Paid Salaries Journal Entry - Accrued salaries = 55,000 x 12 x 2 / 365 = 3,616. Web in order to correct this situation an accrued salaries journal entry is required and the amount is calculated as follows: This entry usually includes debits for the direct labor expense, salaries, and the company's portion of payroll taxes. Automate your debit and credit accounting with vencru. An accountant records these entries into their general ledger for the company and uses payroll journal entries to document payroll expenses. The perks of such expenses are yet to be utilised in a future period. Web sample entries with debits and credits for common scenarios. Let’s look into various journal entries relating to the salary. The company needs to make journal entry by debiting salary advances and credit cash to employees. Web salary paid in advance journal entry.

Payroll Journal Entry Example Explanation My Accounting Course

Debit the land account for rs. It is used to record the payment of an employee’s salary, including wages, bonuses, commissions, and other forms of.

How To Journalize Salaries Cagamee

In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not.

10 Payroll Journal Entry Template Template Guru

The payroll tax expense journal entry tracks employer contributions to payroll. Simultaneously, the cash or bank account is credited, indicating the reduction in business funds.

What Is The Journal Entry For Payment Of Salaries Info Loans

Journal entry to record the payment of salaries. It is used to record the payment of an employee’s salary, including wages, bonuses, commissions, and other.

Your BookKeeping Free Lessons Online Examples of Payroll Journal

Web in order to correct this situation an accrued salaries journal entry is required and the amount is calculated as follows: This entry usually includes.

How To Correctly Post Your Salary Journal

Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received. House rent allowance = 150000. Web journal entry.

Complete journal entries of Salaries YouTube

Debit the land account for rs. On january 23, 2019, received cash payment in full from the customer on the january 10 transaction. Web a.

Salary Paid Journal Entry CArunway

Journal entry to record the payment of salaries. On january 23, 2019, received cash payment in full from the customer on the january 10 transaction..

What Is The Journal Entry For Payment Of Salaries Info Loans

Web in order to correct this situation an accrued salaries journal entry is required and the amount is calculated as follows: Cgwo pays salaries and.

Web A Journal Entry For Accrued Salary Would Comprise Of An Entry To The Salary Expense Account ( In P&L) And Accrued Salary Expense Account (In Bs).

Most of the company pays employees at the end of the month or even the beginning of next month. It is shown on the debit side of an income statement (profit and loss. The payroll tax expense journal entry tracks employer contributions to payroll. Accrued salaries = 55,000 x 12 x 2 / 365 = 3,616.

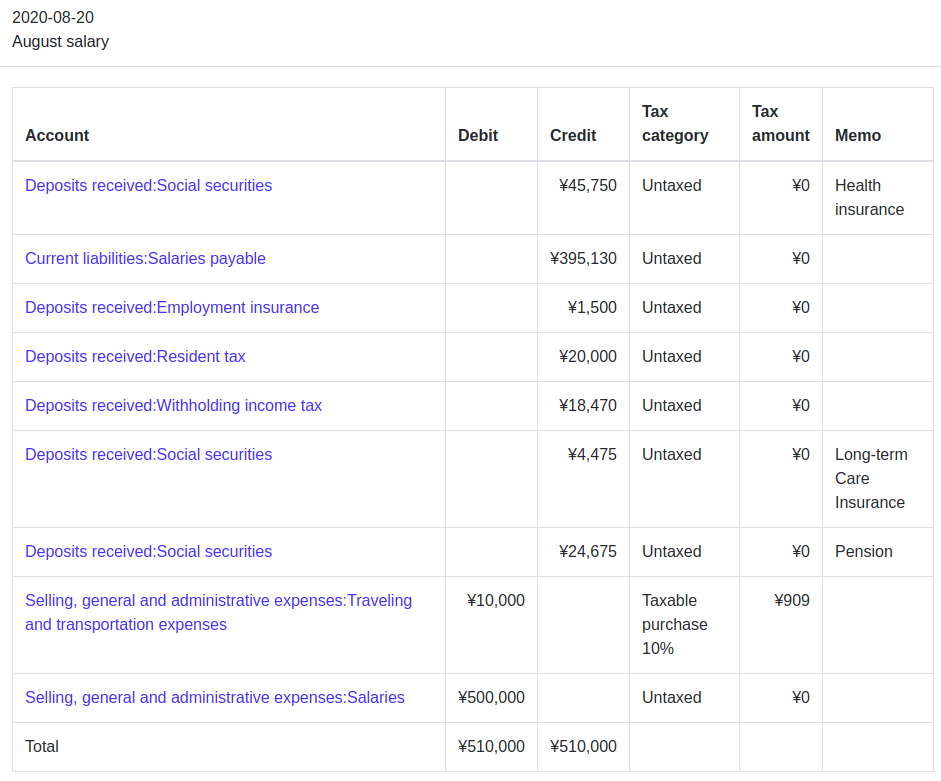

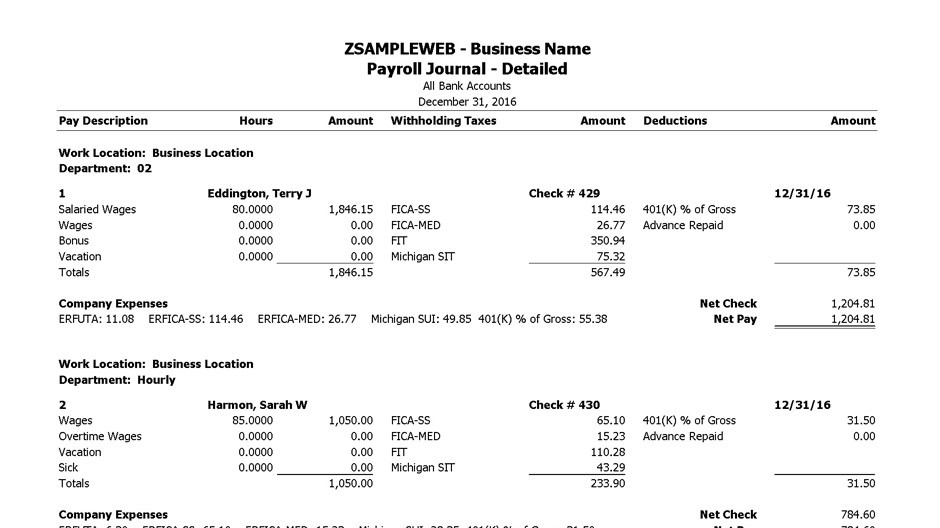

Web Examples Of Payroll Journal Entries For Salaries.

A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. 7) what is a payroll tax expense journal entry? A salary of ₹20,000 is paid through cheque. Web on january 20, 2019, paid $3,600 cash in salaries expense to employees.

We Need To Debit The Salary Gl To Increase The Expenditure With A Corresponding Credit To The Salary Payable Gl Per The Above Rules.

Web per modern accounting rules, salary paid journal entry: Let’s assume our company also has salaried employees who are paid semimonthly on the 15th and the last day of each month. [q1] the entity paid $8,000 salaries expense in cash. An accountant records these entries into their general ledger for the company and uses payroll journal entries to document payroll expenses.

The Journal Entry Is Debiting Wage Expense $ 35,000 And Credit Cash $ 35,000.

Journal entry for prepaid expenses. Entry at the time of actual payment of the salary due. Thefollowing table presents the allocation of the costs to the various programs, management andgeneral, and fundraising. Web what is a payroll journal entry?