Sale Of Equipment Journal Entry - Web what is the entry in quickbooks for the sale of an asset? Web how do i create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? Account type = other income* account. Since the sale proceeds exceed the carrying amount by $0.3 million (=$0.5 million − ($2. Accounting for depreciation to date of disposal. Abc is a retail store that sells many types of goods to the consumer. Web the journal entry to record the sale is: Web when it’s time to buy new equipment, know how to account for it in your books with a purchase of equipment journal entry. Debits depreciation expense (for the depreciation up to the date of the disposal) credits accumulated depreciation (for the. Sale of an asset may be done to retire an asset, funds.

Journal Entry for Purchase of Inventory YouTube

When the assets is purchased: How to record the journal entry. Web the fixed assets journal entries below act as a quick reference, and set.

Sale of Assets journal entry examples Financial

When the assets is purchased: Account type = other income* account. Web the first step requires a journal entry that: Web disposal of fixed assets:.

Accounting Journal Entries For Dummies

When gain is made on the sale of fixed assets: Web how do i create a journal entry for the sale of a fixed asset.

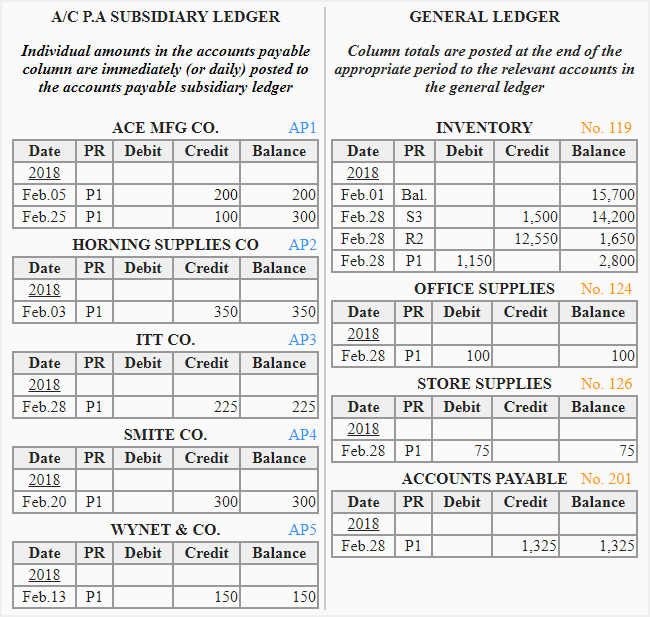

Perpetual Inventory Systems

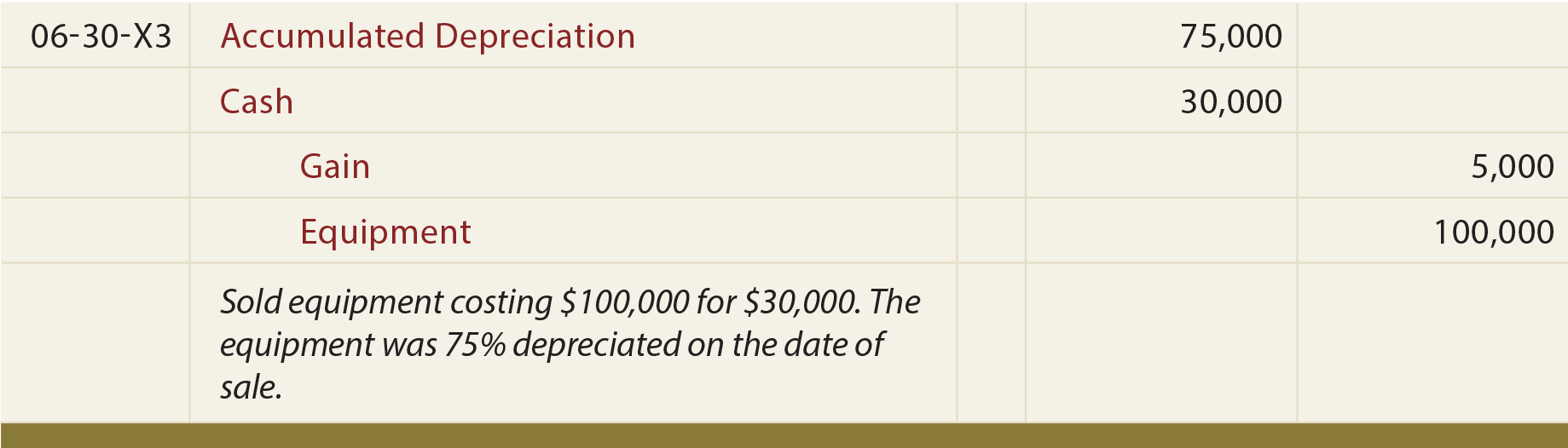

Web the journal entry will have four parts: Web journal entry for sale of used equipment example. Removing the asset, removing the accumulated depreciation, recording.

Journal Entry For Equipment Purchase Jenkins Exchilliked

When the assets is purchased: Web the fixed assets journal entries below act as a quick reference, and set out the most commonly encountered situations.

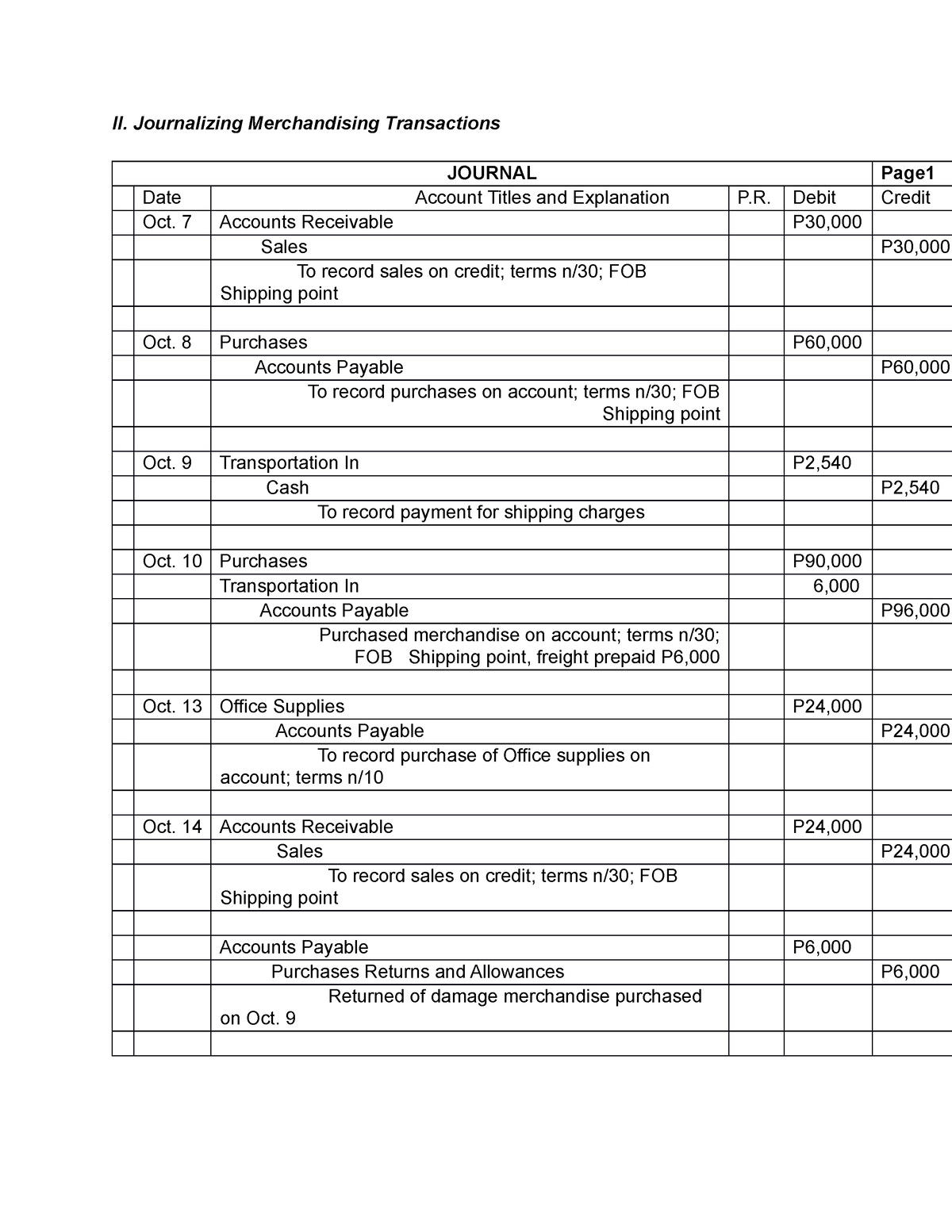

Merchandising business Example of a journal entry II. Journalizing

In the accounting year, company decides to sell 3. Web defining the entries when selling a fixed asset when a fixed asset or plant asset.

Sold machinery for cash journal entry CArunway

This is needed to completely remove all traces of an asset from the (known as ). Web how do i create a journal entry for.

General Journal entry form June 1 . Purchased equipment in the amount

How to record the journal entry. When gain is made on the sale of fixed assets: Web journal entries for sale of fixed assets. Web.

Disposal of PP&E

This is needed to completely remove all traces of an asset from the (known as ). Web when it’s time to buy new equipment, know.

Web The Fixed Assets Journal Entries Below Act As A Quick Reference, And Set Out The Most Commonly Encountered Situations When Dealing With The Double Entry Posting.

When the assets is purchased: Removing the asset, removing the accumulated depreciation, recording the receipt of cash, and recording the gain. This is needed to completely remove all traces of an asset from the (known as ). Debits depreciation expense (for the depreciation up to the date of the disposal) credits accumulated depreciation (for the.

December 10, 2018 05:29 Pm.

Web the journal entry will have four parts: The disposal of involves eliminating assets from the. Entity a sold the following equipment. How to record the journal entry.

Web Actual Proceeds From Sale Of The Used Asset Turned Out To Be $0.5 Million.

The fixed asset's depreciation expense. Account type = other income* account. Accounting for depreciation to date of disposal. Web journal entry for sale of used equipment example.

Web The First Step Requires A Journal Entry That:

See examples of profit and loss on sale of fixed asset depending on the net book value and the sale amount. Web the journal entry to record the sale is: In which type of account do i record the net gain? Sale of an asset may be done to retire an asset, funds.