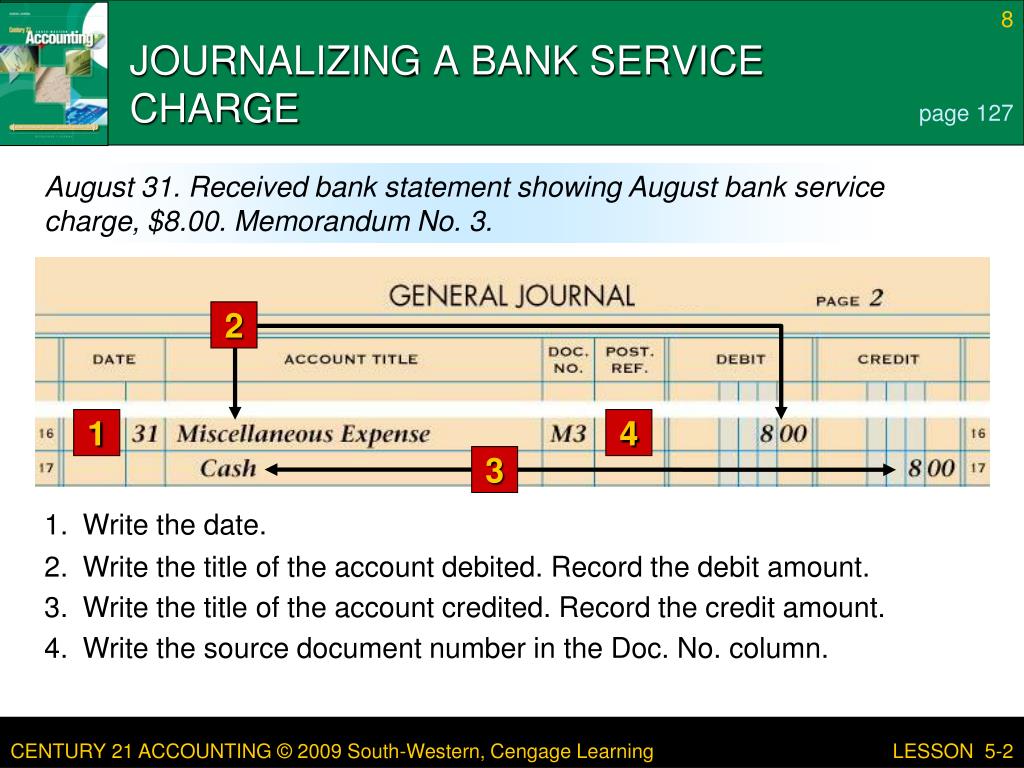

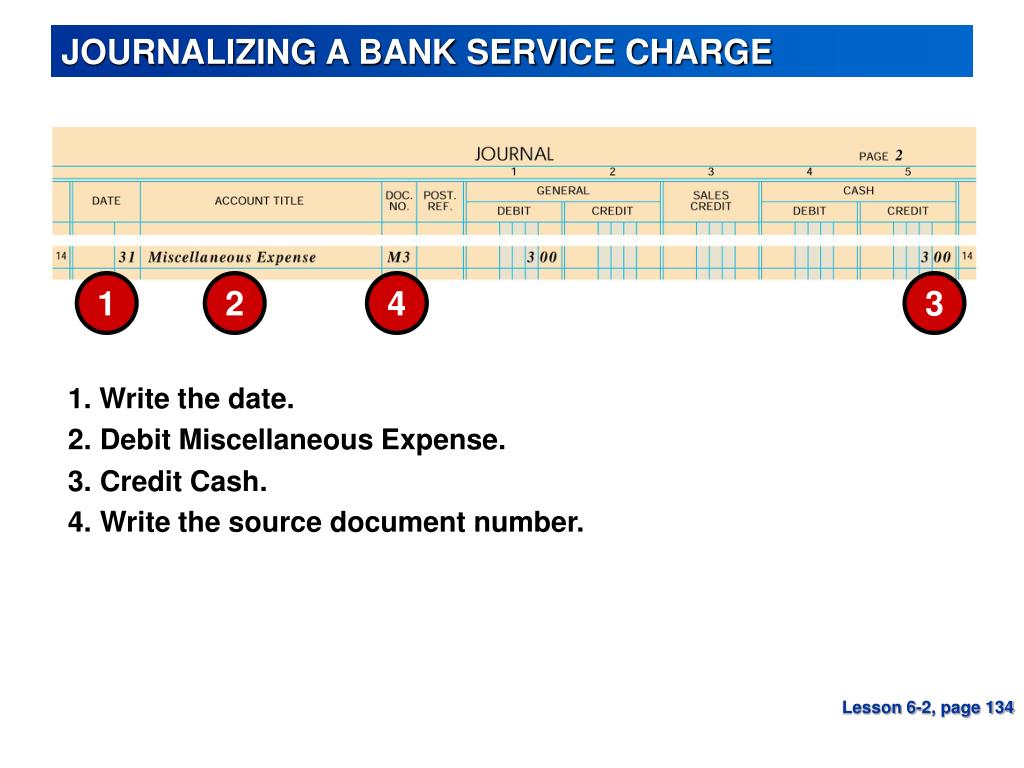

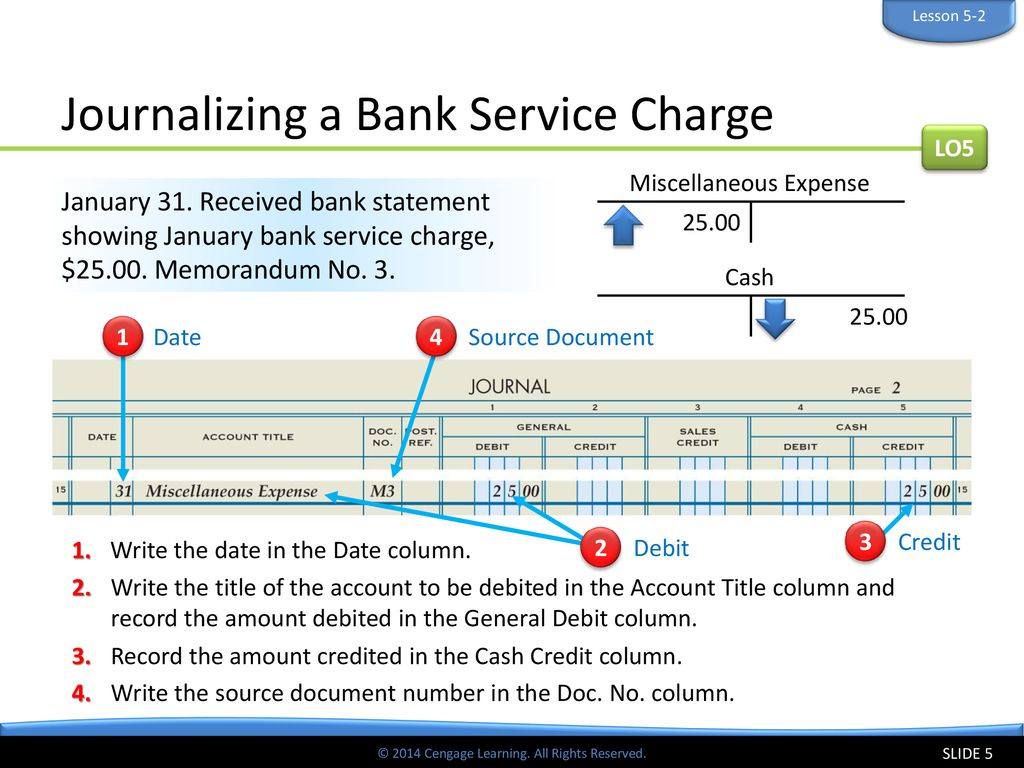

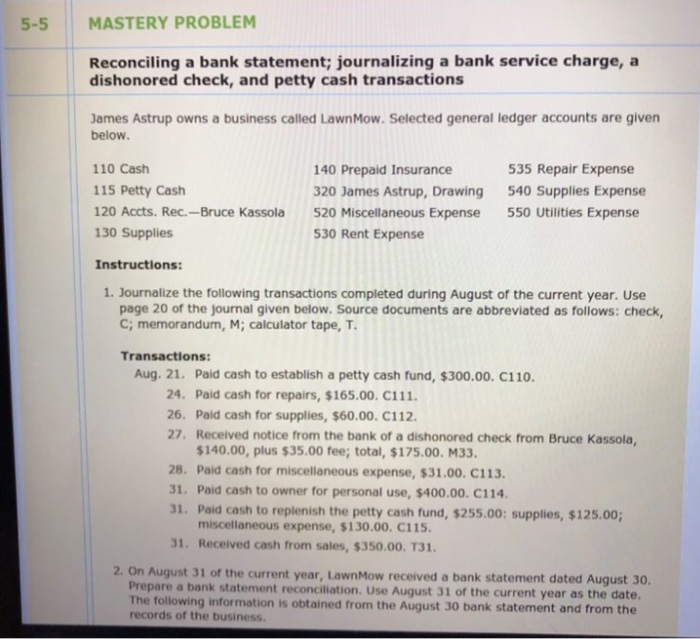

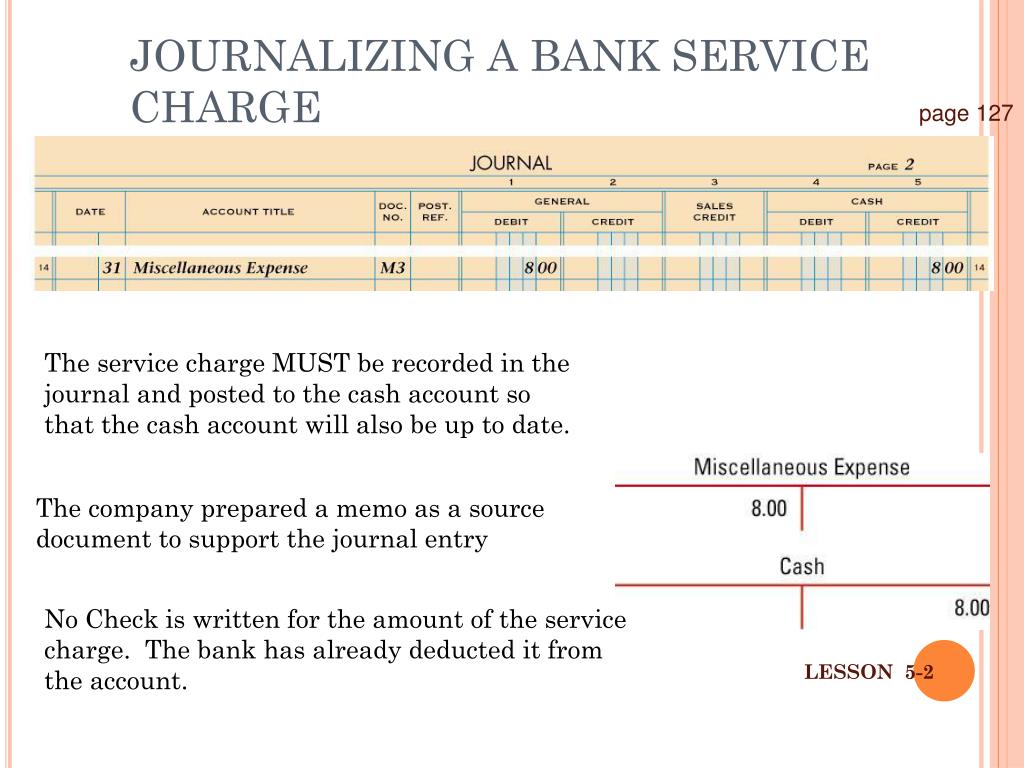

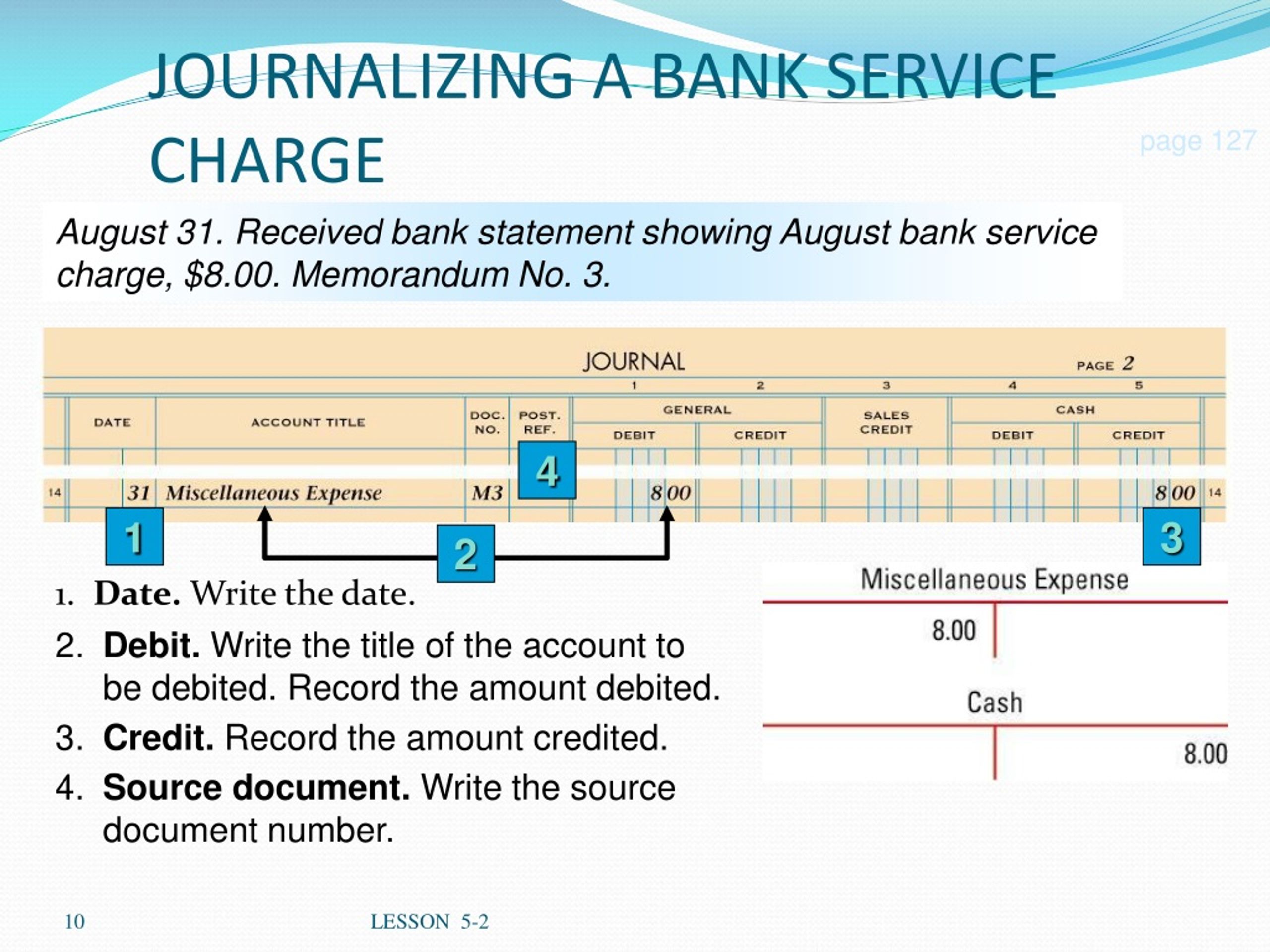

Journalize Bank Service Charge - Web in the journal entry for bank charges paid, the “bank charges a/c” is debited and the “bank a/c” is credited. In the income statement or profit and loss account of the business, the bank charges would be debited as it is an expense and it reduces the profit. Web journalize the bank service charge and nsf check. Web by fraser sherman updated september 08, 2020. Transaction general journal debit credit record entry clear entry view general journal [the following information applies to the questions displayed below.) hills company's june 30 bank statement and the june ledger account for. Web journal entry worksheet record the service charges of $30 deducted by the bank. Web the company can make the journal entry for note collected by the bank by debiting the cash account and bank service charges account for fee charged and crediting the notes receivable account and interest revenue account. Bank reconciliation wouldn't be a problem if everything on your bank statement matched up with your ledgers. Since the service charge is on the bank statement, but not yet on the company’s books, a journal entry is needed to credit cash and to debit an expense such as bank charges or miscellaneous expense. Web when an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal entry must be made.

PPT LESSON 52 PowerPoint Presentation, free download ID2436926

Web we had invoiced a client $1000.00 for services rendered, but with the ach payment terms, we received only $985.00. The $15 difference is not.

Accounting Journal Entries For Dummies

Common adjustments to the balance per books include: Web journalize the bank service charge and nsf check. Web by fraser sherman updated september 08, 2020..

Journalize entries related to bank reconciliation and

Web examples of journal entries in a bank reconciliation. Bank charges must be accurately tracked and recorded as part of the bank reconciliation process. Web.

Solved a. Outstanding checks of 12,800. b. Bank service

They have not been recorded on feeter’s records. The transaction will record bank fees as the expense on the income statement. Exclude explanations from journal.

PPT Accounting I PowerPoint Presentation, free download ID5757178

Likewise, this journal entry increases the expense in the income statement and decrease. Transaction general journal debit credit record entry clear entry view general journal.

© 2014 Cengage Learning. All Rights Reserved. ppt download

The transaction will record bank fees as the expense on the income statement. Likewise, this journal entry increases the expense in the income statement and.

(Solved) 5 5 Mastery Problem Reconciling Bank Statement Journalizing

Each item would be recorded on the bank reconciliation as follows: Bank fees or service charges for maintaining the account, fees for returned checks, processing.

PPT Accounting Chapter 5 PowerPoint Presentation, free download ID

Likewise, this journal entry increases the expense in the income statement and decrease. In the income statement or profit and loss account of the business,.

PPT Chapter 5 PowerPoint Presentation, free download ID303926

In this journal entry, the bank service charge is an expense account in the income statement. Web when an item in a bank statement does.

Web In The Journal Entry For Bank Charges Paid, The “Bank Charges A/C” Is Debited And The “Bank A/C” Is Credited.

Bank charges must be accurately tracked and recorded as part of the bank reconciliation process. Web examples of journal entries in a bank reconciliation. Web we had invoiced a client $1000.00 for services rendered, but with the ach payment terms, we received only $985.00. Web for purposes of this lesson, we’ll prepare journal entries.

Exclude Explanations From Journal Entries.) Journal Entry Date Account Titles Pr Dr.

Since the service charge is on the bank statement, but not yet on the company’s books, a journal entry is needed to credit cash and to debit an expense such as bank charges or miscellaneous expense. Transaction general journal debit credit record entry clear entry view general journal [the following information applies to the questions displayed below.) hills company's june 30 bank statement and the june ledger account for. Two debit memoranda accompanied the bank statement service charges for december of $25, and a $775 check drawn by jone jones marked nsf. Accounting coach explains that adjustments include:.

The Debit Represents The Amount Of The Service Charges That Have Been Incurred And The Credit Represents The.

The other side will decrease the cash at bank as they already reduce the balance to settle the fees. So, cash handling charges are the charges levied by bank for providing cash deposit services to the account holder. Likewise, this journal entry increases the expense in the income statement and decrease. One important trait of the bank reconciliation is that it identifies transactions that have not been recorded by the company that are supposed to be recorded.

Example Of Note Collected By The Bank.

Common adjustments to the balance per books include: Web bank service charges for the month are $80. Web when an item in a bank statement does not appear in a company’s general ledger account, a bank reconciliation journal entry must be made. Web journal entry worksheet record the service charges of $30 deducted by the bank.