Adjusting General Journal Entries - Web when posting any kind of journal entry to a general ledger, it is important to have an organized system for recording to avoid any account discrepancies and misreporting. Web the adjusting entry for accounts receivable in general journal format is: Web an adjusting journal entry is a financial accounting entry made to ensure accuracy by updating accounts, correcting errors, and reflecting proper revenue and. The balance in the liability account accounts payable at the end of the year will carry forward to the next. Web adjusting entries requires updates to specific account types at the end of the period. Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Traditional journal entry format dictates that debited accounts are. Web adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared. Web if you use accrual accounting, your accountant must also enter adjusting journal entries to keep your books in compliance. Web adjusting entries are made in your accounting journals at the end of an accounting period after a trial balance is prepared.

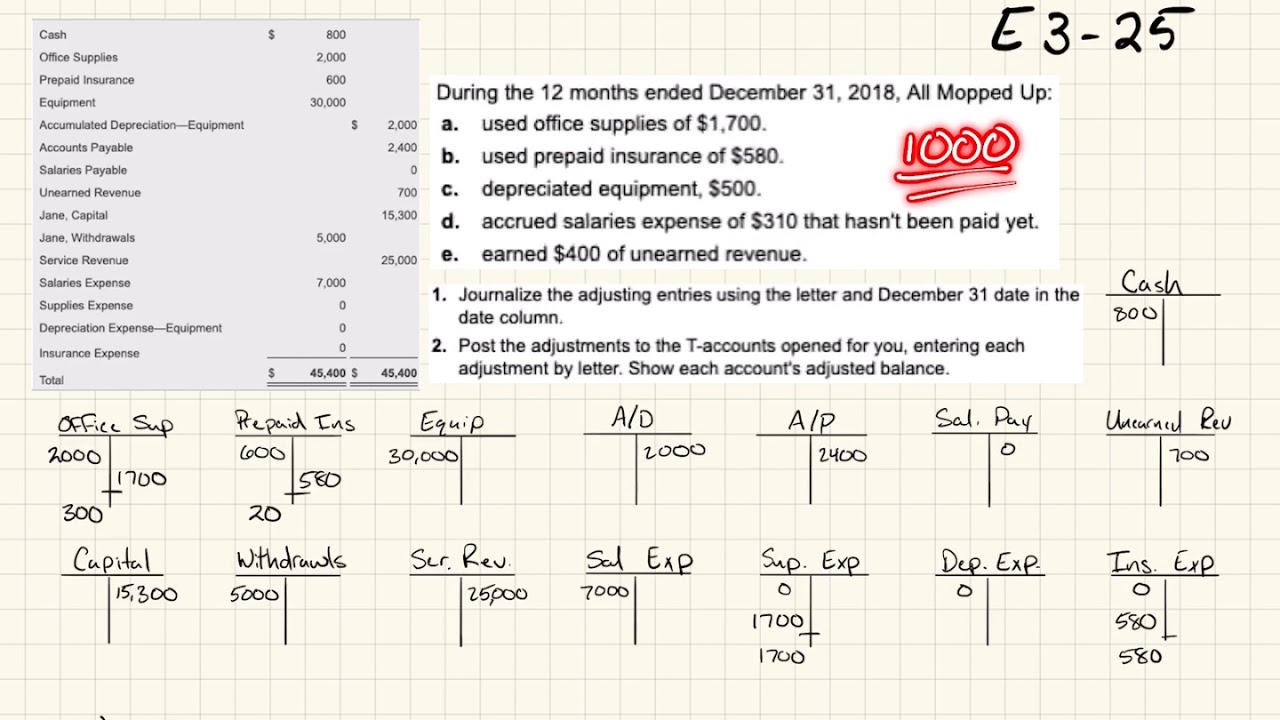

E325 Basic Adjusting Journal Entry Example YouTube

Web adjusting entries are made at the end of an accounting period to properly account for income and expenses not yet recorded in your general.

Adjusting Journal Entries Defined Accounting Play

The balance in the liability account accounts payable at the end of the year will carry forward to the next. Web journal entries use debits.

Adjusting Entries Example, Types, Why are Adjusting Entries Necessary?

The balance in the liability account accounts payable at the end of the year will carry forward to the next. The purpose of adjusting entries..

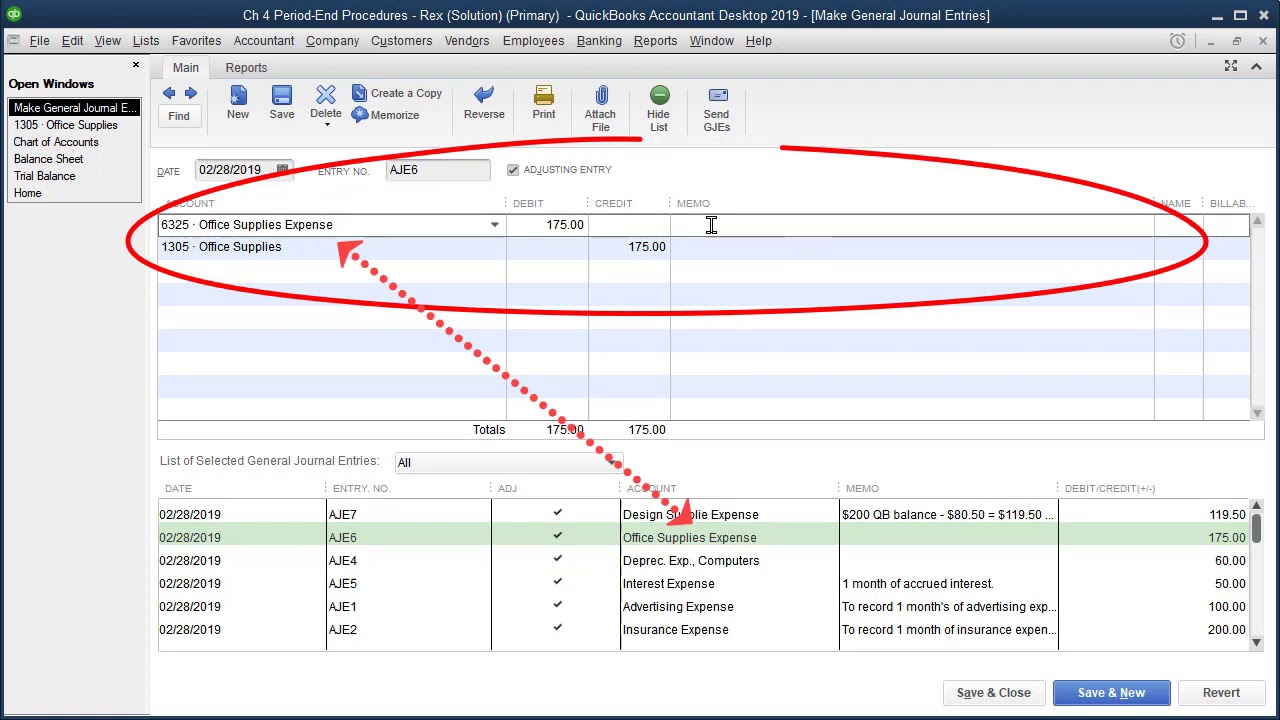

Correcting a QuickBooks Adjusting Journal Entry YouTube

The purpose of adjusting entries. The matching principle states expenses must be matched with the revenue generated during the period. Web if you use accrual.

Solved Record The Adjusting Entries In The A General Jour...

The purpose of adjusting entries. Not all accounts require updates, only those not naturally triggered by an original source. Web adjusting journal entries are accounting.

5.1 The Need for Adjusting Entries Financial Accounting

Adjusting journal entries are made in a company’s general ledger at the end of an accounting period—typically affecting. Web the adjusting entry for accounts receivable.

Solved Record the adjusting entries in the a General Journal

Web if you use accrual accounting, your accountant must also enter adjusting journal entries to keep your books in compliance. After adjusted entries are made.

Adjusting Entries Examples Accountancy Knowledge

The purpose of adjusting entries. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense.

Adjusting Journal Entry Definition Purpose, Types, and Example

The purpose of adjusting entries. Web journal entries use debits and credits to record the changes of the accounting equation in the general journal. After.

Web Adjusting Entries Are Made In Your Accounting Journals At The End Of An Accounting Period After A Trial Balance Is Prepared.

Adjusting entries ensure that expenses and. Web adjusting entries, also known as adjusting journal entries (aje), are the entries made in a business firm’s accounting journals to adapt or update the revenues. Web the general journal is simply a list of journal entries in chronological order, and is used to save time, avoid cluttering the general ledger with too much detail, and to. Web adjusting entries, also called adjusting journal entries, are journal entries made at the end of a period to correct accounts before the financial statements are prepared.

Adjusting Journal Entries Are Made In A Company’s General Ledger At The End Of An Accounting Period—Typically Affecting.

The balance in the liability account accounts payable at the end of the year will carry forward to the next. Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Traditional journal entry format dictates that debited accounts are. After adjusted entries are made in.

Web An Adjusting Journal Entry Is A Financial Accounting Entry Made To Ensure Accuracy By Updating Accounts, Correcting Errors, And Reflecting Proper Revenue And.

Some common types of adjusting journal entries are accrued. It is a result of accrual accountingand follows the matching and revenue recognition principles. Web what are adjusting journal entries? Web what is an adjusting journal entry?

Each Entry Impacts At Least One Income.

The purpose of adjusting entries. The matching principle states expenses must be matched with the revenue generated during the period. Web the adjusting entry for accounts receivable in general journal format is: Not all accounts require updates, only those not naturally triggered by an original source.

:max_bytes(150000):strip_icc()/AdjustingJournalEntry_V1-2dbdebbd05d74d808f539458dcfa2e2a.jpg)