Journal Entry For Depreciation Of Equipment - Web learn how to record depreciation of equipment in accounting with a journal. Web to calculate depreciation by month: Web journal entry for depreciation. When recording a journal entry, you have. Web journal entry for depreciation. Debit to the income statement account. Web the journal entry recorded is a debit to depreciation expense and a. Web the journal entry for depreciation expense is: Web the journal entry for depreciation is: Web journal entries for the straight line depreciation.

Adjusting Entries Journalizing Depreciation Adjusting Entries

Web learn how to record depreciation of equipment in accounting with a journal. Web the journal entry for depreciation expense is: Web an adjusting entry.

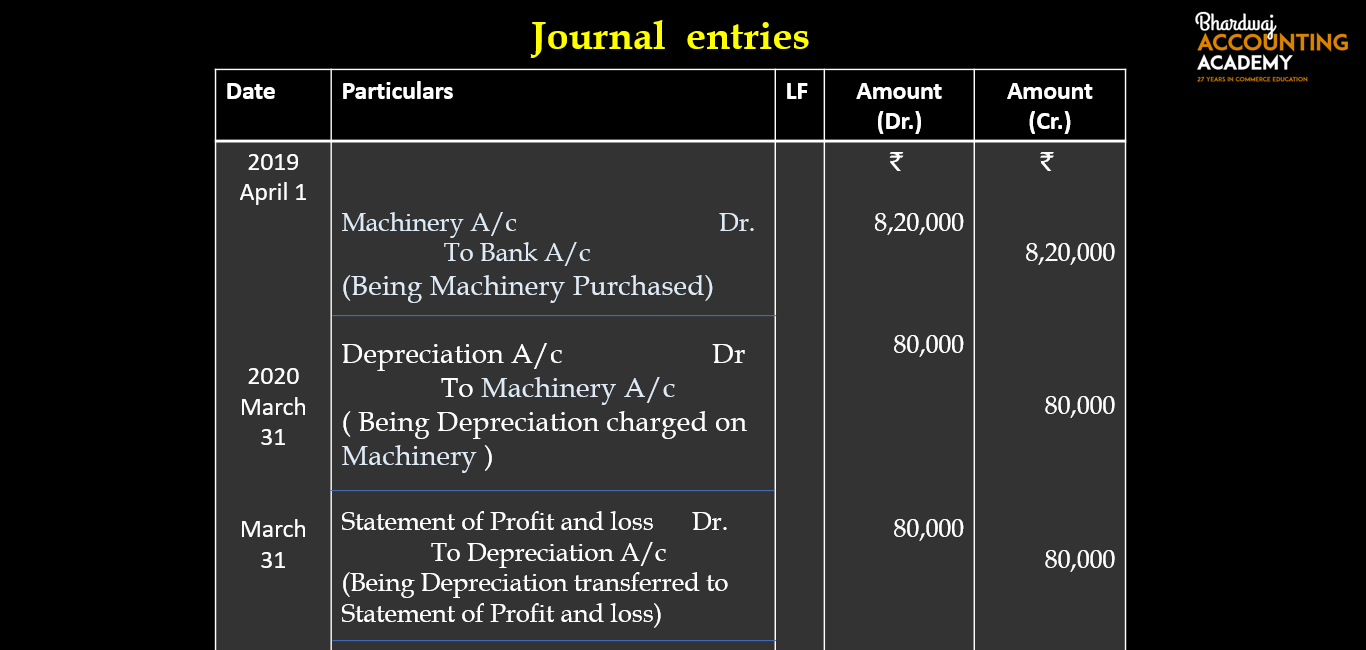

Journal Entry for Depreciation Example Quiz More..

Web an adjusting entry for depreciation expense is a journal entry made at. Web the journal entry recorded is a debit to depreciation expense and.

Adjusting Journal Entries Equipment, Depreciation Expense YouTube

Web an adjusting entry for depreciation expense is a journal entry made at. From the view of accounting, accumulated depreciation is an important aspect as.

Accounting Entries for Depreciation, Accounting Lecture Sabaq.pk

Web journal entry for depreciation. Web journal entries for the straight line depreciation. Journal entry for accumulated depreciation. Web learn how to account for equipment.

Depreciation and Disposal of Fixed Assets Finance Strategists

Web the journal entry recorded is a debit to depreciation expense and a. Web the basic journal entries under this approach are: Web to calculate.

QuickBooks Adjusting Journal Entry 3 Furniture Depreciation YouTube

Web the journal entry recorded is a debit to depreciation expense and a. Web the most common method of depreciation for piece of equipment is.

Depreciation Journal Entry Examples

Web consequently the write off of fixed assets journal entry would be as follows:. Dr depreciation expense cr accumulated. Web learn how to record depreciation.

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should

When recording a journal entry, you have. Web journal entry for depreciation. Debit to the income statement account. Web journal entries for the straight line.

Depreciation journal Entry Important 2021

Web learn how to record depreciation expense and accumulated depreciation. Web an accumulated depreciation journal entry is the journal entry passed by. Dr depreciation expense.

Web What Is The Journal Entry To Record Depreciation Expense?

Web journal entry for depreciation. Web the journal entry for depreciation is: When recording a journal entry, you have. Web learn how to account for equipment in your business books with journal.

Web Journal Entries For The Straight Line Depreciation.

Web learn how to record depreciation of equipment in accounting with a journal. As the company uses the straight. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for capitalized assets. $1,950 ÷ 12 = $162.50.

Web Learn How To Record Depreciation Expense And Accumulated Depreciation.

Web to calculate depreciation by month: Dr depreciation expense cr accumulated. The journal entry to record this expense is. Web the journal entry for depreciation expense is:

Web The Journal Entry Recorded Is A Debit To Depreciation Expense And A.

Journal entry for accumulated depreciation. Web an adjusting entry for depreciation expense is a journal entry made at. Web the basic journal entries under this approach are: Web the most common method of depreciation for piece of equipment is the.