Paid Wages Journal Entry - Dr wages (p&l) with total gross wages. The $1,500 balance in wages payable is the true amount not yet paid to employees for their work through december 31. Web the journal entry for prepaid expenses involves two accounts: Web learn how to record wage expense and cash transactions in a journal entry for paid wages. Web learn what payroll journal entries are, why they are important, and how to record them in five steps. Web recording the payroll process with journal entries involves three steps: See examples of initial, accrued wages, and manual payments. Web the adjusting journal entry for wages payable is: Dr social security (p&l) with total employer's nic. Learn how to account for them and create a.

Salary Paid Journal Entry CArunway

These entries are initially used to create ledgers and trial balances. Learn how to account for them and create a. This entry can be recorded.

Complete journal entries of Salaries YouTube

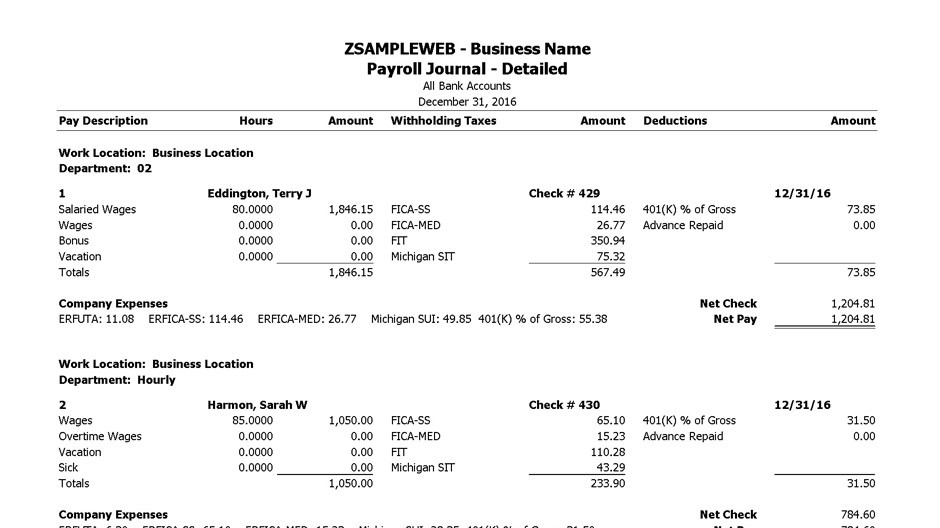

Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Learn how to prepare journal entries correctly in this lesson. The company can make the journal entry for advance salary by debiting the advance salary.

Complete journal entries of wages YouTube

See the formula, the income statement impact, and a practical example with numbers. Accruing payroll liabilities, transferring cash, and making payments. The $1,500 balance in.

10 Payroll Journal Entry Template Template Guru

Web the adjusting journal entry for wages payable is: Web learn how to record your payroll expenses and taxes in a journal entry with this.

What Is The Journal Entry For Payment Of Salaries Info Loans

This entry can be recorded in the books of accounts by using two different approaches of accounting. Web learn what payroll journal entries are, why.

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

These entries are initially used to create ledgers and trial balances. Web learn how to record your payroll expenses and taxes in a journal entry.

Payroll Journal Entry Example Explanation My Accounting Course

Web the journal entry for prepaid expenses involves two accounts: Web to enter the journal you will need a gross to net wages monthly payment.

What Is The Journal Entry For Payment Of Salaries Info Loans

Maes, julie, and leen marynissen. Web the journal entry for prepaid expenses involves two accounts: Web in this section of payroll accounting we will provide.

Web The Adjusting Journal Entry For Wages Payable Is:

See examples of initial, accrued wages, and manual payments. Learn how to prepare journal entries correctly in this lesson. Dr social security (p&l) with total employer's nic. Outstanding expense a/c and expense a/c.

Dr Wages (P&L) With Total Gross Wages.

Web with mr a, c and d the journal entry is: This entry can be recorded in the books of accounts by using two different approaches of accounting. Web what are wages payable? Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and employer costs related to.

Web Advance Salary Journal Entry.

Prepaid expense a/c and expense a/c. Web to enter the journal you will need a gross to net wages monthly payment summary showing all the deductions and also a p32 confirming the paye liability to hmrc. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Learn how to account for them and create a prepaid.

The Company Can Make The Journal Entry For Advance Salary By Debiting The Advance Salary Account And Crediting The Cash Account.

Web recording the payroll process with journal entries involves three steps: Learn how to account for them and create a. Web payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings. Web the wages payable journal entry is a crucial part of recording your company’s financial transactions accurately.