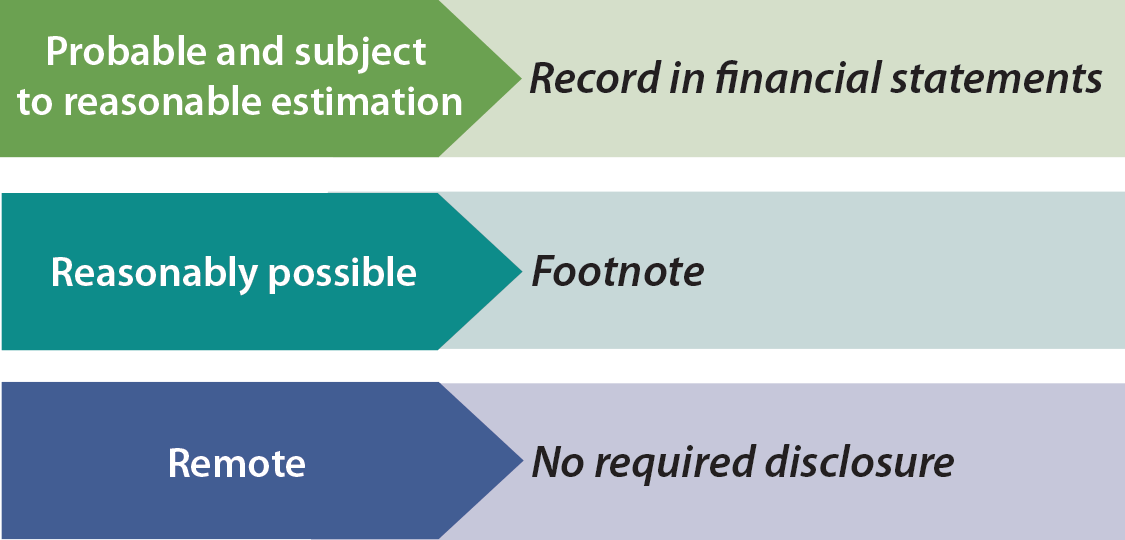

Loss Contingency Journal Entry - Web asc 450 defines a loss contingency as an “existing condition, situation, or set of circumstances involving uncertainty as to possible loss to an entity that will ultimately be. Web key definitions [ias 37.10] provision: The concept of a contingent liability is centered around the two primary aspects of an. (1) the likelihood of the loss occurring and (2) the ability to estimate the amount of the loss. Web loss contingencies are recorded (accrued) if certain conditions are met: A liability of uncertain timing or amount. Under us gaap, loss contingencies are accrued if they are probable and can be estimated. It is common, for example, for auditors to ask the company’s. Web as the double entry for a provision is to debit an expense and credit the liability, this would potentially reduce profit to $10m. Web the proper accounting treatment for loss contingencies is based on two factors:

PPT Intermediate Accounting PowerPoint Presentation, free download

Under us gaap, loss contingencies are accrued if they are probable and can be estimated. Web a loss contingency that is probable or possible but.

[Solved] Journal entries for 1, 2 and 3 P1311. (Loss Contingencies

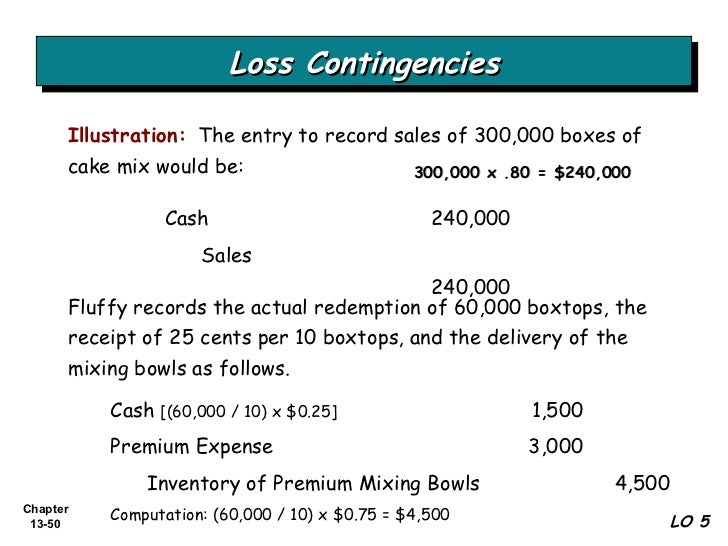

Web what is the journal entry to record a contingent liability? Examples of common loss contingencies include a lawsuit, a product recall, an. Company a.

Formidable Loss Contingency Journal Entry Projected Balance Sheet

Recorded with a journal entry; A loss contingency gives the readers. Web a loss contingency is when the future outcome is most likely to result.

Formidable Loss Contingency Journal Entry Projected Balance Sheet

Web a loss contingency is when the future outcome is most likely to result in a liability. Are limited to a disclosure in the notes.

Formidable Loss Contingency Journal Entry Projected Balance Sheet

A loss contingency gives the readers. Web fasb identifies a number of examples of loss contingencies that are evaluated and reported in this same manner.

Intermediate Accounting . CH 13 . by MidoCool

Web loss contingencies are recorded (accrued) if certain conditions are met: The concept of a contingent liability is centered around the two primary aspects of.

Formidable Loss Contingency Journal Entry Projected Balance Sheet

(1) the likelihood of the loss occurring and (2) the ability to estimate the amount of the loss. It is common, for example, for auditors.

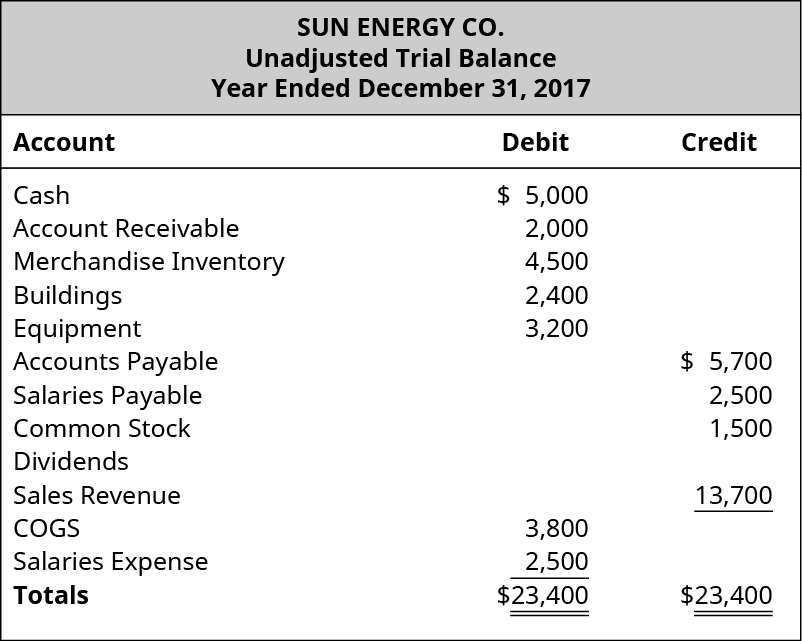

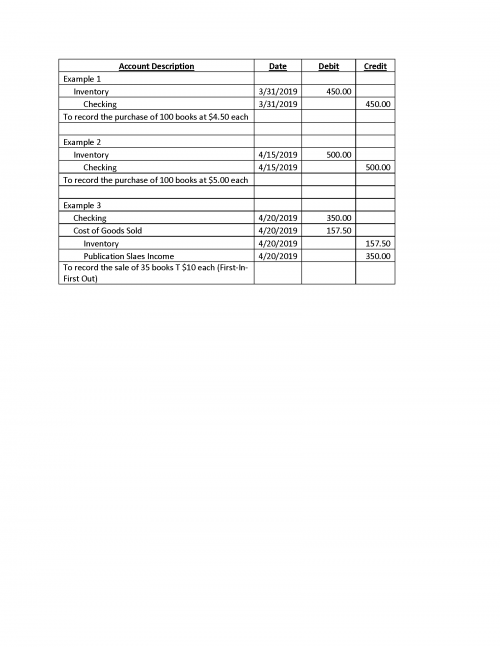

First Class Cost Of Goods Sold For Nonprofits Financial Statement

Company a would record the following journal entry: The concept of a contingent liability is centered around the two primary aspects of an. Web a.

Formidable Loss Contingency Journal Entry Projected Balance Sheet

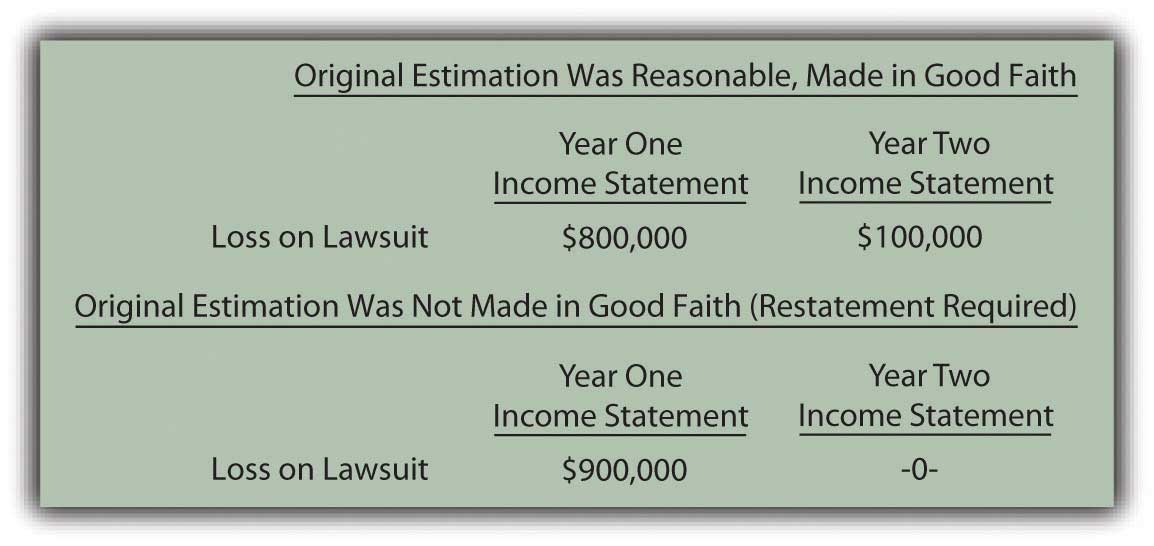

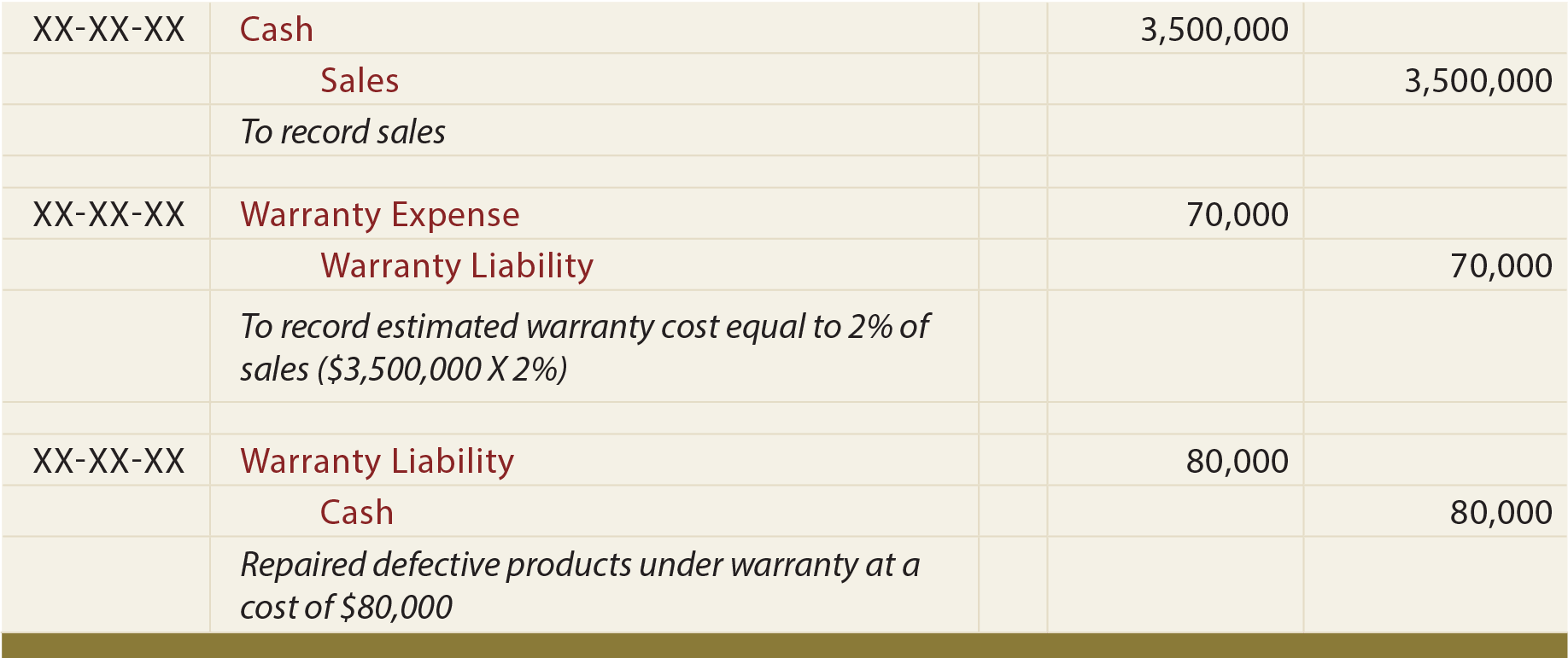

Assuming that the loss contingency is “probable” and can be reasonably estimated, then a journal entry. Then in the next year, the chief accountant could..

Under Us Gaap, Loss Contingencies Are Accrued If They Are Probable And Can Be Estimated.

An existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss. Web fasb identifies a number of examples of loss contingencies that are evaluated and reported in this same manner including: Present obligation as a result of past events. (1) the likelihood of the loss occurring and (2) the ability to estimate the amount of the loss.

The Concept Of A Contingent Liability Is Centered Around The Two Primary Aspects Of An.

In this journal entry, lawsuit payable account is a contingent liability, in which it is probable that a. If the loss is probable and the amount can be estimated,. Web what is the journal entry to record a contingent liability? Are limited to a disclosure in the notes to the financial statements;.

A Loss Contingency Gives The Readers.

Web loss contingencies are recorded (accrued) if certain conditions are met: Examples of common loss contingencies include a lawsuit, a product recall, an. Web the proper accounting treatment for loss contingencies is based on two factors: Web asc 450 defines a loss contingency as an “existing condition, situation, or set of circumstances involving uncertainty as to possible loss to an entity that will ultimately be.

Web Loss Contingencies Are Recorded (Accrued) If Certain Conditions Are Met:

When such liability is likely and can be reasonably estimated, it is recorded as a loss or expense in the income statement. Web a loss contingency is when the future outcome is most likely to result in a liability. Overview of contingent liability journal entry. Assuming that the loss contingency is “probable” and can be reasonably estimated, then a journal entry.