Journal Entry For Owner Contribution - At the time of the distribution of funds to an owner, debit the owner’s drawing account and credit the cash in bank account. What is an owner’s draw? Tax implications and regulations differ based on the business structure chosen. You close the drawing and investment as well as the retained earnings account to partner equity with journal entries. If amy ott begins a sole proprietorship by putting money into her business, the sole. January 25, 2019 03:15 am. Web with quickbooks online, you can record personal money you use to pay bills or start your business. So far we have demonstrated how to create a partnership, distribute the income or loss, and. If it is a partnership, credit the appropriate partner's capital account. When an owner contribution is made, it is credited to the owner’s equity account and is.

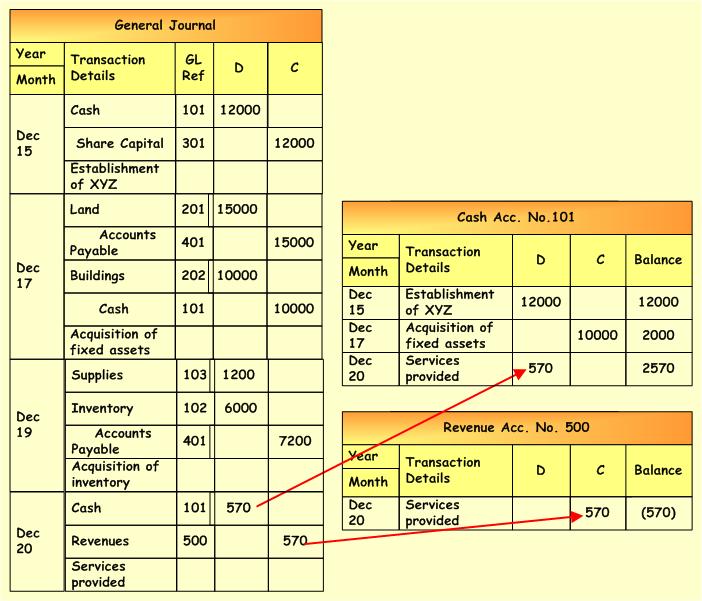

General Journal And General Ledger Entries Accounting Corner

At the time of the distribution of funds to an owner, debit the owner’s drawing account and credit the cash in bank account. Web with.

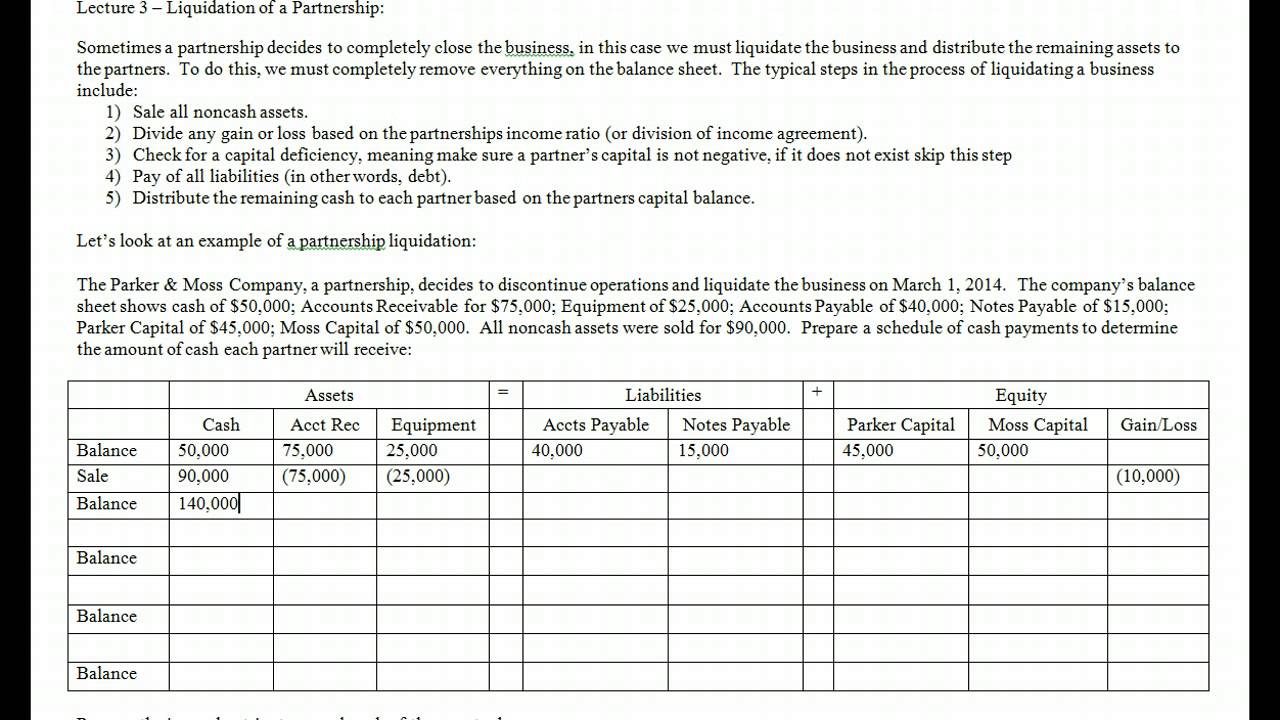

a. On January 1, 2017, Frances Corporation started doing business and

A is the only owner of the company. Web to record assets and note contributed by owner. If it is a partnership, credit the appropriate.

What Is A Cash Receipts Journal Report Printable Form, Templates and

Debit to the bank account. Recording money to start a sole proprietorship. Web to record cash contribution by owner: Here's how to track adding capital,.

Invested In The Business As Capital Journal Entry Business Walls

Credit to an equity account. What is an owner’s draw? The journal entry is debiting cash $ 20,000 and credit owner capital $ 20,000. Let’s.

Capital Invested In Business Journal Entry Invest Walls

Let’s try to clarify this concept with the help of an. Web this entry is typically used to record an owner contribution, which is a.

Accounting Journal Entries For Dummies

If it is a partnership, credit the appropriate partner's capital account. Web december 11, 2018 02:30 pm. These funds come from you as an owner,.

Journal Entry For Tax Payable

Automobile 30,000 note payable 20,000 r. Web the owner’s contribution or the owner’s investment is recorded on the balance sheet. Web for the detailed steps,.

journal entry format accounting accounting journal entry template

Web to record assets and note contributed by owner. Accountants call this a capital investment. Debit to the bank account. Tax implications and regulations differ.

Journal Entry Examples

You close the drawing and investment as well as the retained earnings account to partner equity with journal entries. So far we have demonstrated how.

All Of The Transactions You've Created Using This Account Will Be Posted In Your Account's Register.

Web to record assets and note contributed by owner. If you need to review your data, simply run an account quick. Web owners withdrawal journal entry. Owner’s draws allow business owners to withdraw funds for personal use across various business structures.

Let’s Try To Clarify This Concept With The Help Of An.

What is an owner’s draw? An owners draw is a money draw out to an owner from their business. Web with quickbooks online, you can record personal money you use to pay bills or start your business. Automobile 30,000 note payable 20,000 r.

Recording Money To Start A Sole Proprietorship.

Web december 11, 2018 02:30 pm. So far we have demonstrated how to create a partnership, distribute the income or loss, and. The entries could be separated as illustrated or it could be combined into one entry with a debit to cash for $125,000 ($100,000 from sam and $25,000 from ron) and the other debits and credits remaining. If it is a sole proprietorship, credit owner capital account.

Weighing The Pros And Cons Of Owner’s Draws Against Other.

Credit to an equity account. Web for the detailed steps, you can check out this article: If it is a partnership, credit the appropriate partner's capital account. Web how do you record an owner's money that is used to start a company?