Paid In Advance Journal Entry - The company will receive payments and provide service base on the package period. Prepaid insurance and cash are both balance sheet items. Likewise, the company needs to record the rent paid in advance as the prepaid rent (asset) in the journal entry. Complete the transaction once the work is invoiced. Salary paid in advance is initially recorded as an asset because it provides some future economic benefit and is charged at the time when the actual benefit is realized in the succeeding accounting period. A service retainer is paid as part of a service agreement, in which your business agrees to provide a specific level of service at a negotiated rate. Web customer revenue received in advance. Web journal entry when advance payment is made: Salary paid in advance is also known as prepaid salary (it is a prepaid expense ). Therefore, it is classified as a current asset.

What Is The Journal Entry For Payment Of Salaries Info Loans

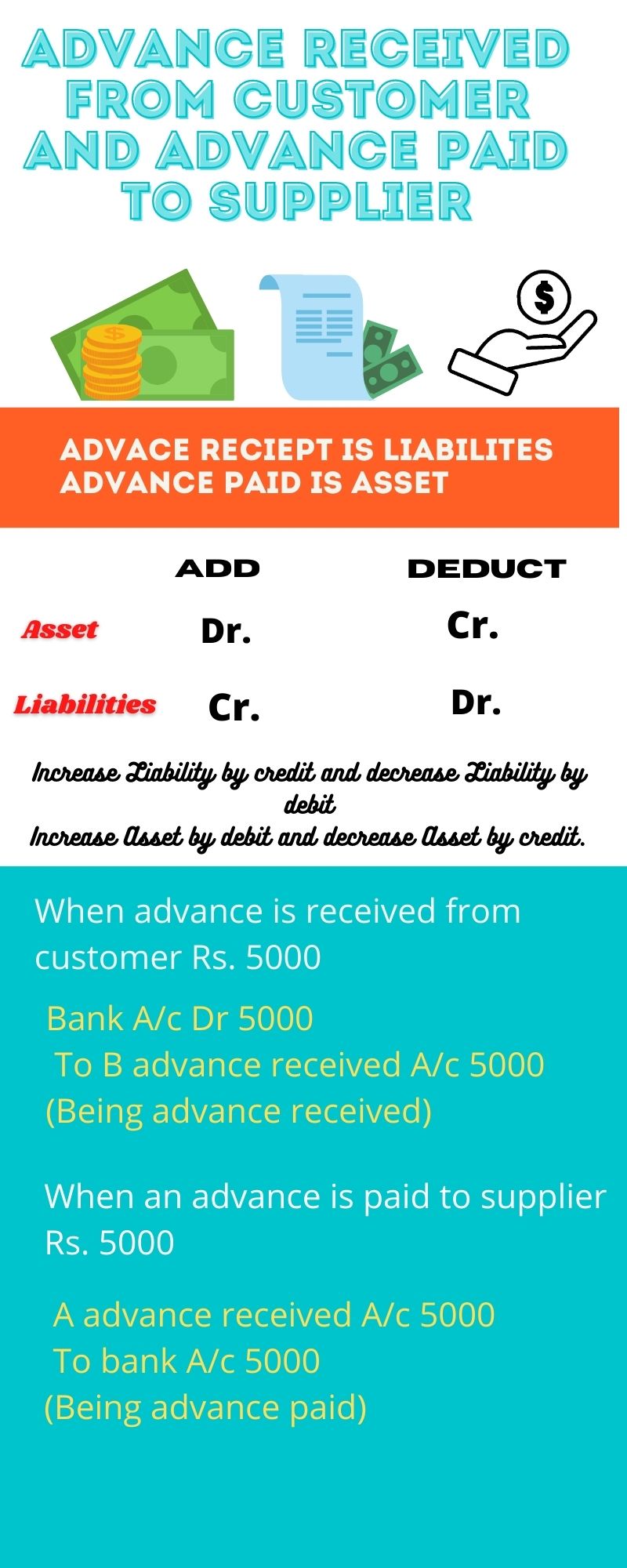

Such advances received are treated as a. Debit the customer advances (liability) account and credit the revenue account. Web journal entry for cash paid in.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

Web two journal entries are involved. Initial journal entry for prepaid rent: Make accounting records for the amount of the payment. By definition, a current.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

Web they are also known as unexpired expenses or expenses paid in advance. Adjusting journal entry as the prepaid rent expires: The double entry bookkeeping.

Salary entries for beginners salary advance adjustment entry

The company will receive payments and provide service base on the package period. Web the company can make the journal entry for advance salary by.

Journal Entry For Advance Rent Received Info Loans

Initial journal entry for prepaid rent: Make accounting records for the amount of the payment. Web journal entry for advance received from a customer. The.

journal entry format accounting accounting journal entry template

The company will receive payments and provide service base on the package period. Initial journal entry for prepaid rent: Web the journal entry to record.

Journal entry of Advance received from Customer and advance paid to

A service retainer is paid as part of a service agreement, in which your business agrees to provide a specific level of service at a.

Salary Paid Journal Entry CArunway

Web the journal entry for recording rent paid in advance is provided below: The rent repayment is calculated as follows. Prepaid insurance and cash are.

Rent Paid In Advance Journal Entry

Max pays a rent of 10,000 every month. Period of accounts = 1 month. At the end of april one third of the prepaid rent.

Web Advance To Suppliers Is A Payment Made In Advance For A Service (Or Good) To Be Utilized At A Later Date.

Web whenever an advance payment is made, the accounting entry is expressed as a debit to the asset cash for the amount received. Period of accounts = 1 month. Such advances received are treated as a. An unearned revenue journal entry involves recording a double entry in your accounts records when you receive payment,.

This Type Of Situation Might Occur For Example When A Business Demands Cash In Advance To Pay For Materials On A Large Or Bespoke Order Or As A Rental Deposit On A Property.

Prepaid insurance is insurance paid in advance and that has not yet expired on the date of the balance sheet. They have record unearned revenue and reclass to revenue during the subscription period. Web some companies even encourage the customesr to pay a year in advance in exchange for a huge discount. It will show the commitment of the buyer to the seller.

The Rent Repayment Is Calculated As Follows.

Web journal entry when advance payment is made: Debit the increase in expenses, credit the decrease in assets) example. Web journal entry for advance received from a customer. Make accounting records for the amount of the payment.

Period Of Rent Prepayment = 3 Months.

Web service retainers paid in advance. Therefore, it is classified as a current asset. Web journal entry for income received in advance recognizes the accounting rule of “credit the increase in liability”. Complete the transaction once the work is invoiced.