Payroll Journals - Web learn what payroll journal entries are, why they are important, and how to prepare and record them in five steps. Web shifting to treating payroll income as employment wages would require “full income tax withholding and payment of employee and employer taxes on all income the. See examples of payroll accounting for gross pay, net pay, taxes, deductions, fring… Best for robust free plan features. Web learn how to record payroll expenses, taxes, and deductions in a journal. Web learn what a payroll journal is, how it helps to reconcile wages and costs, and how dataplan payroll can provide it as part of their managed payroll service. Web understanding what payroll journal entries are and how to prepare them can help you track payments to employees. How to record salary payments made to. Learn how to record payroll transactions using journal entries and control accounts. Web a payroll ledger is a recordkeeping tool employers use to document the total expense of payroll processing.

Creating a payroll journal Caseron Cloud Accounting

Companies make these entries to keep an accurate. We explain it with journal entries, importance, types, advantages, disadvantages, and an example. Web a payroll ledger.

10 Payroll Journal Entry Template Template Guru

How to record salary payments made to. Learn how to record payroll transactions using journal entries and control accounts. Web the best 5 free payroll.

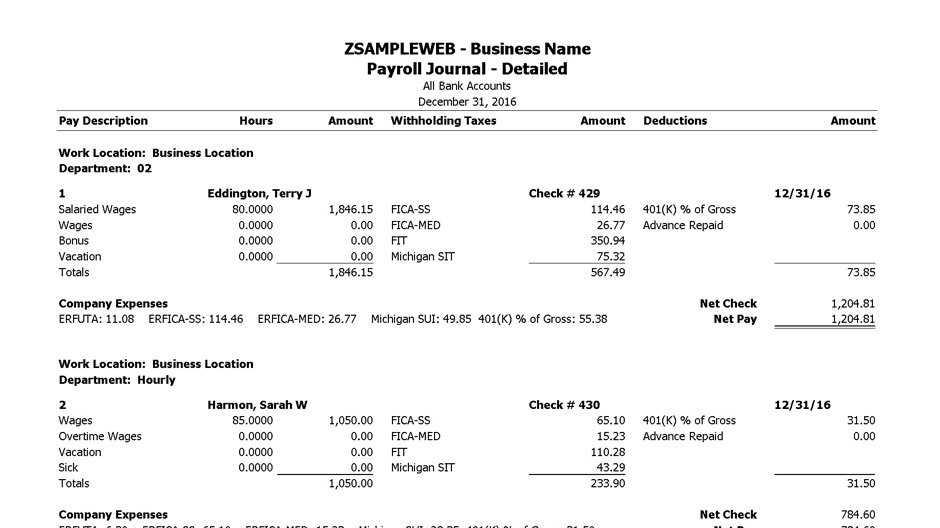

Payroll reports myPay Solutions Thomson Reuters

Web a payroll journal entry records the wages and salaries paid to employees and their related payroll taxes. Web in this guide we explain the.

Payroll Journals with Max Column (150NJ) OneWrite Checks Business

In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Web learn what payroll journal.

Payroll Journal Entry Example Explanation My Accounting Course

Companies make these entries to keep an accurate. In the following examples we assume that the employee’s tax rate for social security is 6.2% and.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

See examples of initial, accrued wages, and. Web guide to what is payroll accounting. May 29, 2024 20:00 et | source: See examples of primary,.

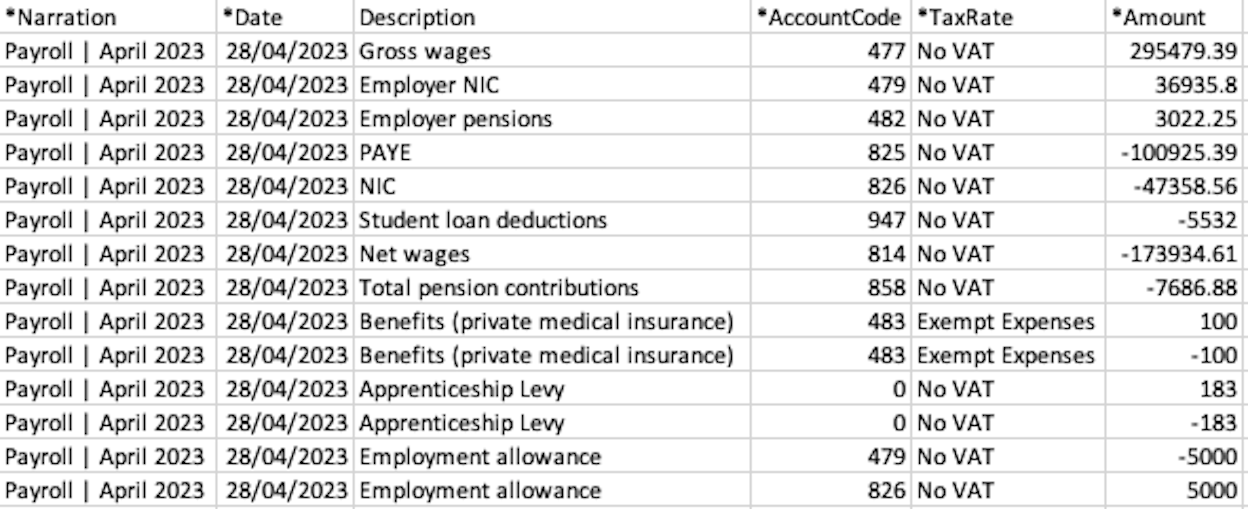

How To Correctly Post Your Salary Journal

Each payroll journal entry is. See examples of payroll accounting for gross pay, net pay, taxes, deductions, fring… Web a payroll journal entry records the.

Payroll Journals A Guide + Processing Them With PayFit

Web learn what payroll journal entries are, why they are important, and how to prepare and record them in five steps. We explain it with.

FREE 26+ Payroll Templates in Excel

How to record salary payments made to. We explain it with journal entries, importance, types, advantages, disadvantages, and an example. Web learn what payroll journal.

Each Payroll Journal Entry Is.

Accruing payroll liabilities, transferring cash, and making payments. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Web in a 2022 survey of over 100,000 workers by the payroll provider gusto,. Web learn how to record payroll expenses, taxes, and deductions in a journal.

Web In This Section Of Small Business Accounting Payroll, We Will Use A Fictitious Company To Provide Examples Of Journal Entries To Record Gross Wages, Payroll Withholding, And.

Web learn what a payroll journal is, how it helps to reconcile wages and costs, and how dataplan payroll can provide it as part of their managed payroll service. The city of portland is taking action to fix issues with its payroll program, following the discovery of delayed tax payments and system updates. Best for robust free plan features. In this article, we define a payroll journal.

See Examples Of Payroll Accounting For Gross Pay, Net Pay, Taxes, Deductions, Fring…

In this section, we explain these elements of payroll and. How to record salary payments made to. It tracks any transaction that originates in the payroll department,. Web payroll journal entries are the numbers you record in your small business’s general ledger to track employees’ wages.

Updated May 23, 2024 2:58Am Edt.

Web learn what payroll journal entries are, why they are important, and how to prepare and record them in five steps. Web this explains how to record information about your payroll in your accounts. See examples of initial, accrued wages, and. Web understanding what payroll journal entries are and how to prepare them can help you track payments to employees.