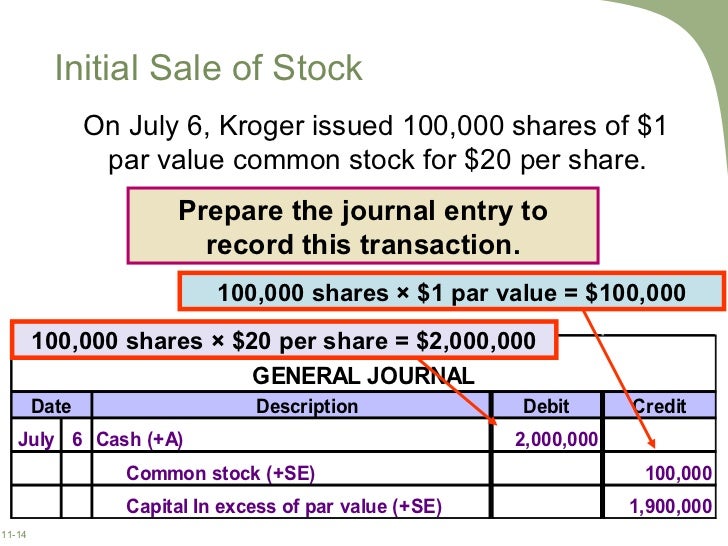

Preferred Stock Journal Entry - Web to record the issue of common (or preferred) stock, you will: Figure 14.5 shows what the equity section of the balance sheet will reflect after the preferred stock is issued. Web the journal entry is: (shares issued x price paid per share) or market value of item received. Web be able to prepare complete journal entries to record the issuance of par value stock. Web preferred stock, $40 par (100 shares x $40 par) 4,000: Web preferred stock journal entries. Company abc issues the preferred share to the market with a par value of $ 1 per. Web journal entry for issuance of preferred stock. The preferred stock is issued in a bundled transaction with other instruments (e.g., warrants);

Issuing Stock Journal Entry YouTube

How is stock accounted for that is issued for assets other than cash? The preferred stock is issued in a bundled transaction with other instruments.

Preferred Stock Journal Entry Ppt Powerpoint Presentation File

Web journal entry for issuance of preferred stock. The preferred stock is issued in a bundled transaction with other instruments (e.g., warrants); Web common stock.

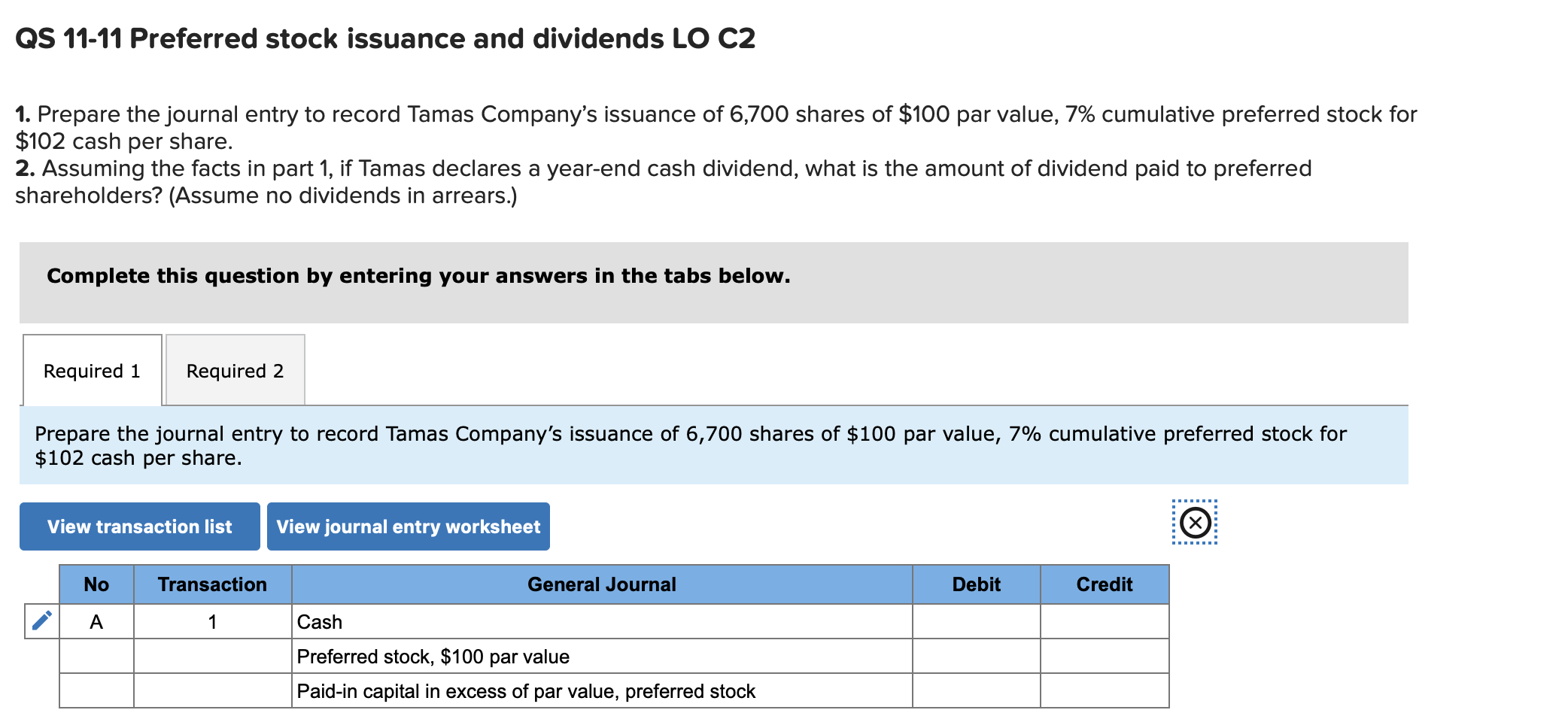

Solved QS 1111 Preferred stock issuance and dividends LO C2

Web entries to the retained earnings account, book value. Web the journal entry is: Companies use book value method to account for the conversion of.

Redemption of Preference Shares Practical Problem and Solutions

Web entries to the retained earnings account, book value. Upon issuance, common stock is generally. The preferred stock is issued in a bundled transaction with.

Preferred Stock Journal Entry YouTube

Figure 14.5 shows what the equity section of the balance sheet will reflect after the preferred stock is issued. What is the accounting for preferred.

Journal entry for purchasing shares of common stock and more bidvest

Web the journal entry is: Upon issuance, common stock is generally. If a commitment to issue additional preferred stock is a freestanding instrument, the. As.

cumulative preferred stock formula Patrina Regalado

As the preferred stock has a preferable status in the company, it. What is the accounting for preferred stock? Web the journal entry for issuing.

Problems and Solutions on Redeeming Preference Shares

Web to record the issue of common (or preferred) stock, you will: To record the receipt of legal. Web entries to the retained earnings account,.

ACC212_Weygandt_Chapter13

The preferred stock is issued in a bundled transaction with other instruments (e.g., warrants); Companies use book value method to account for the conversion of.

Web The Journal Entry Is:

Web in this journal entry of callable preferred stock, both total assets and total equity on the balance sheet decreased by the same amount. Web the fasb reduced the number of accounting models for convertible debt and convertible preferred stock instruments and made certain disclosure amendments to improve the. Cash or other item received. Figure 14.5 shows what the equity section of the balance sheet will reflect after the preferred stock is issued.

The Company Has Paid A Preferred Stock Dividend Of $ 70,000, So They Have To Reduce The Retained.

If a commitment to issue additional preferred stock is a freestanding instrument, the. Web journal entry for issuance of preferred stock. Web in this journal entry, both assets and equity in the balance sheet increase by the same amount of $150,000. Web if ten thousand shares of this preferred stock are each issued for $101 in cash ($1,010,000 in total), the company records the following journal entry.

Web Common Stock Should Be Recognized On Its Settlement Date (I.e., The Date The Proceeds Are Received And The Shares Are Issued).

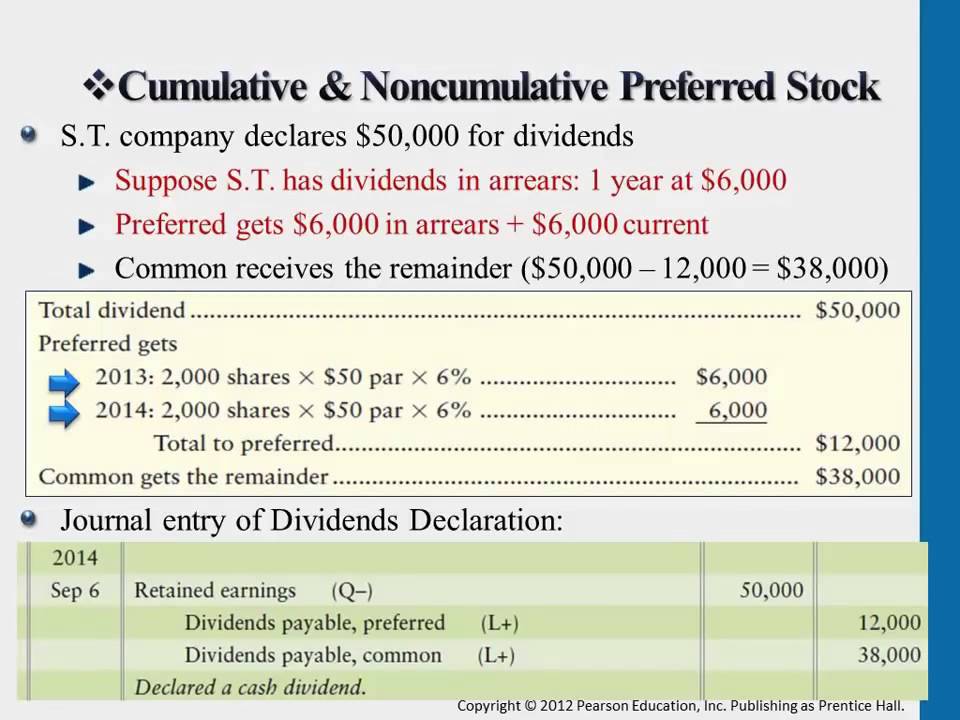

Web please prepare a journal entry for dividends paid to preferred stockholders. What is the accounting for preferred stock? Web entries to the retained earnings account, book value. To record the receipt of legal.

(Shares Issued X Price Paid Per Share) Or Market Value Of Item Received.

Web journal entries for conversion of preferred stock to common stock. The preferred stock is issued in a bundled transaction with other instruments (e.g., warrants); The proceeds received by the. When it comes to dividends and.