Accounting Write Off Journal Entry - Agreement may specify a term over which the creditor has to claim the outstanding amount at the expiry of which the debtor seizes to be liable for the amount due towards the payable. It is the amount the company owes. Web following journal entry shall be recognized to account for the cancellation of liability: The value of the inventory has fallen by 1,000, and the reduction in value needs to be reflected in the accounting records. The accounting records will show the following bookkeeping entries for the bad debt written off. In this case, writing off accounts receivable affects the balance sheet only;. Credit the accounts receivables with the uncollectible amount. Michael cohen's invoice dated feb. Web when the company writes off accounts receivable under the allowance method, it can make journal entry by debiting allowance for doubtful accounts and crediting accounts receivable. The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense account.

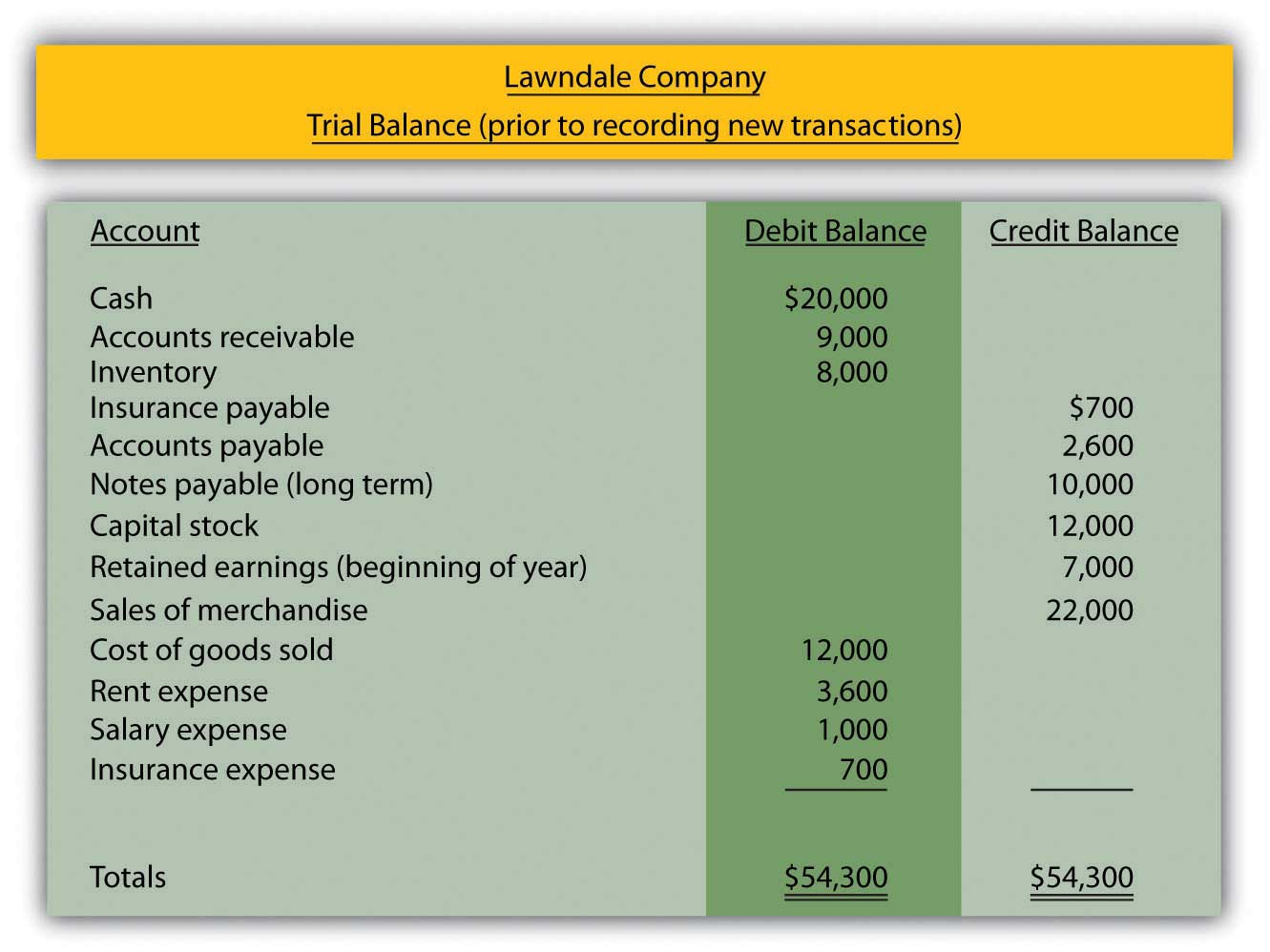

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web the following accounting double entry is necessary by the entity to record this transaction: An allowance for doubtful accounts is also maintained to anticipate.

Recovering Writtenoff Accounts Wize University Introduction to

There are two choices for the debit part of the entry. A credit to accounts receivable (to remove the amount that will not be collected).

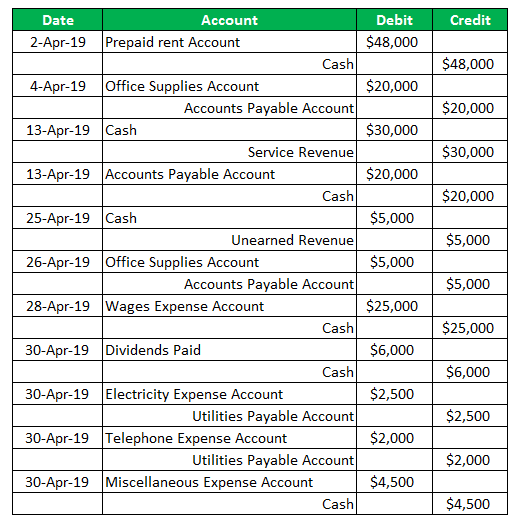

What is Journal Entry? Example of Journal Entry

Debit accounts payable balance credit other income. Agreement may specify a term over which the creditor has to claim the outstanding amount at the expiry.

journal entry format accounting accounting journal entry template

Web following journal entry shall be recognized to account for the cancellation of liability: The entry to write off a bad account affects only balance.

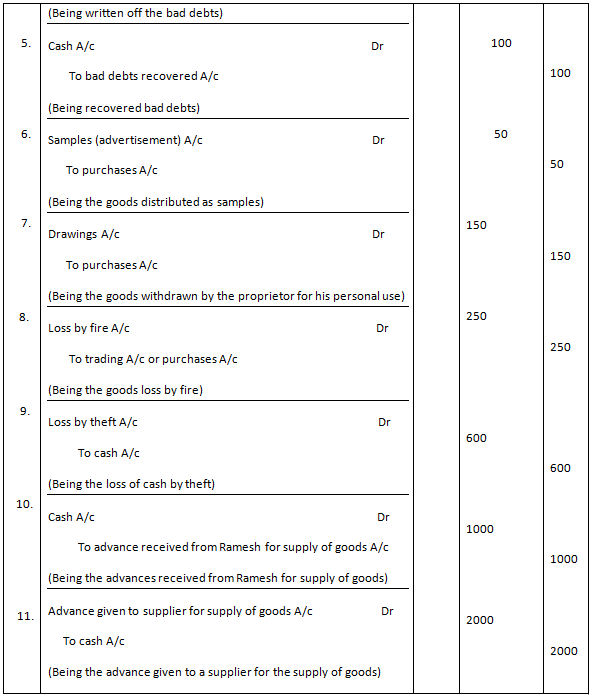

Journal Entry Problems and Solutions Format Examples MCQs

The journal entry is debiting bad debt expenses and credit accounts receivable. Web journal entry for the bad debt write off. Allowance for doubtful accounts.

Accounting Journal Entries For Dummies

One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

The bad debt written off is an expense for the business and a charge is made to the income statement through the bad debt expense.

A Beginner's Guide to Journal Entries A and M Education

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

Accounting Journal Entries For Dummies

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be.

Create A Journal Entry To Write Off The Appropriate Amount Of The Asset.

It is the amount the company owes. An allowance for doubtful accounts is also maintained to anticipate losses. Using the allowance method for writing off bad debts, journal entries are made using debit in the allowance for doubtful debts and credit for accounts receivable. Web following journal entry shall be recognized to account for the cancellation of liability:

Prepare A Journal Entry To Record This Transaction.

Web under the allowance method, if a specific customer’s accounts receivable is identified as uncollectible, it is written off by removing the amount from accounts receivable. It can be to an expense account, if no reserve was ever set up. For example, the amount of account payable to be canceled is also $4,000, the same as the above example, then here is the example of a journal entry: A credit to accounts receivable (to remove the amount that will not be collected) a debit to allowance for doubtful accounts (to reduce the allowance balance that was previously established)

Agreement May Specify A Term Over Which The Creditor Has To Claim The Outstanding Amount At The Expiry Of Which The Debtor Seizes To Be Liable For The Amount Due Towards The Payable.

Under accrual accounting, uncollectible ar is written off as an expense, reflecting the loss accurately. Bad debt write off bookkeeping entries explained. The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account. This involves assessment, internal approval, accounting entries, and adjusting the allowance for doubtful accounts.

The Journal Entry Is Debiting Bad Debt Expenses And Credit Accounts Receivable.

Web for proper recording of accounts that get written off, one has to make the following standard journal entries in their accounts book: Steps to write off ar: Web create a journal entry. In this case, writing off accounts receivable affects the balance sheet only;.