Paid Employee Salary Journal Entry - In accounting, accrued salaries are the amount that the company owes to its employees for the services they have performed during the period but not have been. House rent allowance = 150000. Web on january 20, 2019, paid $3,600 cash in salaries expense to employees. Salary is among the most recurring transactions and paid on. Web journal entry for salary: On january 23, 2019, received cash payment in full from the customer on the january 10 transaction. It is paid as a consideration for the efforts undertaken by the employees for the business. Web in this section of payroll accounting we will provide examples of the journal entries for recording the gross amount of wages, payroll withholdings, and employer costs related. Salary expense is recorded in the books of accounts with a journal entry for salary paid. Journal entries relating to the salary:

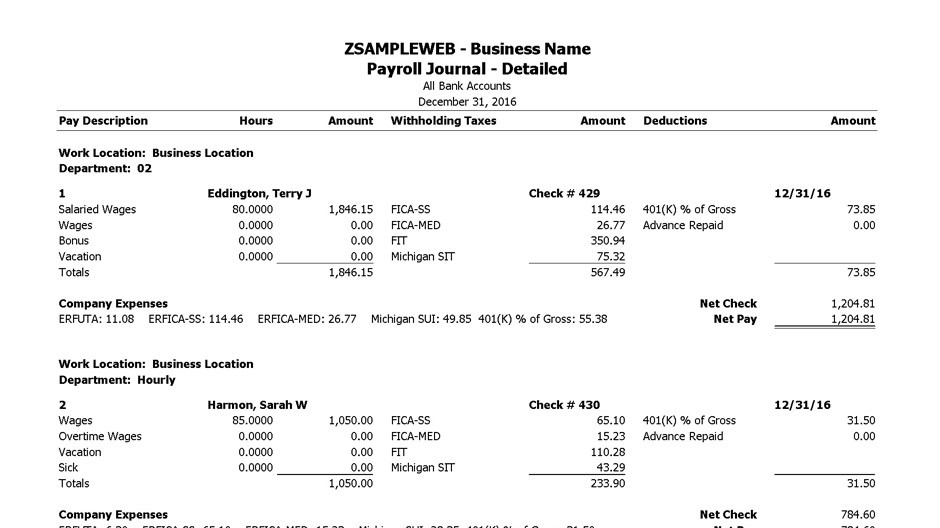

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

Web table of contents. They provide an ongoing record of the company’s payroll obligations and. Many of the items discussed are subject to federal and..

10 Payroll Journal Entry Template Template Guru

A salary of ₹50,000 is paid in cash after making deductions of professional tax ₹500, tds ₹1,000,. House rent allowance = 150000. The company has.

LO 3.5 Use Journal Entries to Record Transactions and Post to T

Web on january 20, 2019, paid $3,600 cash in salaries expense to employees. This is the amount employees are paid, whether based on hourly rates.

Complete journal entries of Salaries YouTube

Salary is an indirect expense incurred by every organization with employees. A payroll journal entry is a record of your employee wages. Web this journal.

How To Correctly Post Your Salary Journal

When salaries are paid, the salary expense journal entry is debited, reflecting the. A salary of ₹50,000 is paid in cash after making deductions of.

Salary Paid Journal Entry CArunway

A payroll journal entry is a record of your employee wages. What is a payroll journal entry? When salaries are paid, the salary expense journal.

How To Journalize Salaries Cagamee

It is paid as a consideration for the efforts undertaken by the employees for the business. On january 23, 2019, received cash payment in full.

Payroll Journal Entry Example Explanation My Accounting Course

Web table of contents. Salary is among the most recurring transactions and paid on. A payroll journal entry is a record of how much you.

What Is The Journal Entry For Payment Of Salaries Info Loans

Web when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit cash. It is paid.

Web In This Section Of Payroll Accounting We Will Provide Examples Of The Journal Entries For Recording The Gross Amount Of Wages, Payroll Withholdings, And Employer Costs Related.

Smp, spp and sap reclaimed. On january 23, 2019, received cash payment in full from the customer on the january 10 transaction. Web payroll journal entries reflect the wages, salaries, and taxes paid in each pay period. Web when it comes to accounting for salary payments, a journal entry is typically made to debit salary expenses and credit cash.

Web Hourly Payroll Entry #1:

Web what is a payroll journal entry? They provide an ongoing record of the company’s payroll obligations and. Web to create a nominal code: It is paid as a consideration for the efforts undertaken by the employees for the business.

A Payroll Journal Entry Is A Record Of Your Employee Wages.

Web journal entry for salary: A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s. Many of the items discussed are subject to federal and.

Web Salary Paid In Advance Journal Entry.

That way, you can look back and. Web table of contents. This is the amount employees are paid, whether based on hourly rates or a preset annual amount. Journal entries relating to the salary: