Salary Accrued Journal Entry - The accrued expenses may include interest expense, salaries. It is the total of all the. Web payroll journal entries are used to record the compensation paid to employees. Edited by ashish kumar srivastav. Web accrued payroll journal entry. Web a journal entry for accrued salary would comprise of an entry to the salary expense account ( in p&l) and accrued salary expense account (in bs). This is in line with the principle of. For small businesses that use the accrual. Web discover how to calculate payroll accrual + journal entries. In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been paid for yet.

10 Payroll Journal Entry Template Template Guru

In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not.

Accrued Salaries Double Entry Bookkeeping

Web the accrued wages journal entries allow the company to recognize payroll expenses in the correct reporting period even though cash payment has not occurred.

Payroll Journal Entry Example Explanation My Accounting Course

It is the total of all the. Web updated on january 3, 2024. This information is used to. Web payroll journal entries are used to.

Accrued Salary Journal Entry YouTube

Web hence, the accrued salaries journal entry would be a debit to the salaries expense account and a credit to the accrued salaries (or wages).

Accruals and Prepayments Journal Entries HeathldDunn

Web payroll journal entries are used to record the compensation paid to employees. Web accrued payroll journal entry. These entries are then incorporated into an.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web accrued revenue journal entries refer to the figures derived and entered by adjusting entries at the end of an accounting period to record sales.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web the journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued salaries liability account. Explanation example journal entries.

Record The Payment Of Accrued And Current Salaries Aulaiestpdm Blog

This is in line with the principle of. Web the initial journal entry of an accrued wage is a “debit” to the employee payroll account,.

What Is The Journal Entry For Payment Of Salaries Info Loans

Web hence, the accrued salaries journal entry would be a debit to the salaries expense account and a credit to the accrued salaries (or wages).

The Company Can Make The Accrued Wages.

These financial entries are included. Web the journal entry to record accrued salaries involves debiting the salaries expense account and crediting the accrued salaries liability account. It is the total of all the. This is in line with the principle of.

For Small Businesses That Use The Accrual.

Likewise, as the expense has already incurred, the company needs to properly. Web accrued payroll journal entry. The accrued expenses may include interest expense, salaries. Web the accrued payroll refers to the company’s current liability arising from accrued salary, wages, bonuses, commissions, payroll taxes, and other expenses.

Web A Journal Entry For Accrued Salary Would Comprise Of An Entry To The Salary Expense Account ( In P&L) And Accrued Salary Expense Account (In Bs).

This information is used to. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Before discussing that, it is crucial to understand accrued wages and their meaning. Web hence, the accrued salaries journal entry would be a debit to the salaries expense account and a credit to the accrued salaries (or wages) account.

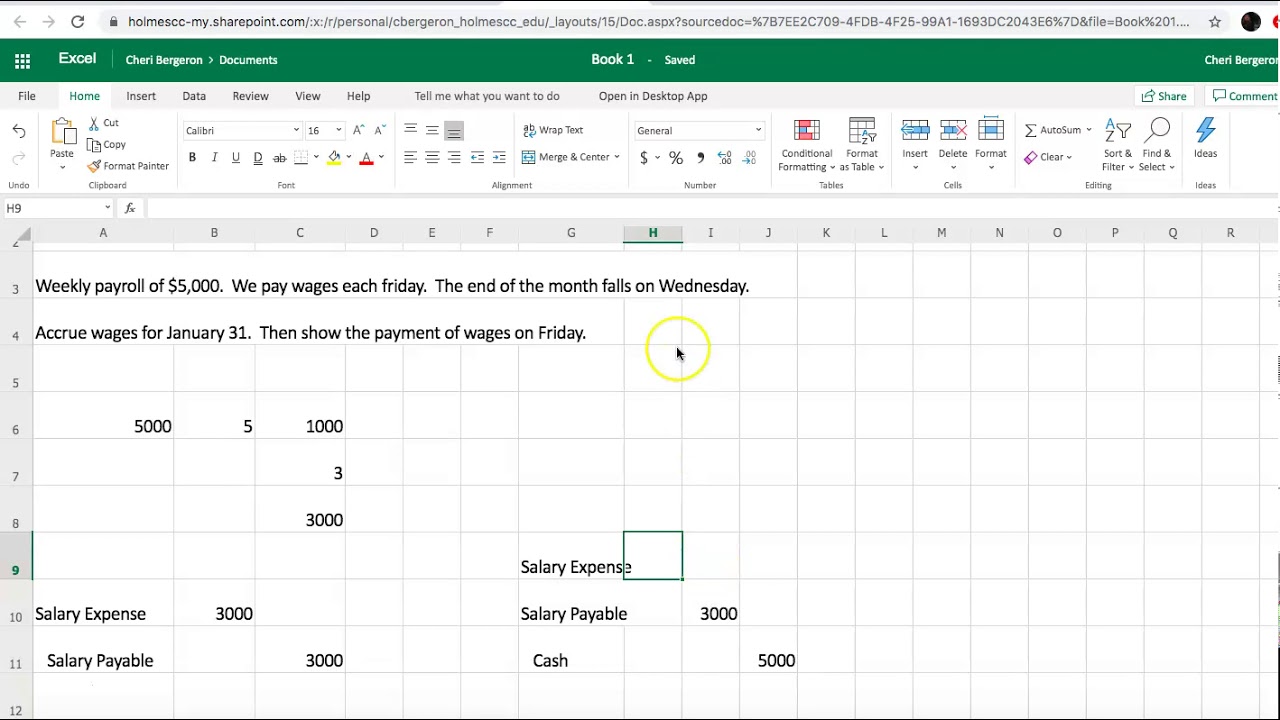

Web This Journal Entry Is Made To Eliminate The Wages Payable Of $3,000 That Company Abc Has Recorded In The January 31 Adjusting Entry.

Web in order to correct this situation an accrued salaries journal entry is required and the amount is calculated as follows: Explanation example journal entries to record accrued expenses accrued expenses faqs. In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been paid for yet. Within quickbooks, you can prepare a single journal entry to record all salaries.