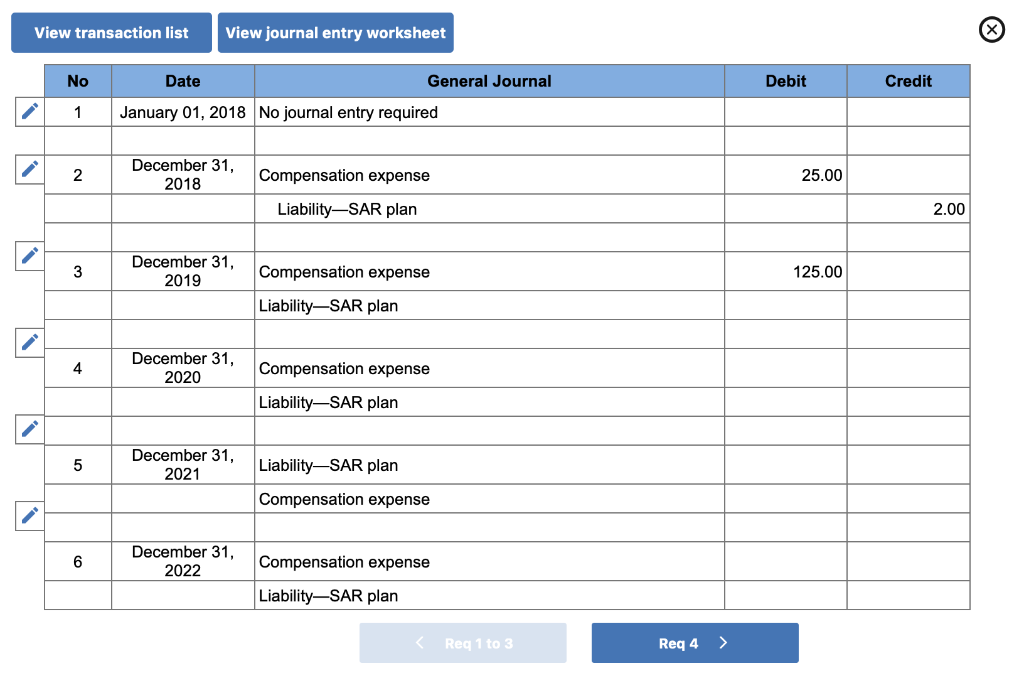

Stock Compensation Expense Journal Entry - Sc corporation estimates a 5% annual forfeiture rate, based on its historical forfeitures. On january 1, 20x5, 20,000 sars are exercised at a fair value of $21 per sar, resulting in a cash payment of $420,000 (20,000 × $21). It’s important to note that every transaction should. Web journal entry for the redemption of stock appreciation rights. What is stock based compensation? This section discusses the determination of the grant date, service inception date, and requisite service period, expense attribution and how to account for changes in the requisite service period. In this ultimate guide, we will decode the intricacies of stock compensation expense and procurement journal entries. Web compensation—stock compensation (topic 718) and revenue from contracts with customers (topic 606): For today’s blog entry, i get back to the basics in stock plan accounting. The two most common methods recognized by the financial accounting standards board (fasb) are intrinsic value and fair value methods.

How to calculate stock based compensation expense, kmart fountain gate

Asc 718 addresses the accounting for. For today’s blog entry, i get back to the basics in stock plan accounting. Web journal entry for the.

Stock compensation journal entries r/Accounting

Web are you baffled by stock compensation expenses and procurement journal entries? The two most common methods recognized by the financial accounting standards board (fasb).

Stock Based Compensation Expense and FCF Explained In a Simple Way

Do these terms seem like a foreign language to you? Asc 718 addresses the accounting for. Learn how to record stock based compensation expense using.

Accounting Journal Entries For Dummies

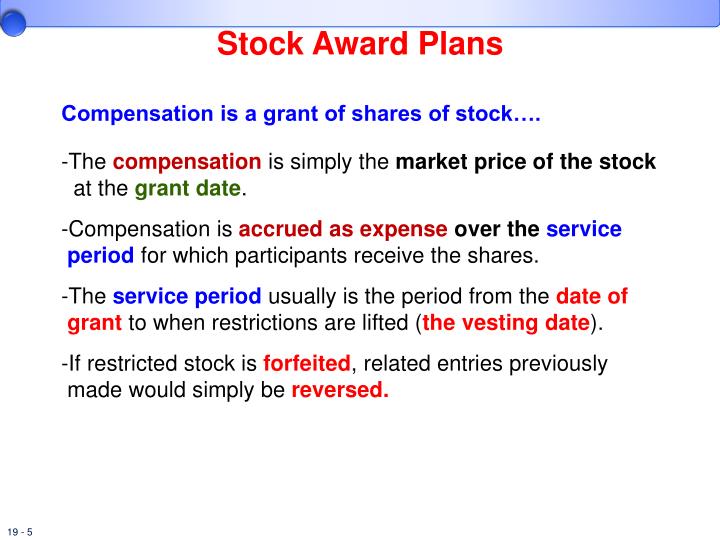

This section discusses the determination of the grant date, service inception date, and requisite service period, expense attribution and how to account for changes in.

Solved Hi! I just need help with the two journal entries

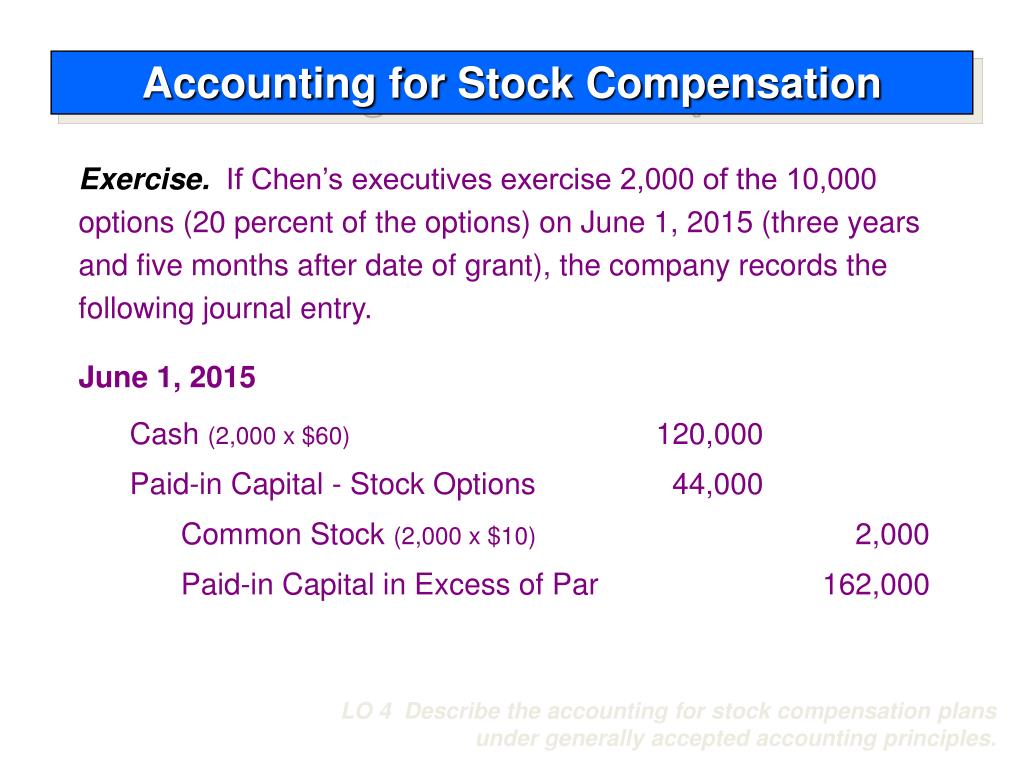

Web armed with key details, including the stock type, vesting conditions and schedule, grant date, and fmv, you’re now prepared to make journal entries. Do.

PPT Intermediate Accounting 14th Edition PowerPoint Presentation

What is stock based compensation? Do these terms seem like a foreign language to you? Web armed with key details, including the stock type, vesting.

Stock Based Compensation Expense and FCF Explained In a Simple Way

Web reduction in tax expense. What is stock based compensation? Learn how to record stock based compensation expense using journal entries for different types of.

Solved As part of its stockbased compensation package,

The journal entries would be: In 2014, the financial accounting. See fsp 6 for presentation considerations for the statement of. Sc corporation estimates a 5%.

Stock Based Compensation Expense Journal Entry In Powerpoint And Google

The offset to this expense recognition is either an increase in an equity or liability account, depending on the nature of the transaction. Asc 718.

Web Compensation—Stock Compensation (Topic 718) And Revenue From Contracts With Customers (Topic 606):

See examples, benefits and disadvantages of stoc… On january 1, 20x5, 20,000 sars are exercised at a fair value of $21 per sar, resulting in a cash payment of $420,000 (20,000 × $21). This section discusses the determination of the grant date, service inception date, and requisite service period, expense attribution and how to account for changes in the requisite service period. Journal entry for the expiration of stock appreciation rights.

Web Reduction In Tax Expense.

Sc corporation estimates a 5% annual forfeiture rate, based on its historical forfeitures. Learn how to record stock based compensation expense using journal entries for different types of stock options. The journal entries would be: Of asc 718 is to account for the fair value of employee awards as compensation expense in the financial statements.

See Fsp 6 For Presentation Considerations For The Statement Of.

Asc 718 addresses the accounting for. Web in order to be recorded in journal entries, the stock compensation must be appropriately valued. In 2014, the financial accounting. The two most common methods recognized by the financial accounting standards board (fasb) are intrinsic value and fair value methods.

Expected Future Issuance Of Dilutive Securities.

Don’t worry, we have got your back! Here are six fundamental principles that govern how stock compensation is accounted for. To recognize compensation expense in 20x4 for the 20x1 awards. What is stock based compensation?