Provision For Tax Journal Entry - Web [1] provision for income tax : This is below the line entry. Web provision expense journal entry. For companies that use the cash basis for both. Your accountant may also have other entries for you to. After adjusting necessary items from gross profit, (e.g. This episode will show you how to record a journal entry for the tax provision. Web (iv) a journal entry—the appropriate ledger reference, the name of the person on whose behalf the transfer was made and the matter description. Web by jay way updated march 06, 2019. The masks section of a 2023 cochrane review of non.

Journal Entry For Tax Provision

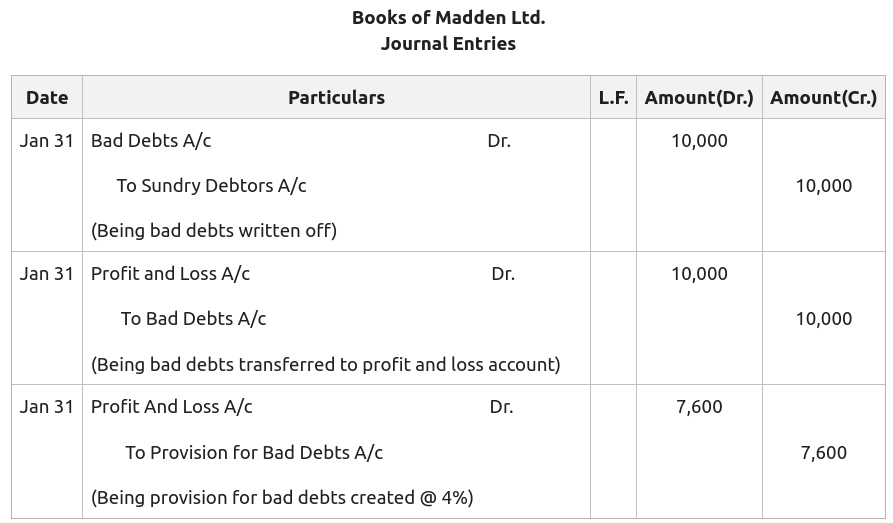

In accounting, after estimating the loss that it may suffer due to the defaulting loans, the company can make the journal entry of provision. See.

Blt 134 chapter 4

Web the company tax rate is 28.5% and thus the projected tax payable will be $14,250.00. This is below the line entry. See journal entries.

Provision For Tax Journal Entry

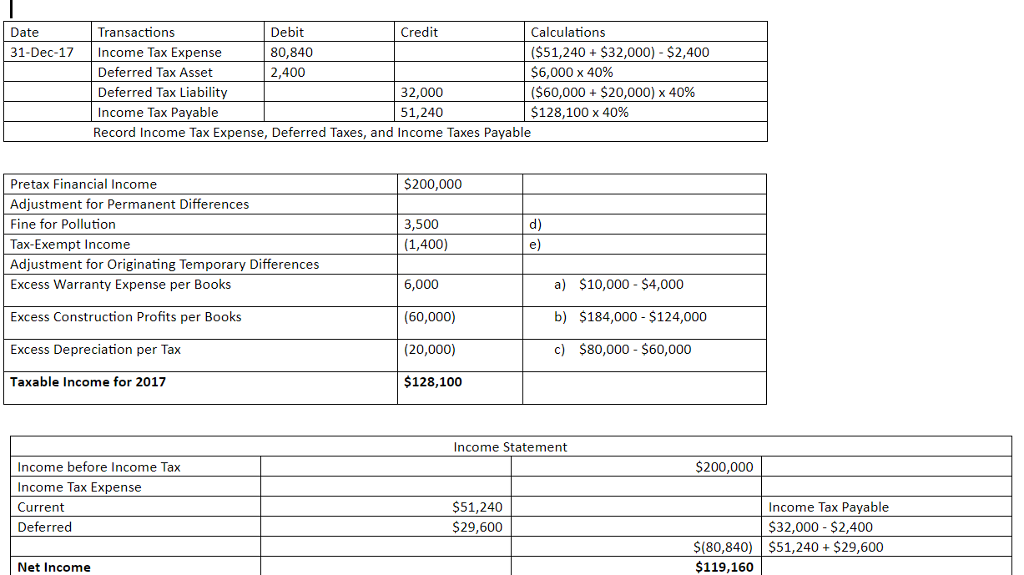

Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the.

Provision For Tax Journal Entry

Web provision expense journal entry. After adjusting necessary items from gross profit, (e.g. Journal entry (episode 6) tom fazio. Web the company tax rate is.

Provisions in Accounting Meaning, Accounting Treatment, and Example

Web tax provision basics: Web the journal entry to record provision is: Your accountant may also have other entries for you to. This is below.

Entries for TDS Receivable and Provision for Tax Chapter 8 TDS Recei

Web the need for a new review on masks was highlighted by a widely publicized polarization in scientific opinion. Web (iv) a journal entry—the appropriate.

Provision For Tax Journal Entry

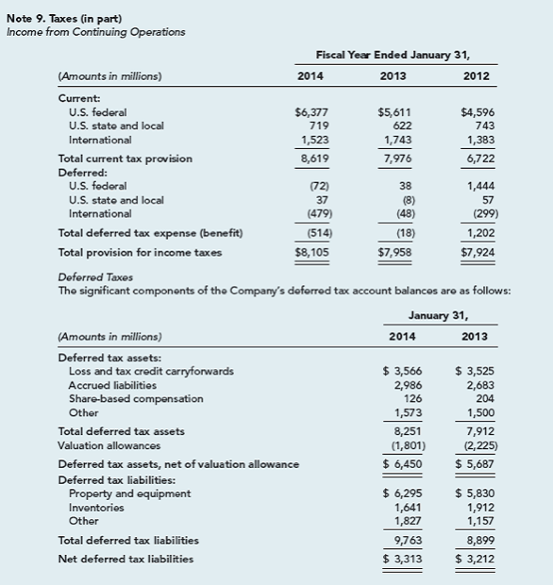

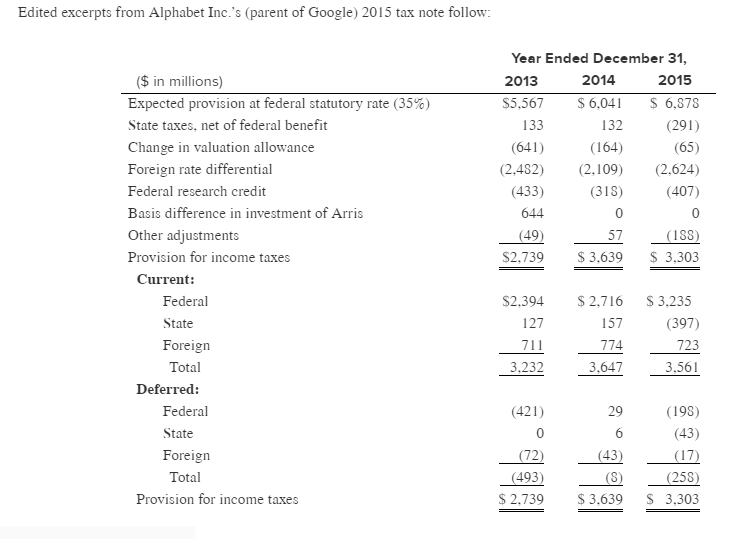

Web journal entries for deferred tax liability. Web accounting for taxes. Deferred tax assets and liabilities are crucial components of a company’s financial reporting, reflecting.

Journal Entry For Tax Provision

See journal entries for sole proprietorship, partnership,. In accounting, after estimating the loss that it may suffer due to the defaulting loans, the company can.

Journal Entry For Tax Provision

We account for this by the following end of year journal entries: (provision for bad debts) 5% provision for bad debts is to be maintained.

Web Tax Accounting Perspectives.

Web learn what an income tax provision is, how to calculate it and why it matters for financial reporting. In accounting, after estimating the loss that it may suffer due to the defaulting loans, the company can make the journal entry of provision. Web a powerful tax and accounting research tool. Find out the key components, permanent and.

Asc 740 Considerations As Income Tax Returns Are Finalized.

Here are the types of provision. Web the journal entry to record provision is: This provision is created from profit. Web journal entries for deferred tax liability.

Deferred Tax Assets And Liabilities Are Crucial Components Of A Company’s Financial Reporting, Reflecting Differences In The.

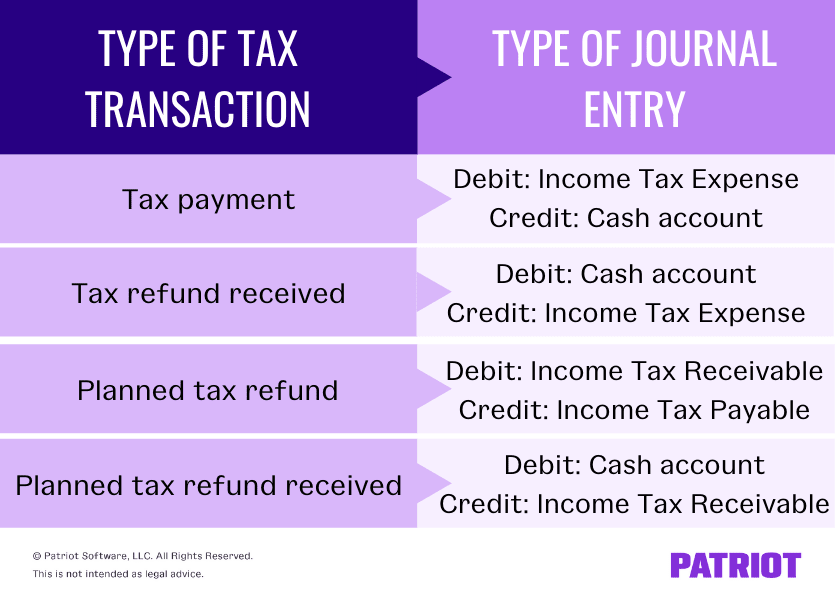

There are different types of provision expenses, and we will look into each type separately. Journal entry (episode 6) tom fazio. Get more accurate and efficient results with the power of ai, cognitive computing, and machine learning. Companies record both income tax expense and income tax payable in journal entries.

Tax Provision Processes Include Analyzing.

Web the actual taxation entries are most important things as they clears the balance sheet picture and gives real result. Web by jay way updated march 06, 2019. Web in this lesson, we will explain how to prepare journal entries to record the income tax expense and related assets and liabilities in the financial statements. Taxes are amounts levied by governments on businesses and individuals to finance their expenditures, to fight business cycles, to.

+and+the+Journal+Entry+to+Record+Income+Taxes.jpg)