Lease Journal Entries - Web updated on january 3, 2024. Web so what does this mean? In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Calculate the initial lease liability. Under asc 842, an operating lease you now recognize: Web ifrs 16 has revolutionised lease accounting journal entries, emphasising transparency and accurate reporting. Utilizing the amortization table, the journal entry for the end of the first period is as follows: Determine the total lease payments under gaap. Cashflow requirements under asc 842; Right of use (asset) lease (liability) finance teams may have found that it’s created more work, such as:

Finance Lease Journal Entries businesser

Cashflow requirements under asc 842; Calculate the initial lease liability. Lessee corp would record the following journal entry on the lease commencement date. Record the.

Journal entries for lease accounting

For many businesses, navigating the complexities of asc 842 journal entries can be a daunting task. The initial journal entry under ifrs 16 records the.

Check this out about Capital Lease Accounting Journal Entries

Recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting. Utilizing the amortization table, the journal entry for.

Finance Lease Journal Entries businesser

Recording journal entries appropriate for the lease accounting standard being tracked is critical for accurate financial reporting. This amount is $1,330 ($798 + $432+ $100)..

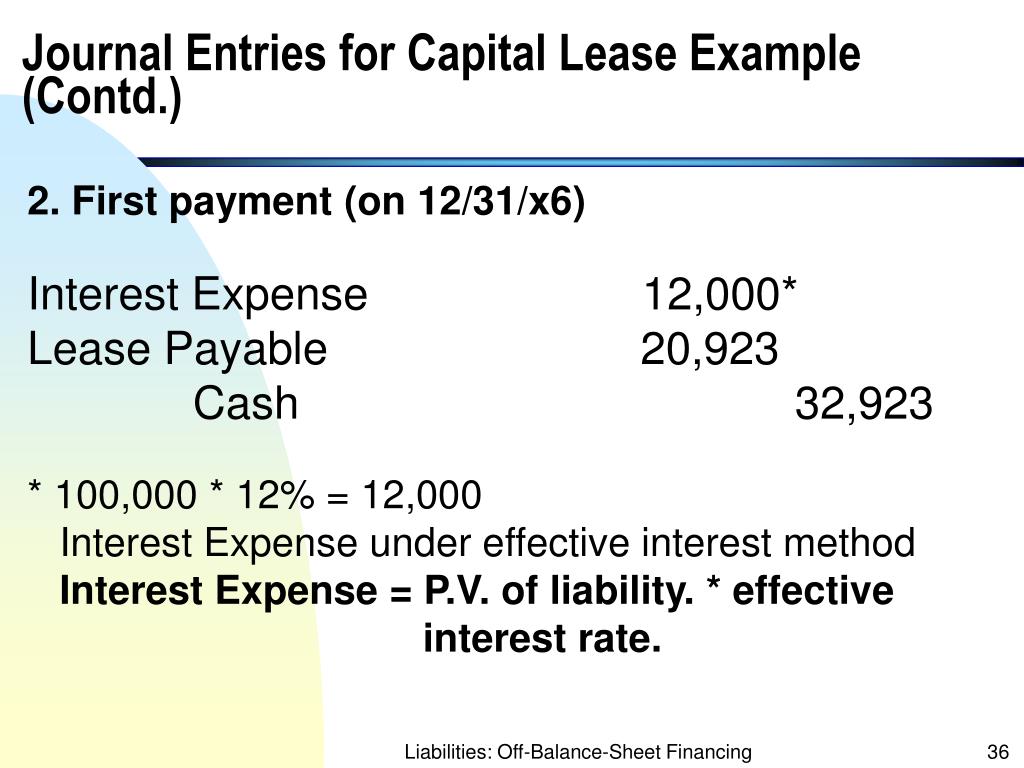

PPT Leases PowerPoint Presentation, free download ID3337655

On the asc 842 effective date,. Lessor accounting remains largely unchanged from asc 840 to 842. Web the finance lease accounting journal entries below act.

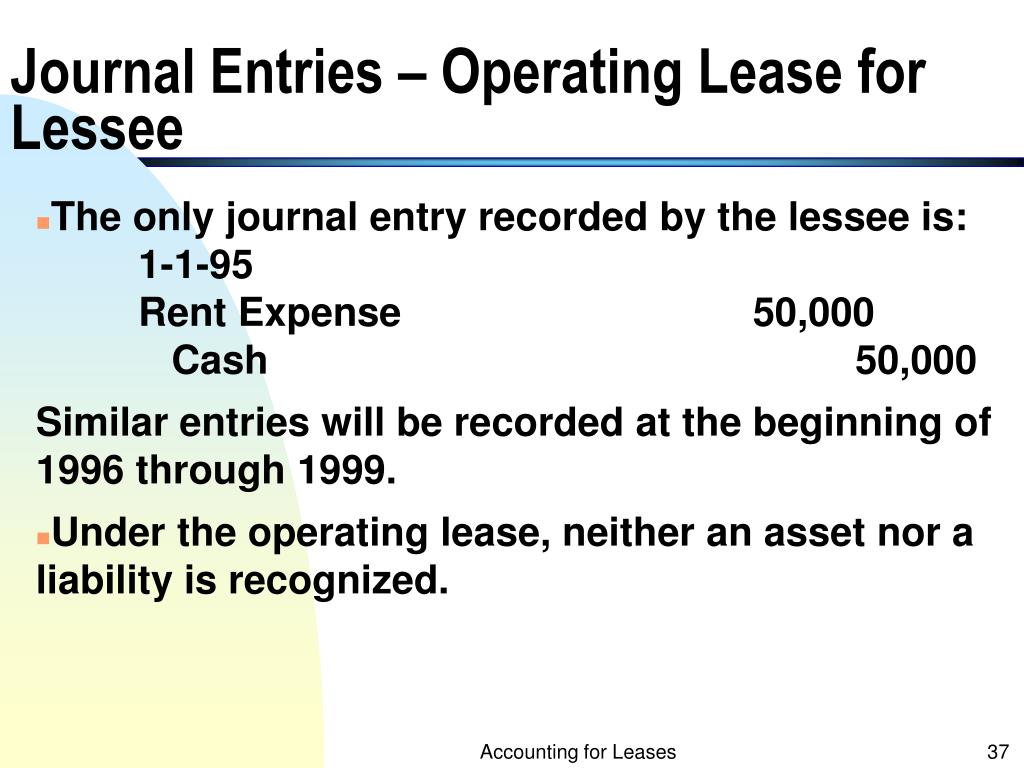

PPT Accounting for Leases PowerPoint Presentation, free download ID

Web so what does this mean? Web this article serves just that purpose. Under asc 842, an operating lease you now recognize: For many businesses,.

Finance Lease Journal Entries Lessor businesser

Creating new processes for managing contracts. This article cuts through the confusion and provides a clear roadmap for mastering asc 842 lease accounting. Details on.

How to Calculate the Journal Entries for an Operating Lease under ASC 842

Web the finance lease accounting journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the.

PPT Liabilities OffBalanceSheet Financing PowerPoint Presentation

Below we present the entry recorded as of 1/1/2021 for our example: Lessor accounting remains largely unchanged from asc 840 to 842. Web ifrs 16.

The New Lease Accounting Standard, Asc 842, Has Introduced Significant Changes To How Companies Record And Report Leases.

Reviewed by dheeraj vaidya, cfa, frm. The present value of all known future lease payments. Calculate the initial lease asset value. Determine the total lease payments under gaap.

Capital Lease Accounting Follows The Principle Of Substance Over Form, Wherein The Assets Are Recorded In The Lessee’s Books As Fixed Assets.

Right of use (asset) lease (liability) finance teams may have found that it’s created more work, such as: Web so what does this mean? Below we present the entry recorded as of 1/1/2021 for our example: Utilizing the amortization table, the journal entry for the end of the first period is as follows:

We Begin By Describing What Asc 842 Requires For Lease Accounting, Then We Tackle The Ins And Outs Of Journal Entries Themselves, Along With Special Cases And.

Web updated on january 3, 2024. Here, we’ll break down operating lease journal entries simply and straightforwardly, including both the lessee and lessor sides. In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative. Five more articles to help you get ready for the gasb 87 effective date.

Record The Opening Journal Entry Under Gasb 87.

Web the principal payment is the difference between the actual lease payment and the interest expense. Web this article serves just that purpose. Web journal entries are foundational to recording the accounting transactions associated with your lease portfolio. Web according to asc 842, journal entries for operating leases are as follows: