General Journal Entry For Depreciation - Web here are four easy steps that’ll teach you how to record a depreciation journal entry. Using our depreciation schedule for spivey company,. Web typically, the general journal entries record transactions such as the following: Accelerated depreciation methods, on the other. Web straight line depreciation journal entry. This is recorded at the end of the period (usually, at the end of every. Web depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. To calculate depreciation expense, you need to. Debit to the income statement account depreciation expense; Web depreciation records an expense for the value of an asset consumed and removes that portion of the asset from the balance sheet.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web here are four easy steps that’ll teach you how to record a depreciation journal entry. In year 2, the depreciation is the same as.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

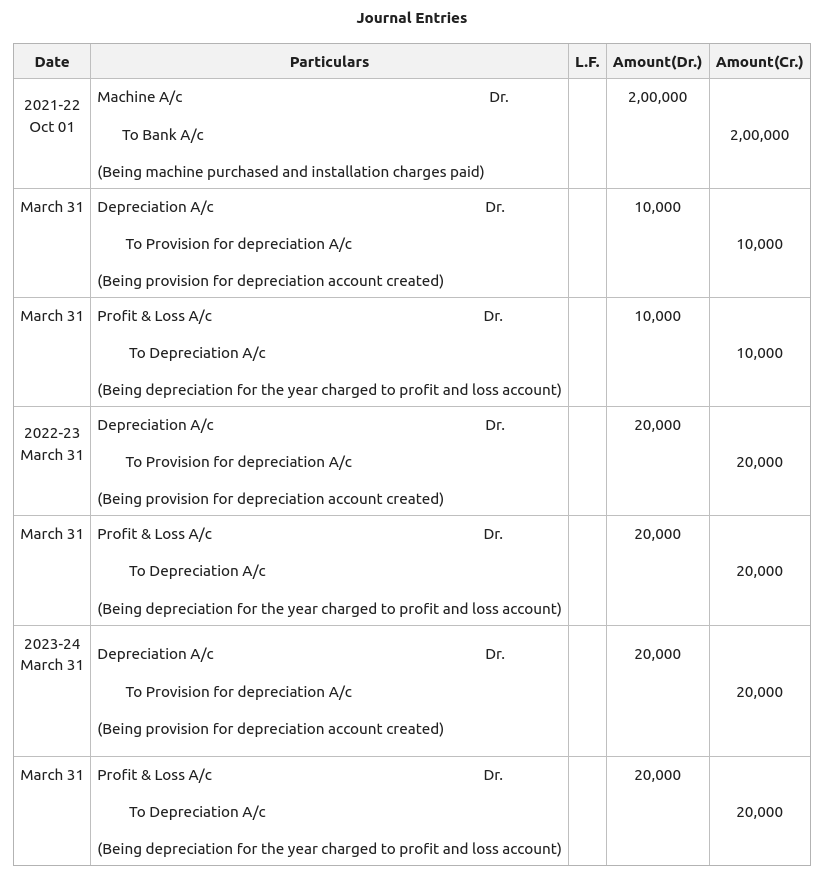

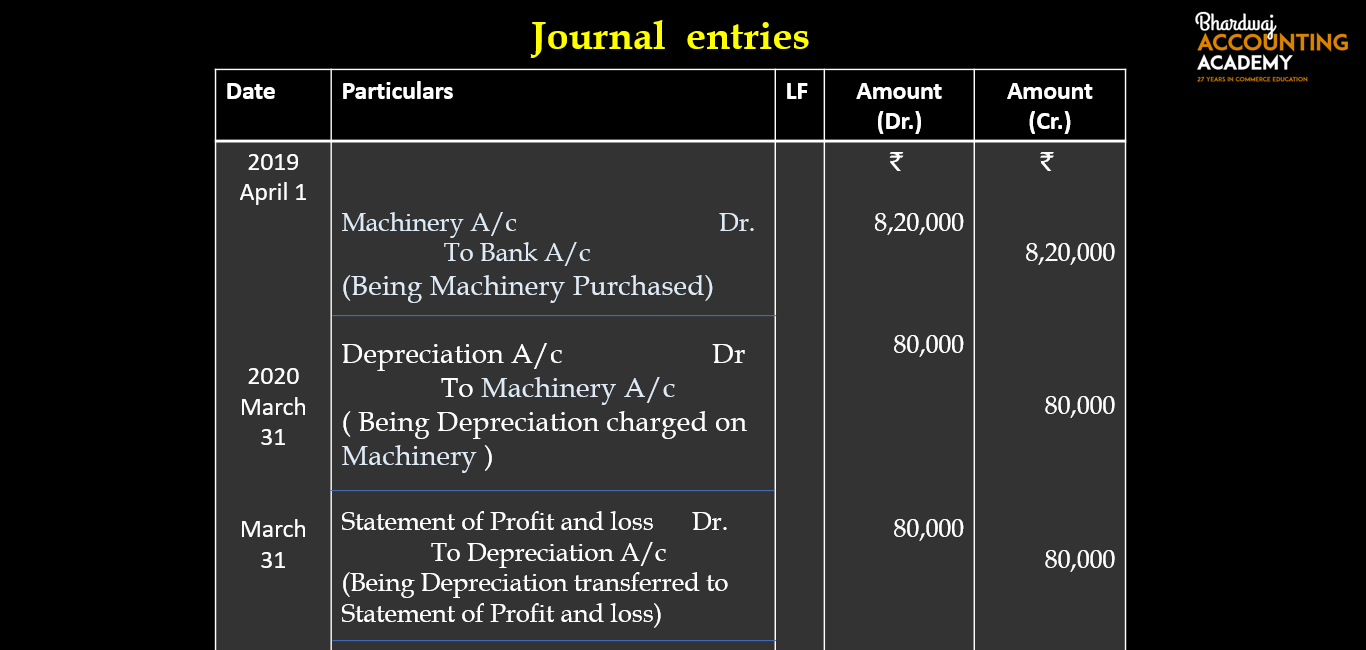

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

Provision for Depreciation and Asset Disposal Account

Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in.

General Journal in Accounting Double Entry Bookkeeping

Journal entry for business started (in cash) when a business commences and capital is introduced in form of cash. The company needs to make monthly.

Depreciation and Disposal of Fixed Assets Finance Strategists

Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Accelerated depreciation methods, on the.

13.4 Journal entries for depreciation YouTube

To calculate depreciation expense, you need to. When provision for depreciation/accumulated depreciation is maintained. Debit to the income statement account depreciation expense; Web depreciation is.

Depreciation journal Entry Important 2021

Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation..

Depreciation Explanation Accountingcoach with Bookkeeping Reports

In this case, we can make the journal entry of depreciation expenses in the june 30 adjusting entry as. Web the basic journal entry for.

Journal Entry for Depreciation Example Quiz More..

Using our depreciation schedule for spivey company,. The journal entry to record depreciation is fairly standard. Before you record depreciation, you must first select. Journal.

Web Depreciation Journal Entry Is The Journal Entry Passed To Record The Reduction In The Value Of The Fixed Assets Due To Normal Wear And Tear, Normal Usage Or Technological Changes,.

Web straight line depreciation journal entry. Web an accumulated depreciation journal entry is the journal entry passed by the company at the end of the year. Cash is an asset for the business hence debit the increase in. Web the journal entry consists of a:

Accelerated Depreciation Methods, On The Other.

Web once depreciation has been calculated, the expense must be recorded as a journal entry. It is done to adjust the book values of the different capital assets of. When depreciation is charged to the ‘asset’ account. Web the basic journal entry for depreciation is to debit the depreciation expense account (which appears in the income statement) and credit the accumulated depreciation.

In This Case, We Can Make The Journal Entry Of Depreciation Expenses In The June 30 Adjusting Entry As.

In year 2, the total. Web the journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software. Credit to the balance sheet account accumulated depreciation; Using our depreciation schedule for spivey company,.

Web Journalize Adjusting Entries For The Recording Of Depreciation.

Once depreciation has been calculated, you’ll need to record the expense as a. Credit to accumulated depreciation, which is reported on the balance. The company needs to make monthly journal entry by debiting depreciation expenses and credit accumulated depreciation. To calculate depreciation expense, you need to.