Journal Entry For Inventory Write Off - As the $5,000 merchandise inventory has expired, we can make the journal entry to write off the expired inventory by debiting the $5,000 amount to the loss on. Inventory should be written off when it. In this article, we explain how to write off inventory and when to do it. Inventory is written down when its net realizable value is less than its cost. The journal entry above shows the inventory write down expense being debited to the loss on inventory write. The company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. The transaction will not impact the income statement as well as the net balance of inventory. Web there are two ways to write down inventory. Web the journal entry is debiting allowance for obsolete inventory and credit inventory. Web the inventory write down journal entry is as follows:

Inventory Write Off All you Need to Know with Example Zetran

Inventory is written down when its net realizable value is less than its cost. In this case, the company needs. Web if you do have.

Inventory WriteOff AwesomeFinTech Blog

Web the journal entry is debiting allowance for obsolete inventory and credit inventory. Inventory should be written off when it. The company may write off.

Inventory Write Off Double Entry Bookkeeping

We provide simplified instructions along with examples on how to do it properly. In this case, the company needs. Inventory is written down when its.

journal entry format accounting accounting journal entry template

Inventory should be written off when it. As the $5,000 merchandise inventory has expired, we can make the journal entry to write off the expired.

Inventory WriteOff Definition as Journal Entry and Example

Web if you do have a general ledger and keep track of journal entries, then as soon as your find inventory has become obsolete or.

Journal Entry for Purchase of Inventory Professor Victoria Chiu YouTube

Web the inventory write down journal entry is as follows: Inventory is written down when its net realizable value is less than its cost. As.

Inventory WriteOff Definition As Journal Entry And, 47 OFF

We provide simplified instructions along with examples on how to do it properly. Web if you do have a general ledger and keep track of.

Perpetual Inventory System Journal Entry

Web the inventory write down journal entry is as follows: Web there are two ways to write down inventory. Inventory is written down when its.

Accounting Journal Entries For Dummies

In this case, the company needs. Web if you do have a general ledger and keep track of journal entries, then as soon as your.

Web The Inventory Write Down Journal Entry Is As Follows:

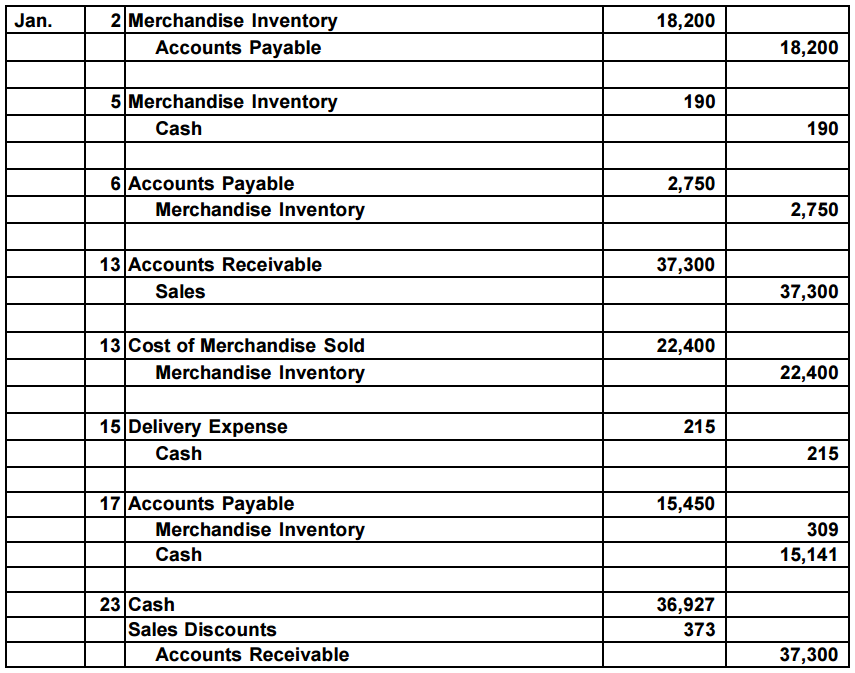

There are two aspects to writing down inventory, which are the journal entry used to. As the $5,000 merchandise inventory has expired, we can make the journal entry to write off the expired inventory by debiting the $5,000 amount to the loss on. The journal entry above shows the inventory write down expense being debited to the loss on inventory write. In this case, the company needs.

Web There Are Two Ways To Write Down Inventory.

Inventory should be written off when it. Web the journal entry is debiting allowance for obsolete inventory and credit inventory. The company may write off some items in the inventory when it deems that they are no longer have value in the market or the business. We provide simplified instructions along with examples on how to do it properly.

Web If You Do Have A General Ledger And Keep Track Of Journal Entries, Then As Soon As Your Find Inventory Has Become Obsolete Or Spoiled, You Can Write A Journal Entry In Your General.

Inventory is written down when its net realizable value is less than its cost. In this article, we explain how to write off inventory and when to do it. The transaction will not impact the income statement as well as the net balance of inventory. Web when actual inventory writes down incur, the company needs to make a journal entry by debiting inventory reserve and credit inventory.

:max_bytes(150000):strip_icc()/Inventory-Write-Off_Final3-resized-9ab3fcc8c1234d1ea005ca1443e8ff65.jpg)