Journal Entry For Rent Payable - How to pass accounting entries in tally? Web the journal entry is debiting rental expenses and credit cash. Web rent payments are expenses to the business. In this journal entry, the debit of 1,600 rent payable is to eliminate the rent payable that we have recorded in january and february and the debit of 800 of rent expense is to recognize the rent expense that has incurred in march 2021. Written by andrew in accounting tutorials, tutorials. You can see these two entries below, keeping the accounting equation in balance. Accounting for accrued rent with journal entries. When an advance payment for the rent is made by the entity, the prepaid rent account is debited and the cash account is credited as mentioned in the example earlier. The transaction will impact the rental expense on the income statement. The transaction will increase the rental expense on income statement and rent payable on balance sheet.

Rent Receivable Journal Entry CArunway

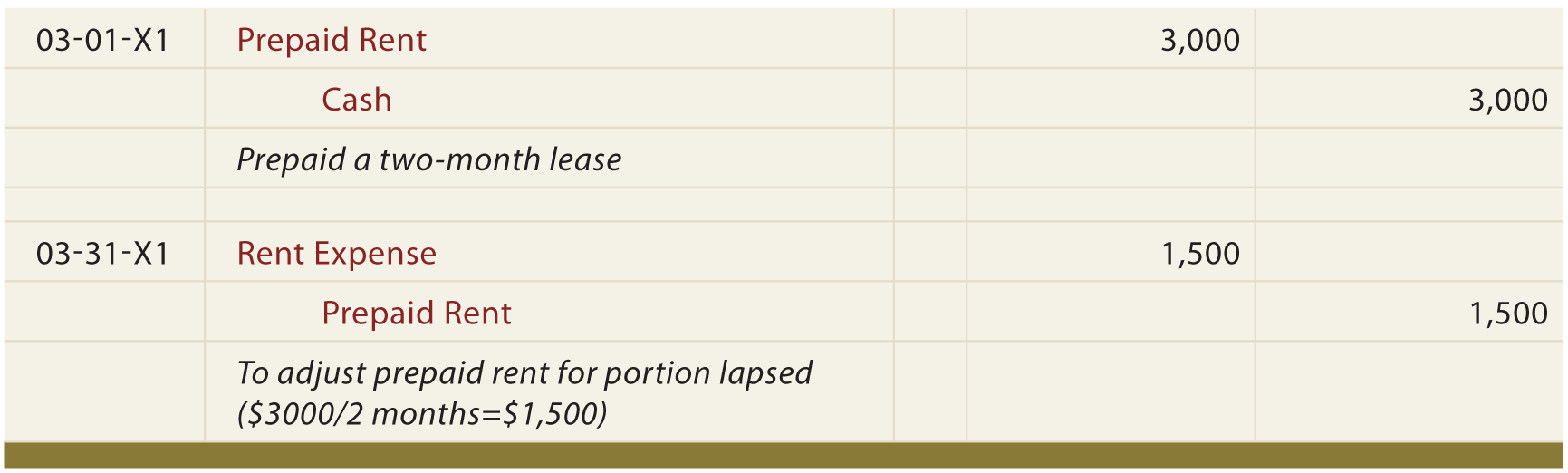

In the first scenario, the is paid rent in cash, drawing down on the bank account. You can see these two entries below, keeping the.

Journal Entries Accounting

Written by andrew in accounting tutorials, tutorials. Web journal entry when advance payment is made: How should accounts payables be recorded? In the first scenario,.

Prepaid Salary Journal Entry

The journal entry is debiting rent payable $ 2,000 and credit cash $ 2,000. To record accounts payable, the business needs to pass a journal.

How to Adjust Journal Entry for Unpaid Salaries

Rent of ₹10,000 is paid every month, in cash. Other considerations in rent expense measurement. Web journal entry when advance payment is made: Web the.

Journal entries for lease accounting

It can be recorded against a transaction from an expense account to your accounts payable charge. Likewise, the journal entry here doesn’t involve an income.

Self Study Notes The Adjusting Process And Related Entries

Web prepaid rent journal entry. Prepare a journal entry to record this transaction. Likewise, the journal entry here doesn’t involve an income statement account as.

Prepaid Expenses Entry Calculation In Excel Printable Templates

How is rent expense measured? Web journal entry to record the payment of rent. Let’s assume you own a single rental property, as my wife,.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

How to pass accounting entries in tally? Web the journal entry is debiting rental expenses and credit cash. Web prepaid rent journal entry. Web the.

Journal Entry For Advance Rent Received Info Loans

You can see these two entries below, keeping the accounting equation in balance. Accounting for base rent with journal entries. How has accounting for rent.

So The Credit In The Journal Entry Is Minus $1,500 In The Accounting Equation.

The journal entry is debiting rental payable and credit cash. Web the journal entry is debiting rental expenses and credit cash. You can see these two entries below, keeping the accounting equation in balance. Such a security deposit is a refundable amount at the rental agreement tenure.

On 5 Th Of Next Month, Abc Needs To Pay The Landlord And The Rent Payable Will Be Reversed As Well.

How to pass accounting entries in tally? Accounting for rent under asc 842. Web rent payments are expenses to the business. How is rent expense presented in the financial statements?

Web Prepaid Rent Journal Entry.

Differences in timing of cash flows in rent payments. Likewise, the journal entry here doesn’t involve an income statement account as both prepaid rent and cash are balance sheet items. We’ll work through the three different types of entries you can make. When an advance payment for the rent is made by the entity, the prepaid rent account is debited and the cash account is credited as mentioned in the example earlier.

Web Journal Entry When Advance Payment Is Made:

Under accrual concept, an entity must recognize a rent expense in each period in which it has occupied the rented property. These are both asset accounts and do not increase or decrease a company’s balance sheet. Web what is rent expense? Rent of ₹10,000 is paid every month, in cash.