Direct Labor Journal Entry - Web the journal entry required would be: $ 9,000 to job no. During july, the shaping department incurred $15,000 in direct labor costs and $600 in indirect labor. This is because direct labor costs are expenses in nature, and therefore, they are supposed to be treated as such. During july, creative printers sent direct materials from the materials storeroom to jobs as follows: Web journal entries to move direct materials, direct labor, and overhead into work in process dinosaur vinyl keeps track of its inventory and orders additional inventory to have on hand when the production department requests it. Web the journal entries follow the job costing process from purchase of raw materials, allocation of direct materials, direct labor, and manufacturing overhead to work in process, transfer of the goods through to finished. Web direct labor for job 1: Web journal entries to move direct materials, direct labor, and overhead into work in process; Web the journal entry required would be:

Journal Entries for Recording Labour Cost, Accounting Lecture Sabaq

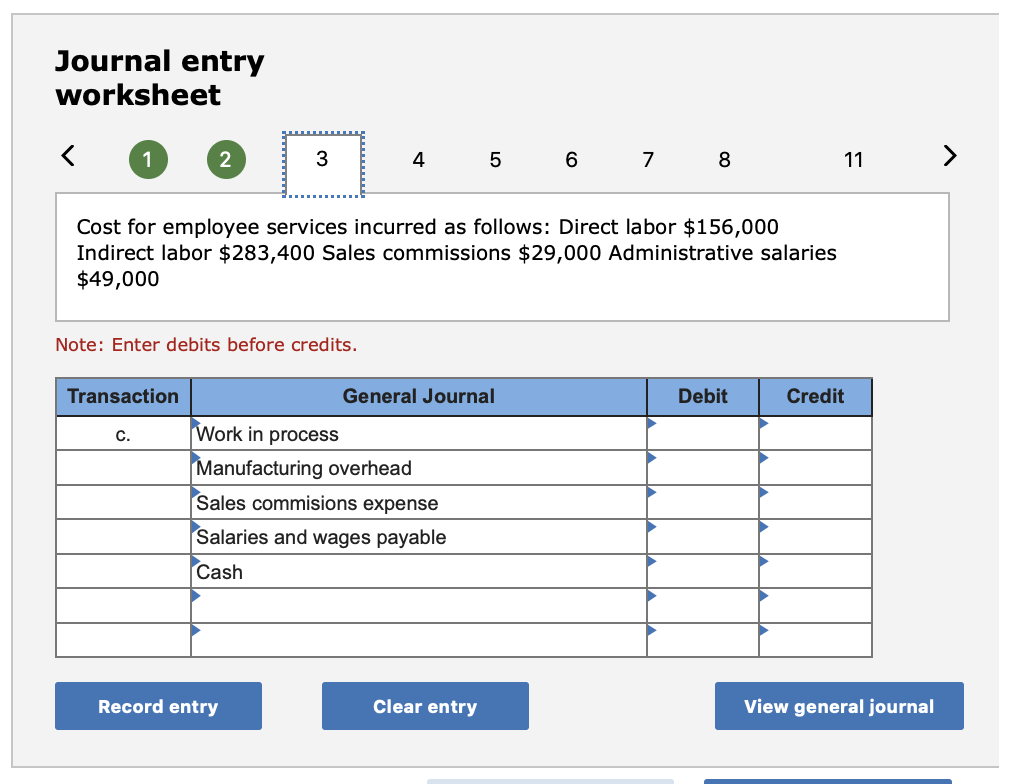

For direct labor, we want to take the cost of labor from the payroll summary account to work in process inventory. During july, creative printers.

Solved Prepare journal entries to record the following

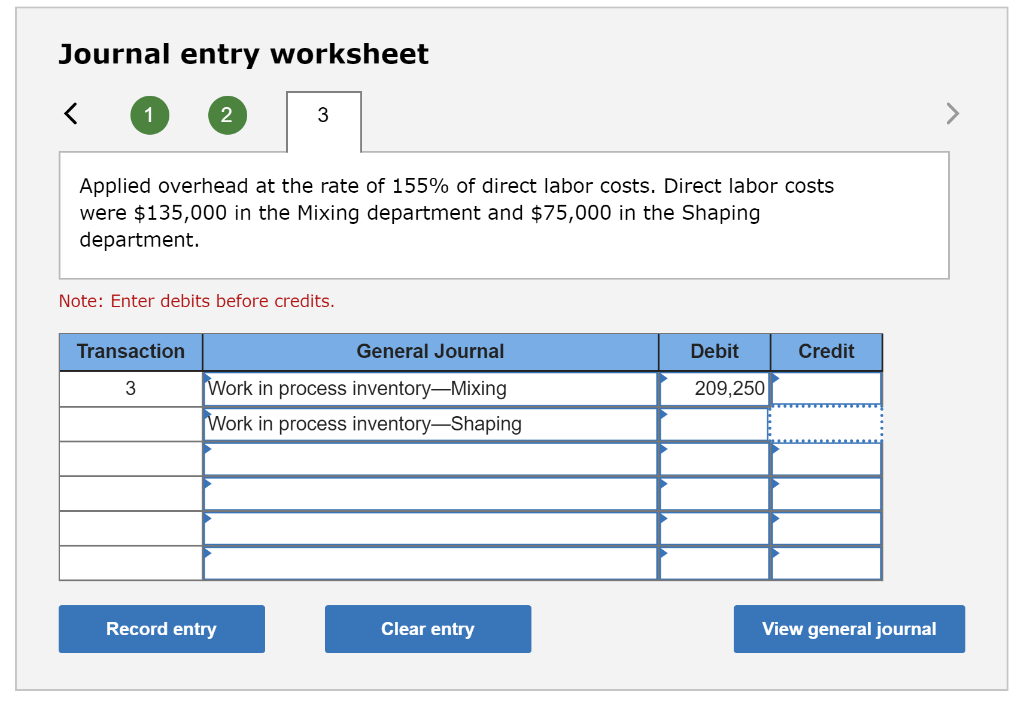

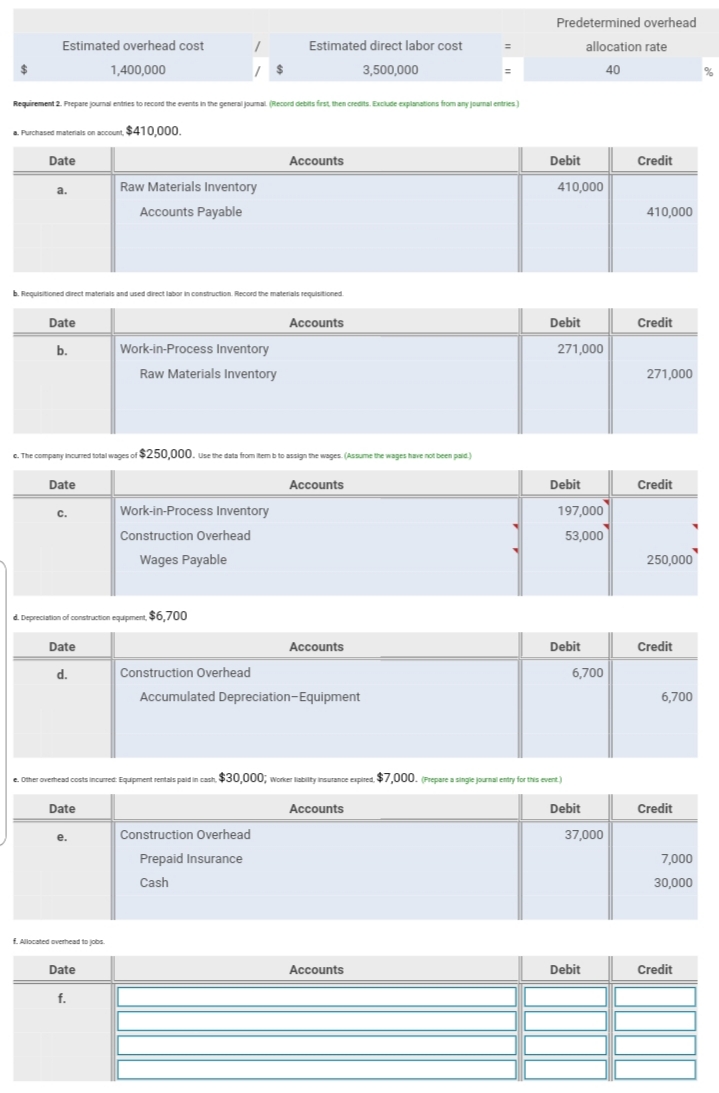

Figure 2.6 shows the manufacturing overhead applied based on the six hours worked by tim wallace. Web journal entries to move direct materials, direct labor,.

The Journal Entry to Record Labor Costs Credits

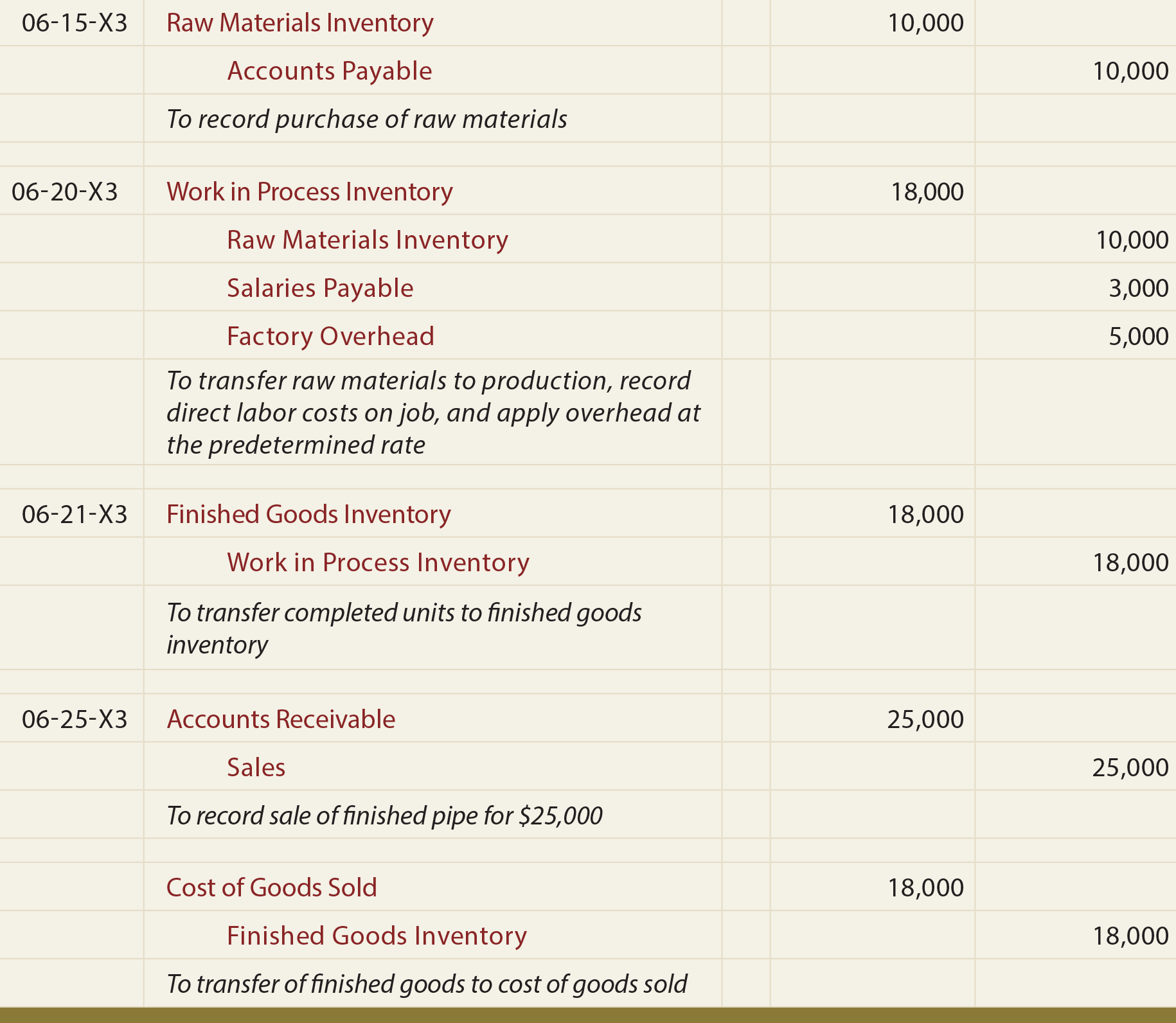

Job 1 is transferred to finished goods; To record direct materials, direct labor, and apply factory overhead. The company also sent indirect materials of $.

Prepare journal entries to record the following production activities

For direct labor, we want to take the cost of labor from the payroll summary account to work in process inventory. During july, the shaping.

Solved Journal entry worksheet 4 5 6 7 8 11 > Cost for

Web the journal entry required would be: $ 9,000 to job no. Web direct labor for job 1: This is because direct labor costs are.

Accounting Journal Entries For Dummies

In this last example, $100,000 was actually spent and accounted for: During july, the shaping department incurred $15,000 in direct labor costs and $600 in.

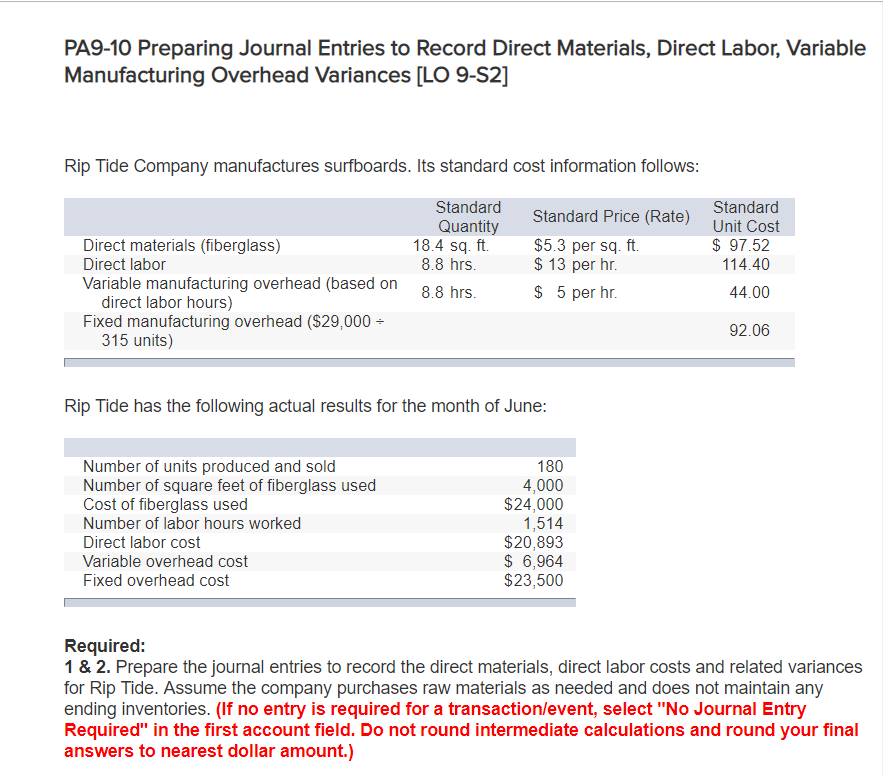

Solved PA910 Preparing Journal Entries to Record Direct

Web direct labor for job 1: Web the journal entries for the flow of production costs are the same with process and job costing. Standard.

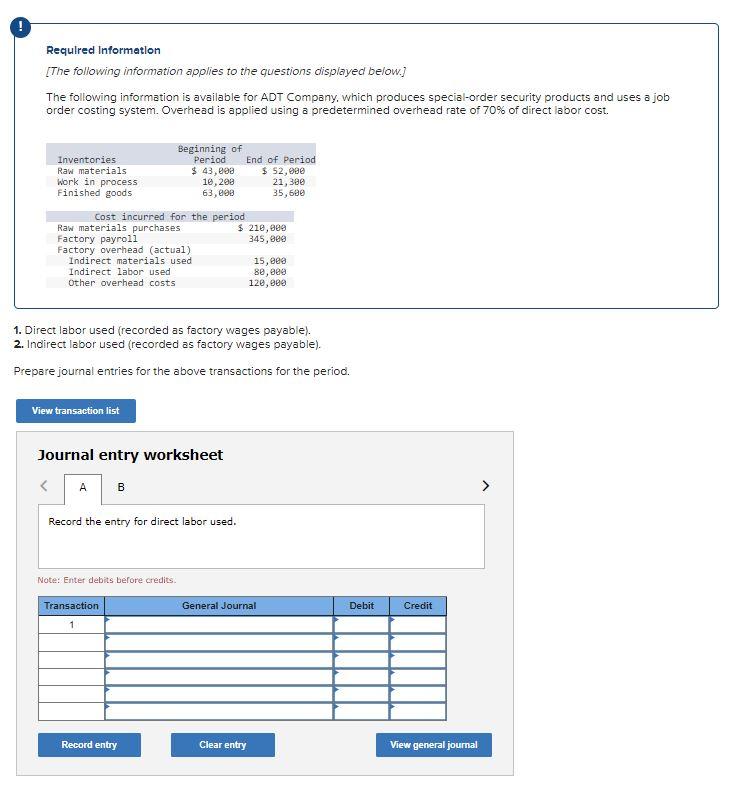

Solved 1. Direct labor used (recorded as factory

The journal entry to record the labor costs is: Tracking job costs within the corporate ledger. Figure 2.6 shows the manufacturing overhead applied based on.

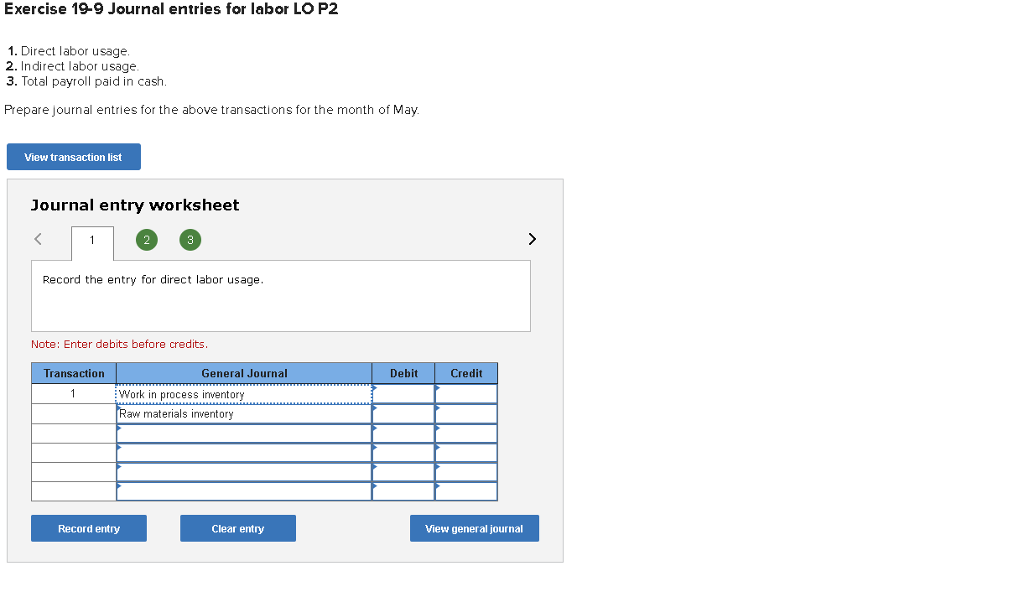

Solved Exercise 199 Journal entries for labor LO P2 1.

Rock city percussion july journal entry to record the labor cost. Web direct labor paid by all production departments. Always keep in mind that the.

Web Direct Labor For Job 1:

For indirect labor, we will charge this to overhead instead of to a specific job in work in process inventory. Tracking job costs within the corporate ledger. Direct labor paid by all production departments. Web this journal entry involves shifting raw materials from the raw materials inventory account to the work in process inventory account, shifting direct labor expense into the work in process inventory account, and shifting factory overhead from the overhead cost pool to the wip inventory account.

The Journal Entry To Record The Labor Costs Is:

Web computation of standard direct labor cost to be applied to production: Web the next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead: $ 9,000 to job no. Web the journal entry to record the requisition and usage of materials is:

To Record Direct Materials, Direct Labor, And Apply Factory Overhead.

Web when this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. In this last example, $100,000 was actually spent and accounted for: 106, and $ 14,000 to job no. Always keep in mind that the goal is to “zero out” the factory overhead account and measure the actual cost incurred.

The Journal Entry To Record The Labor Costs Is:

$ 9,000 to job no. Marshal company would make the following journal entry to charge standard direct labor cost to production: This is because direct labor costs are expenses in nature, and therefore, they are supposed to be treated as such. The company also sent indirect materials of $ 1,000 to jobs.