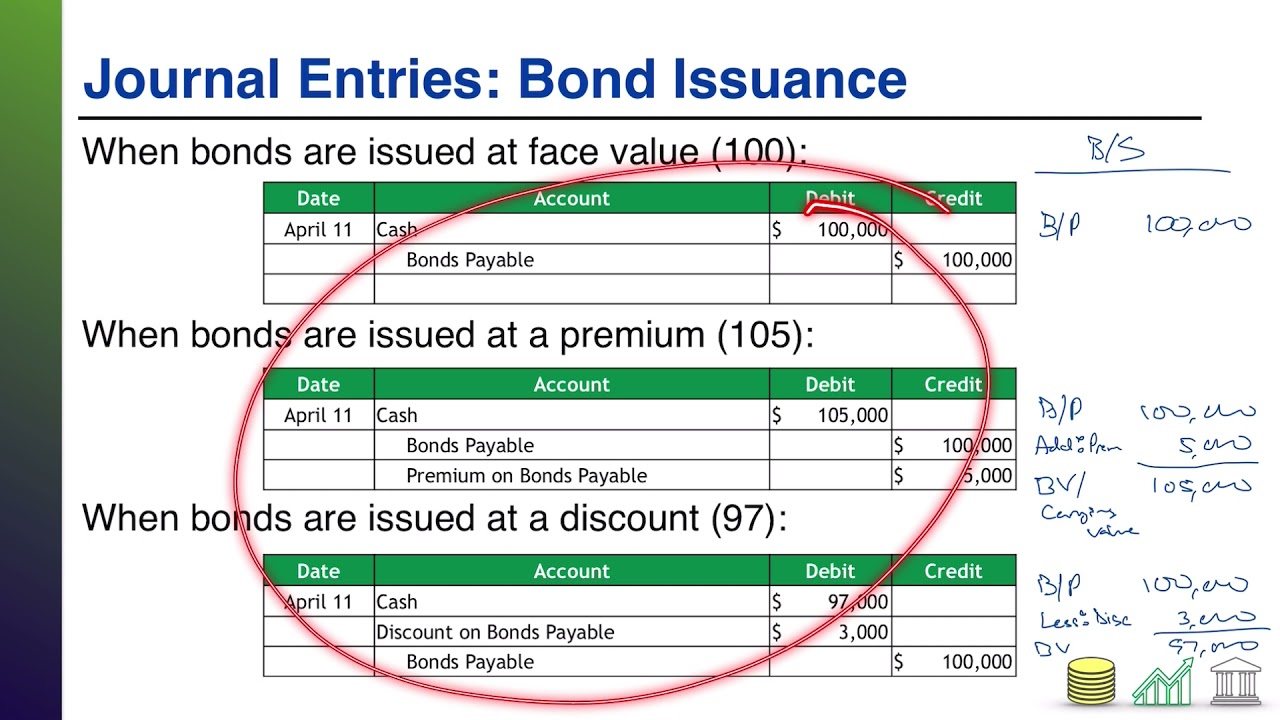

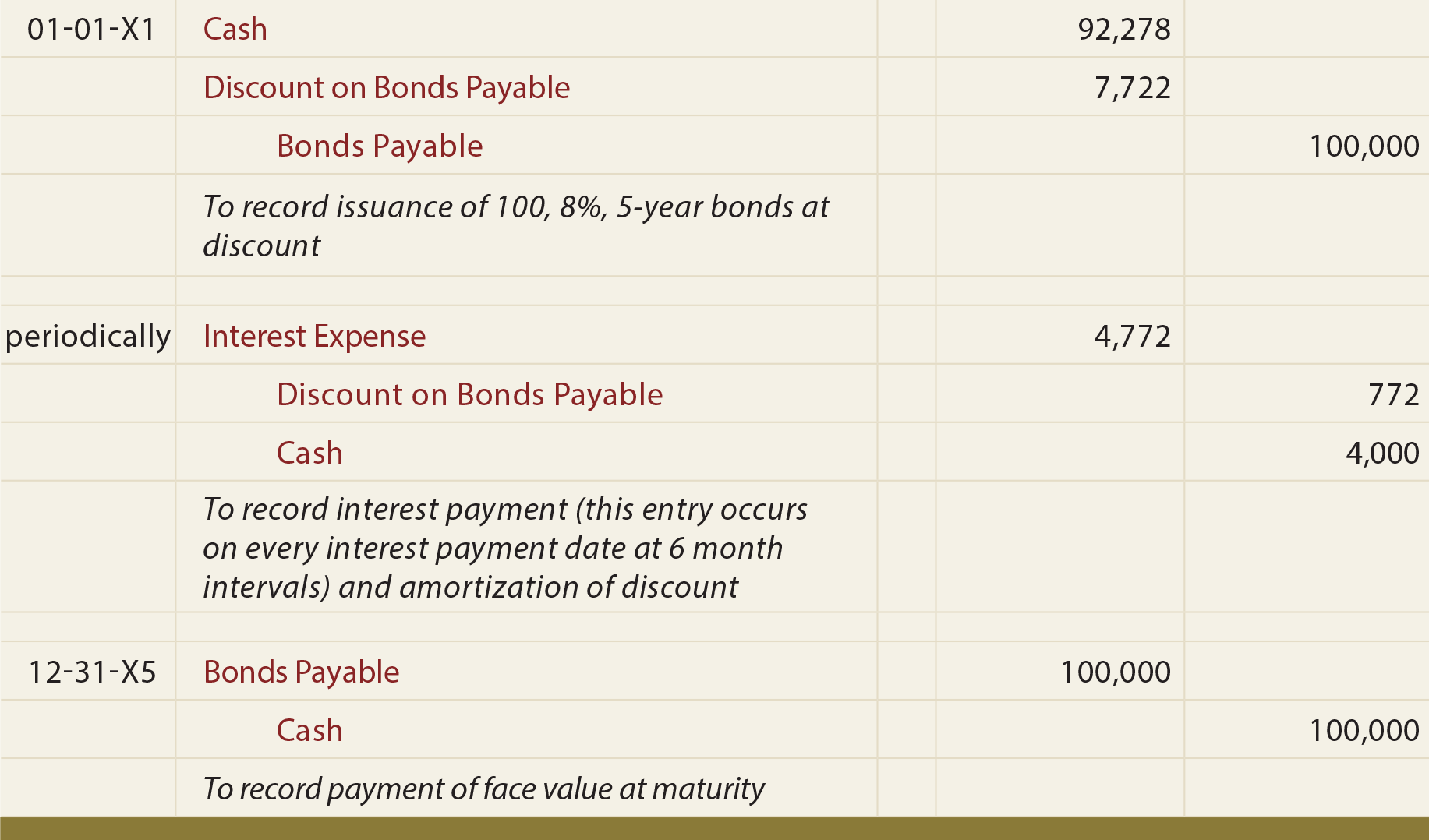

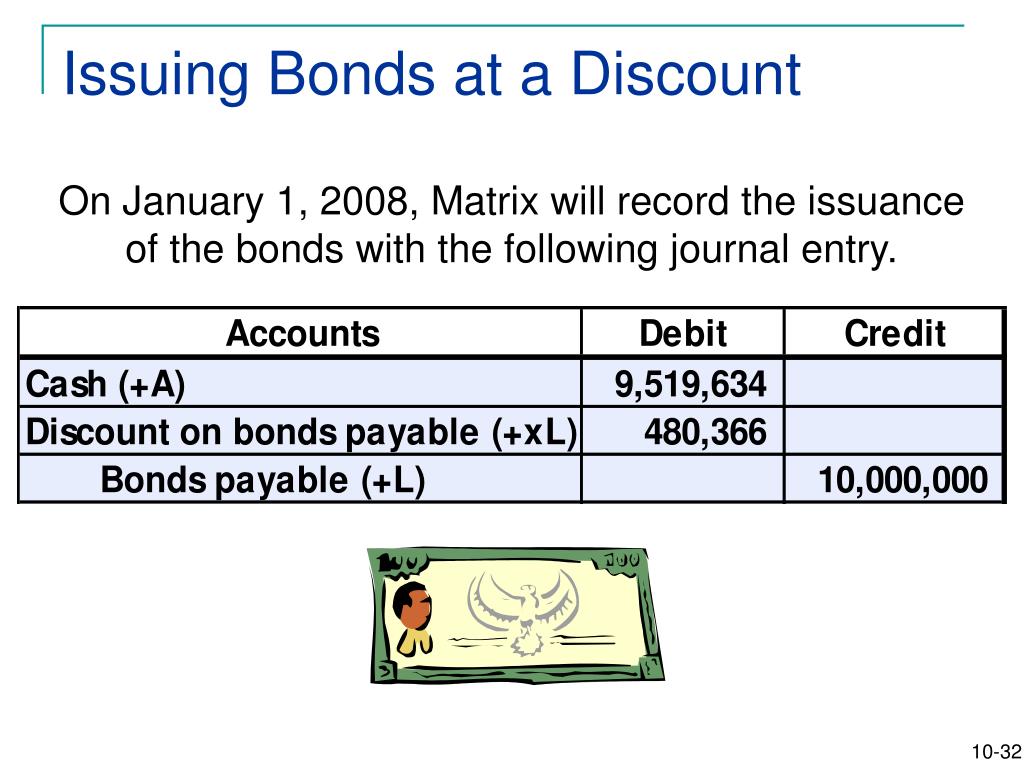

Journal Entry For Bond Discount - Thus, at the date of issuance, the journal entry for bond issued at discount is as follow: The process of recording the amortization of a bond discount involves a debit and a credit entry in the company’s accounting records. Web in this section, we will explore the journal entries related to bonds. Web the total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years. When the company issues a bond at the discount, it can make the bond discount journal entry by debiting the cash account and the unamortized bond discount account and crediting the bonds payable account. To record issue of bond at a discount. The journal entry is debiting investments in bonds and credit cash. Interest = interest amount per payable period. Amortize the discount or premium; The transaction will increase the investment account on the balance sheet and reduce the cash amount.

Bond Issuance Journal Entries and Financial Statement Presentation

Unamortized bond discount is a contra account to bonds payable which its normal balance is on. There are two primary methods of bond amortization: Web.

P108A, Prepare journal entries to record issuance of bonds, interest

Web journal entry for bond purchased at discount. Earlier, we found that cash flows related to a bond include the following: Web journal entry of.

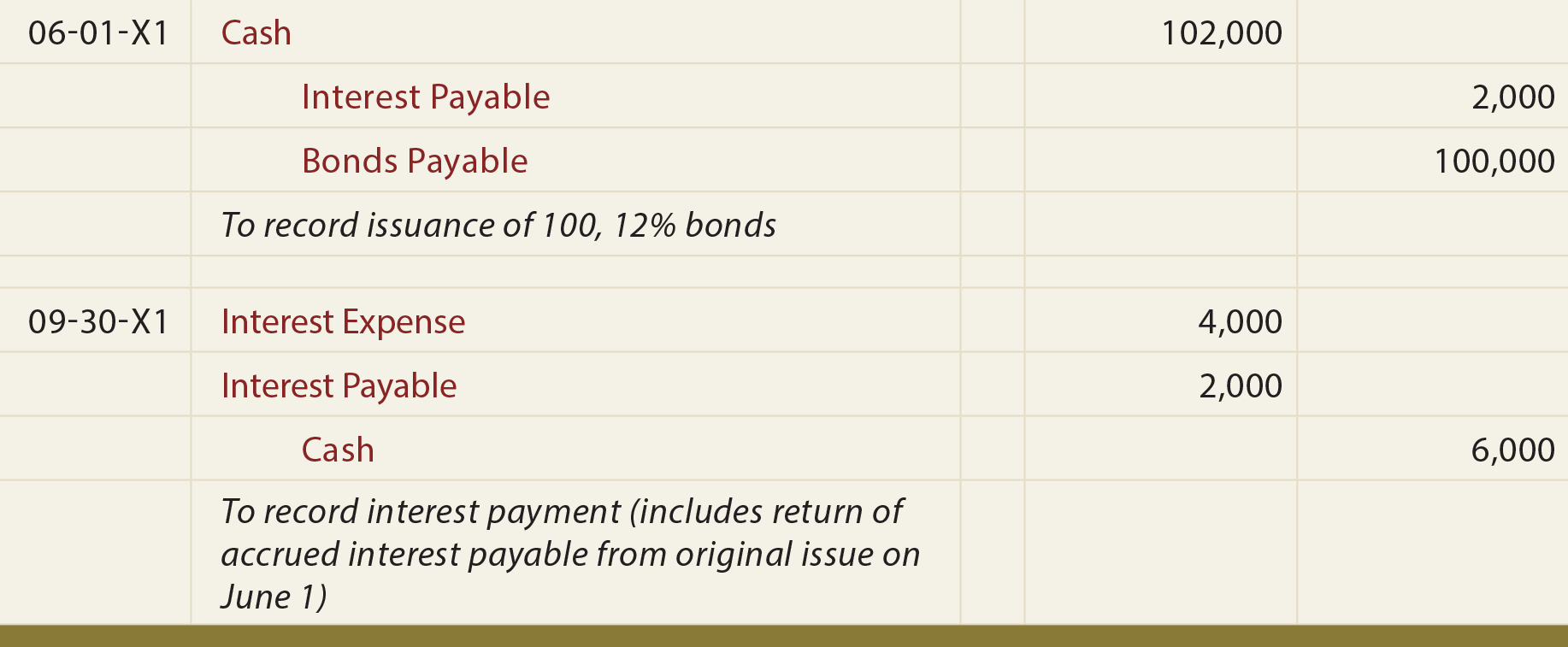

Bonds Issued Between Interest Dates

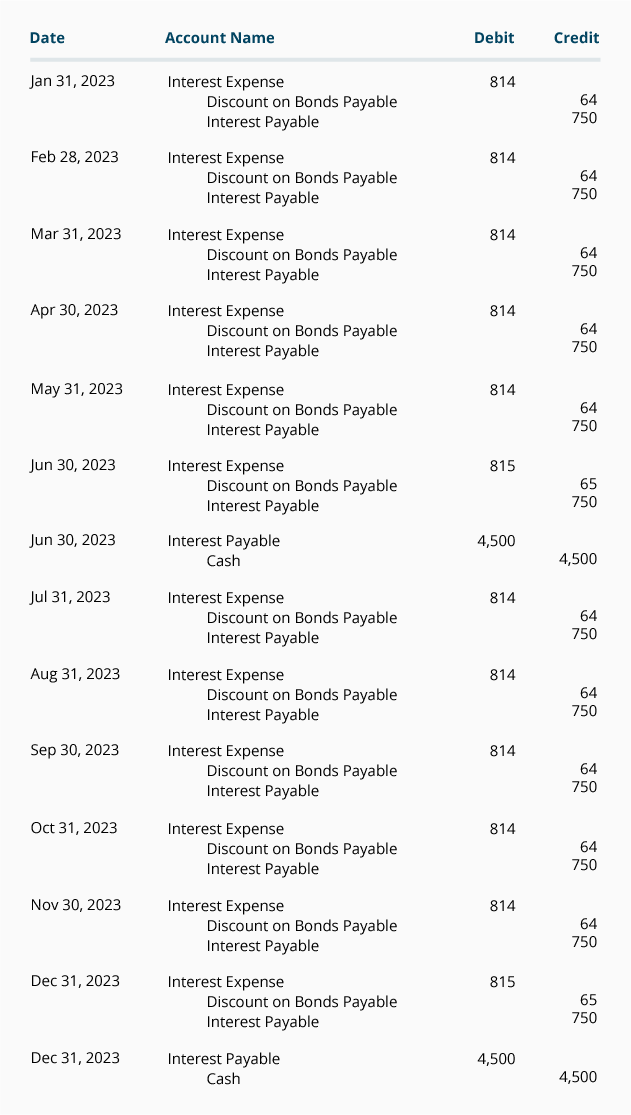

Under straight line method, amortization of bond discount do not vary over the term of the bond. The debit is made to the interest expense.

Bond Discount with StraightLine Amortization AccountingCoach

Using the effective interest rate method; Web the total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

Web the total par value of the bonds is $100,000 with an interest of 10% semiannually with a maturity of 5 years. The debit is.

Premium On Bonds Payable Journal Entry / Bonds Issued At A Premium

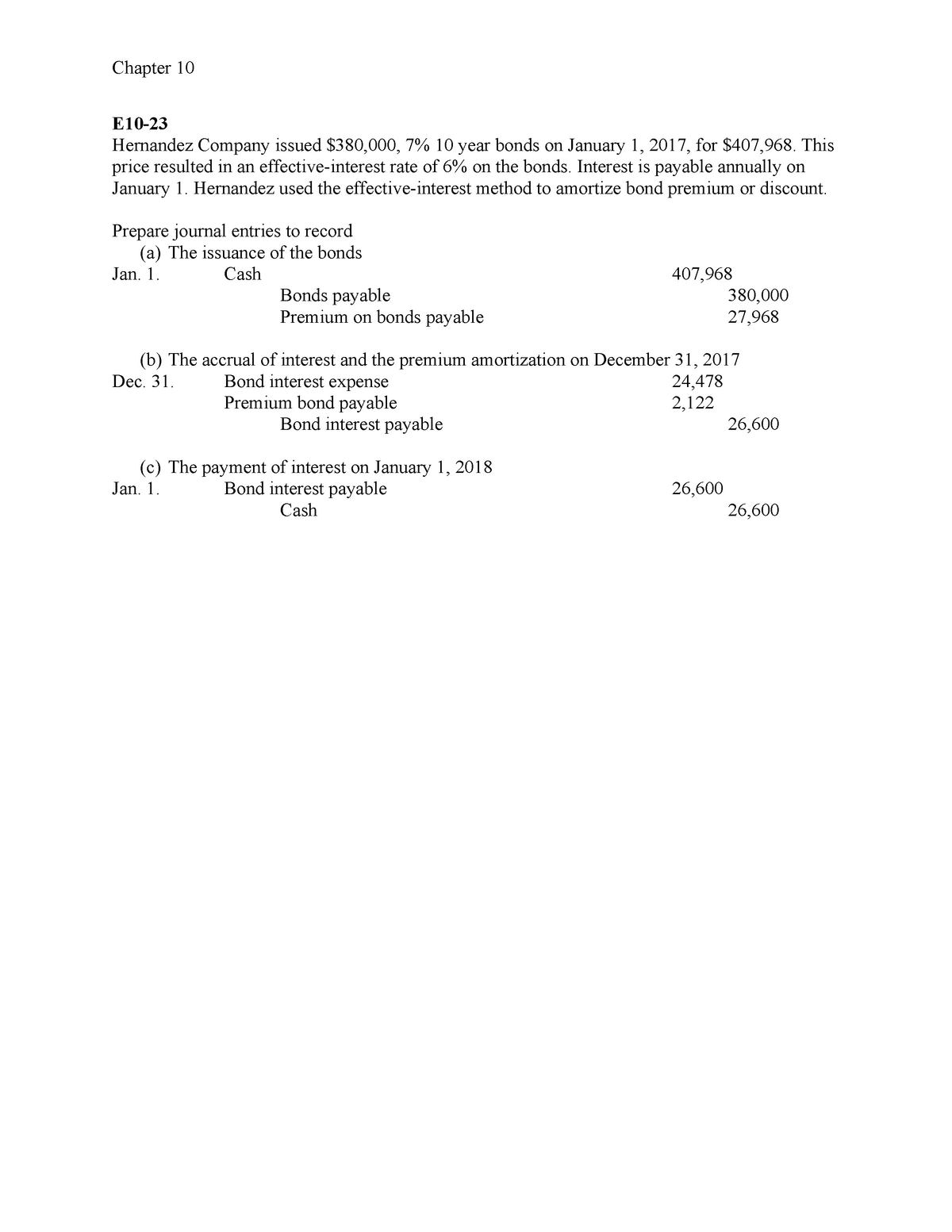

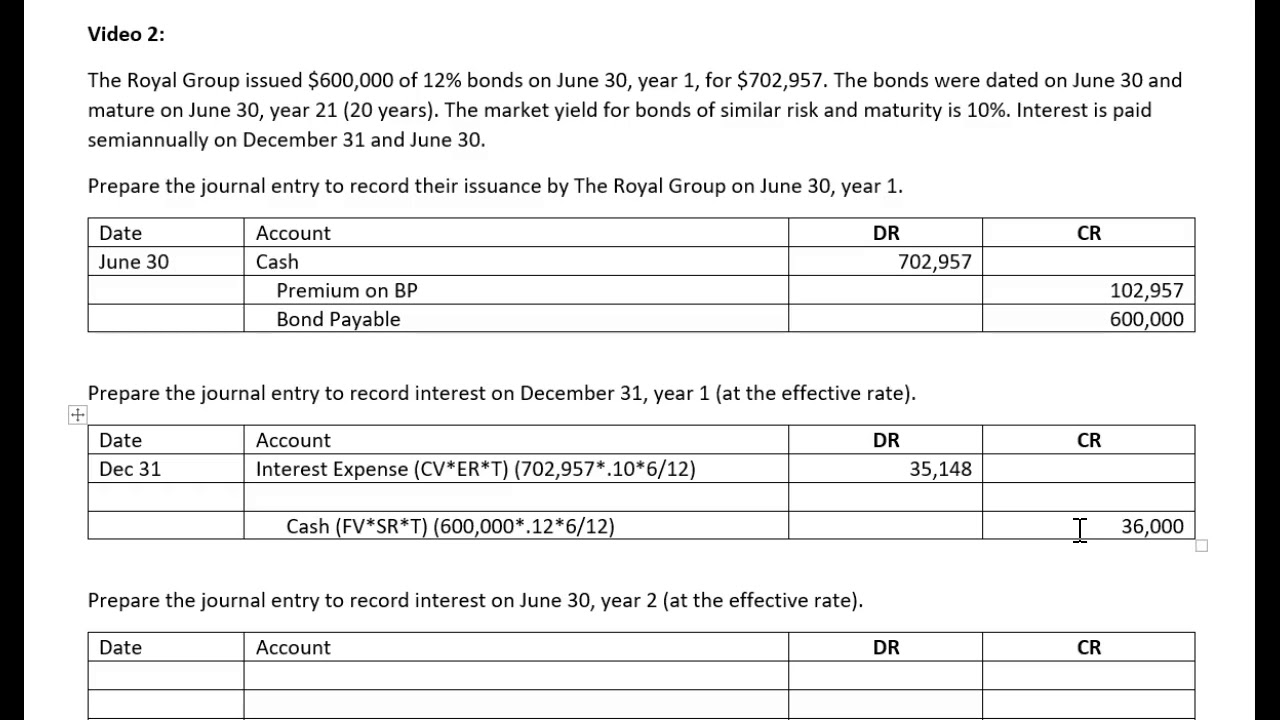

Bonds issued at a premium. I = the market interest rate. Web there are four journal entries that relate to bonds that are issued at.

Discount Received Journal Entry Cash Purchase of Goods Double Entry

One simple way to understand bonds issued at a premium is to view the accounting relative to counting money! Web journal entry for discount amortization..

Chapter 11 Journal Entry Bond&Discount Bonds YouTube

Bond discount amortization is the process through which bond discount is written off over the life of the bond. Web the 12 monthly journal entries.

Bonds Payable Lecture 2 Journal Entries YouTube

The journal entry is debiting investments in bonds and credit cash. The issuer needs to recognize the financial liability when publishing bonds into the capital.

The Journal Entries For The Remaining Years Will Be Similar If All Of The Bonds Remain Outstanding.

Earlier, we found that cash flows related to a bond include the following: Web by obaidullah jan, aca, cfa and last modified on oct 31, 2020. Under straight line method, amortization of bond discount do not vary over the term of the bond. Bond issue at par value.

Web Journal Entry Of Discount On Bond Payable.

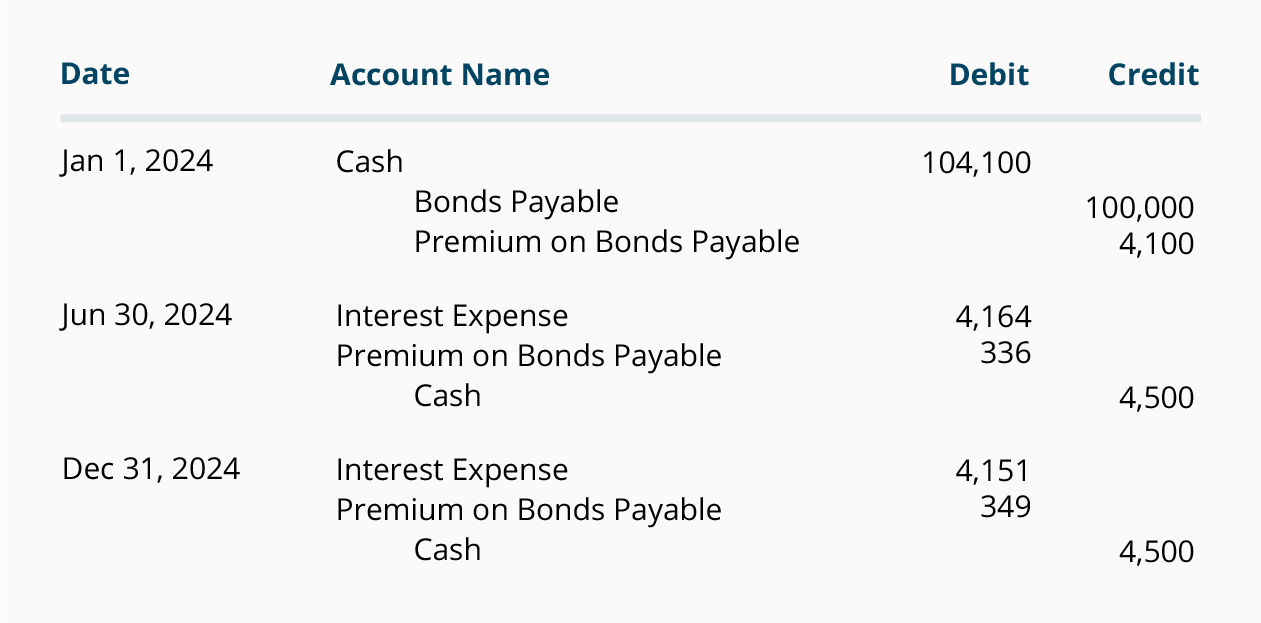

The transaction will increase the investment account on the balance sheet and reduce the cash amount. When a company issues bonds at a premium or discount, the amount of bond interest expense recorded each period differs from bond interest payments. A journal entry must be made for each of these transactions. Web journal entry for bonds.

Web There Are Five Possible Journal Entries Related To Investing In Bonds, As Follows:

Web journal entry for discount amortization. 3.2k views 4 years ago accounting videos. Bonds issued at a premium. The issuer needs to recognize the financial liability when publishing bonds into the capital market and cash is received.

Interest = Interest Amount Per Payable Period.

Web journal entry for bond purchased at discount. Thus, at the date of issuance, the journal entry for bond issued at discount is as follow: The debit is made to the interest expense account, reflecting the increase in cost over the coupon payment due to the amortization. Amortize the discount or premium;