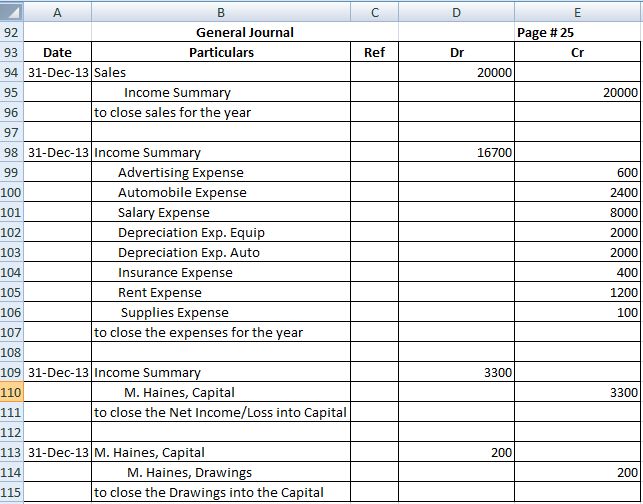

Income Summary Journal Entry - The net balance in income summary account after posting the first two closing entries. To close that, we debit service revenue for the full amount and credit income summary for the same. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period. Web income summary account is debited and retained earnings account is credited for the an amount equal to the excess of service revenue over total expenses i.e. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero. Closing the revenue accounts —transferring the credit balances in the revenue accounts to a clearing account called income summary. Income summaries typically transfer temporary accounts balances to retained earnings, which are permanent accounts on the balance sheets. All of paul’s revenue or income accounts are debited and credited to the income summary account. Shift all $9,000 of expenses generated during the month to the income summary account (there is assumed to be just one expense account): Web a closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account.

Closing Entries I Summary I Accountancy Knowledge

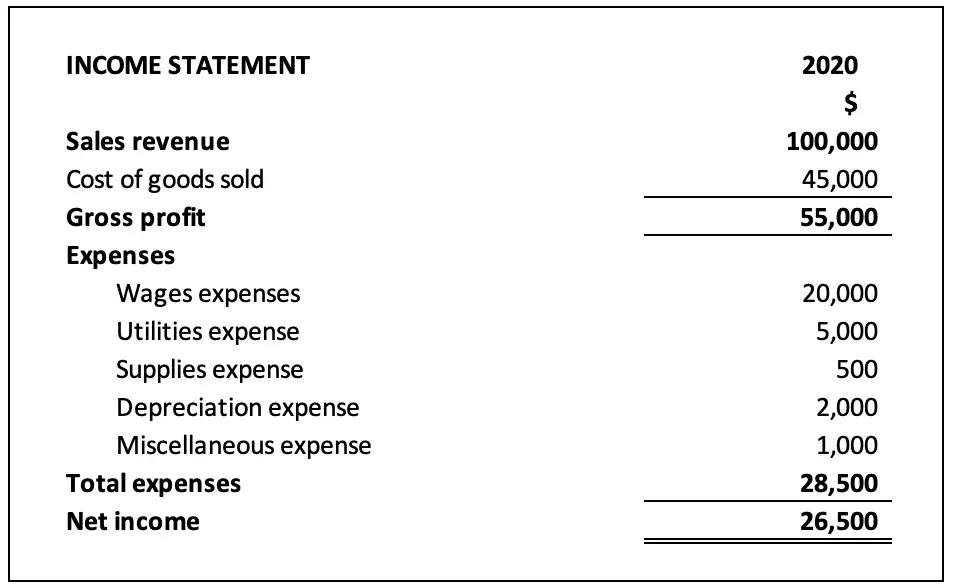

In this case $85,600 − $77,364 = $8,236. To close that, we debit service revenue for the full amount and credit income summary for the.

Summary Journal Entry Example Accountinginside

Web the income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step.

Closing Entries Example, Preparing Closing Entries, Summary, Next Step

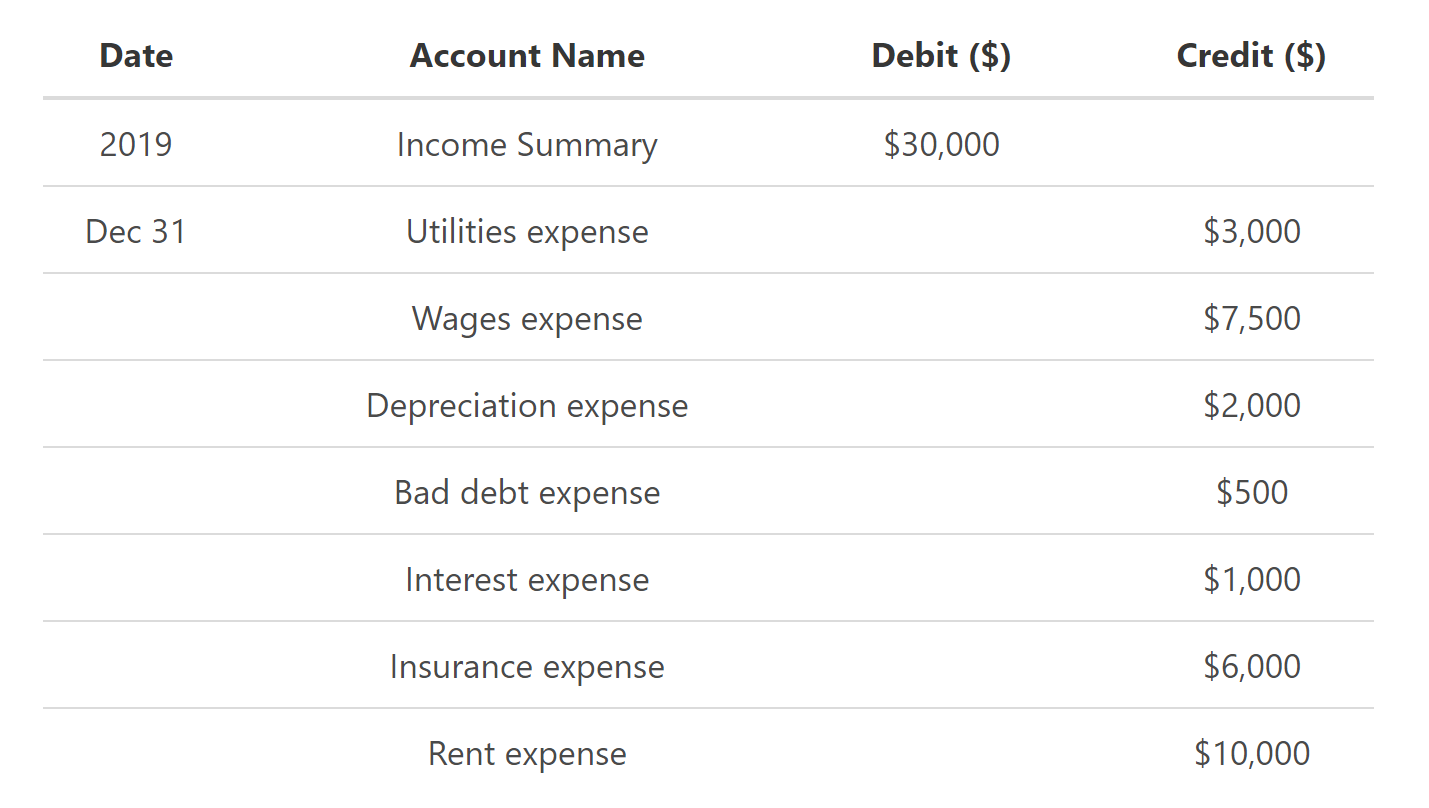

Close all income accounts to income summary. Close all revenue and gain accounts. Empty the income summary account by debiting it for $5,000, and transfer.

[Solved] Prepare Journal Entries, General Ledger, Statement

Web now, we are going to review an example of creating the income summary account and posting closing journal entries to it. The fourth entry.

Accounting An Introduction Adjusting and Closing Journal Entries

Shift all $10,000 of revenues generated during the month to the income summary account: It is used to close income and expenses. In the given.

Closing Entries Definition, Types, and Examples

In this case $85,600 − $77,364 = $8,236. It has a credit balance of $9,850. Web a closing entry is a journal entry that is.

Closing Entries are journal entries made to close

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start.

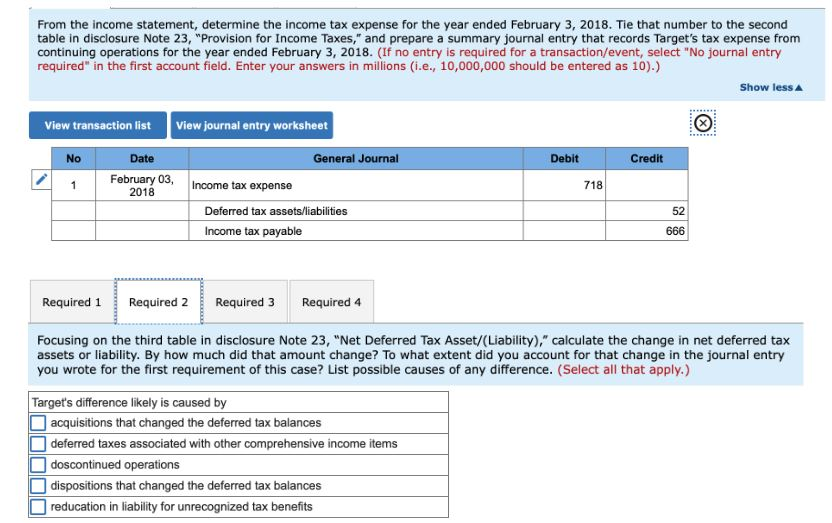

Tax Expense Journal Entry Journal Entries for Normal Charge

Shift all $9,000 of expenses generated during the month to the income summary account (there is assumed to be just one expense account): Web the.

How To Record Net In Journal Entry

This means that the value of each account in the income statement is debited from the temporary accounts and then credited as one value to.

Journal Entry To Close The Income Summary Account.

Web closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account. Learn how to use the income summary account to close the income statement at the end of the period. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero. Closing the revenue accounts —transferring the credit balances in the revenue accounts to a clearing account called income summary.

The Second Entry Closes Expense Accounts To The Income Summary Account.

In this case $85,600 − $77,364 = $8,236. Closing the expense accounts —transferring the debit balances in the expense accounts to a clearing account called income summary. The income summary account is temporary. Web the closing entries are the journal entry form of the statement of retained earnings.

See The Journal Entries For Revenues, Expenses And Net Income Or Loss, And An Example For Company Abc.

The third entry closes the income summary account to retained earnings. Assume that at the end of the period (december 31), there are credit balances of $2,600 in patient services revenues and $1,350 in laboratory fees revenues. Close all income accounts to income summary. The fourth entry closes the dividends account to retained earnings.

Web What Is An Income Summary?

A temporary account is an income statement account, dividend account or drawings account. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Web the income summary account is a temporary account used to store income statement account balances, revenue and expense accounts, during the closing entry step of the accounting cycle. Web the following journal entries show how to use the income summary account: