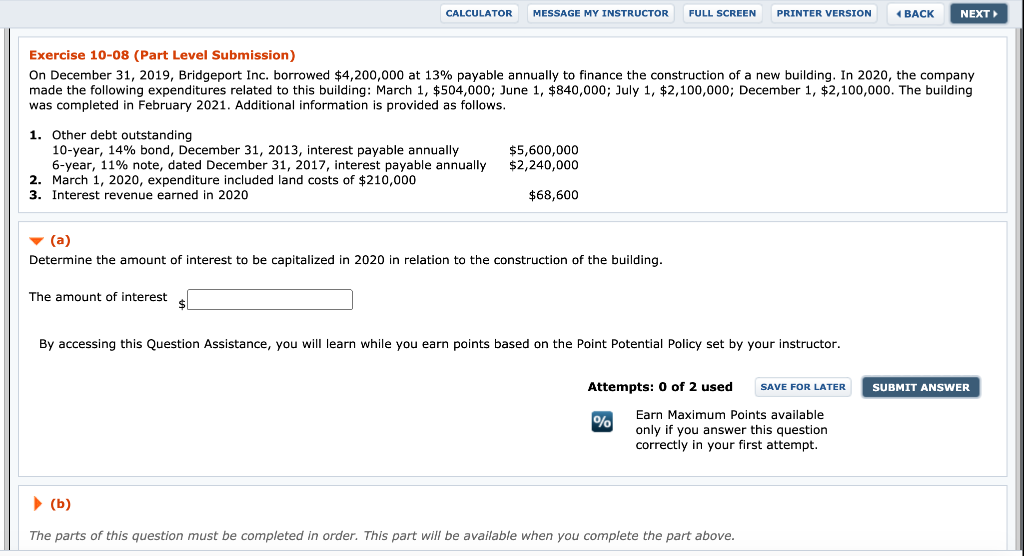

Capitalize Expense Journal Entry - Preparation of a schedule of expenditures incurred on the asset, differentiating. Web last updated january 24, 2023. Incorporation costs refer to the fees and expenses that are incurred in the. The decision of whether to expense or capitalize an expenditure is based on how long the benefit of that spending is expected to last. In the example the total interest for the period was 44,750 and the amount to be capitalized calculated as 17,141. Web the decision to capitalize assets or record a purchase as an expense is an area of accounting that confuses many bookkeepers and small business owners. Increase the general ledger asset account with a debit on the first line of the entry. Web journal entries to capitalize vs expense asset payments. Web as shown in the journal entry for capitalization of the fixed asset above, we do not record the expense immediately after purchasing the fixed asset. Web when to capitalize vs.

Capitalize vs. Expense What is the Difference?

However, as we use the fixed. Web prepare a journal entry to capitalize the total costs you've calculated. Businesses employ a strategic process known as.

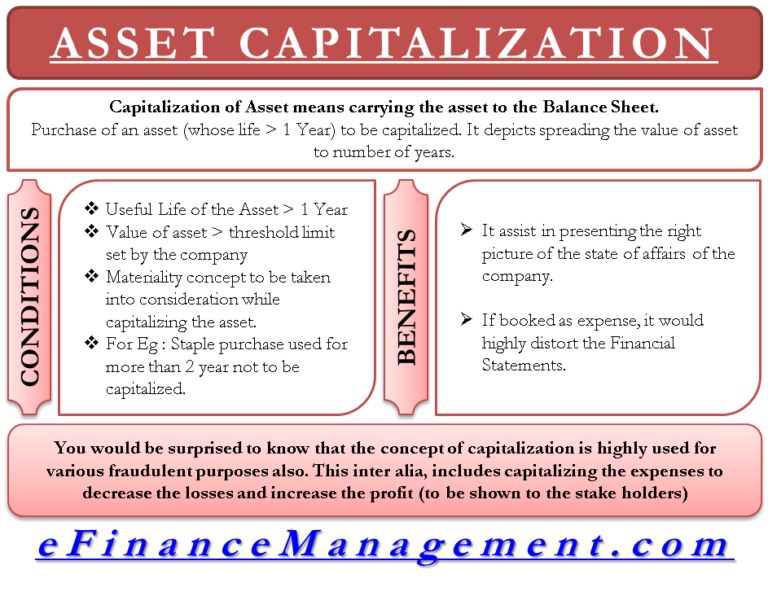

Capitalizing Assets Define, Example, Matching Concept, Fraud, Benefits

Web last updated january 24, 2023. Subtract the total deductions from the gross pay to find the net pay—the amount that will actually be disbursed.

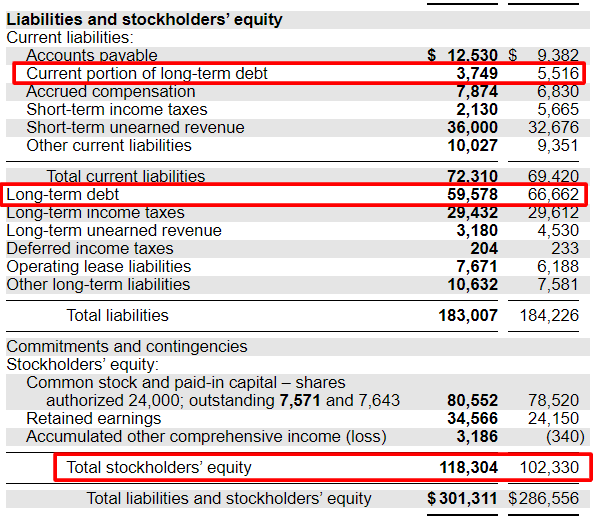

Accounting for Share Capital Accountancy Knowledge

Web journal entries for capitalizing incorporation costs. Web capitalize expense journal entry. Web what is capitalizing r&d expenses? Web however, as the machine wears and.

Adjusting Journal Entries Defined Accounting Play

Web in general, calculation of capitalized interest involves the following steps: What are capitalized software costs? Web the journal entry would involve debiting the interest.

Solved B. Prepare the journal entry to record the

Web when to capitalize vs. Web journal entries for capitalizing incorporation costs. The decision of whether to expense or capitalize an expenditure is based on.

Capitalize vs Expense Basic Accounting YouTube

Web prepare a journal entry to capitalize the total costs you've calculated. Subtract the total deductions from the gross pay to find the net pay—the.

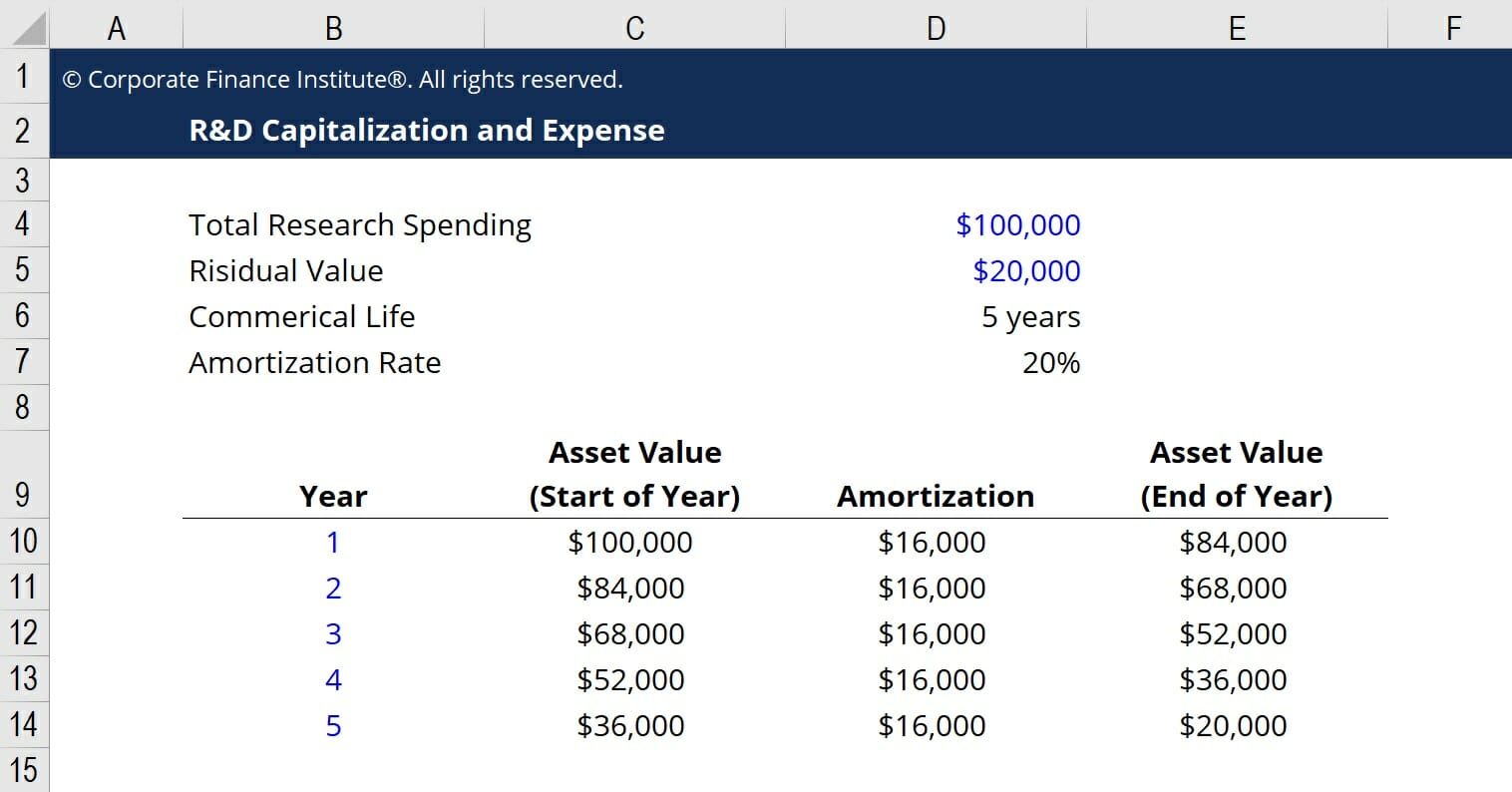

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

Web journal entries to capitalize vs expense asset payments. Web examples of capitalized costs include expenses incurred to put fixed assets to use, software development.

Capitalizing Versus Expensing Costs Learn accounting, Bookkeeping

Web the decision to capitalize assets or record a purchase as an expense is an area of accounting that confuses many bookkeepers and small business.

R&D Capitalization vs Expense How to Capitalize R&D

(a)prepare the necessary journal entries to record each of the changes or errors. Web in general, calculation of capitalized interest involves the following steps: The.

Web Decommissioning Cost (Also Known As Asset Retirement Obligation) Is The Cost Incurred By Companies In Reversing The Modifications Made To Landscape When A.

According to the three types of accounts in accounting “prepaid expense” is a personal account. Web capitalize expense journal entry. The journal entry is debiting fixed assets and credit accounts payable or cash. Web in general, calculation of capitalized interest involves the following steps:

When The Company Spends On The Capitalized Expense, They Need To Record The Fixed Assets And Credit Cash Or Accounts Payable.

Web the benefit of the ifrs approach is that at least some research and development costs can be capitalized (i.e., turned into an asset on the company’s balance sheet) instead of. Web journal entries to capitalize vs expense asset payments. (a)prepare the necessary journal entries to record each of the changes or errors. Web prepare a journal entry to capitalize the total costs you've calculated.

Preparation Of A Schedule Of Expenditures Incurred On The Asset, Differentiating.

Web journal entries for additions and capitalizations (oracle assets help) this section includes addition and capitalization journal entry examples for the following. Following are typical journal entries involved in recognition and depreciation of capital expenditure: Increase the general ledger asset account with a debit on the first line of the entry. Web last updated january 24, 2023.

However, As We Use The Fixed.

The decision of whether to expense or capitalize an expenditure is based on how long the benefit of that spending is expected to last. Web the journal entry would involve debiting the interest expense account for $200, debiting the loan liability account for $800, and crediting the cash account for the. Web however, as the machine wears and tears over some time, the company will record expense journal entry for calculating depreciation expenses. Web what is capitalizing r&d expenses?