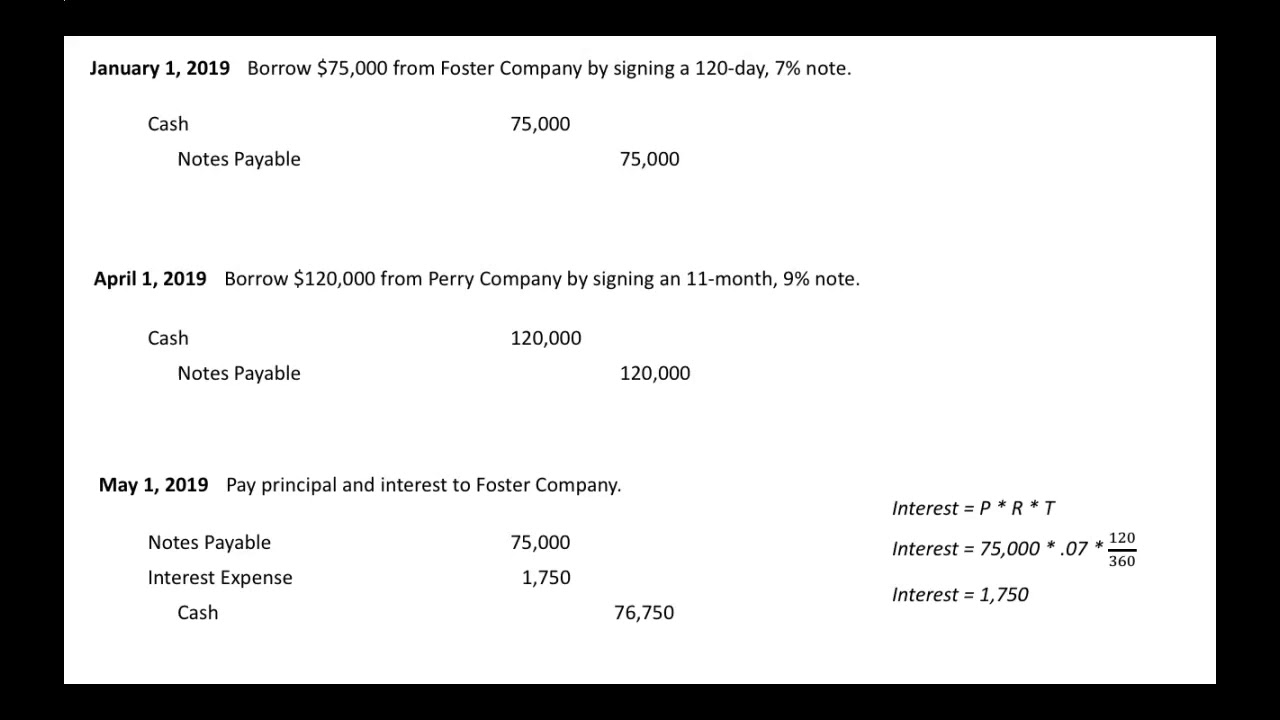

Note Payable With Interest Journal Entry - Monthly payments will be $1,625.28. The interest payable account is classified as liability account and the balance shown by it up to the balance sheet date is usually stated as a line item under current liabilities section. In this journal entry, the company debits the interest payable account to eliminate the liability that it has previously recorded at the period. The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal entry. Later, on january 1, 2022, when we make the payment to honor the promissory note that we have issued, we can make the journal entry as below: Web for example, if interest of $1,000 on a note payable has been incurred but is not due to be paid until the next fiscal year, for the current year ended december 31, the company would record the following journal entry: The carrying value of these notes will be: Web this journal entry is made to eliminate the interest payable that we have recorded above. The amount of interest reduces the amount of cash that the borrower receives up front. Web the journal entry to record the payment for the first year is:

Notes Receivable Journal Entries, with Interest YouTube

If ram inc issues notes payable for $30,000 due in 3 months at 8% p.a. Web note payable is credited for the principal amount that.

Mortgage Note Payable (Journal Entries) YouTube

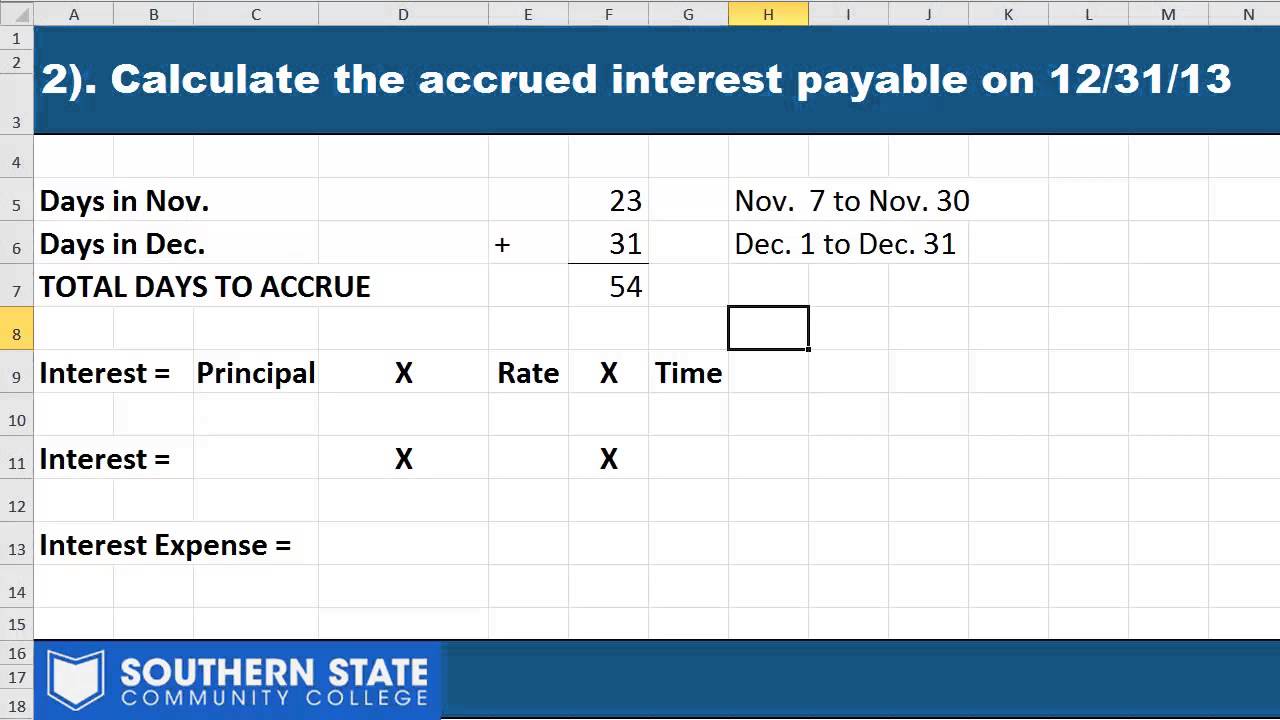

Interest payable [debit] cash/bank [credit] interest payable on balance sheet. Web the journal entry for the interest payable should include the amount of interest that.

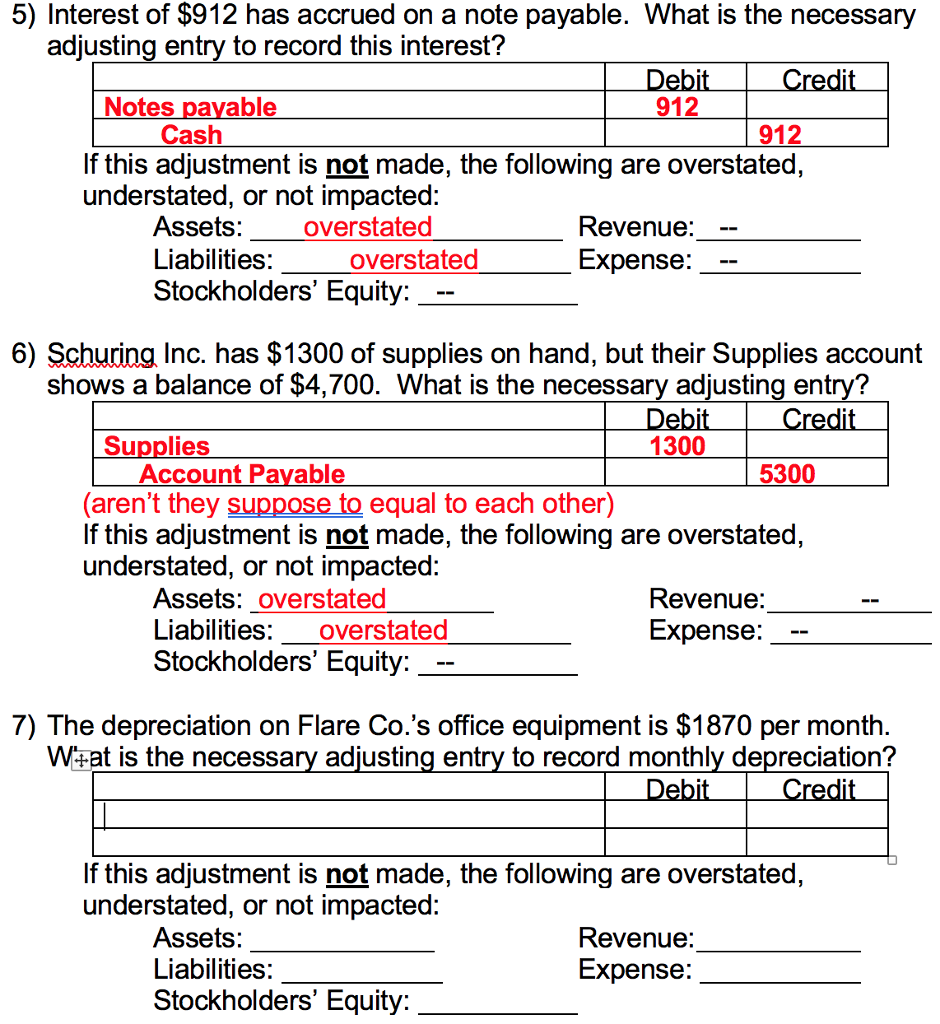

Solved 5) Interest of 912 has accrued on a note payable.

What is the definition of notes payable? Web this journal entry of accrued interest on note payable will increase total expenses on the income statement.

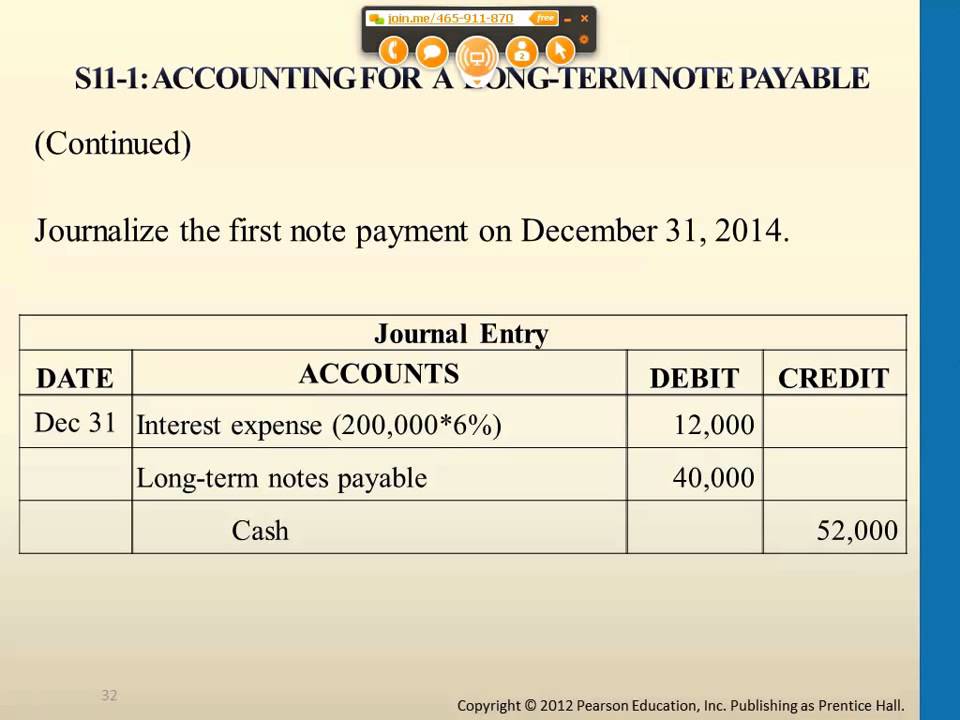

Accounting for a Long Term Note Payable YouTube

If the notes are payable within a year, the reporting entity can record only one transaction. Let’s discuss the various instances of notes payable with.

Notes Payable

We can make the journal entry for purchasing equipment with note payable by debiting the equipment account as a fixed asset on the. Web this.

Mortgage Payable Journal Entry

Web journal entries for notes payable. Web interest payable journal entry. We can make the journal entry for purchasing equipment with note payable by debiting.

Notes Payable (Journal Entries) YouTube

Web notes payable is a written promissory note stating a borrower’s payment obligation to a lender along with the associated borrowing terms (e.g. Web journal.

Accounting for a Note Payable YouTube

Some key characteristics of this written promise to pay (see figure 12.12) include an established date for repayment, a specific payable amount, interest terms, and.

Notes Payable Adjusting Entry Adjusting Journal Entry for Notes

When the company makes the payment on the interest of notes payable, it can make journal entry by debiting the interest payable account and crediting.

Web Note Payable Is Credited For The Principal Amount That Must Be Repaid At The End Of The Term Of The Loan.

The entries in the following years would be made in the same manner. Yourco borrows $100,000 from the bank on december 1 of 20x1 at 12% interest (compounded monthly) with principal and interest due monthly so that the loan is completely amortized by december 1 of 20x9. Web the journal entry for this looks like the following: Interest payable is the amount of interest owed to lenders by a corporation as of the balance sheet date.

Interest Payable [Debit] Cash/Bank [Credit] Interest Payable On Balance Sheet.

In addition, the amount of interest charged is recorded as part of the initial journal entry as interest expense. The issuer will need to amortize the notes over the maturity period for reporting purposes. The amount of interest reduces the amount of cash that the borrower receives up front. The following is an example of notes payable and the corresponding interest, and how each is recorded as a journal entry.

When The Company Makes The Payment On The Interest Of Notes Payable, It Can Make Journal Entry By Debiting The Interest Payable Account And Crediting The Cash Account.

If ram inc issues notes payable for $30,000 due in 3 months at 8% p.a. Web the journal entry to record the payment for the first year is: What is the definition of notes payable? In this case the note receivable is issued to replace an amount due from a customer currently shown as accounts receivable.

The Interest Would Be $ 30,000 * 3/12 * 8% = $600.

Some key characteristics of this written promise to pay (see figure 12.12) include an established date for repayment, a specific payable amount, interest terms, and the possibility of debt resale to another party. Web interest = 15,000 x 8% x 3/12 = 300. If the notes are payable within a year, the reporting entity can record only one transaction. The relevant journal entry would be.