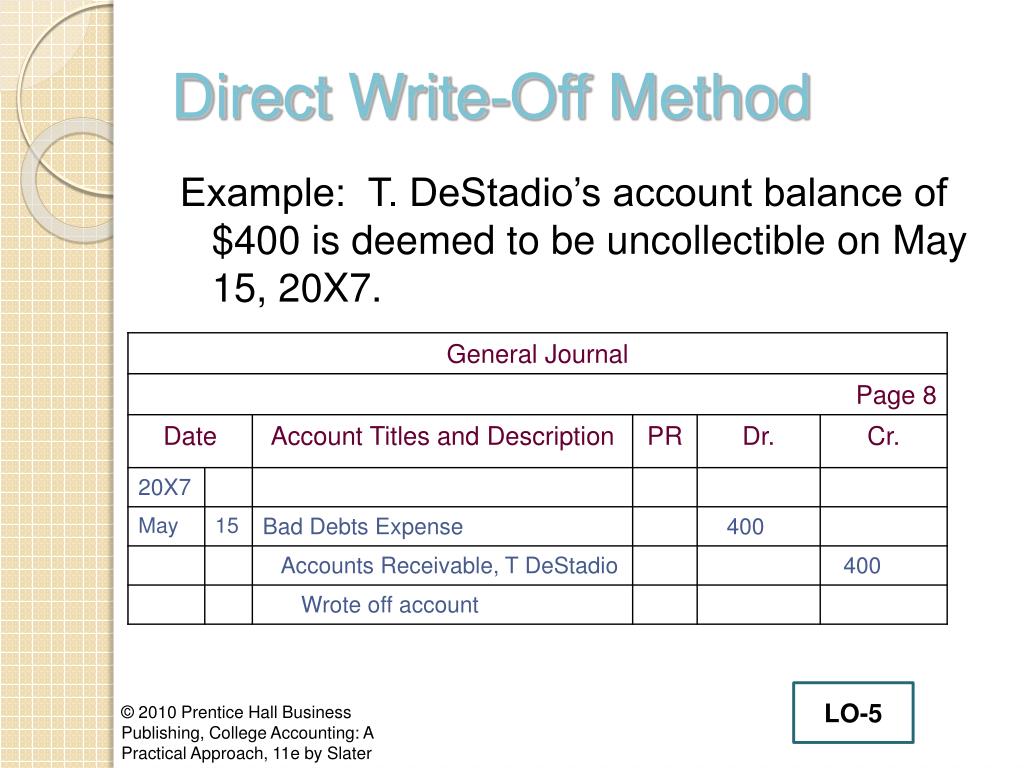

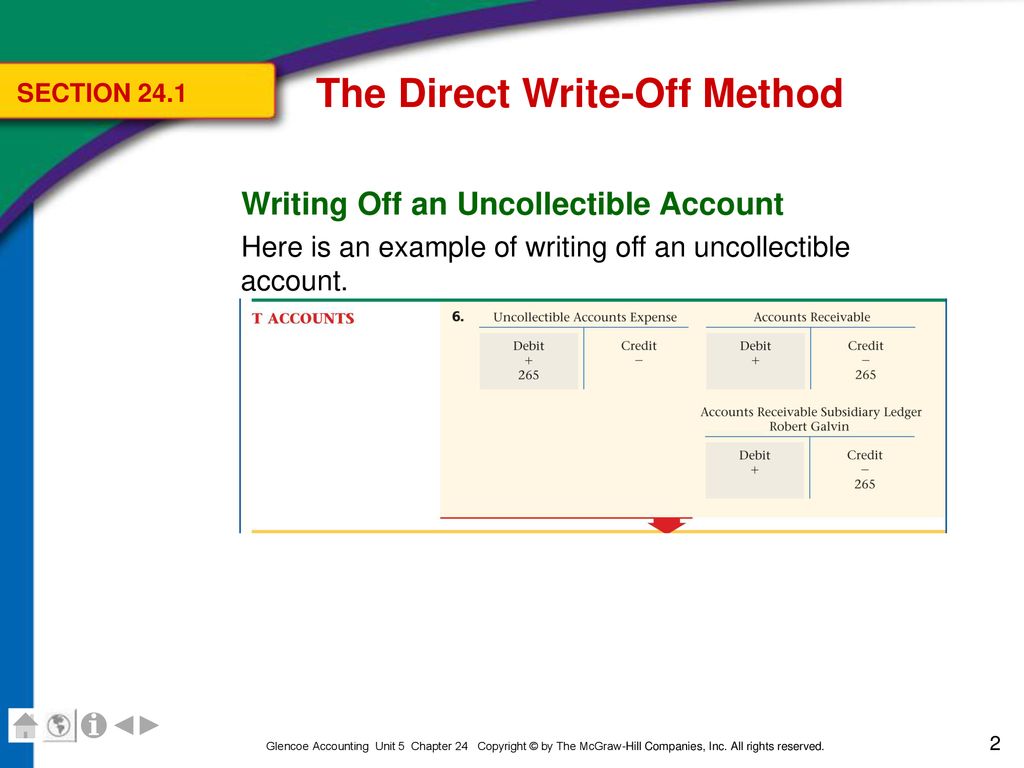

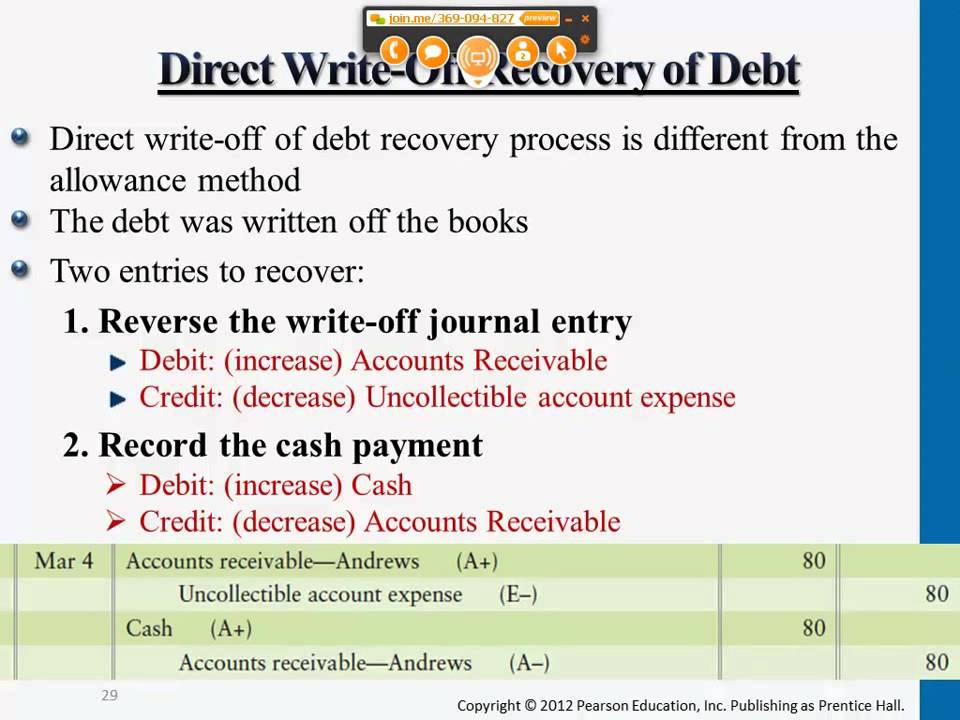

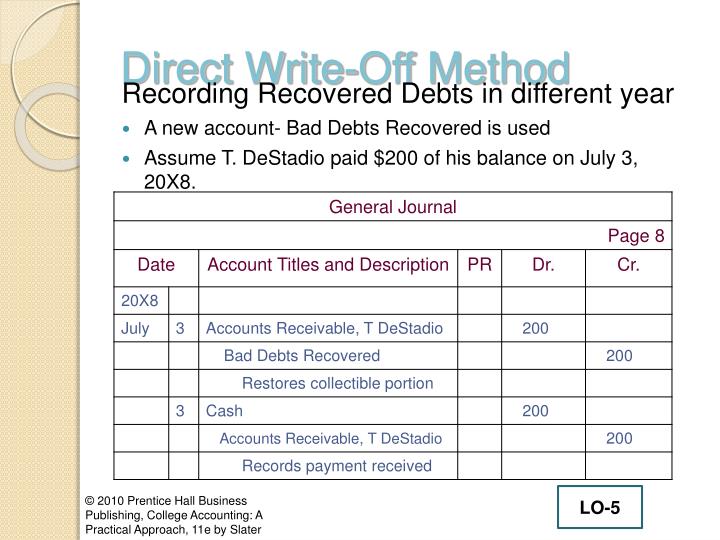

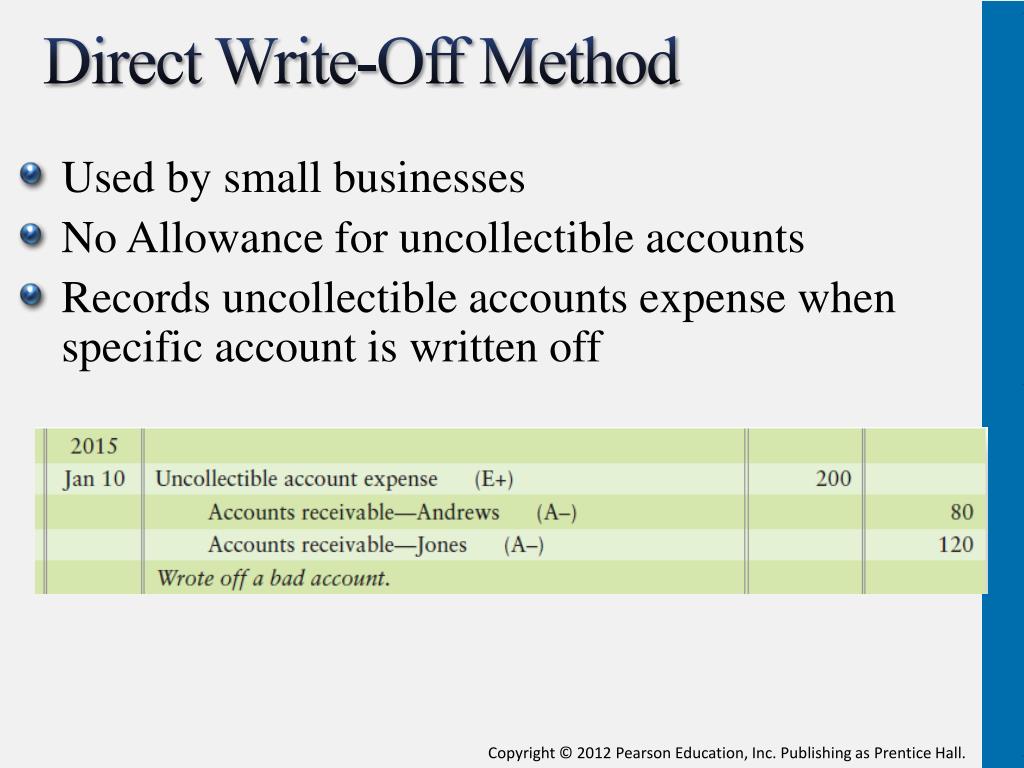

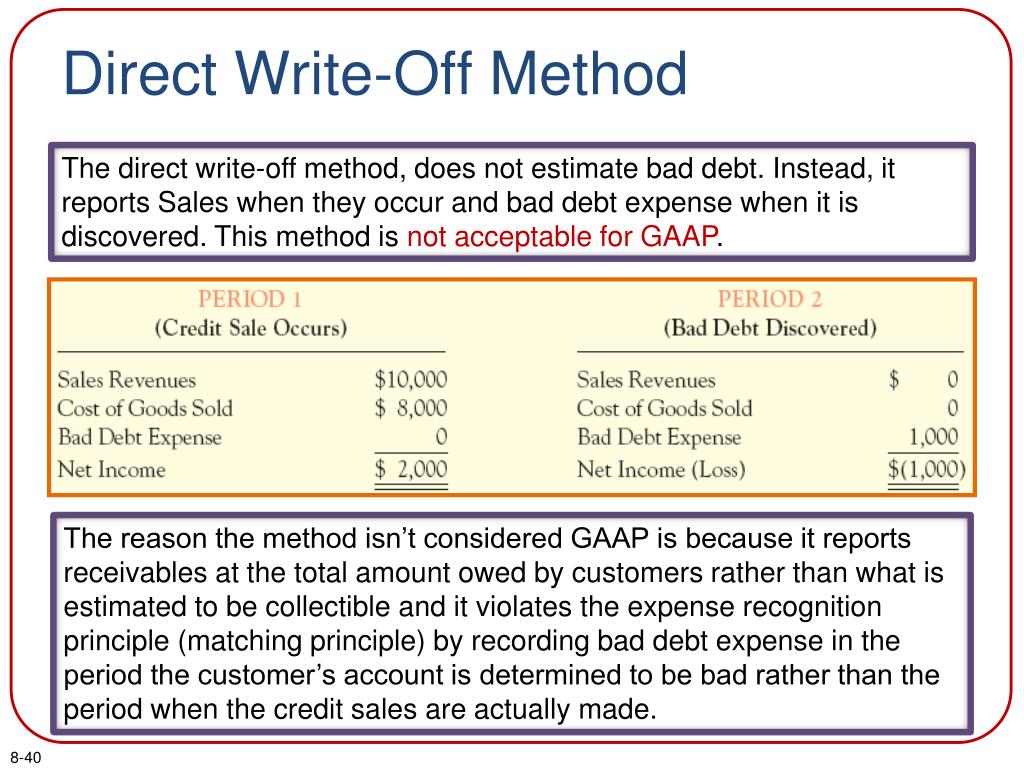

Direct Write Off Method Journal Entry - One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt. Web the journal entry to record the loss is as follows: Hence, it’s important to note that writing off an account does not erase the debt legally or financially; The accounting records will show the following bookkeeping entries for the bad debt written off. Z as uncollectible with a balance of usd 350. This method can be considered a reasonable accounting method if the amount that is written off is an immaterial amount, since doing so has minimal impact on an entity's reported financial results. Web direct write off method. (dr.) bad debt expense 12,500 (cr.) accounts receivable 12,500. This is the simplest way to recognize a bad debt, since the entry is only made when a specific customer invoice has been identified as a bad debt. Web once the allowance is established, an adjusting journal entry is made to debit bad debt expense and credit the allowance for doubtful accounts.

PPT Accounting for Bad Debts PowerPoint Presentation, free download

Web direct write off method. Web the direct write off method involves charging bad debts to expense only when individual invoices have been identified as.

The Direct WriteOff Method ppt download

Journal entry for the bad debt write off. This journal entry eliminates the $500 balance in accounts receivable while creating an account for. The allowance.

Direct Write Off Recovery of Debt Professor Victoria Chiu YouTube

Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense.

Direct WriteOff Method for Uncollectible Accounts Principles of

Web the direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. Once this account is.

Accounting Q and A EX 914 Entries for bad debt expense under the

In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created. For.

Example of the direct write off and the allowance methods for Accounts

(dr.) bad debt expense 12,500 (cr.) accounts receivable 12,500. Bad debt write off bookkeeping entries explained. This is the simplest way to recognize a bad.

PPT Accounting for Bad Debts PowerPoint Presentation ID807176

Journal entry for the bad debt write off. The bad debt expense is recognized as an operating expense in the year in which it occurs.

How to calculate and record the bad debt expense QuickBooks

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts.

PPT Receivables PowerPoint Presentation, free download ID1657894

This method can be considered a reasonable accounting method if the amount that is written off is an immaterial amount, since doing so has minimal.

Web Direct Write Off Method.

Decides to write off one of its customers, mr. The accounting records will show the following bookkeeping entries for the bad debt written off. Once this account is identified as uncollectible, the company will record a reduction to the customer’s accounts receivable and an increase to bad debt expense for the exact amount uncollectible. Web the following entry is passed to write off the debt:

Bad Debt Write Off Bookkeeping Entries Explained.

Allowance for doubtful accounts journal entry example. In this method, the company does not make an estimation of bad debt for adjusting entry, so no allowance for doubtful accounts is created. This method can be considered a reasonable accounting method if the amount that is written off is an immaterial amount, since doing so has minimal impact on an entity's reported financial results. (dr.) bad debt expense 12,500 (cr.) accounts receivable 12,500.

Once This Account Is Identified As Uncollectible, The Company Will Record A Reduction To The Customer’s Accounts Receivable And An Increase To Bad Debt Expense For The Exact Amount Uncollectible.

Journal entry for the bad debt write off. Web the direct write off method involves charging bad debts to expense only when individual invoices have been identified as uncollectible. The allowance method estimates bad debt expense at the end of the fiscal year, setting up a reserve account called allowance for doubtful accounts. This journal entry eliminates the $500 balance in accounts receivable while creating an account for.

The Bad Debt Expense Is Recognized As An Operating Expense In The Year In Which It Occurs In The Income Statement.

It merely reflects the acknowledgment that the company believes it is unlikely to recover the amount. Web once the allowance is established, an adjusting journal entry is made to debit bad debt expense and credit the allowance for doubtful accounts. This is the simplest way to recognize a bad debt, since the entry is only made when a specific customer invoice has been identified as a bad debt. What is allowance for doubtful accounts?