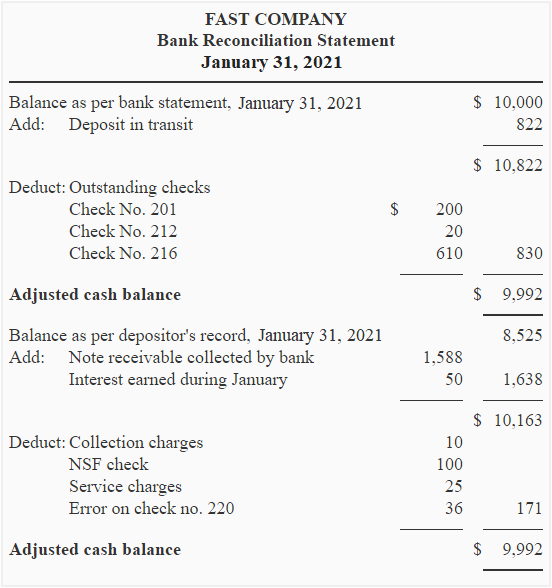

Reconciliation Journal Entries - Reconciliation is a process that must be completed monthly. Example 5 (error) share this post: Web explore journal entries in bank reconciliation. Web journal entries are required in a bank reconciliation when there are adjustments to the balance per books. Web journal entries are required to adjust the book balance to the correct balance. Streamline the process with nanonets. * this is the correct amount for check #640. There are several items of information we can get by comparing the bank statement to our records — any thing that doesn’t match or doesn’t exist on both places is called a reconciling item. Web how does it do this? Web a bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure that everything has been recorded in the company’s or individual’s books.

PPT Cash, Shortterm Investments and Accounts Receivable PowerPoint

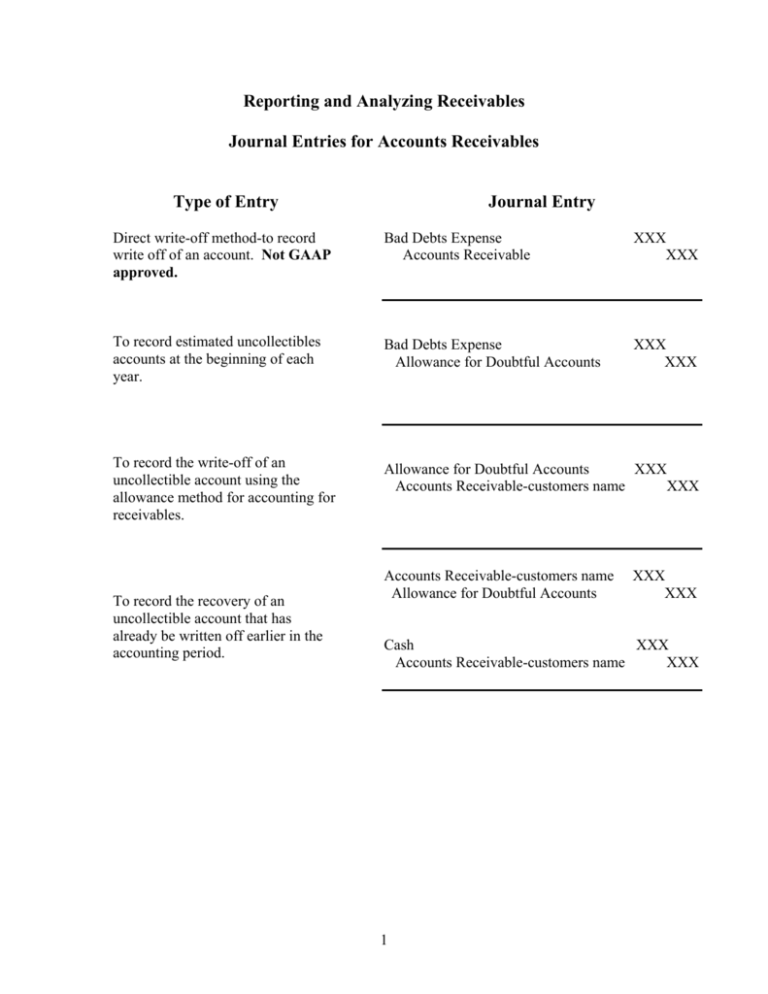

Journal entries are how you record all your transactions (sometimes called debits and credits). Obtain bank records and company records. In the case of feeter,.

Bank Reconciliation

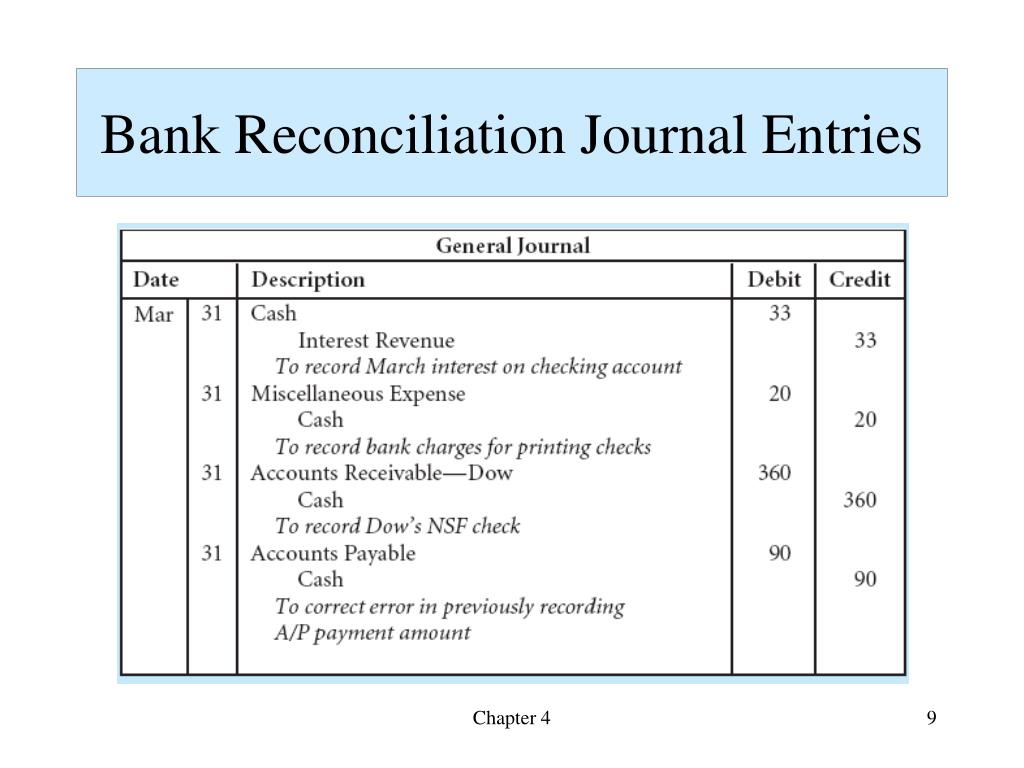

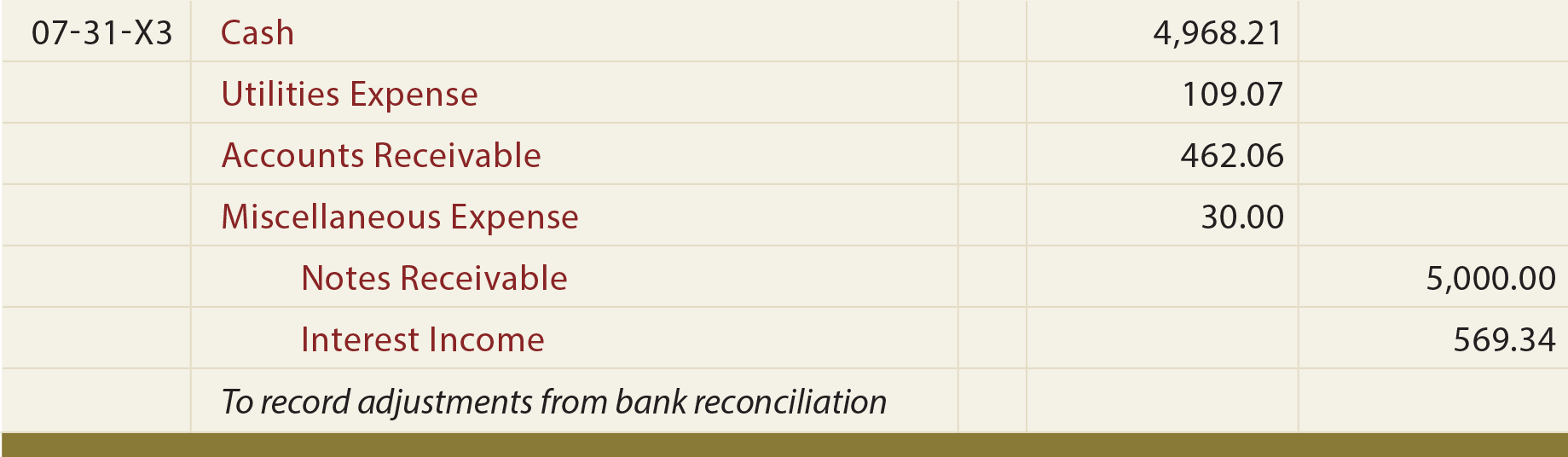

Following the completion of the reconciliation journals are required to post the adjustments for the reconciling items. Prepare wilder videos bank reconciliation at june 30,.

Solved PB52 Preparing A Bank Reconciliation And Journal

Prepare wilder videos bank reconciliation at june 30, 2020. For purposes of this lesson, we’ll prepare journal entries. Bank service charges which are often shown.

Bank Reconciliation Definition & Example of Bank Reconciliation

The second entry required is to adjust the books for. Example 2 (bank collection of notes receivable) bank reconciliation journal entry: Web post adjusting journal.

Bank Reconciliation Journal Entries YouTube

Web once you’ve received it, follow these steps to reconcile a bank statement: These adjustments result from items appearing on the bank statement that have.

Journal Entries from Bank Reconciliation

Web this means that journal entries that hit balance sheet accounts can cause something on the income statement to shift. Reconciliation is a process that.

Bank reconciliation statement definition, explanation, example and

Web in any case, those items that reconcile the general ledger (book balance) to the adjusted bank balance (the target) have to be recorded. Web.

Bank Reconciliation Journal Entries Templates at

A reconciling item will be added or subtracted to the bank or book side of the reconciliation. Reconciliation also confirms that accounts in a general..

Solved Bank Reconciliation? Journal Entries Prepare The

There are several items of information we can get by comparing the bank statement to our records — any thing that doesn’t match or doesn’t.

Example 5 (Error) Share This Post:

Example 3 (bank fee) journal entries for bank reconciliation: Web procedure to complete journal entries. Web journal entries are required to adjust the book balance to the correct balance. Web examples of journal entries for bank reconciliation.

Web Reconciliation Is An Accounting Procedure That Compares Two Sets Of Records To Check That The Figures Are Correct And In Agreement.

This video demonstrates how to prepare journal entries. Web a bank reconciliation is a monthly process by which we match up the activity on the bank statement to ensure that everything has been recorded in the company’s or individual’s books. Examples of journal entries in a bank reconciliation. Bank service charges which are often shown on the last day of the bank statement.

Example 4 (Nsf Check) Bank Reconciliation Journal Entry:

Web bank reconciliation journal entries: The second entry required is to adjust the. Web how does it do this? Example 1 (interest income) bank reconciliation journal entries:

When All The Balance Sheet Accounts Are Reconciled, You’ve Nailed Net Income.

Reconciliation also confirms that accounts in a general. Following the completion of the reconciliation journals are required to post the adjustments for the reconciling items. All your journal entries are gathered in the general ledger. There are several items of information we can get by comparing the bank statement to our records — any thing that doesn’t match or doesn’t exist on both places is called a reconciling item.