Write Off Ar Journal Entry - [q1] the entity concludes that $1,200 of its accounts receivable cannot be. Web the bookkeeper will make the following journal entry to its general ledger: Before proceeding with writing off accounts receivable, it’s essential to thoroughly. Web direct write off method. Credit allowance for doubtful accounts. Web create a journal entry. Web steps to write off accounts receivable. (dr) bad debt expense 1,200 (cr) accounts receivable 1,200. The transaction will remove accounts receivable from balance sheet as the company knows. Web january 28, 2019 10:17 am.

Resolve AR or AP on the cash basis Balance Sheet w... QuickBooks

This will be a credit to the asset account. Web direct write off method. Web here are the 34 business records trump was found guilty.

AR WriteOff Form (South1) PDF Write Off Invoice

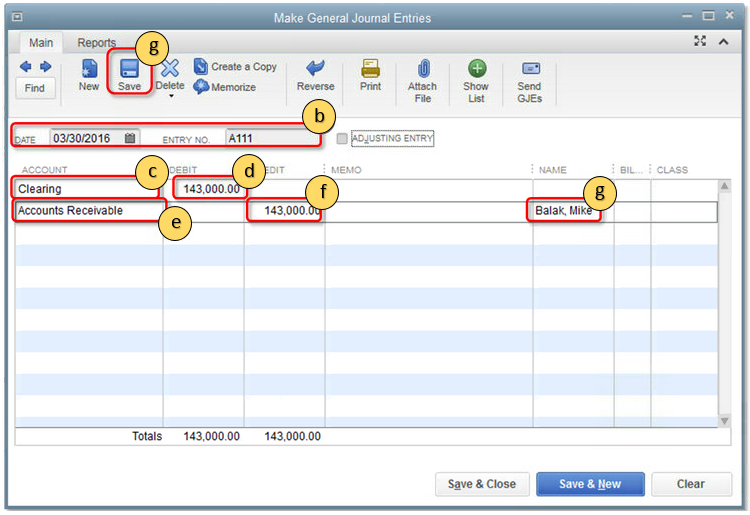

Glad to see you here, @batvalil. If you're making a write off. Web direct write off method. The transaction will remove accounts receivable from balance.

A Beginner's Guide to Journal Entries A and M Education

Web january 28, 2019 10:17 am. One method of recording the bad debts is referred to as the direct write off method which involves removing.

Journal Entry Problems and Solutions Format Examples MCQs

If you're making a write off. Essentially, you write off ar. Web create a journal entry. Debit bad debts expense, and; (dr) bad debt expense.

Uncollectible Accounts Written Off Accounting Methods

Debit bad debts expense, and; (dr) bad debt expense 1,200 (cr) accounts receivable 1,200. Web direct write off method. This journal entry eliminates the $500.

Resolve AR or AP on the cash basis Balance Sheet with journal entries

Web january 28, 2019 10:17 am. This will be a credit to the asset account. Web the bookkeeper will make the following journal entry to.

AR AR Journal

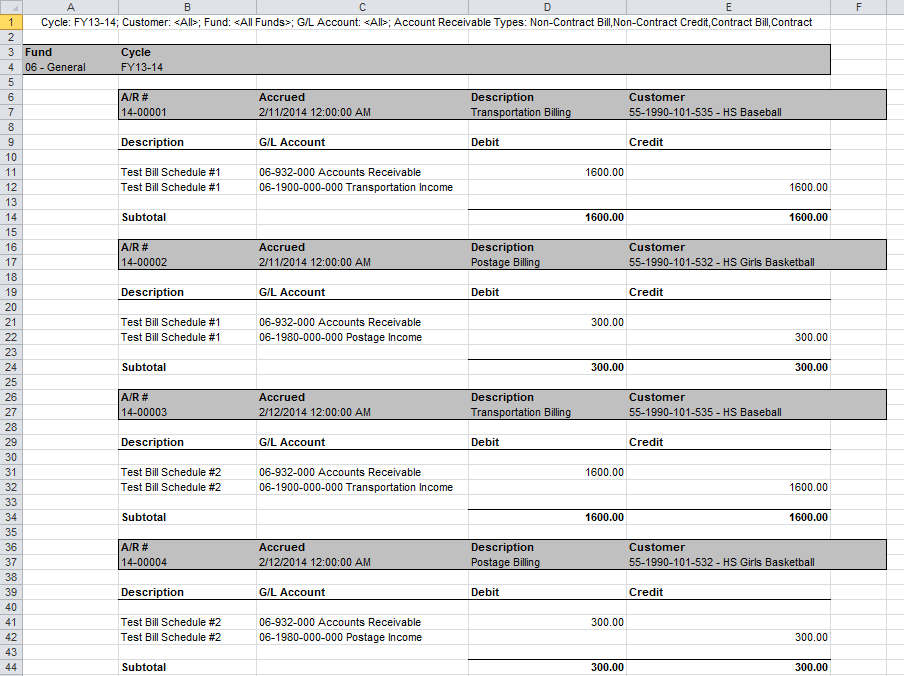

There are two choices for. Create a journal entry to write off the appropriate amount of the asset. The seller can charge the amount of.

Recovering Writtenoff Accounts Wize University Introduction to

Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. If you're making.

9.1 Explain the Revenue Recognition Principle and How It Relates to

Debit bad debts expense, and; An accounts receivable balance represents an amount due to cornell university. This entry reduces the accounts. Web the journal entry.

Web Here Are The 34 Business Records Trump Was Found Guilty Of Falsifying, As Described In Judge Juan Merchan 'S Jury Instructions:

The visual below also includes the journal entry necessary to. I'm here to help walk you through clearing out your customer's old balance in the system. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web january 28, 2019 10:17 am.

Glad To See You Here, @Batvalil.

Web how to create a general journal entry to remove ar and or ap balances from a cash basis balance sheet on the last day of a reporting period. If you're making a write off. The transaction will remove accounts receivable from balance sheet as the company knows. Web the accounts receivable journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry.

Web Direct Write Off Method.

Debit bad debts expense, and; There are two choices for. Essentially, you write off ar. The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid.

Before Proceeding With Writing Off Accounts Receivable, It’s Essential To Thoroughly.

Create a journal entry to write off the appropriate amount of the asset. An accounts receivable balance represents an amount due to cornell university. If there is still a chance. This entry reduces the accounts.