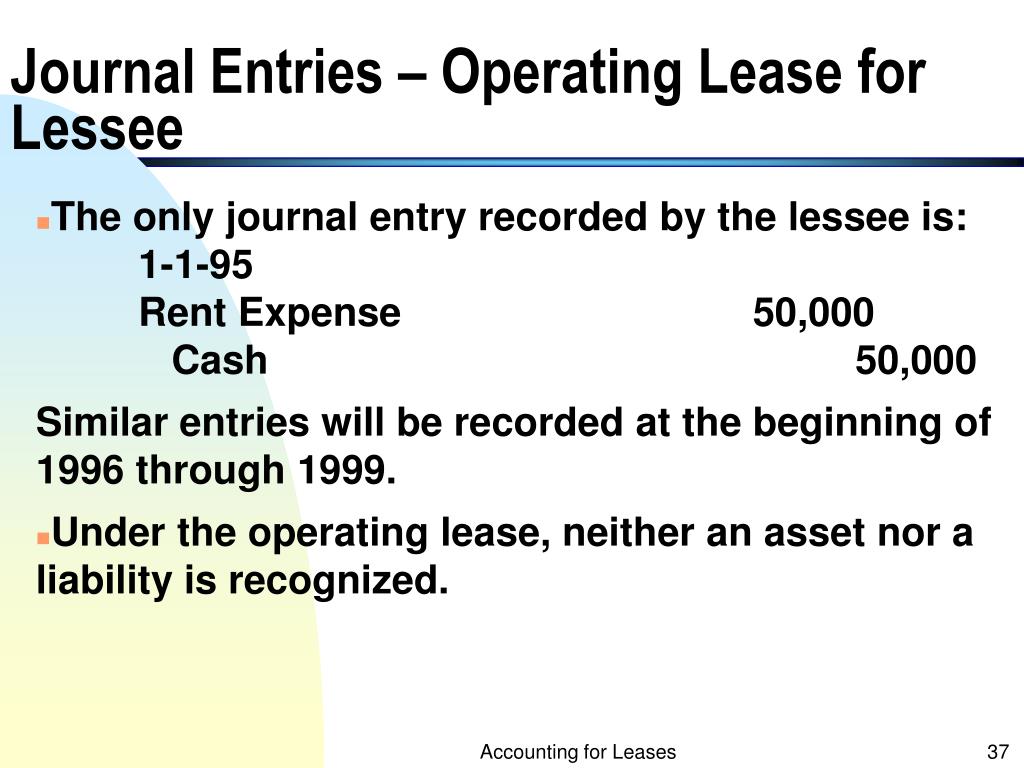

Operating Lease Accounting Journal Entries - Since it is an operating lease accounting, the company will book the lease rentals uniformly over the next twelve. In this journal entry, there is no record. Web accounting for leases under the new standard, part 1. What is a lease under asc 842? See examples of journal entries for initial recognition, amortization, modification and transition. Web operating leases under asc 842. Definition and classification of leases and lessee accounting. Web lessors are required to classify each of their leases as either an operating lease or a finance lease. Operating leases under asc 842 involve the deferred rent, total lease, rou asset, and lease liability. Web 3.1 lessor accounting model 23 3.2 lease classification 24 3.3 operating lease model 27 3.4 finance lease model 28 3.5 presentation and disclosure 29 4 lease definition 31 4.1.

Accounting Treatment Of Operating Lease And Finance Lease businesser

Web april 26, 2023 • hogantaylor. Web operating leases under asc 842. How to account for an operating lease. Effective date for public companies. Asc.

Journal entries for lease accounting

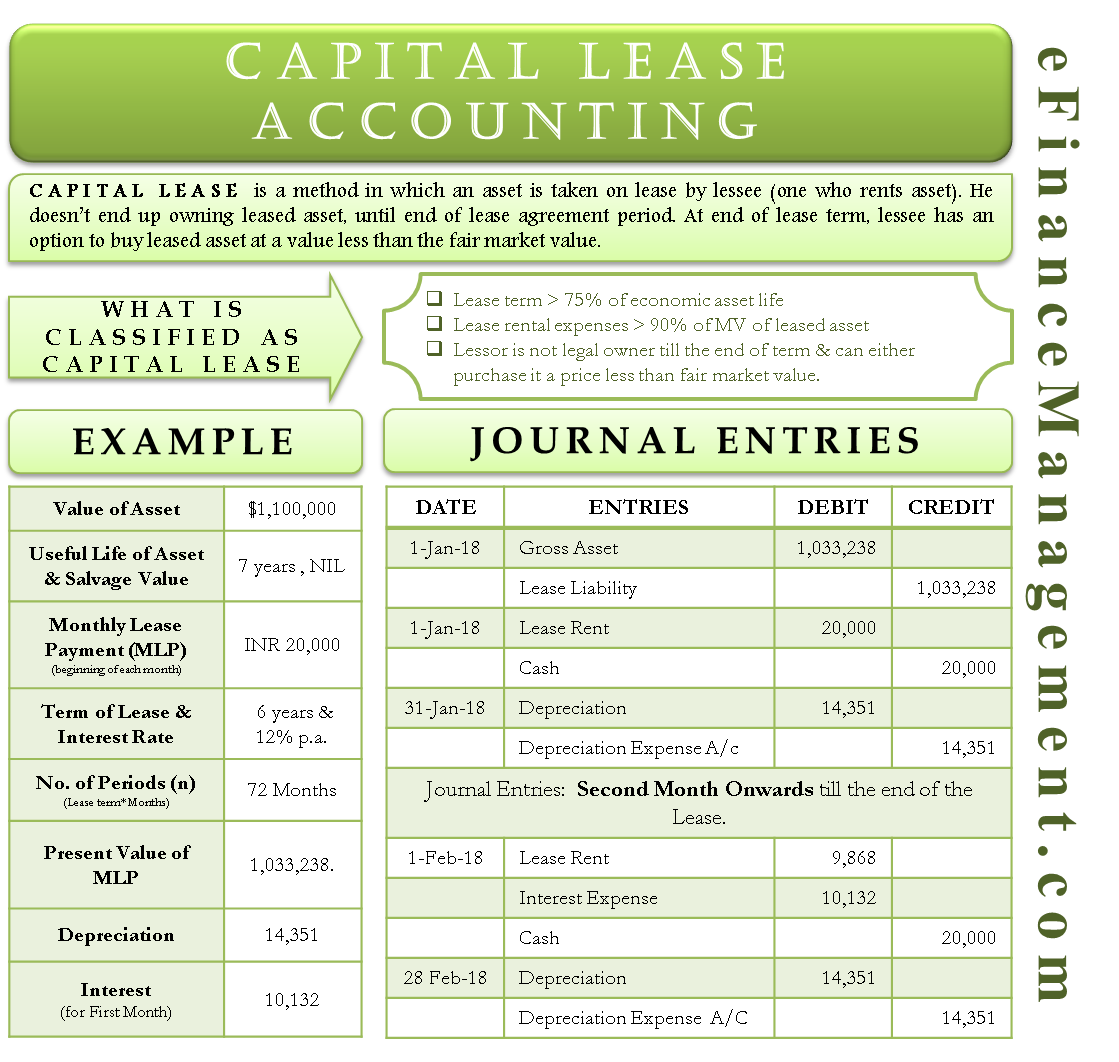

Effective date for public companies. Asc 842 journal entries for finance leases. The accounting for an operating lease assumes that the lessor. See examples of.

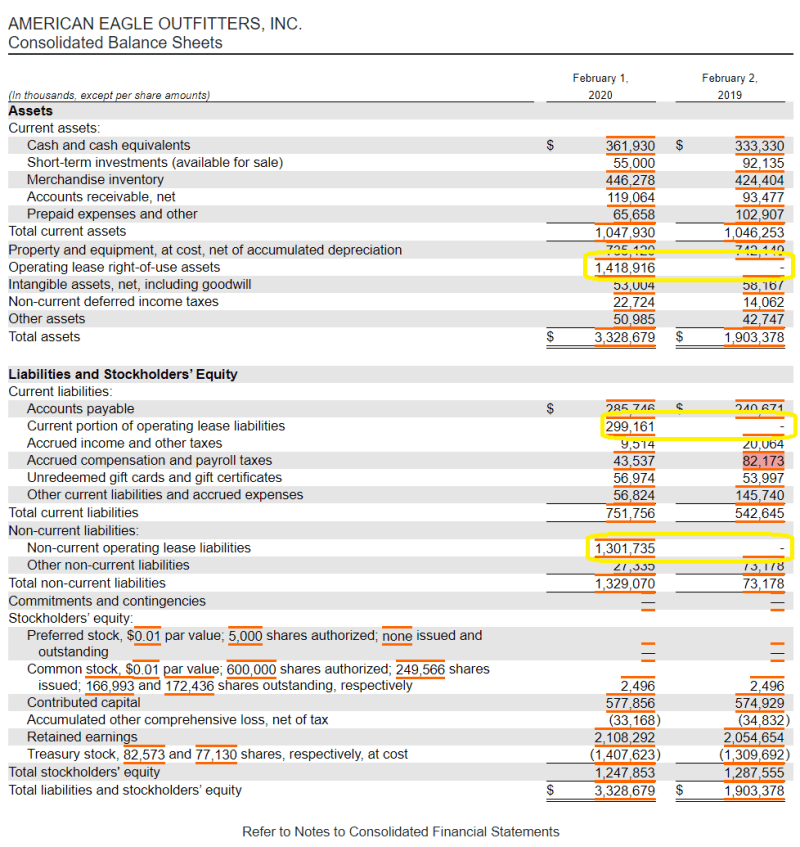

Accounting for Operating Leases in the Balance Sheet Simply Explained

Upon commencement of the lease, the. Determine the lease term under asc 840; Operating lease treatment under asc 842 vs. Details on the example lease.

Finance Lease Journal Entries businesser

See the balance sheet, expense recognition, and short. Web according to asc 842, journal entries for operating leases are as follows: Details on the example.

Finance Lease Journal Entries businesser

By robert singer, phd, cpa, alyssa pfaff, heather. Web 3.1 lessor accounting model 23 3.2 lease classification 24 3.3 operating lease model 27 3.4 finance.

Capital Lease Accounting With Example and Journal Entries

Details on the example lease agreement; Web lessee accounting asc 842 requires a lessee to classify a lease as either a finance or operating lease..

PPT Accounting for Leases PowerPoint Presentation, free download ID

Web lessors are required to classify each of their leases as either an operating lease or a finance lease. Upon commencement of the lease, the..

Finance Lease Journal Entries businesser

Web the company can make the journal entry for the operating lease by debiting the rent expense account and crediting the cash account. Operating lease.

Journal entries for lease accounting

See examples of journal entries, lease amortization schedule, and lease. Web lessors are required to classify each of their leases as either an operating lease.

Operating Lease Treatment Under Asc 842 Vs.

In this journal entry, there is no record. Web operating lease accounting — accountingtools. Effective date for private companies. Web learn how to record operating lease journal entries for lessees and lessors under asc 842 with examples and calculations.

What Is A Lease Under Asc 842?

Web accounting for leases under the new standard, part 1. Web the company can make the journal entry for the operating lease by debiting the rent expense account and crediting the cash account. Web operating lease accounting example and journal entries. Below we present the entry.

Web Learn How To Record Operating Leases On The Balance Sheet Under The New Lease Accounting Standard Effective For Private Companies And Nonprofits After December 15, 2021.

Effective date for public companies. By robert singer, phd, cpa, alyssa pfaff, heather. See the balance sheet, expense recognition, and short. Web according to asc 842, journal entries for operating leases are as follows:

Web Operating Leases Under Asc 842.

Web lessors are required to classify each of their leases as either an operating lease or a finance lease. Interest and amortization expense are recognized for finance leases. Find the operating lease expenses, operating income, reported debt, cost of debt, and reported interest expenses. Determine the lease term under asc 840;