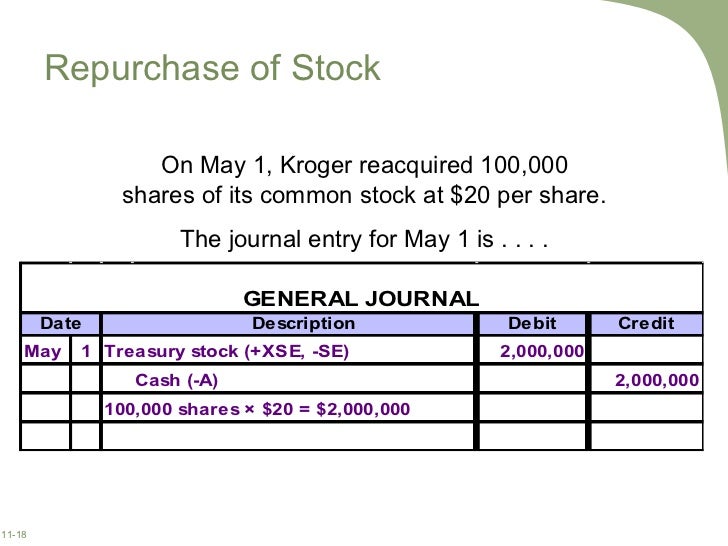

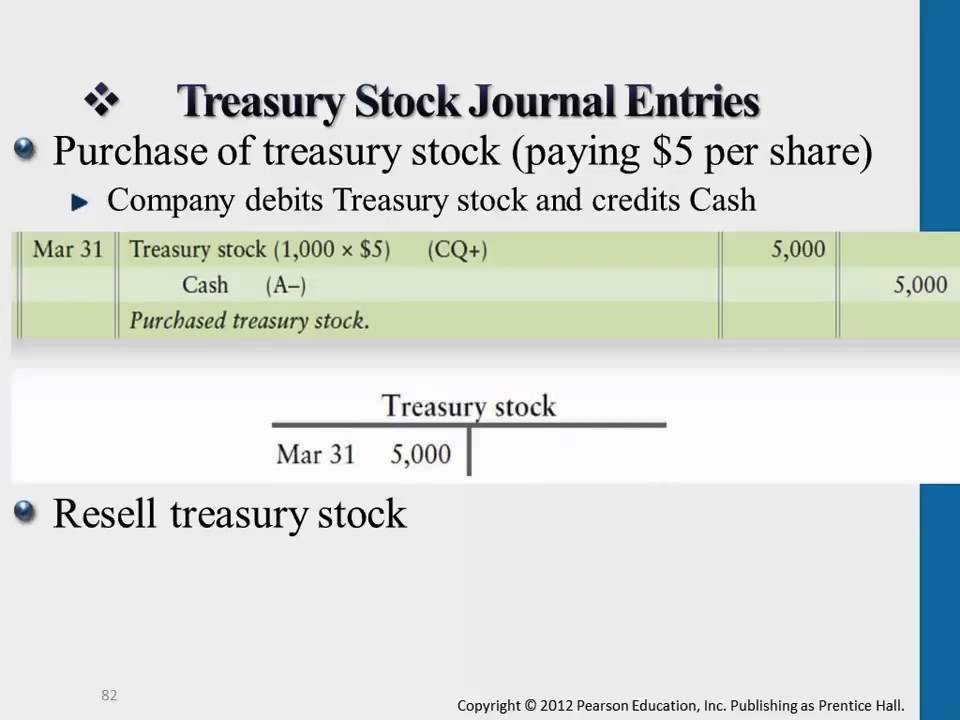

Stock Buyback Journal Entry - The cost method records the repurchase of a company’s shares (treasury stock) at the specific price paid to acquire them, irrespective of their par value. To retire shares under the cost method, two sets of journal entries are conducted: Web what is share buyback? Likewise, its normal balance is on the debit side. Even though the company is purchasing stock, there is no asset recognized for the purchase. Buy back of shares, or share repurchase is a corporate move wherein a company purchases its own outstanding shares from the current shareholders. Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. A share buyback decreases the shares outstanding account and causes a corresponding increase in treasury stock. This buyback takes place at a higher price than the actual market price. Web treasury stock journal entry overview.

Chap011

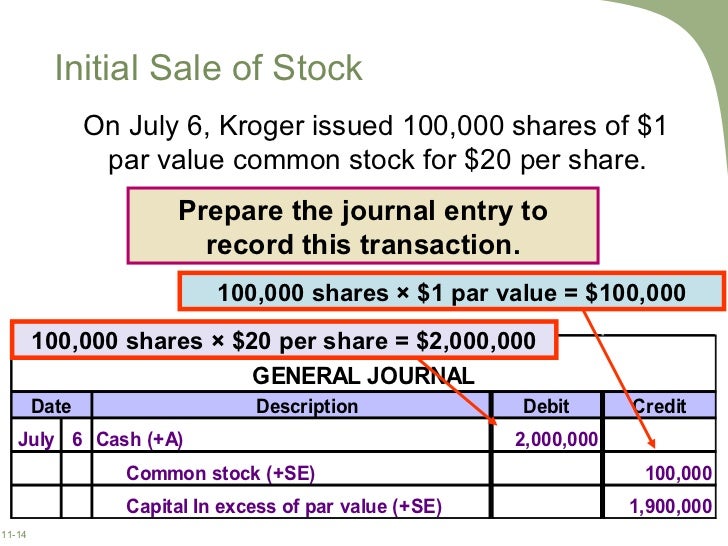

Here is a simple example: Even though the company is purchasing stock, there is no asset recognized for the purchase. Web the following journal entry.

Buying & Selling Treasury Stock (Journal Entries) YouTube

The cost method records the repurchase of a company’s shares (treasury stock) at the specific price paid to acquire them, irrespective of their par value..

Journal entry to record issuance of stock options * yvydarajyxix.web

This represents the cost of obtaining the treasury shares. Regarding company dividend vs share buyback, both terms differ in meaning, recording in the journal entry,.

View 27 Treasury Stock Journal Entry greatsomethingstock

Even though the company is purchasing stock, there is no asset recognized for the purchase. Let us understand the journal entries in a case when.

Accounting for Share Transactions IFRS & ASPE (rev 2020) YouTube

These are two common methods to account for the buyback and retirement of shares: Sometimes, the company may need to purchase back the stock that.

2 Buy Back of Shares Journal Entries / CMA / CA INTER By

Web a stock buyback program that is intended to reduce the overall number of shares and thereby increase the earnings per share. This action can.

Treasury Stock Journal Entries YouTube

Last updated october 26, 2022. When a company buys back its own shares, it must record the transaction in its accounting records. Web what is.

How to Account for Share Buy Back 7 Steps (with Pictures)

Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. This represents the cost of obtaining the.

Journal entry for net settlement of stock options

This buyback takes place at a higher price than the actual market price. Section 4501 imposes an excise tax on each covered corporation equal to.

Sometimes, The Company May Need To Purchase Back The Stock That It Has Issued.

Share buyback or share repurchase is a corporate activity wherein the firm reclaims its shares. The cost method is the most used method to account for the repurchase of shares. A share buyback decreases the shares outstanding account and causes a corresponding increase in treasury stock. Treasury stock balance sheet accounting.

Here Is An Overview Of The Accounting Entry:

An entity cannot own part of. Web the following journal entry is recorded for the purchase of the treasury stock under the cost method. An entity cannot own part of itself, so no asset is acquired. Web 9.3.2 accounting for reissuance of treasury stock.

Common Stock) In The Equity Section Of The Balance Sheet.

A reporting entity may repurchase its common shares for a number of reasons, including to: Web why apple's $110 billion buyback program works. This chapter discusses the accounting for several share repurchase alternatives. Web key learning points.

In Other Words, If A Company Spends $500 To Buy Back The Shares, It Records $500.

Here is a simple example: The stock repurchase excise tax is effective for repurchases after dec. When a company buys back its own shares, it must record the transaction in its accounting records. Next year, i project the tech giant could buy back $94 billion in shares if it raises its.