Paid Cash For Rent Journal Entry - Following are the steps for. The company makes monthly rental payment to the landlord in order to use the building. This is done to keep legal evidence of the accounting transaction and maintain an audit trail. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed to the employee. Web rental expenses are recorded as a debit in the journal entry. Web income and expense a/c is debited to record the journal entry of rent paid. We want to increase the asset prepaid rent and decrease cash. But larger organizations usually prefer paying it only by cheque. Web definitions and conceptual frameworks. So let’s now work through a simple example to show the debits and credits involved.

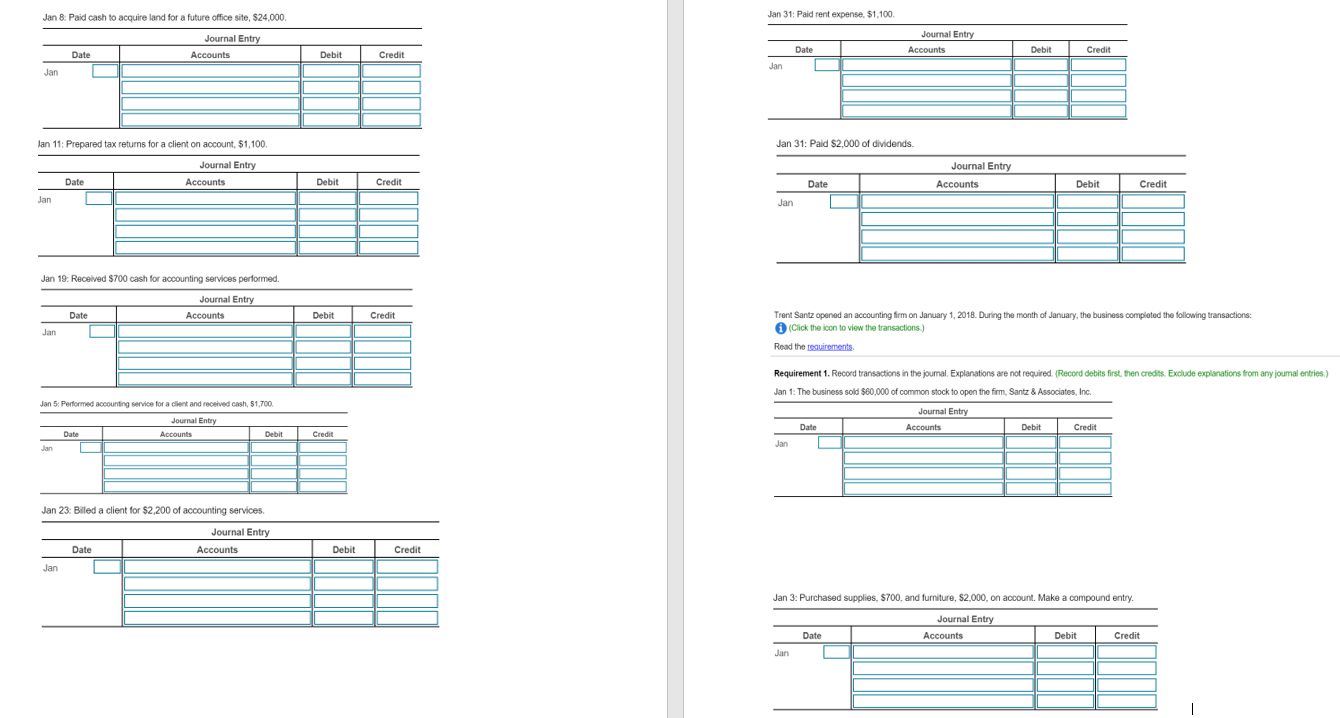

Solved Jan 31 Paid rent expense, 1.100 Journal Entry Jan

Web income and expense a/c is debited to record the journal entry of rent paid. Web definitions and conceptual frameworks. Per nominal account rule, all.

How to Adjust Journal Entry for Unpaid Salaries

The rent expense journal entry is not too complicated: So let’s now work through a simple example to show the debits and credits involved. The.

Journal entries for lease accounting

Following are the steps for. The debit side of the entry will include the amount of the rental expense. Web when cash is paid for.

journal entry format accounting accounting journal entry template

Rent paid journal entry is passed in order to. Web we can make the journal entry for the accrued rent expense by debiting the rent.

Self Study Notes The Adjusting Process And Related Entries

So let’s now work through a simple example to show the debits and credits involved. Web the company can make the journal entry for the.

Journal Entry For Advance Rent Received Info Loans

The company makes monthly rental payment to the landlord in order to use the building. Per nominal account rule, all expenses and losses need to.

Prepaid Expenses Entry Calculation In Excel Printable Templates

Read on to understand how this entry is recorded Rent paid journal entry is passed in order to. The company makes monthly rental payment to.

Journal Entries and Trial Balance in Accounting Video & Lesson

Under the previous accounting standard, asc 840, accounting for prepaid rent would look like the example below. Web prepaid rent journal entries. Following are the.

Prepaid Salary Journal Entry

Web rent paid journal entry is recorded with debit to rent expense & credit to rental liability. Web what is the journal entry for rent.

Web Prepaid Rent Journal Entries.

Web what is the journal entry for rent paid in advance? Web definitions and conceptual frameworks. The credit side of the entry can be either accounts. Web when cash is paid for certain expenses such as rent, then an entry must be booked to record the expense, and also record the cash that has been paid.

Rent Paid Journal Entry Is Passed In Order To.

When we pay for an expense in advance, it is an asset. Small businesses pay office rent either in cash or by cheque. Web please prepare a journal entry for the rental fee paid for the month. But larger organizations usually prefer paying it only by cheque.

The Rent Expense Journal Entry Is Not Too Complicated:

Web rent paid journal entry is recorded with debit to rent expense & credit to rental liability. We want to increase the asset prepaid rent and decrease cash. Web journalizing rent payment: Web the company can make the journal entry for the rent paid in advance by debiting the prepaid rent account and crediting the cash.

This Is Done To Keep Legal Evidence Of The Accounting Transaction And Maintain An Audit Trail.

Per nominal account rule, all expenses and losses need to be debited. Read on to understand how this entry is recorded When does a journal entry balance? Let’s assume you own a single rental property, as.