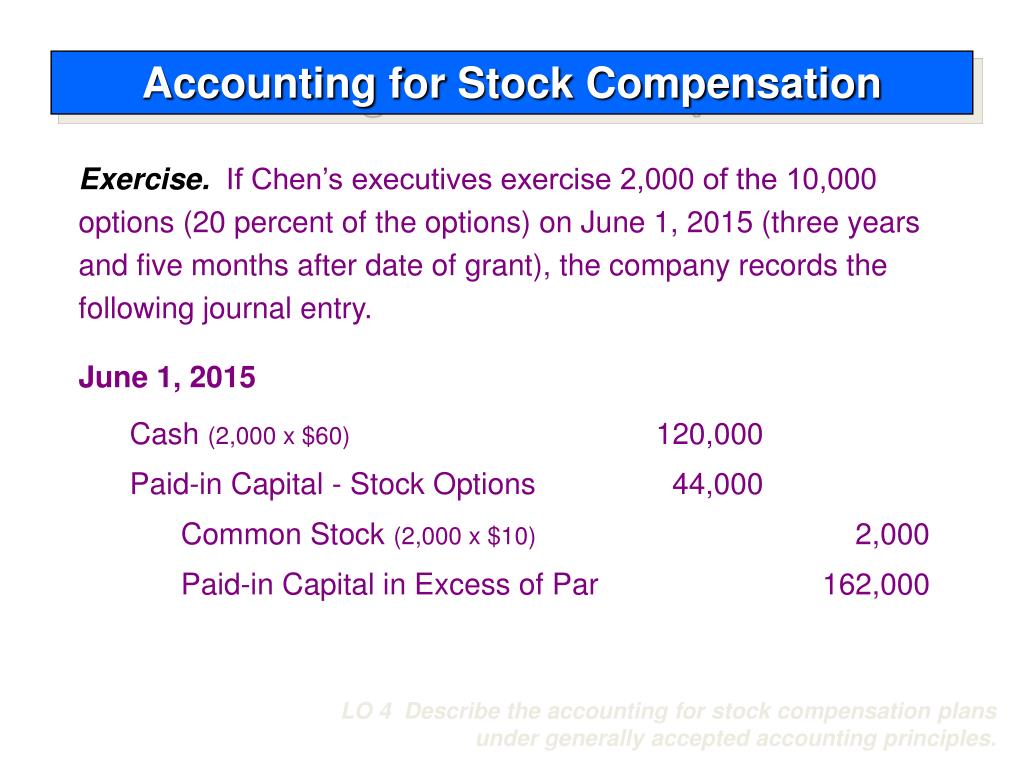

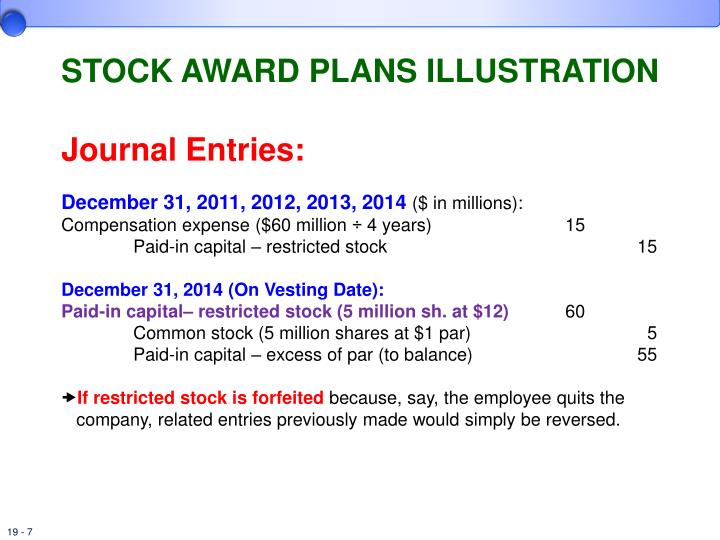

Stock Compensation Journal Entry - Web armed with key details, including the stock type, vesting conditions and schedule, grant date, and fmv, you’re now prepared to make journal entries. Every transaction that impacts a company's financial condition, such as the exercise of a stock option, is recorded with a journal entry. At the end of the period: This chapter addresses the accounting treatment for employee stock purchase plans (espps) under. No journal entry on the grant date. Expected future issuance of dilutive securities. Web in order to be recorded in journal entries, the stock compensation must be appropriately valued. Web journal entry for the redemption of stock appreciation rights. To record the issue of stock compensation there is no impact on the financial statement, these three accounts will be offset in the equity section. To record compensation expense after vested period.

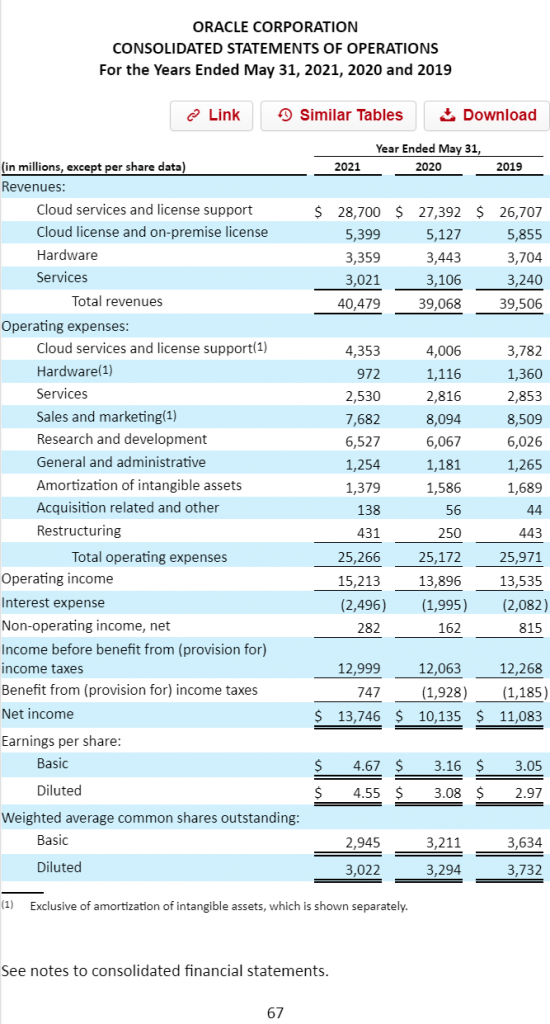

Stock Based Compensation Expense and FCF Explained In a Simple Way

There are three transactions related to the stock compensation. Senior engineers earn 10.8% more. We will not recognize the expense yet. Restricted stock and stock.

Journal entry to record issuance of stock options * yvydarajyxix.web

There are three transactions related to the stock compensation. Every transaction that impacts a company's financial condition, such as the exercise of a stock option,.

Accounting Journal Entries For Dummies

A journal entry has to. There are two prevailing forms of stock based compensation: Web journal entry for the redemption of stock appreciation rights. No.

Solved As part of its stockbased compensation package,

We will not recognize the expense yet. At the end of the period: Senior engineers earn 10.8% more. To record the issue of stock compensation.

Solved As part of its stockbased compensation package, on

Senior engineers earn 10.8% more. Gaap accounting is slightly di erent. A journal entry has to. Journal entry for the expiration of stock appreciation rights..

How Do You Book Stock Compensation Expense Journal Entry? FloQast

A journal entry has to. When the options are exercised:. Web compensation expense entries are made during the vesting period. There are three transactions related.

PPT Intermediate Accounting 14th Edition PowerPoint Presentation

Web compensation expense entries are made during the vesting period. Journal entry for the expiration of stock appreciation rights. Restricted stock and stock options. Web.

PPT Chapter 19 ShareBased Compensation ASC 718 (SFAS 123R

Web journal entry for the redemption of stock appreciation rights. A journal entry has to. Expected future issuance of dilutive securities. Senior engineers earn 10.8%.

Solved Hi! I just need help with the two journal entries

When the options are exercised:. Gaap accounting is slightly di erent. Every transaction that impacts a company's financial condition, such as the exercise of a.

Journal Entry For The Expiration Of Stock Appreciation Rights.

No journal entry on the grant date. Web stock based compensation journal entries. At the end of the period: There are two prevailing forms of stock based compensation:

Gaap Accounting Is Slightly Di Erent.

Web in order to be recorded in journal entries, the stock compensation must be appropriately valued. Expected future issuance of dilutive securities. The two most common methods recognized by the financial. Restricted stock and stock options.

When The Options Are Exercised:.

We will not recognize the expense yet. There are three transactions related to the stock compensation. Web journal entry for the redemption of stock appreciation rights. Senior engineers earn 10.8% more.

Compare Actual Vs Projected Stock Comp.

Web armed with key details, including the stock type, vesting conditions and schedule, grant date, and fmv, you’re now prepared to make journal entries. Every transaction that impacts a company's financial condition, such as the exercise of a stock option, is recorded with a journal entry. To record compensation expense after vested period. Web compensation expense entries are made during the vesting period.