Write Off In Accounting Journal Entry - Web following journal entry shall be recognized to account for the cancellation of liability: When it is determined that the receivable is no longer collectible, the. There are two choices for the debit part of the entry. Web direct write off method. Bad debt provision bookkeeping entries explained. Web an inventory write off is the process of reducing the value of the inventory of a business to record the fact that the inventory has no value. Agreement may specify a term over which the creditor has to claim the. Web record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. One method of recording the bad debts is referred to as the direct write off method which involves removing the. This will be a credit to the asset account.

journal entry format accounting accounting journal entry template

Web following journal entry shall be recognized to account for the cancellation of liability: It is primarily used in its most literal sense. Web here.

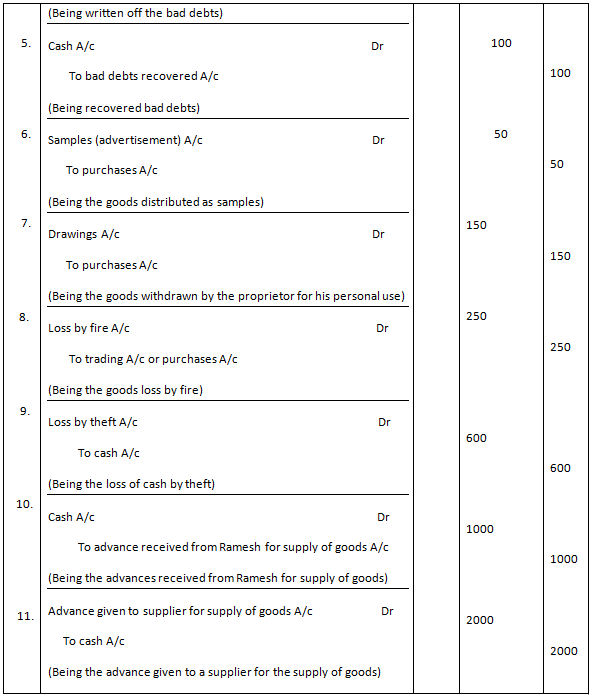

Journal Entry Problems and Solutions Format Examples MCQs

When you decide to write off an account, debit allowance for doubtful. In this method, the company does not make an estimation of bad debt.

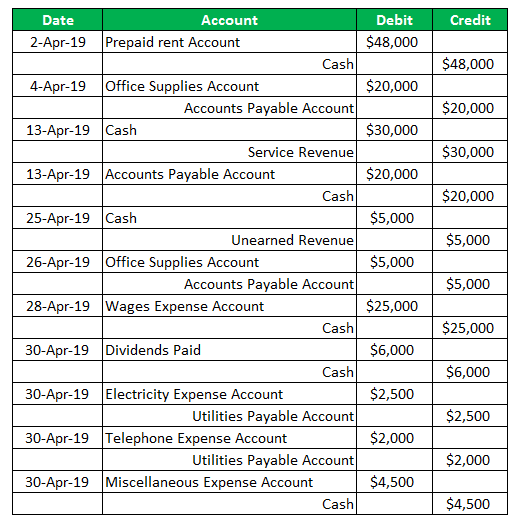

Accounting Journal Entries For Dummies

Web direct write off method. There are two choices for the debit part of the entry. The seller can charge the amount of an invoice.

What is Journal Entry? Example of Journal Entry

Following a credit sale, the company awaits the cash payment from the customer, with the unmet. One method of recording the bad debts is referred.

General Journal Entries Examples

Following a credit sale, the company awaits the cash payment from the customer, with the unmet. Web when a specific customer’s account is identified as.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Agreement may specify a term over which the creditor has to claim the. Web create a journal entry to write off the appropriate amount of.

Journal Examples Top 4 Examples of Journal Entries in Accounting

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web record the.

Accounting Q and A EX 914 Entries for bad debt expense under the

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Web here are the 34 business records trump was found guilty of falsifying, as described in judge juan merchan 's jury instructions: Web when a.

There Are Two Choices For The Debit Part Of The Entry.

Web direct write off method. Web following journal entry shall be recognized to account for the cancellation of liability: Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created.

Web Here Are The 34 Business Records Trump Was Found Guilty Of Falsifying, As Described In Judge Juan Merchan 'S Jury Instructions:

The inventory write off can. Web an inventory write off is the process of reducing the value of the inventory of a business to record the fact that the inventory has no value. Web the accounting records will show the following bookkeeping entries for the bad debt write off. It is primarily used in its most literal sense.

Web Create A Journal Entry To Write Off The Appropriate Amount Of The Asset.

When you decide to write off an account, debit allowance for doubtful. In other words, the cost of the fixed asset equals its accumulated depreciation. A credit to accounts receivable (to remove the amount that will not. Web record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts.

Web Write Off Or Derecognize Of Account Payable (Liability):

Agreement may specify a term over which the creditor has to claim the. When it is determined that the receivable is no longer collectible, the. Following a credit sale, the company awaits the cash payment from the customer, with the unmet. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid.