Paid Income Tax Journal Entry - Web at the end of the accounting period the business needs to accrue the estimated income tax expense due, the accrued income tax payable journal entry is. It is shown in the profit and loss appropriation account. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web provision for income tax journal entry is an accounting item that is debited to the income tax expense account and credited to the income tax payable account. Web payroll journal entries | financial accounting. Web companies record income tax expense as a debit and income tax payable as a credit in journal entries. If refund received is less than expected refund, accounting. Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a. The following are the journal entries recorded earlier for printing. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses.

Tax Expense Journal Entry Journal Entries for Normal Charge

Discover best practices to manage and record your payroll! Web there have been no income tax instalments paid in advance; Web income tax is paid.

Provision For Tax Journal Entry

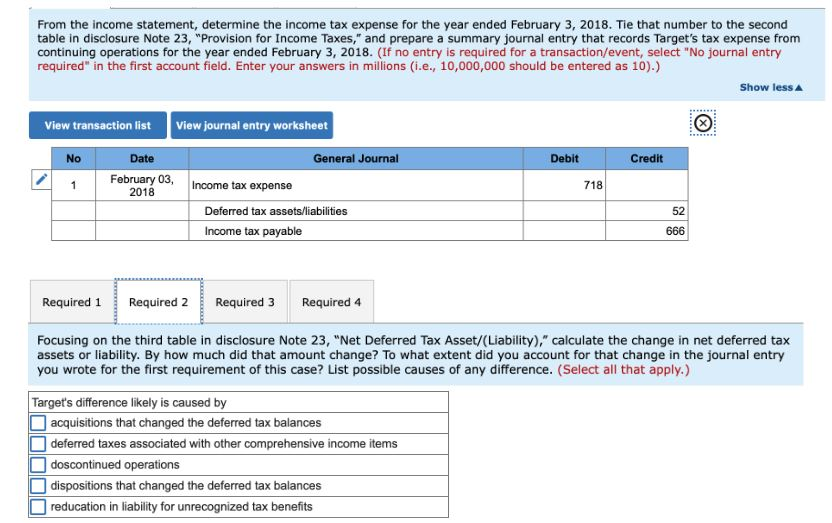

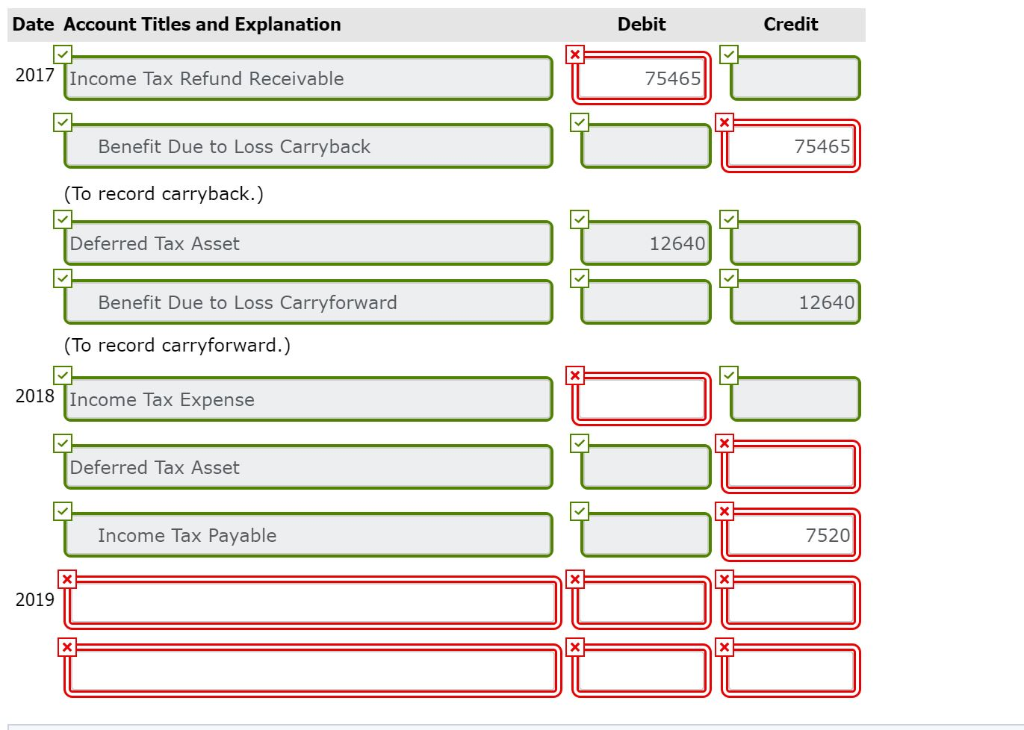

Web journal entries for deferred tax assets and liabilities play a pivotal role in accurately representing a company’s financial health and tax planning strategies. Credit.

Tax Paid Journal Entry Class 11 Journal Entry of Tax

It will reduce cash that pays to the. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Web.

Casual Journal Entry For Tax Payable Financial Statement

Income tax is a personal liability of the proprietor. Discover best practices to manage and record your payroll! Subtract the total deductions from the gross.

Journal Entry For Tax Payable

Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. Web income taxes are determined.

Payroll Journal Entry Example Explanation My Accounting Course

The income tax expense will be present on the income statement and the income tax. Web payroll journal entries are used to record the paid.

LO3 Journalizing and Recording Wages and Taxes. ACCT 032 Payroll

Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. Web the current portion of the income tax expense.

Journal Entry for Tax Paid by Cheque davistakey1939 Davis

It is shown in the profit and loss appropriation account. Web income tax is paid by the business on the profit earned during the year..

Casual Journal Entry For Tax Payable Financial Statement

The income tax expense will be present on the income statement and the income tax. Web the current portion of the income tax expense is.

Credit Your Income Tax Payable.

In this case, income tax is reduced from the net profits. If companies use the same cash method of accounting for. Web the journal entry is debiting wage expenses and credit cash. Web payroll journal entries are used to record the paid to employees, as well as the associated tax and other withholdings.

It Will Reduce Cash That Pays To The.

Web the journal entry is debiting income tax expense and crediting income tax payable. Web the current portion of the income tax expense is calculated in the tax computation and recorded in a journal entry that increases the expense account with a. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. It is shown in the profit and loss appropriation account.

Web The Journal Entry For Income Tax Payable Is A Debit To The Income Tax Expense Account And A Credit To The Income Tax Payable Account.

These entries are then incorporated into. Web payroll journal entries | financial accounting. Web debit your income tax receivable account to increase your assets and show that you expect to receive a refund in the future. Web at the end of the accounting period the business needs to accrue the estimated income tax expense due, the accrued income tax payable journal entry is.

Web Income Tax Is Paid By The Business On The Profit Earned During The Year.

Web journal entries for deferred tax assets and liabilities play a pivotal role in accurately representing a company’s financial health and tax planning strategies. The following are the journal entries recorded earlier for printing. Web companies record income tax expense as a debit and income tax payable as a credit in journal entries. Journal entry for income tax in case of a partnership firm includes debiting the income.