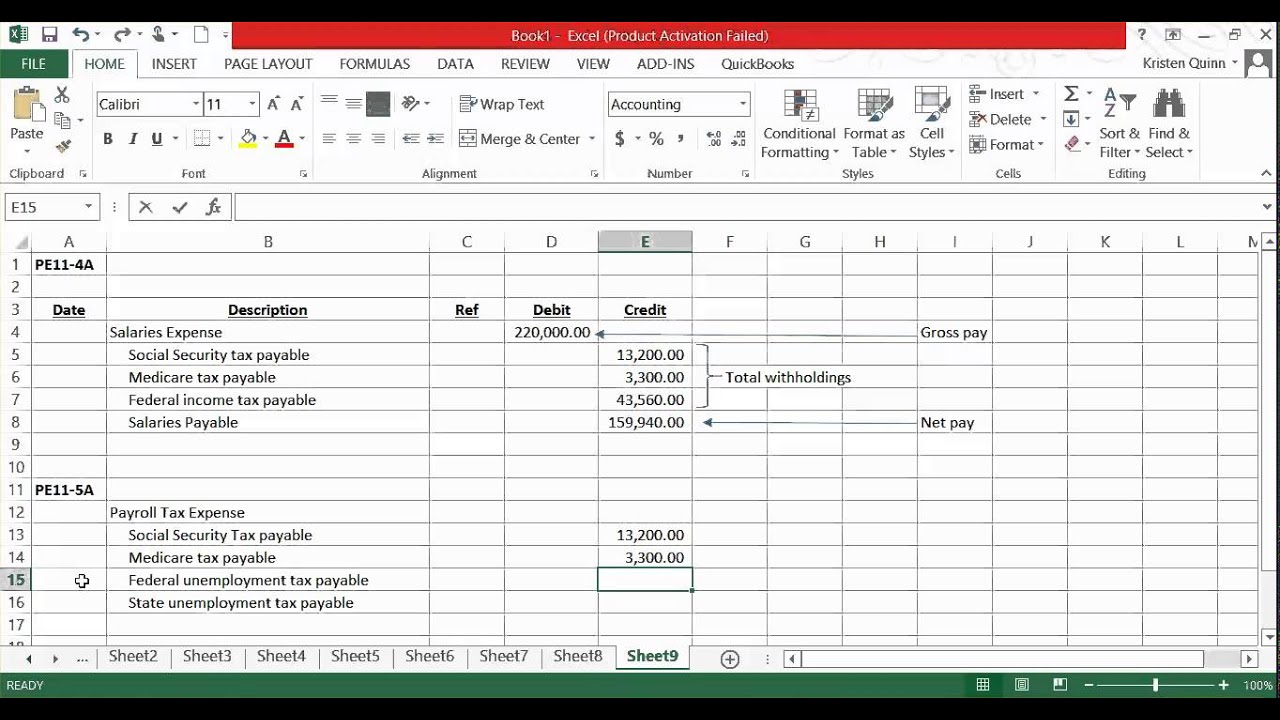

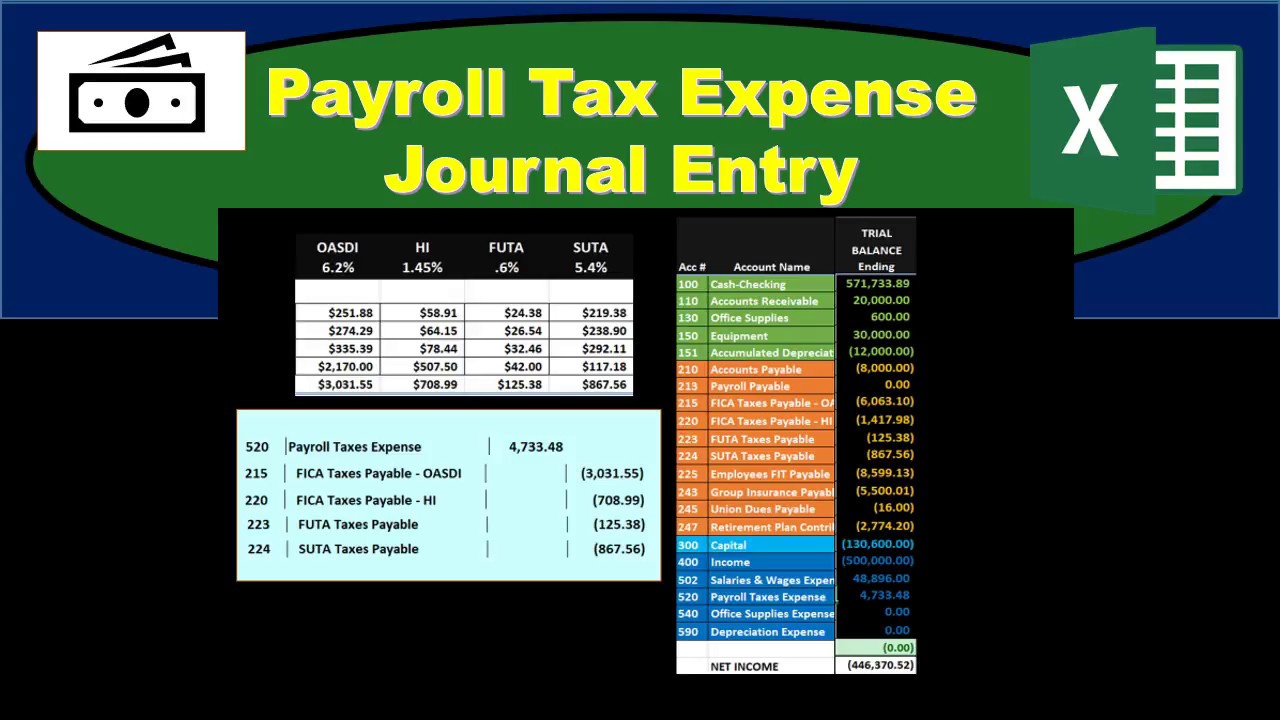

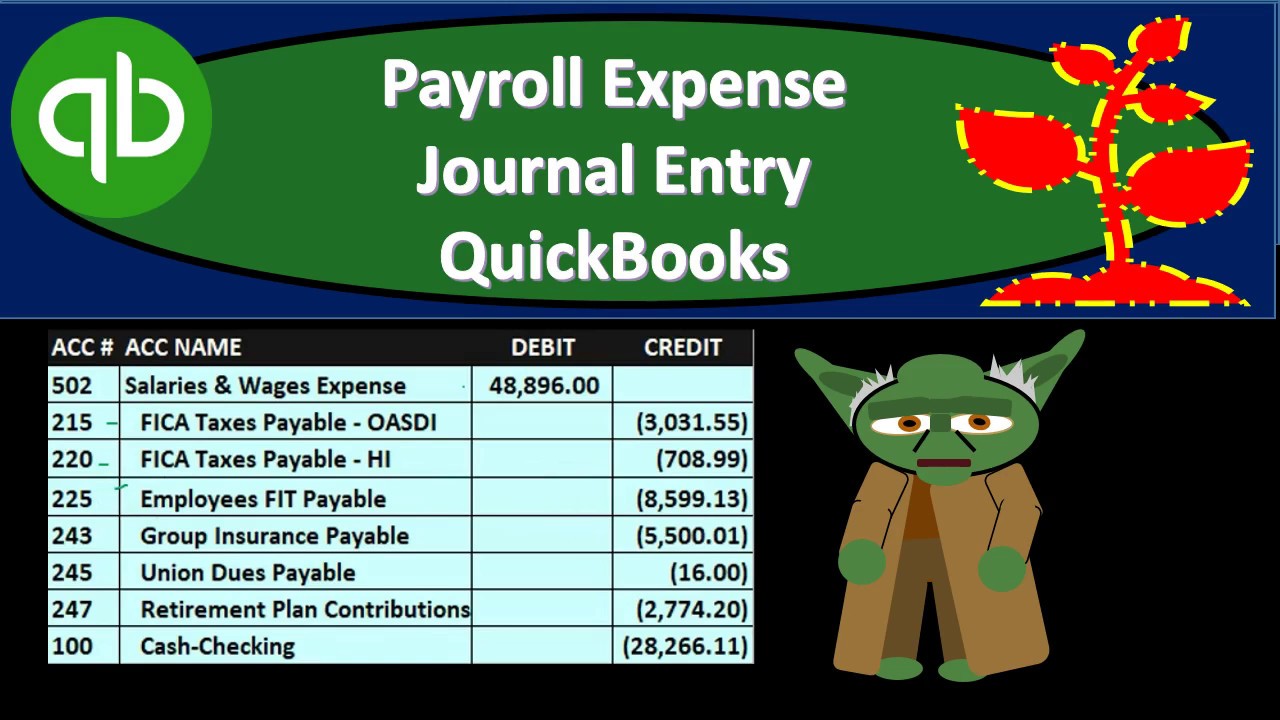

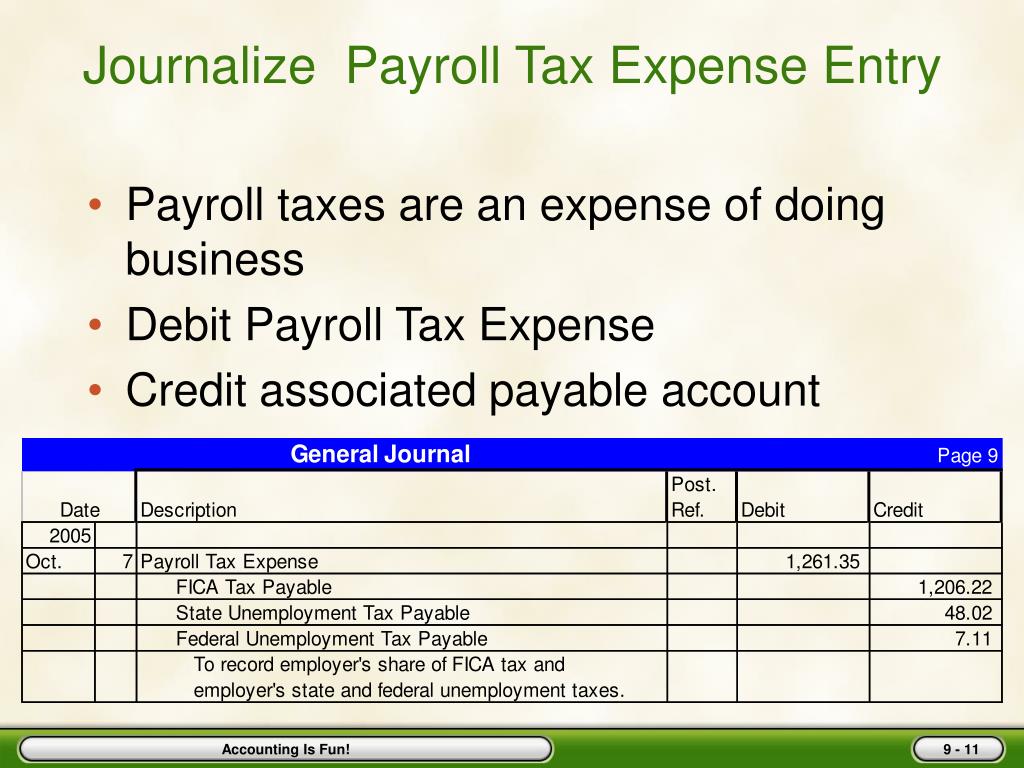

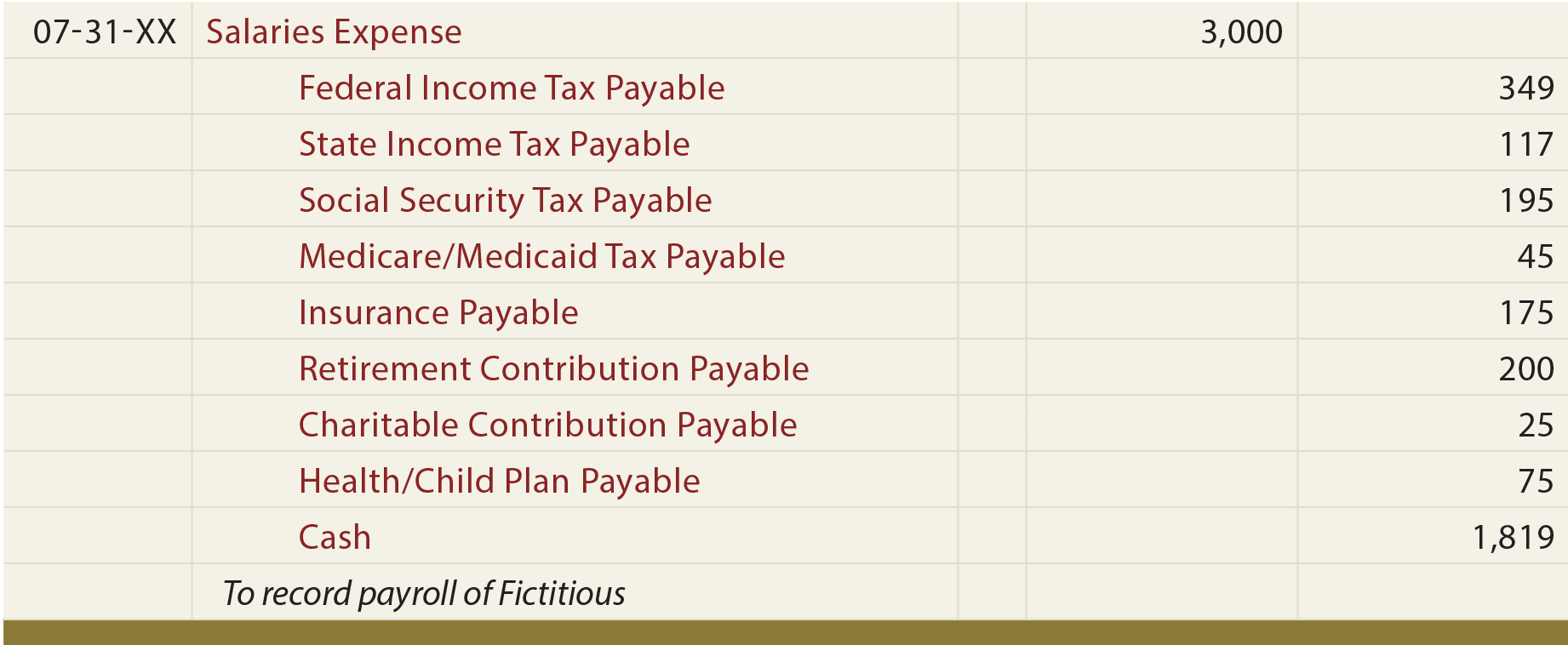

Payroll Tax Expense Journal Entry - See examples of primary, accrued, and manual payroll entries and their accounting effects. Let’s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month. Web what is a payroll journal entry? Business expenses can include a range of things, like rent, payroll, and inventory. Web journal entries for expenses are records you keep in your general ledger or accounting software that track information about your business expenses, like the date they were incurred and how much they cost. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. Web journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Web examples of payroll journal entries for salaries. Web a payroll journal entry is a record of employee earnings for an accounting period. This entry usually includes debits for the direct labor expense, salaries, and the company's portion of payroll taxes.

Journalzing Payroll Tax Expense YouTube

Web journal entries are used in accrual accounting to record payroll expenses that have been incurred, at the time the expense becomes payable. Web payroll.

80 Payroll Tax Expense Journal Entry u YouTube

Web follow this small business payroll expenses guide to learn the answer to these questions, how to calculate your total payroll costs, and how to.

Payroll Expense Journal Entry QuickBooks Desktop 2019 YouTube

The wages and salaries account tracks the gross pay earned by all. Accruing payroll liabilities, transferring cash, and making payments. Web what is a payroll.

Payroll Journal Entry Example Explanation My Accounting Course

Web a payroll journal records each payroll transaction through entries like journal entry wages and payroll tax expense journal entries. The wages and salaries account.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Web payroll taxes expense (er) $687.41: Web a payroll journal entry is a record of employee earnings for an accounting period. An accountant typically includes.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

What are payroll expenses for employers? Web recording the payroll process with journal entries involves three steps: In the following examples we assume that the.

Payroll Expense Journal EntryHow to record payroll expense and

Web learn how to record payroll expenses and taxes in your general ledger with a payroll journal entry. Accruing payroll liabilities, transferring cash, and making.

PPT Chapter Nine PowerPoint Presentation, free download ID458318

Web payroll taxes expense (er) $687.41: Web payroll journal entries fall under the payroll account and are part of your general ledger. The second entry.

10 Payroll Journal Entry Template Template Guru

Web what is a payroll journal entry? Web payroll journal entries fall under the payroll account and are part of your general ledger. Employer payroll.

Record The Following Expenses In Your Payroll Account:

See examples, practice questions, and video explanations for salaries, withholdings, and employer taxes. Web follow this small business payroll expenses guide to learn the answer to these questions, how to calculate your total payroll costs, and how to post them as journal entries. Web payroll journal entries are the numbers you record in your small business’s general ledger to track employees’ wages. Web payroll taxes expense (er) $687.41:

Web Learn What A Payroll Journal Entry Is And How To Book One For Your Business.

An accountant typically includes these entries in the company's general ledger before its financial statements. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. What are payroll expenses for employers? Web recording the payroll process with journal entries involves three steps:

Web Learn How To Record Payroll Expenses And Taxes In Your General Ledger With A Payroll Journal Entry.

This entry usually includes debits for the direct labor expense, salaries, and the company's portion of payroll taxes. Here are typical items in a. Web examples of payroll journal entries for wages. Companies make these entries to keep an accurate record of payroll expenses in their accounting books.

Web A Payroll Journal Records Each Payroll Transaction Through Entries Like Journal Entry Wages And Payroll Tax Expense Journal Entries.

Web learn what payroll journal entries are, why they are important, and how to prepare and record them in five steps. See examples of initial, accrued wages, and manual payments entries for payroll accounting. Unlike cash accounting, which records payments. Let’s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month.