Outstanding Check Journal Entry - How to determine outstanding checks. Web the best practice is to communicate with the payees of your outstanding checks before the checks have been outstanding for a second month. Here's how to do it: Web for purposes of this lesson, we’ll prepare journal entries. Deduct any bank service fees, penalties, and nsf checks. Example of an outstanding check in the bank reconciliation. Web outstanding checks journal entry. Web how to write off outstanding checks. Web once completed, here's how you can start recording your outstanding checks: Choose an item or category.

How to Write Off Outstanding Checks?

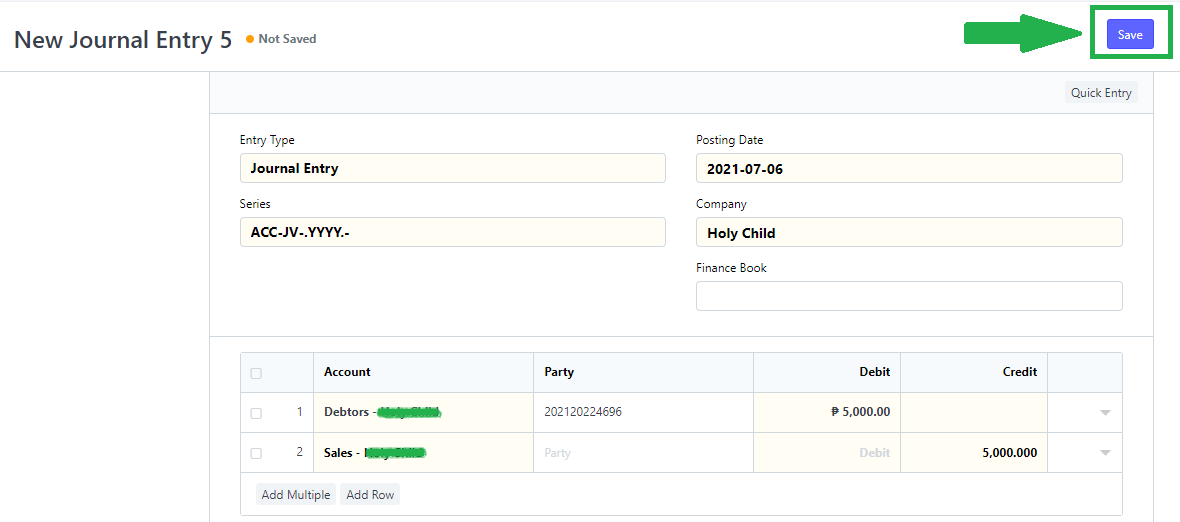

When the company issue check, the accountant credit cash at bank and debit other accounts such as assets, liability, or expense. On the payment account.

Payroll Journal Entry Example Explanation My Accounting Course

In a bank reconciliation the outstanding checks are a deduction from the bank balance (or balance per the bank statement). An outstanding check is still.

Journal Entry Outstanding Balance

Enter the opening balance in the bank account as of a statement ending date on or before your qb start date. When a check has.

Journal Entry Problems and Solutions Format Examples MCQs

How to determine outstanding checks. Go to the plus icon. So in order to write off an outstanding check, we need to look at the.

Accounting Journal Entries For Dummies

On the payment account menu, select the wash account you recently created. In the second step of the accounting cycle, your journal entries get put.

What Is Outstanding Checks In Bank Reconciliation Forex Trading Guide

Here is the process by which you can write off outstanding checks. However, if a company voids one of its outstanding checks, the company will.

Solved Bank Reconciliation? Journal Entries Prepare The

Go to thecompanymenu and choosemakegeneral journal entries. If we added an item in the bank reconciliation, we will debit the checking account (because a debit.

Check Journal Example ZAP ACCOUNTING SOFTWARE

Web below are the steps: Web if a check was voided in the current month but was written in the previous month and appeared on.

Micros Outstanding Checks

Then enter everything that is outstanding in your bank account register. In a bank reconciliation the outstanding checks are a deduction from the bank balance.

Fill Out The Needed Fields Such As Thedate,Account, Etc.

Though prone to causing issues, outstanding checks can be easily kept track of and avoided by employing simple accounting systems. Web once completed, here's how you can start recording your outstanding checks: An outstanding check is still a liability for the payor who issued the check. Web an outstanding check is a check that a company has issued and recorded in its general ledger accounts, but the check has not yet cleared the bank account on which it is drawn.

Go To The Plus Icon.

Web below are the steps: This may eliminate the accounting entries and the need to report and remit the outstanding check amounts to your state government years later. In the second step of the accounting cycle, your journal entries get put into the general ledger. Go to the + new button.

However, Before Performing This, You'll Need To Consult Your Accountant First To Ensure This Option Suits Your Company Set Up.

When there are old on a , they should be eliminated. Credit the account (s) that was debited when the check was originally recorded. Make sure your debits equal your credits when you're done. Example of an outstanding check in the bank reconciliation.

Web If A Check Was Voided In The Current Month But Was Written In The Previous Month And Appeared On The Previous Month’s List Of Outstanding Checks, You Should Write A Journal Entry To Do The Following:

Deduct any bank service fees, penalties, and nsf checks. Then enter everything that is outstanding in your bank account register. Next, use the company’s ending cash balance, add any interest earned and notes receivable amount. Outstanding checks vs unreleased checks.