Outstanding Checks Journal Entry - Web the journal entry for an outstanding check involves recording the check when it is issued and then adjusting the records when the check is eventually cashed or. Web the journal entry for outstanding expenses involves two accounts: The following are the journal entries recorded earlier for printing. Web the best practice is to communicate with the payees of your outstanding checks before the checks have been outstanding for a second month. When a check is written it takes a few days to clear. You can do the journal entry to fix your uncleared checks, filter the date range to end of year. Web in a bank reconciliation the outstanding checks are a deduction from the bank balance (or balance per the bank statement). Learn how to account for them and create a. If an outstanding check from the previous month did. Web you can create a journal entry to get rid off the outstanding check in quickbooks.

Solved Bank Reconciliation? Journal Entries Prepare The

Web you can create a journal entry to get rid off the outstanding check in quickbooks. When a check has been written but has yet.

Outstanding Checks

Web you can create a journal entry to get rid off the outstanding check in quickbooks. The following are the journal entries recorded earlier for.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Web for purposes of this lesson, we’ll prepare journal entries. The most frequent use of checks is to pay off the accounts payable. How to.

Journal Entry Outstanding Balance

Web journal entry for issuing check. Outstanding expense a/c and expense a/c. What is an outstanding check? Web in a bank reconciliation the outstanding checks.

How to Write Off Outstanding Checks?

How to find outstanding checks on bank reconciliation. An outstanding check is a check payment that is. Web let me help you with your concern..

What Is Outstanding Checks In Bank Reconciliation Forex Trading Guide

Outstanding expense a/c and expense a/c. The most frequent use of checks is to pay off the accounts payable. Web in a bank reconciliation the.

PA53 Identifying Outstanding Checks and Deposits in Transit and

When there are old on a , they should be eliminated. The most frequent use of checks is to pay off the accounts payable. What.

PA53 Identifying Outstanding Checks and Deposits in Transit and

Web the best practice is to communicate with the payees of your outstanding checks before the checks have been outstanding for a second month. When.

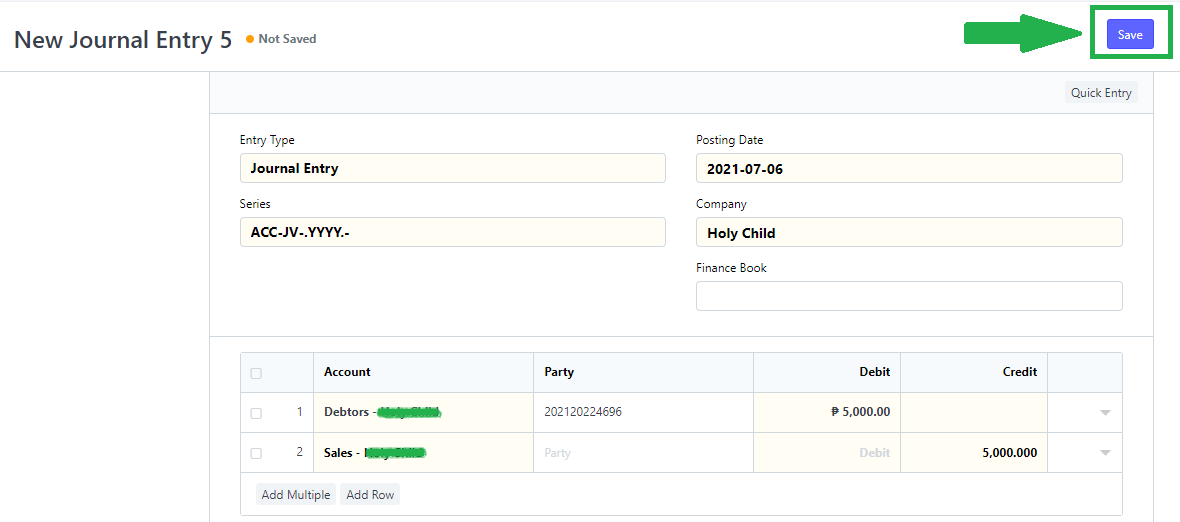

Check Journal Example ZAP ACCOUNTING SOFTWARE

The most frequent use of checks is to pay off the accounts payable. Web journal entry for issuing check. Web the journal entry for outstanding.

December 10, 2018 05:08 Pm.

Outstanding expense a/c and expense a/c. Web in a bank reconciliation the outstanding checks are a deduction from the bank balance (or balance per the bank statement). The company issue checks to settle the. Web you can create a journal entry to get rid off the outstanding check in quickbooks.

Web Let Me Help You With Your Concern.

How to find outstanding checks on a bank statement. When a check has been written but has yet to be deposited, it can lead to a plethora of accounting errors. If we added an item in the bank reconciliation, we will debit the checking account (because a debit increases an asset. If an outstanding check from the previous month did.

However, Before Performing This, You'll Need To Consult Your Accountant.

Web journal entry for issuing check. Web the journal entry for an outstanding check involves recording the check when it is issued and then adjusting the records when the check is eventually cashed or. You can do the journal entry to fix your uncleared checks, filter the date range to end of year. Web there is no need for the company to write a journal entry, as the checks were recorded in the company’s general ledger account when the checks were written.

Web The Best Practice Is To Communicate With The Payees Of Your Outstanding Checks Before The Checks Have Been Outstanding For A Second Month.

An outstanding check is a check payment that is. Web the journal entry for outstanding expenses involves two accounts: The company may issue the check for various reasons including settling the previous credit purchase, purchasing the assets, or paying the. Web december 19, 2019 03:55 am.