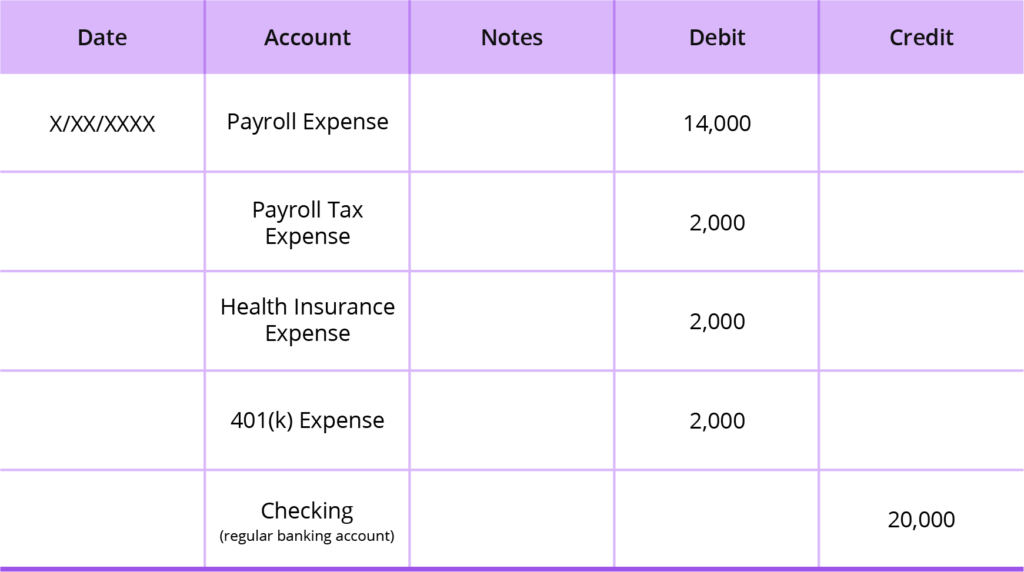

Ppp Loan Forgiveness Journal Entry - Effective march 13, 2024, all. Web cost of ppp compared to student debt forgiveness. They have to reves the loan from balance sheet as they have no obligation to pay back the loan. I'd recommend reaching out to your accountant to determine which. Web irs provides guidance for ppp loan forgiveness. Web loan forgiven journal entry: This example assumes the full ppp loan has been forgiven in whole. A portion of the borrower’s ppp loan (and related interest) will be forgiven, equal to eligible expenses, including payroll costs, interest payments on. Where to apply for loan forgiveness. Web the journal entries would be as follows:

Journal Entry For Ppp Loan In Quickbooks

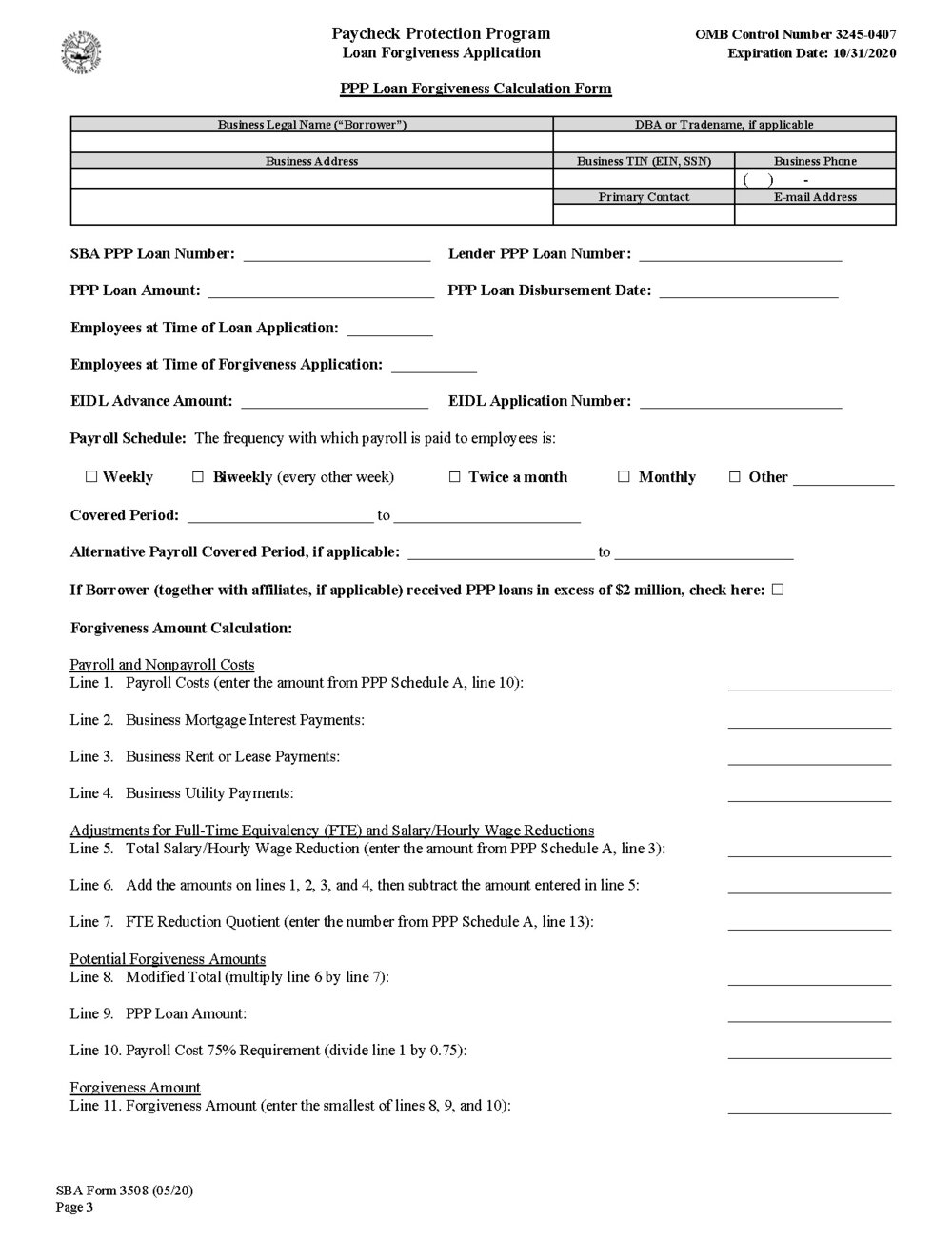

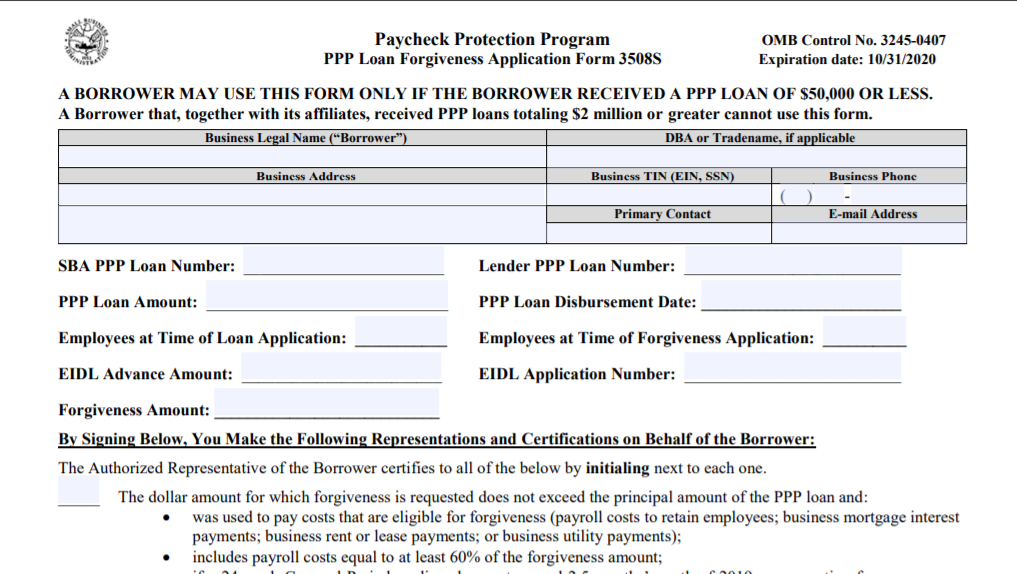

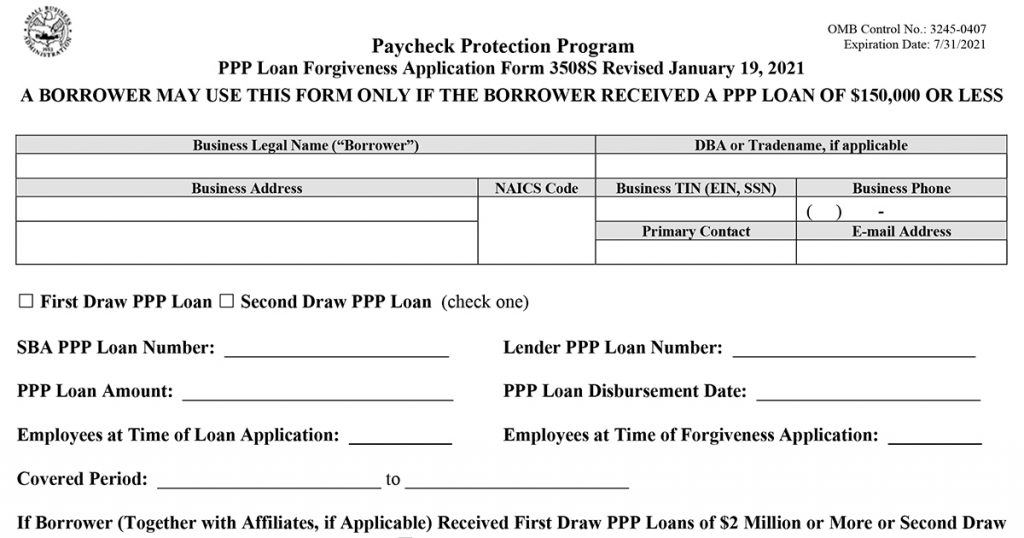

Where to apply for loan forgiveness. A portion of the borrower’s ppp loan (and related interest) will be forgiven, equal to eligible expenses, including payroll.

PPP Loan Application And Instructions Released Printable

Any amounts not forgiven would remain as a liability. They have to reves the loan from balance sheet as they have no obligation to pay.

PPP Loan How to Record in Quickbooks YouTube

Where to apply for loan forgiveness. The irs recently released guidance ( rev. Create an income account for ppp loan forgiveness. This example assumes the.

Recording of the PPP Loan BYO Bookkeeper

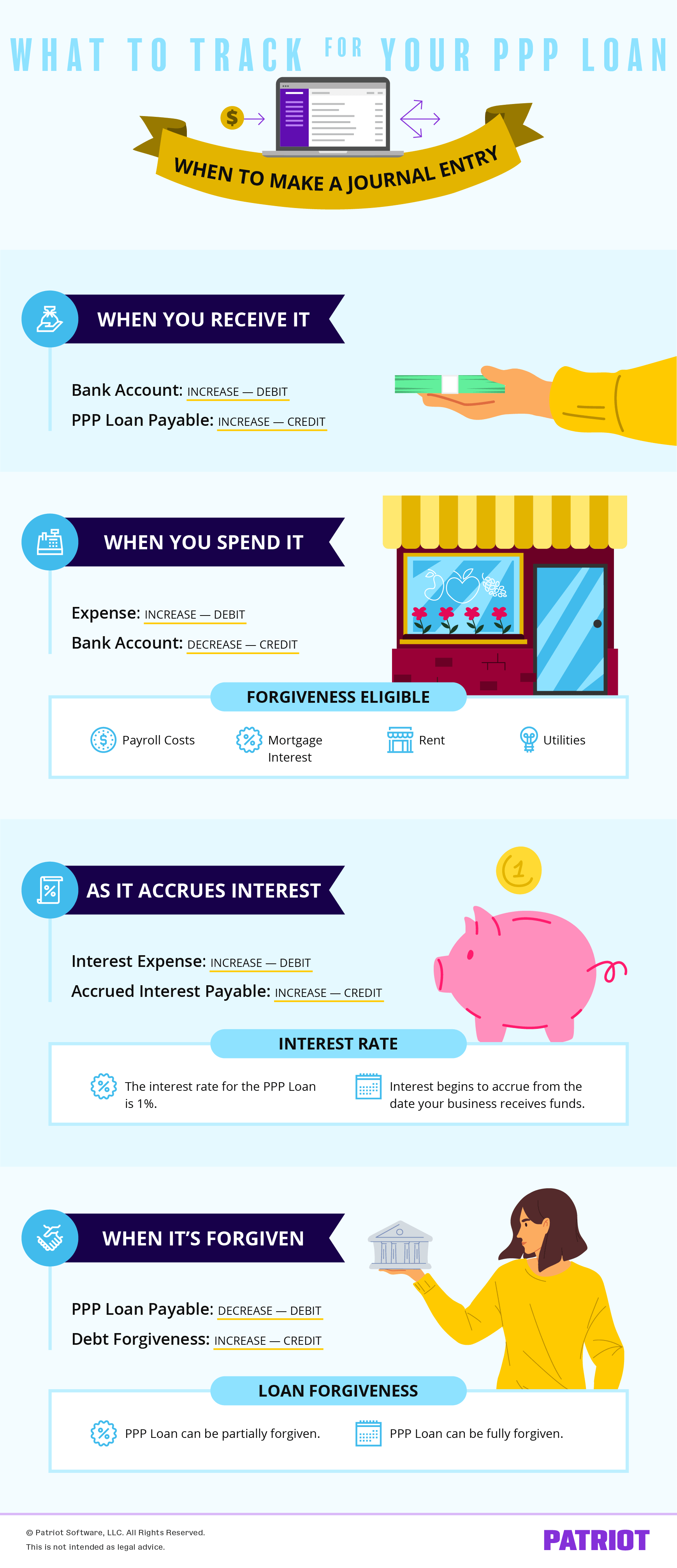

Web to get off the ppp loan or record the forgiveness, you'll have to create a journal entry. They have to reves the loan from.

A Simpler PPP Application For Loans Of 50 000 Printable

Web paycheck protection program loan forgiveness. Any amounts not forgiven would remain as a liability. Web cost of ppp compared to student debt forgiveness. For.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

When you receive the funds, debit the ppp loan funds cash account and credit the ppp loan funds. Web paycheck protection program loan forgiveness. Web.

SBA Releases PPP Form For Loans Of 150 000 Or Printable

Solved•by quickbooks•486•updated september 07, 2023. They have to reves the loan from balance sheet as they have no obligation to pay back the loan. Web.

PPP Loan Application And Instructions Released Printable

This example assumes the full ppp loan has been forgiven in whole. Taxpayers may treat such income as received or accrued when either. A nongovernmental.

PPP Loan Accounting Creating Journal Entries & PPP Accounting Tips

Web forgiveness of ppp loans. They have to reves the loan from balance sheet as they have no obligation to pay back the loan. Web.

Web The Forgiveness, When Granted, Is Nontaxable Income Even Though No Cash Is Received.

Web borrowers may be eligible for paycheck protection program (ppp) loan forgiveness. Web cost of ppp compared to student debt forgiveness. A nongovernmental entity may account for a paycheck protection program (ppp) loan as a financial liability in accordance with fasb. When you receive the funds, debit the ppp loan funds cash account and credit the ppp loan funds.

Web Ppp Loans Are Administered By The Small Business Administration (Sba) And Are Disbursed By Banks, For Potentially Forgivable Loans To Support Eligible Small.

Create an income account for ppp loan forgiveness. They have to reves the loan from balance sheet as they have no obligation to pay back the loan. Web the journal entry is debiting loan liability of $ 100,000 and credit other income of $ 100,000. The committee for a responsible federal budget estimates that changes established by biden’s student loan.

Web Loan Forgiven Journal Entry:

This example assumes the full ppp loan has been forgiven in whole. The first step in recording ppp loan forgiveness in quickbooks is to create a designated income account. Effective march 13, 2024, all. The irs recently released guidance ( rev.

Where To Apply For Loan Forgiveness.

Taxpayers may treat such income as received or accrued when either. I'd recommend reaching out to your accountant to determine which. Web for those on the cash basis of accounting, you would record the following general journal entry: A portion of the borrower’s ppp loan (and related interest) will be forgiven, equal to eligible expenses, including payroll costs, interest payments on.