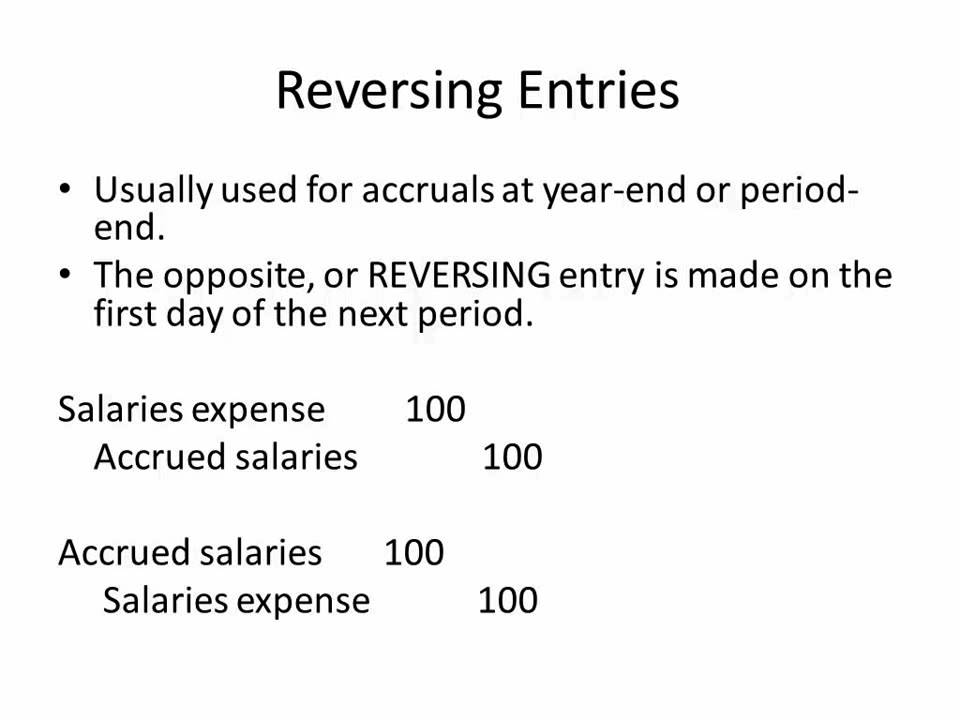

Reversing A Journal Entry - Web a reversing journal entry is a type of adjusting entry that is made at the beginning of an accounting period to reverse the effects of a previous adjusting entry. Web what is a reversing entry? A journal entry made on the first day of a new accounting period to undo the accrual type adjusting entries made prior to the preparation of the financial statements dated one day earlier. Bookkeepers make them to simplify the records in the new accounting period, especially if they use a cash basis system. In part 1, we had an introduction to reversing entries and discussed examples for accrued income and accrued expense. Web when reversing entries are not made, the accountant needs to remember last period adjusting entries and account for any expense/revenue previously recognized relating to current period payments or receipts. A reversing entry is a very special type of adjusting entry. Web part 2 of 2. Reversing entry for unearned income. Web here are three situations that describe why adjusting entries are needed:

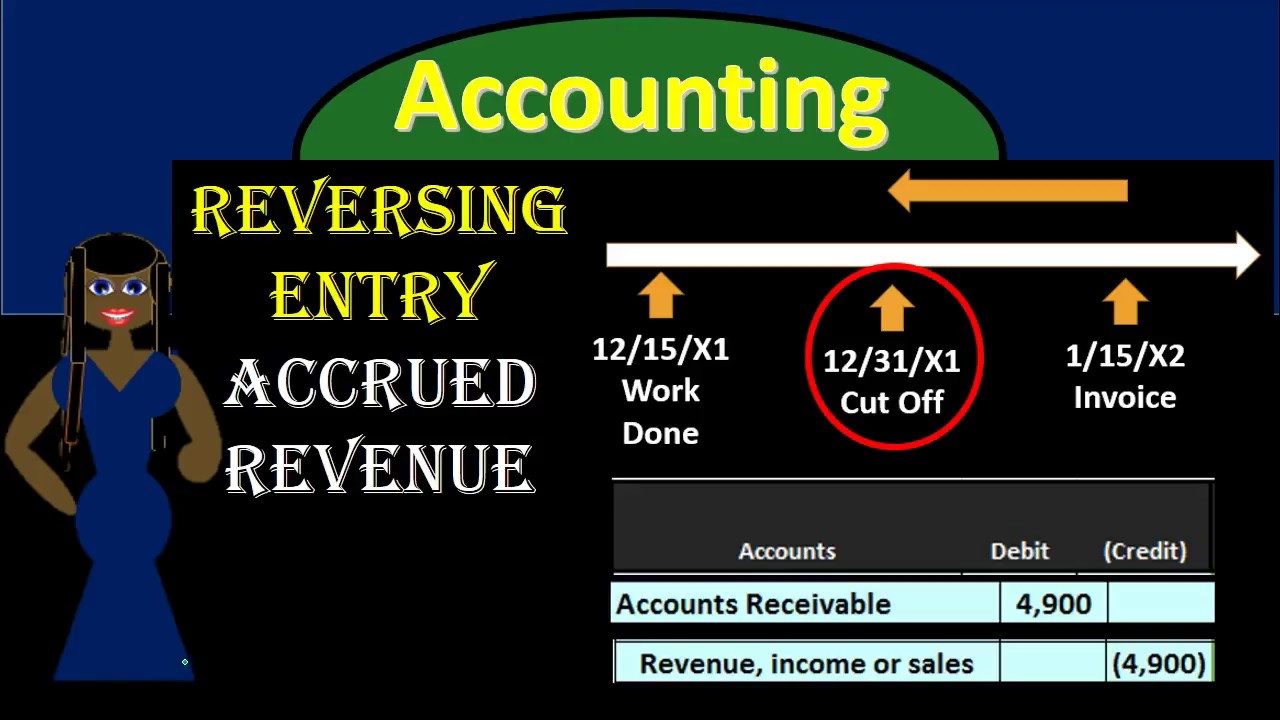

300 Reversing Journal Entries Accrued Revenue YouTube

This is done to simplify the accounting process and. If it interest you, do share it with your fellows. Query the batch and journal within.

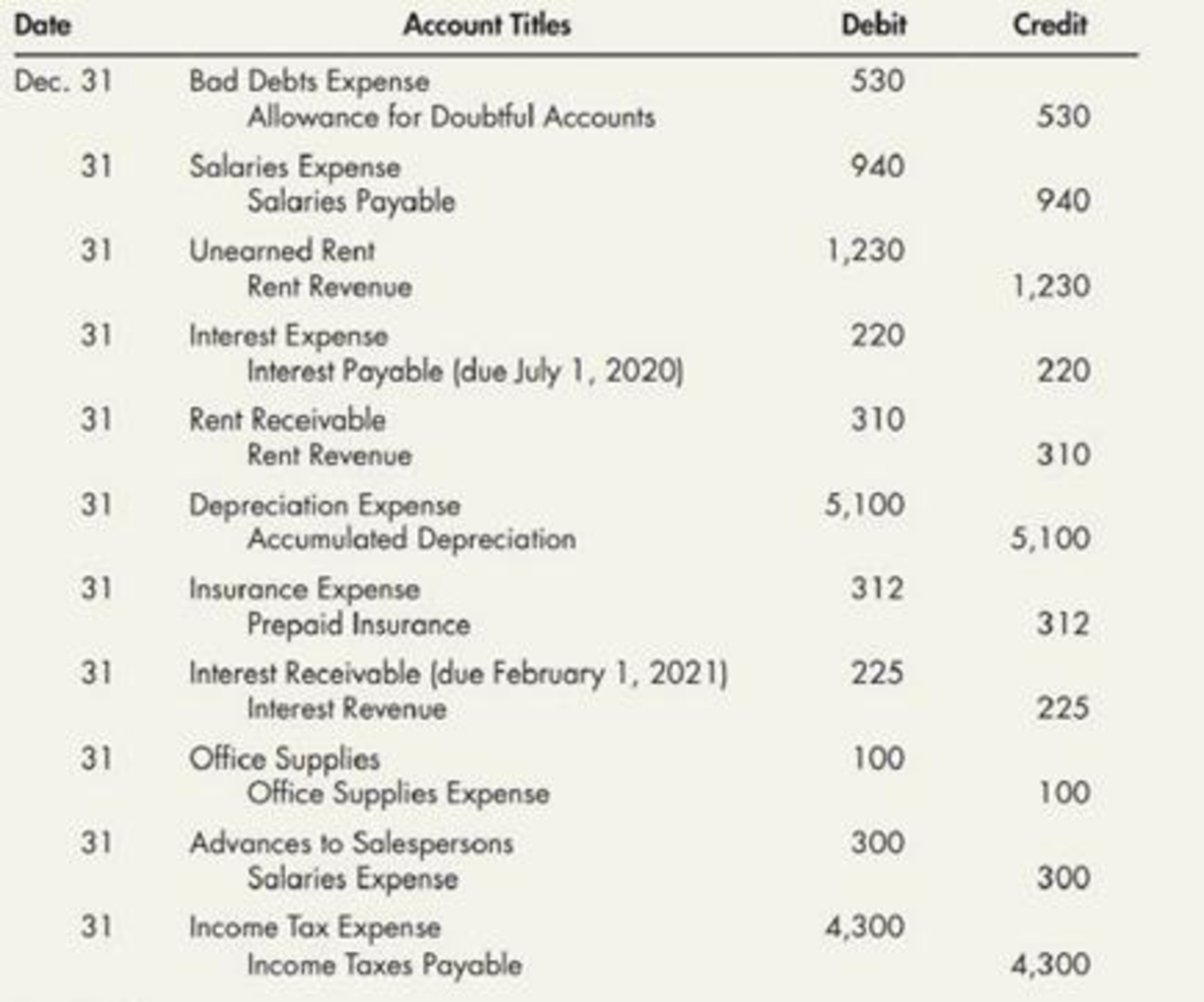

Reversing Entries On December 31, 2019, Mason Company nude the

What does reversing entry mean? Procedure of recording reversing entry. Note that the reversal effective date is only necessary when you have average balances enabled.

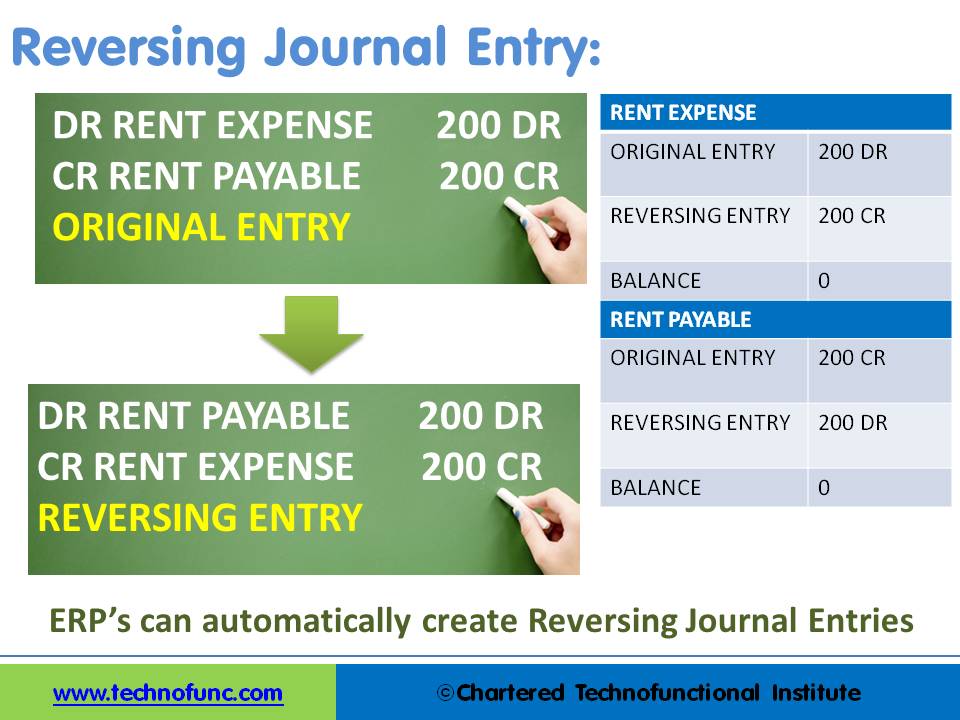

TechnoFunc GL Reversing Journal Entry

Web reversing entries refer to those journal entries passed in the current accounting period to offset the entries for outstanding expenses and accrued income recorded.

Reversing Entries When, What, How and Why? YouTube

You can make them at the beginning of an accounting period, and they usually adjust some entries for accrued expenses and revenues from the end.

Reversing Journal Entries Accrued Revenue 11 YouTube

Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period. Web reversing entries are.

Reversing Entries

Query the batch and journal within the batch for which you want to assign a reversal period. This is done using compound journal entries. Navigate.

Reversing Entries

Web reversing entries are used to reverse journal entries that were made the month prior. The reversing entry typically occurs at the beginning of an.

Reversing Journal Entries YouTube

They can be extremely useful and should be used where necessary. Web reversing entries are used to reverse journal entries that were made the month.

How to do entries in Reversing Journal voucher in tally in english

As these entries are no longer required to be recorded as the business’s assets or liabilities, they are reversed at the. In other words, these.

The Preparation Of Reversing Entries Is Optional And Is Usually Done To Simplify The Recording Process.

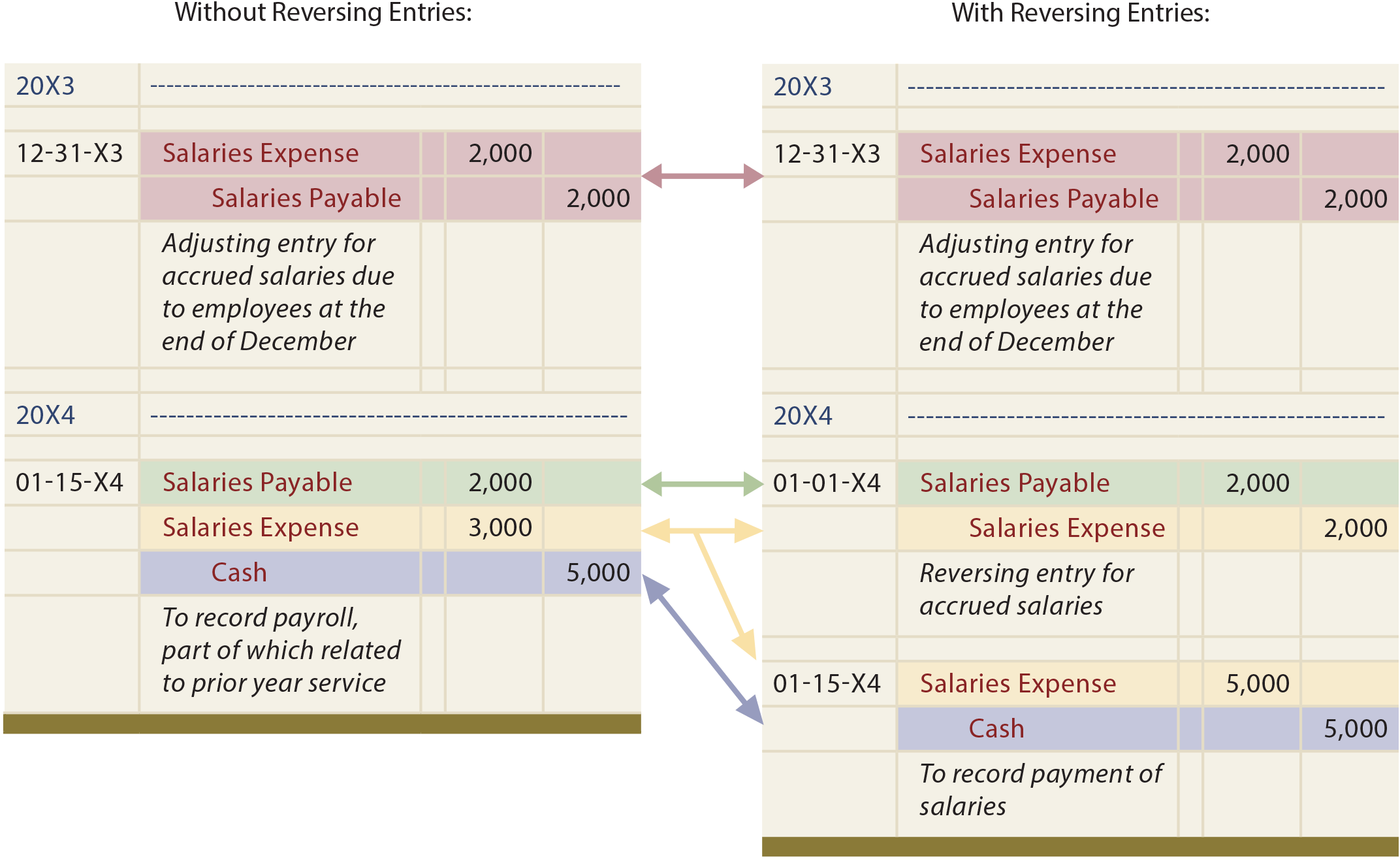

Web reversing entries are made on the first day of an accounting period to remove accrual adjusting entries that were made at the end of the previous accounting period. Web when reversing entries are not made, the accountant needs to remember last period adjusting entries and account for any expense/revenue previously recognized relating to current period payments or receipts. This is done to simplify the accounting process and. In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period.

Bookkeepers Make Them To Simplify The Records In The New Accounting Period, Especially If They Use A Cash Basis System.

Reversing entries are best explained using an example: A reversing entry comes in two parts: Query the batch and journal within the batch for which you want to assign a reversal period. Web reversing entries are accounting journal entries you make in a certain period to reverse, or cancel out, some entries of a previous accounting period.

You Can Make Them At The Beginning Of An Accounting Period, And They Usually Adjust Some Entries For Accrued Expenses And Revenues From The End Of The Previous Period.

Web the purpose of reversing entries is to cancel out certain adjusting entries that were recorded in the previous accounting period. A reversing entry is often used in payroll, but may also be used to fix errors like miscalculating revenue. In part 1, we had an introduction to reversing entries and discussed examples for accrued income and accrued expense. They are usually made on the first date of the.

Web What Is A Reversing Entry?

Web here are three situations that describe why adjusting entries are needed: The sole purpose of a reversing entry is to cancel out a specific adjusting entry made at the end of the prior period, but they are optional and not every company uses them. The reversing entry typically occurs at the beginning of an accounting period. Web reversing entries are used to reverse journal entries that were made the month prior.