Operating Lease Journal Entry - Since it is an operating lease accounting, the company will book the lease rentals uniformly over the next twelve months, which is the lease term. This includes the following steps (how to record journal entries): We’ll tackle accounting for operating leases under asc 842 much like the standard (or “topic”) released by the fasb does. What is a lease under asc 842? At the time of first payment, lessor shall record receipt of cash, reduction in lease receivable and recognition of finance income: It's essentially like accounting for all your leases as if they were capital leases under asc 840. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. Details on the example lease agreement. Web how to calculate the journal entries for an operating lease under asc 842. Web in accordance with ifrs 16.61, a lessor should classify each of its leases as either a finance lease or an operating lease.

Journal entries for lease accounting

Cashflow requirements under asc 842. Since it is an operating lease accounting, the company will book the lease rentals uniformly over the next twelve months,.

Journal entries for lease accounting

What is a lease under asc 842? Determine the lease term under asc 840. Web show the journal entry for the operating lease transaction. Details.

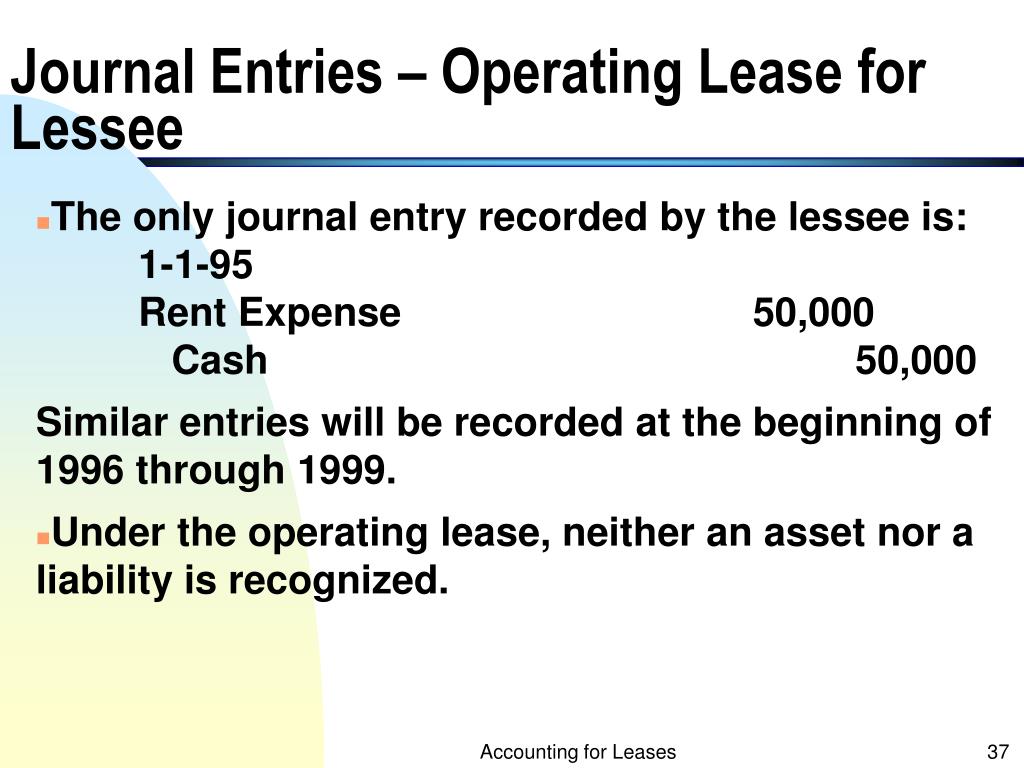

PPT Accounting for Leases PowerPoint Presentation, free download ID

Since it is an operating lease accounting, the company will book the lease rentals uniformly over the next twelve months, which is the lease term..

In an Operating Lease the Lessee Records JaelynhasCox

The present value of all known future lease payments. Under asc 842, an operating lease you now recognize: Web operating leases under asc 842. Credit.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

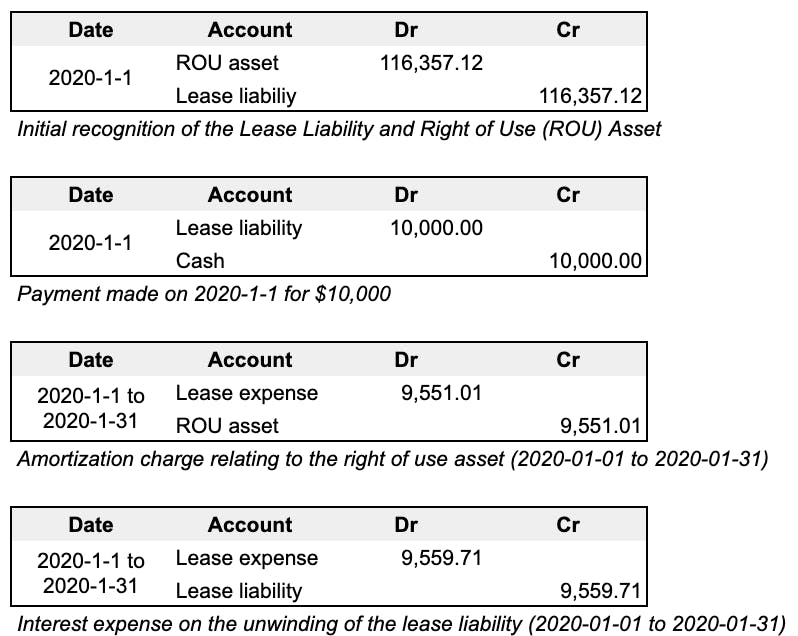

Below we present the entry recorded as of 1/1/2021 for our example: Effective date for private companies. The initial journal entry under ifrs 16 records.

Accounting Treatment Of Operating Lease And Finance Lease businesser

On the asc 842 effective date,. The monthly rental expense will be calculated as follows, rental expense per month = total lease rental / no..

Finance Lease Journal Entries businesser

Web operating lease accounting example and journal entries. At the time of first payment, lessor shall record receipt of cash, reduction in lease receivable and.

Your Guide To Calculating Journal Entries For Operating Leases

Richard stuart, partner, national professional standards group, rsm us llp [email protected], +1 203 905 5027 Web according to asc 842, journal entries for operating leases.

Finance Lease Journal Entries businesser

Web to help accounting teams at businesses and nonprofits, here are some of the basic journal entries you’ll need to use to account for operating.

Determine The Total Lease Payments Under Gaap.

The lessee's right to use the leased asset. Web journal entries in case of a finance lease. Web a guide to lessee accounting under asc 842 prepared by: See examples, calculations, and tips for operating lease vs.

Web How To Calculate The Journal Entries For An Operating Lease Under Asc 842.

Details on the example lease agreement. The initial journal entry under ifrs 16 records the asset and liability on the balance sheet as of the lease commencement date. Lessor accounting under ifrs 16 is substantially unchanged from the accounting under ias 17. Below we present the entry recorded as of 1/1/2021 for our example:

What’s Covered And What’s Not Covered?

Effective date for private companies. Web asc 842 journal entries for operating leases. Subsequent journal entries for an operating lease are recorded on a straight. Accounting for lease incentives under asc 842.

Credit Lease Liability—Present Value Of All Future Lease Payment (Discount Rate Used In Calculation Is Your Incremental Borrowing Rate “Ibr”).

Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses. The monthly rental expense will be calculated as follows, rental expense per month = total lease rental / no. Asc 842 journal entries for finance leases. Web show the journal entry for the operating lease transaction.