Insurance Journal Entry - The adjusting entry would be: Web journal entry for insurance claims: Learn how to record different types of insurance payments and proceeds in your bookkeeping records. We will look at two examples of prepaid expenses: Web accounting for insurance proceeds — accountingtools. Premium receivable recorded with offsetting unearned premium liability for total written premium. Adjusting journal entry as the prepaid insurance expires: When the company signs an insurance contract and makes payment to the insurance provider, we need to record cash out and prepaid insurance. Web the journal entry to record the transaction would be: Web initial journal entry for prepaid insurance:

Insurance Journal Entry for Different Types of Insurance Bookkeeping

Web on december 31, the company writes an adjusting entry to record the insurance expense that was used up (expired) and to reduce the amount.

Journal Entry for Prepaid Insurance Online Accounting

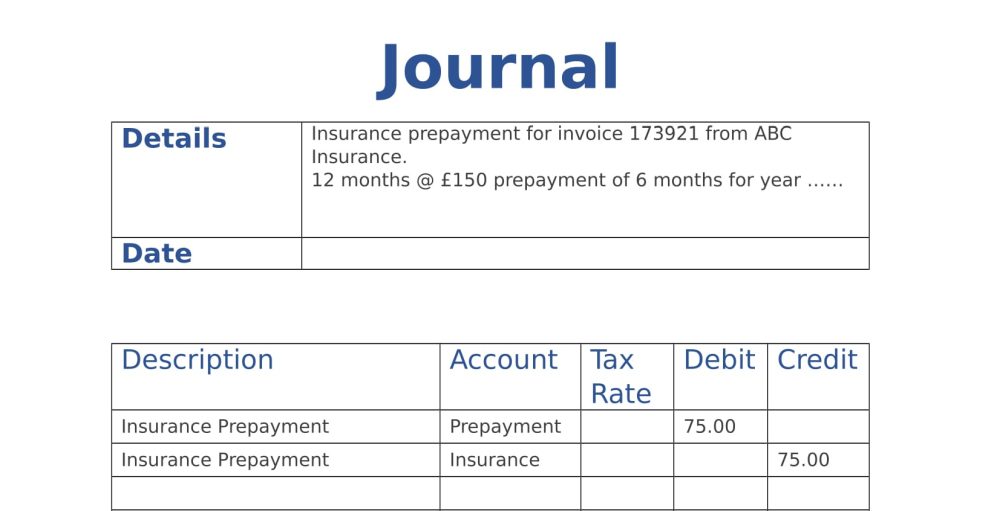

Prepaid insurance is the insurance premium that businesses pay during an accounting period that did not expire within that business period. Web journal entry for.

How to Account for Health Insurance Contributions in QuickBooks Online

Premium receivable recorded with offsetting unearned premium liability for total written premium. At contract inception (january 1, 20x1), insurance company would record the following journal.

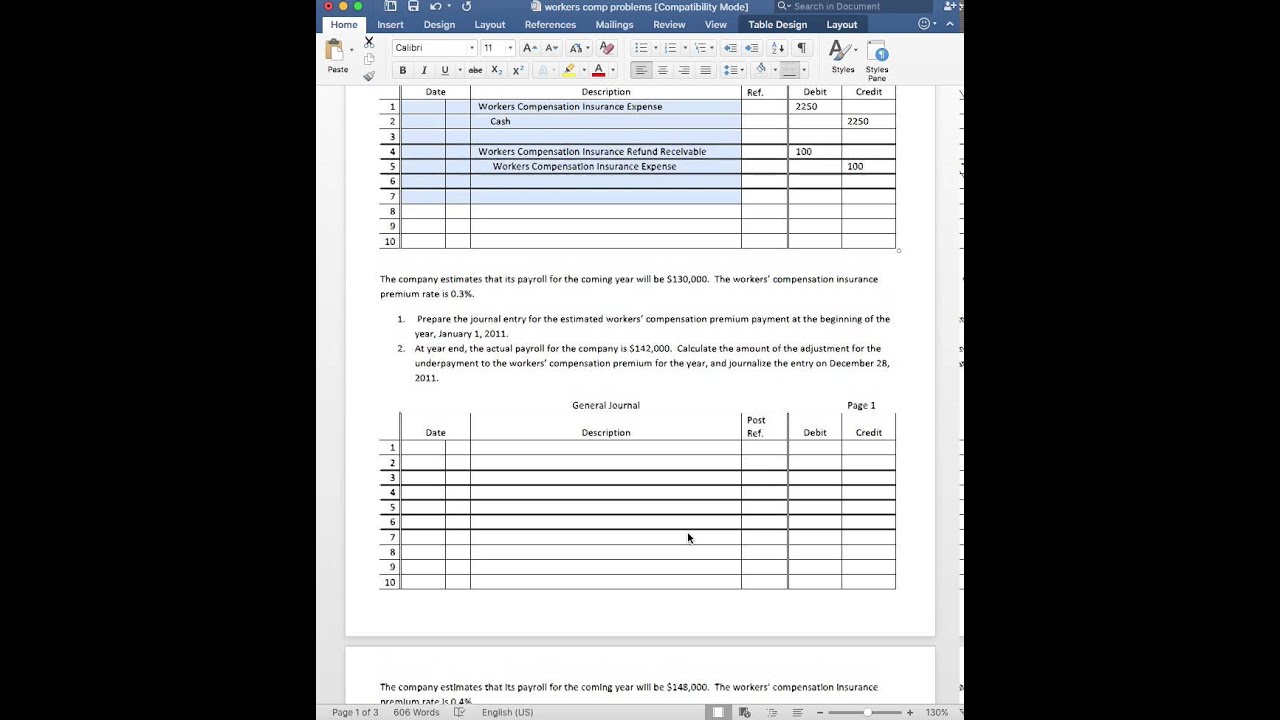

Accounting Worker's Compensation Insurance Journal Entries YouTube

When the company signs an insurance contract and makes payment to the insurance provider, we need to record cash out and prepaid insurance. Prepaid insurance.

Self Study Notes The Adjusting Process And Related Entries

At march 31, 20x1, insurance company would record the following journal entry. At the end of any accounting period, the amount of the insurance premiums.

The Adjusting Process And Related Entries laacib

As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting.

Insurance Journal Entry for Different Types of Insurance

Find out the journal entries for business insurance, motor vehicle insurance, personal insurance, employee insurance and more. There is a date of april 1, 2018,.

Journal Entry Problems and Solutions Format Examples

This is accomplished with a debit of $1,000 to insurance expense. Premium receivable recorded with offsetting unearned premium liability for total written premium. The prepaid.

Journal Entry For An Insurance Claim En Intipanime

There are a number of journal entries that are important and one of those accounting journal entries is recording the financing of insurance premiums. Web.

Web In This Journal Entry, The Credit Of The Fixed Asset Is To Remove It From The Balance Sheet As It Should Already Have Been Destroyed By The Accident (E.g.

Unexpected events can impact the financial stability of the business. A quick & easy guide. Premium receivable recorded with offsetting unearned premium liability for total written premium. The journal entry also helps to ensure that the company is properly tracking its expenses.

On December 31, 2021, The End Of The Accounting Period, An Adjusting Entry Should Be Prepared To Transfer A Portion Of Prepaid Insurance To Insurance Expense Since 3 Months Has Already Expired.

At contract inception (january 1, 20x1), insurance company would record the following journal entries. Accountants view the insurance that businesses prepay as an asset. There are a number of journal entries that are important and one of those accounting journal entries is recording the financing of insurance premiums. Web prepaid insurance journal entry.

If Companies Use The Coverage Within A Year After Purchase, Prepaid Insurance Is A Current Asset.

Web initial journal entry for prepaid insurance: When a business suffers a that is covered by an , it a in the amount of the insurance proceeds received. The monthly insurance expense is equal to $1,392 / 12 months or $116. When the company signs an insurance contract and makes payment to the insurance provider, we need to record cash out and prepaid insurance.

Web Published On 26 Sep 2017.

The prepaid insurance account is a type of asset on the balance sheet in which its normal balance is on the debit side. Web jul 5, 2023 bookkeeping by adam hill. Web in this journal entry, the $500 (6,000 / 12) of insurance expense is the expired cost of insurance in january 2021. This is accomplished with a debit of $1,000 to insurance expense.