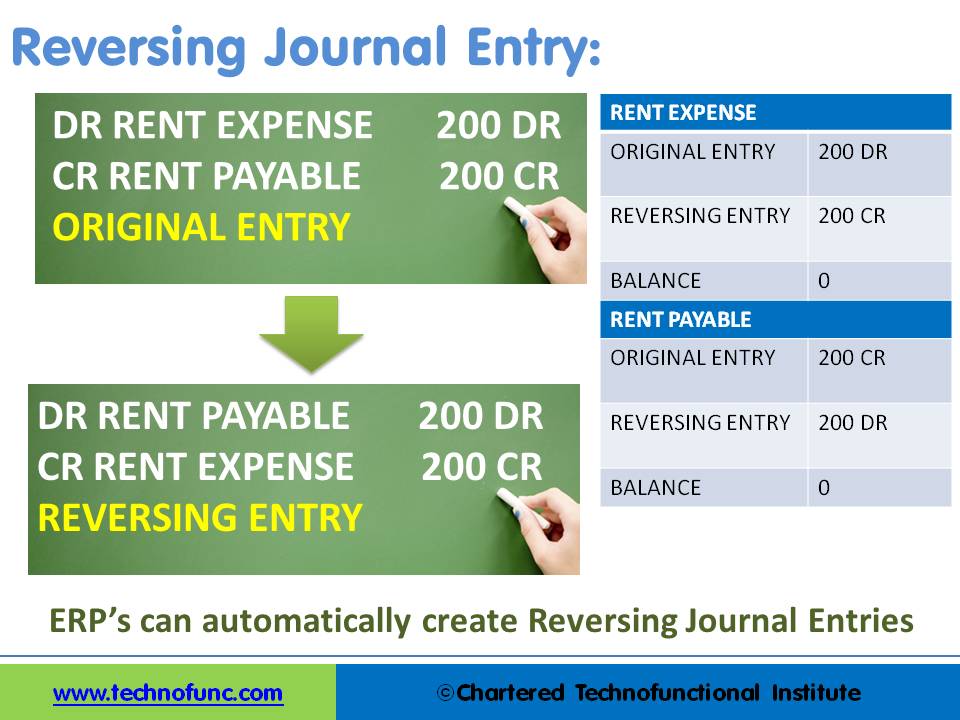

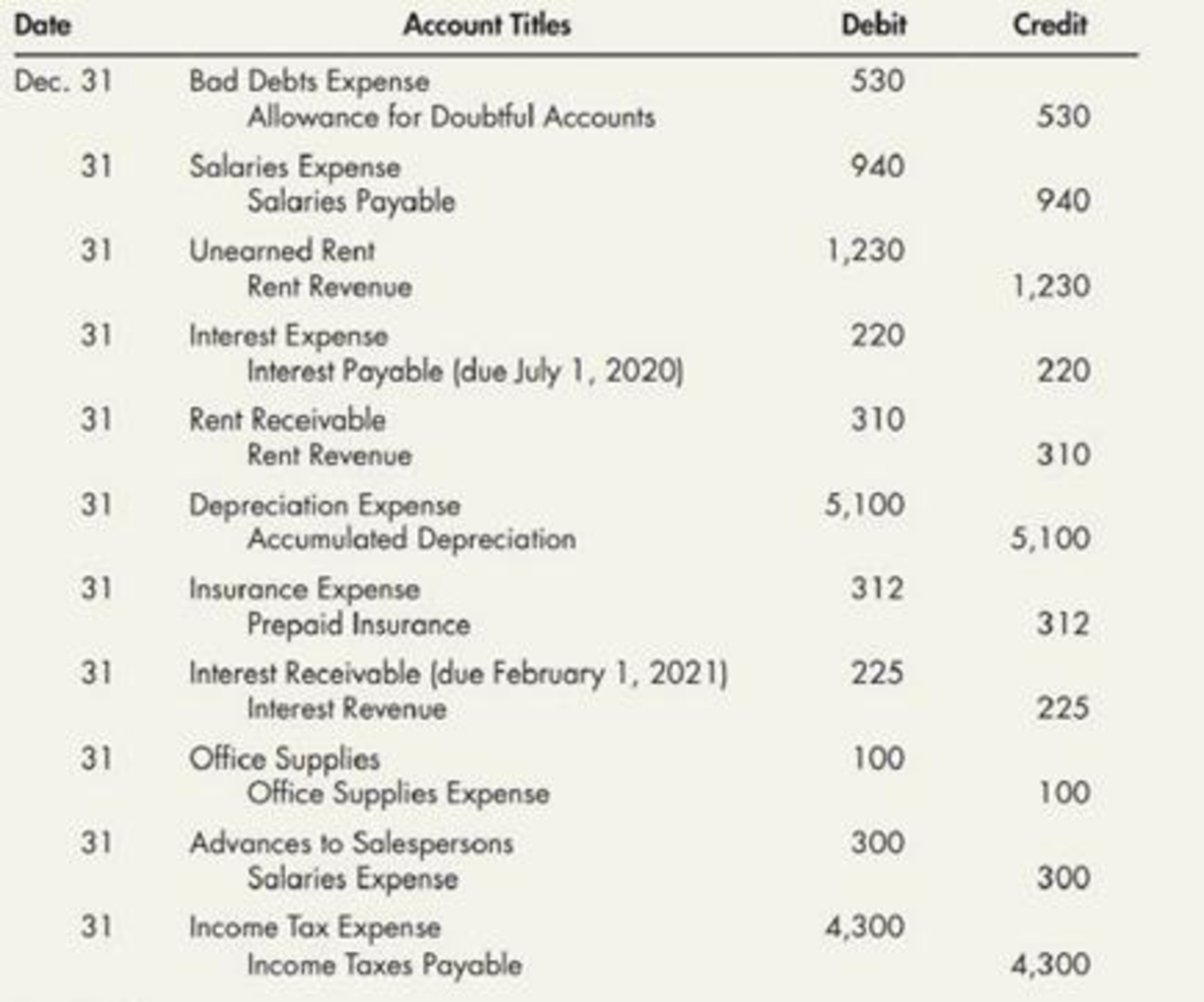

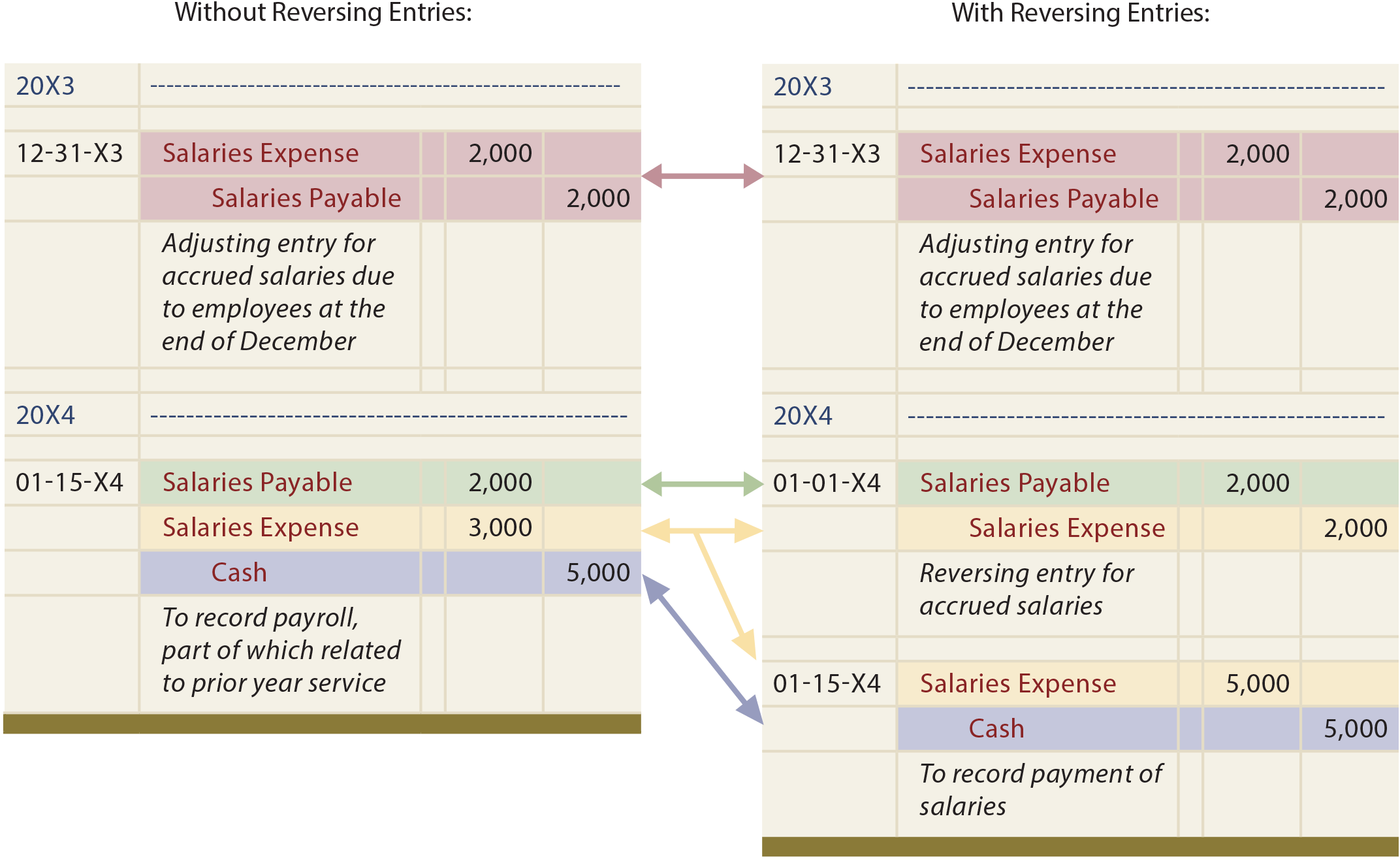

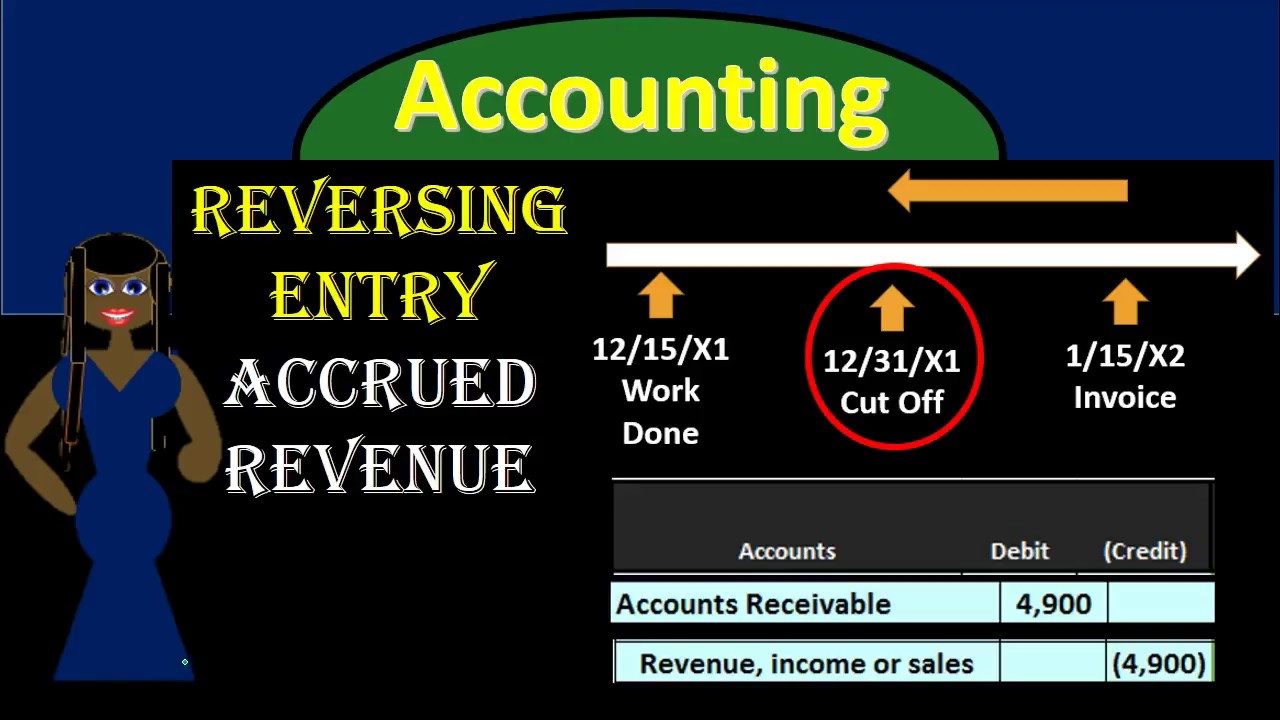

Reverse Journal Entry - A journal entry made on the first day of a new accounting period to undo the accrual type adjusting entries made prior to the preparation of the financial statements dated one day earlier. Bookkeepers make them to simplify the records in the new accounting period, especially if they use a cash basis system. This is done to simplify the accounting process and ensure. Navigate to the enter journals window. Note that the reversal effective date is only necessary when you have average balances enabled for your set of books. Their ability to transmit this disease of major public health importance is dependent on their abundance, biting behaviour, susceptibility and their ability to survive long enough to transmit malaria parasites. Web in app reverse journal entries the following fields are mandatory: A reversing entry is a journal entry made in an accounting period, which reverses selected entries made in the immediately preceding period. Web a reversing entry is an accounting journal entry made at the beginning of an accounting period to reverse or cancel out a prior entry. Reversing entries, or reversing journal entries, are journal entries made at the beginning of an accounting period to reverse or cancel out adjusting journal entries made at the end of the previous accounting period.

Reversing Entries When, What, How and Why? YouTube

If you post a journal in error, or with the wrong date or amount, it's easy to correct it in sage 50 accounts. This is.

TechnoFunc GL Reversing Journal Entry

Delete the journal > use the reversals option to post a reverse journal > manually post further journals to reverse the effect of the incorrect.

Reversing Entries On December 31, 2019, Mason Company nude the

Delete the journal > use the reversals option to post a reverse journal > manually post further journals to reverse the effect of the incorrect.

Reversing Entries

To reverse a journal you can: In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the.

What Is The Journal Entry For Payment Of Salaries Info Loans

Web in app reverse journal entries the following fields are mandatory: Web reversing entries are passed at the beginning of an accounting period as an.

How to do entries in Reversing Journal voucher in tally in english

Use reverse function of app manage journal entries. Enter the period for the reversing entry. A journal entry made on the first day of a.

300 Reversing Journal Entries Accrued Revenue YouTube

A reversing entry is an optional journal entry that is recorded at the beginning of an accounting period to undo the prior period’s adjusting entries..

Reversing Journal Entries Accrued Revenue 11 YouTube

They are usually made on the first date of the. Web reversing entries are passed at the beginning of an accounting period as an optional.

Numia Accounting Reverse Journal entry in Numia

Bookkeepers make them to simplify the records in the new accounting period, especially if they use a cash basis system. Navigate to the enter journals.

Not All Of A Company’s Financial Transactions That Pertain To An Accounting Period Will Have Been Processed By The Accounting Software As Of The End Of The Accounting Period.

The sole purpose of a reversing entry is to cancel out a specific adjusting entry made at the end of the prior period, but they are optional and not every company uses them. This is done to simplify the accounting process and ensure. Web here are three situations that describe why adjusting entries are needed: Web what is a reversing entry?

To Reverse A Journal You Can:

In other words, these entries cancel out or reverse the adjusting journal entries recorded at the end of the prior accounting period. Note that the reversal effective date is only necessary when you have average balances enabled for your set of books. Reversing entry for unearned income. Most often, the entries reverse accrued revenues or expenses for the previous period.

With The App Reverse Journal Entries You Can Create Reversals Of Asset Related Postings.

Web reversing entries are journal entries made at the beginning of each accounting period. Delete the journal > use the reversals option to post a reverse journal > manually post further journals to reverse the effect of the incorrect journals > In part 1, we had an introduction to reversing entries and discussed examples for accrued income and accrued expense. Two benefits of using reversing entries are:

Bookkeepers Make Them To Simplify The Records In The New Accounting Period, Especially If They Use A Cash Basis System.

Navigate to the enter journals window. Checked for updates, april 2022. This is the last step in the accounting cycle. Query the batch and journal within the batch for which you want to assign a reversal period.