Journalize The Adjusting Entries - Web the purpose of an adjusting entry is to update revenue and expense accounts at the end of each accounting period (month or year) to conform to the rules of accrual basis accounting. Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. Usually the trigger is from an original source. If the company earned $2,500 of the $4,000 in june, it must journalize this amount in an adjusting entry. Look for anything that is missing. Some common types of adjusting journal entries are accrued expenses, accrued revenues, provisions, and deferred revenues. Web journal entries are recorded when an activity or event occurs that triggers the entry. Recall that an original source can be a formal document substantiating a transaction, such as an. Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Web adjusting entries are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting.

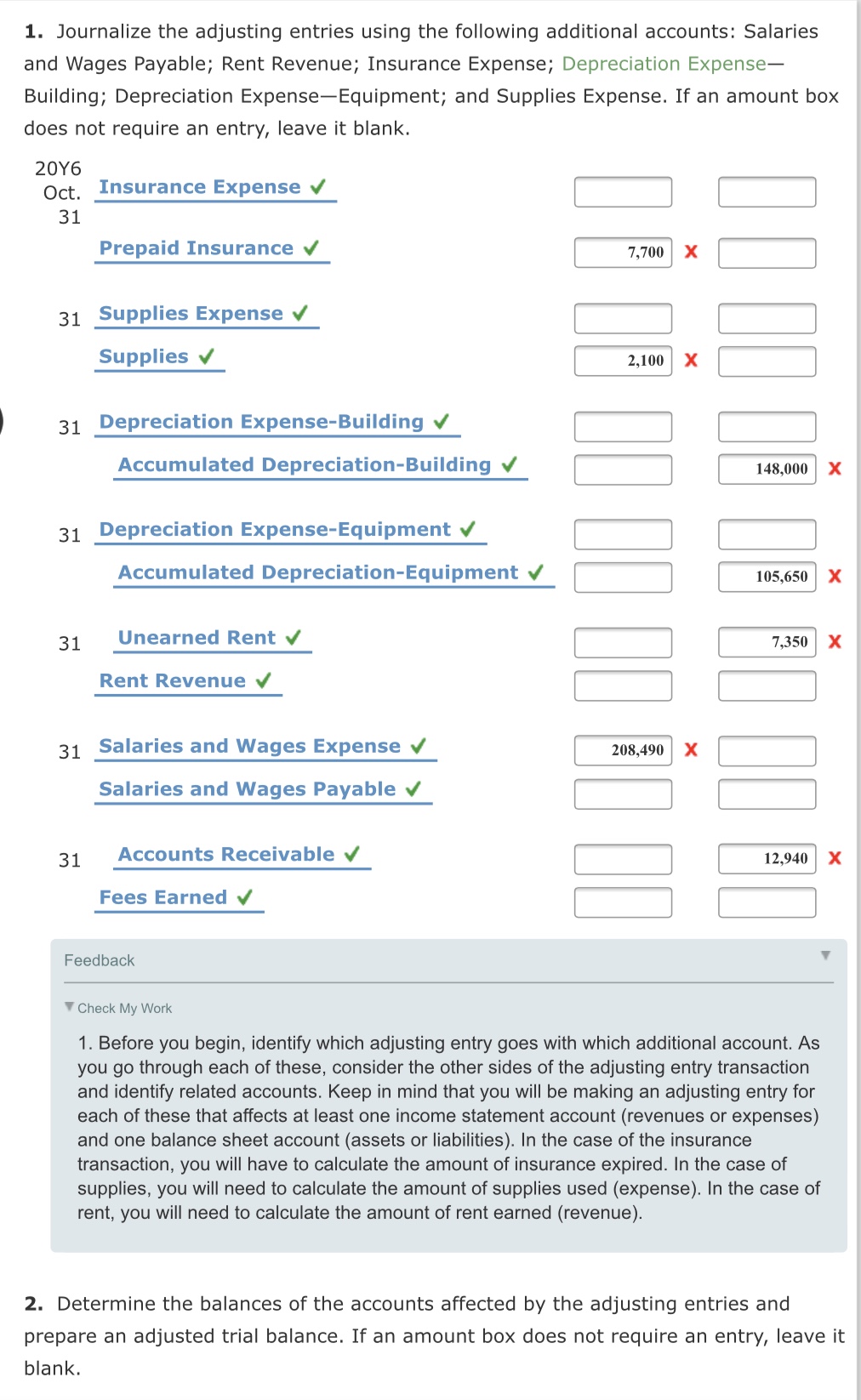

Journalizing Adjusting Entries and Analyzing Their Effect on the

This ensures accurate financial statements and management analyses by aligning revenue and expenses with the accrual basis, recording them when earned or incurred, regardless of.

How To Journalize Adjusting Entries

Usually the trigger is from an original source. Usually the trigger is from an original source. Recall that an original source can be a formal.

Answered 1. Journalize the adjusting entries… bartleby

After preparing the journal entries, we have to post them to the ledgers. You can use an adjusting journal entry for accrual accounting when accounting.

What Are Adjusting Entries

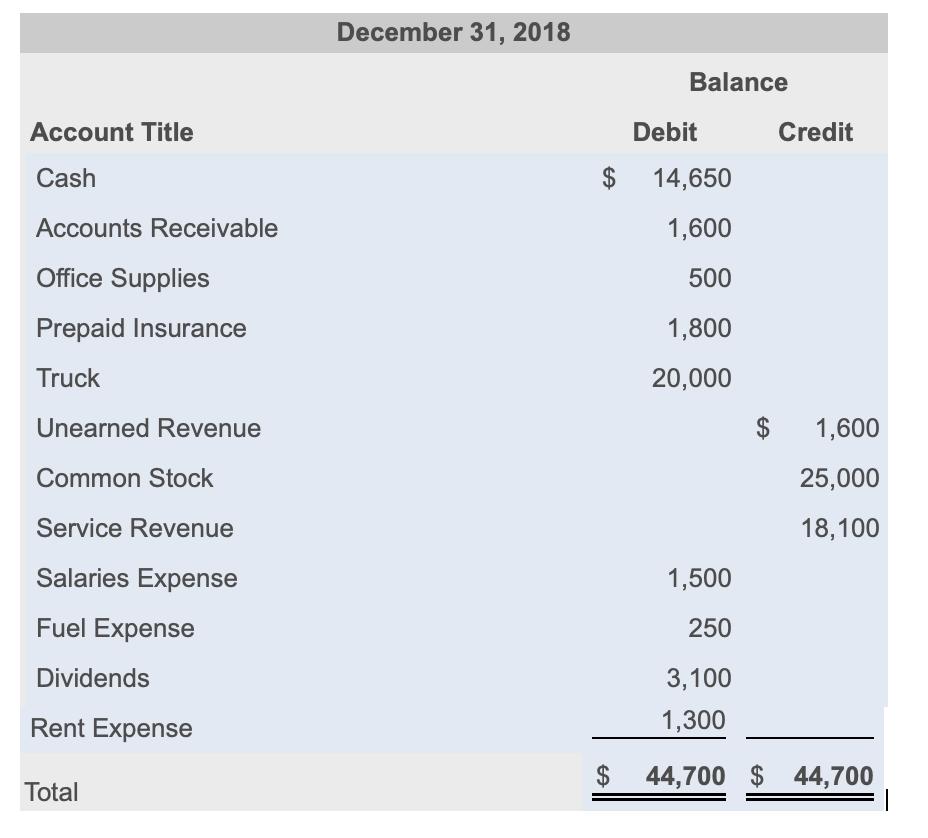

Web adjusting entries involve a balance sheet account and an income statement account. An income statement, a statement of retained earnings, a balance sheet, and.

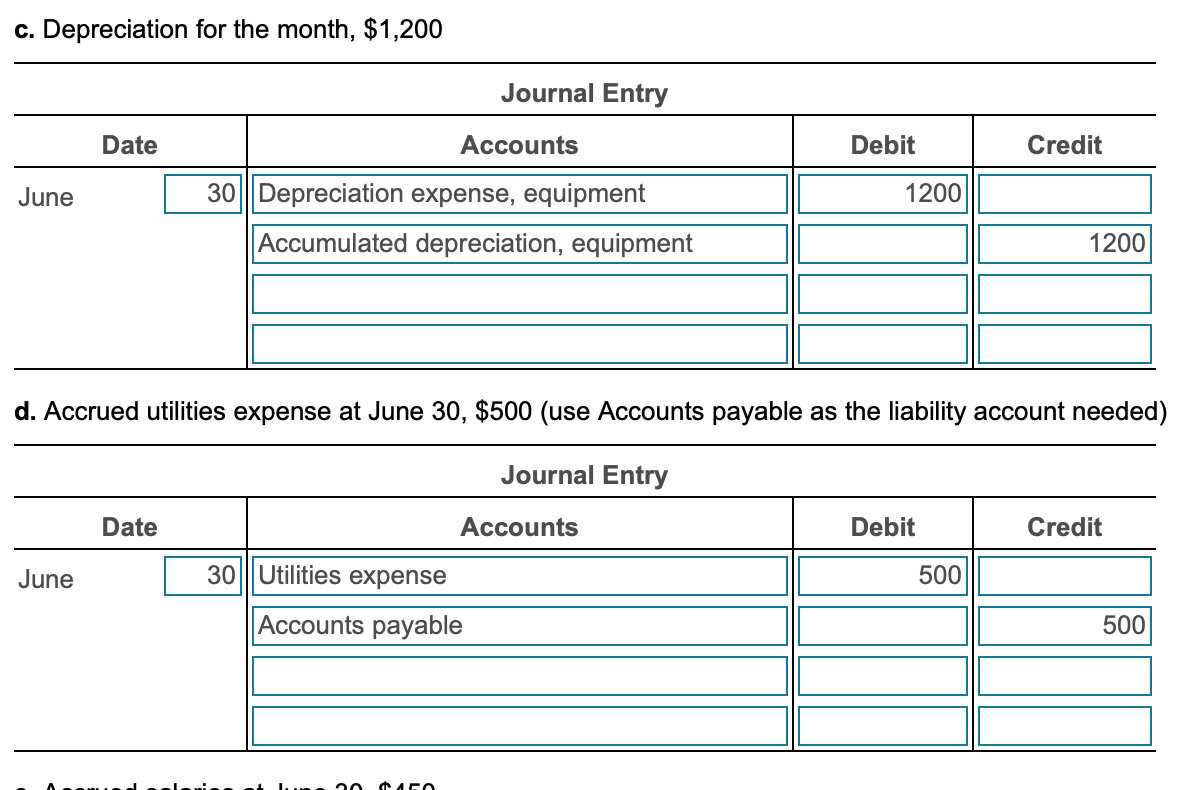

Solved Requirement 1. Journalize the adjusting entries.

The three most common types of adjusting journal entries are accruals, deferrals and estimates. Let’s dig into each step. Print out the unadjusted trial balance..

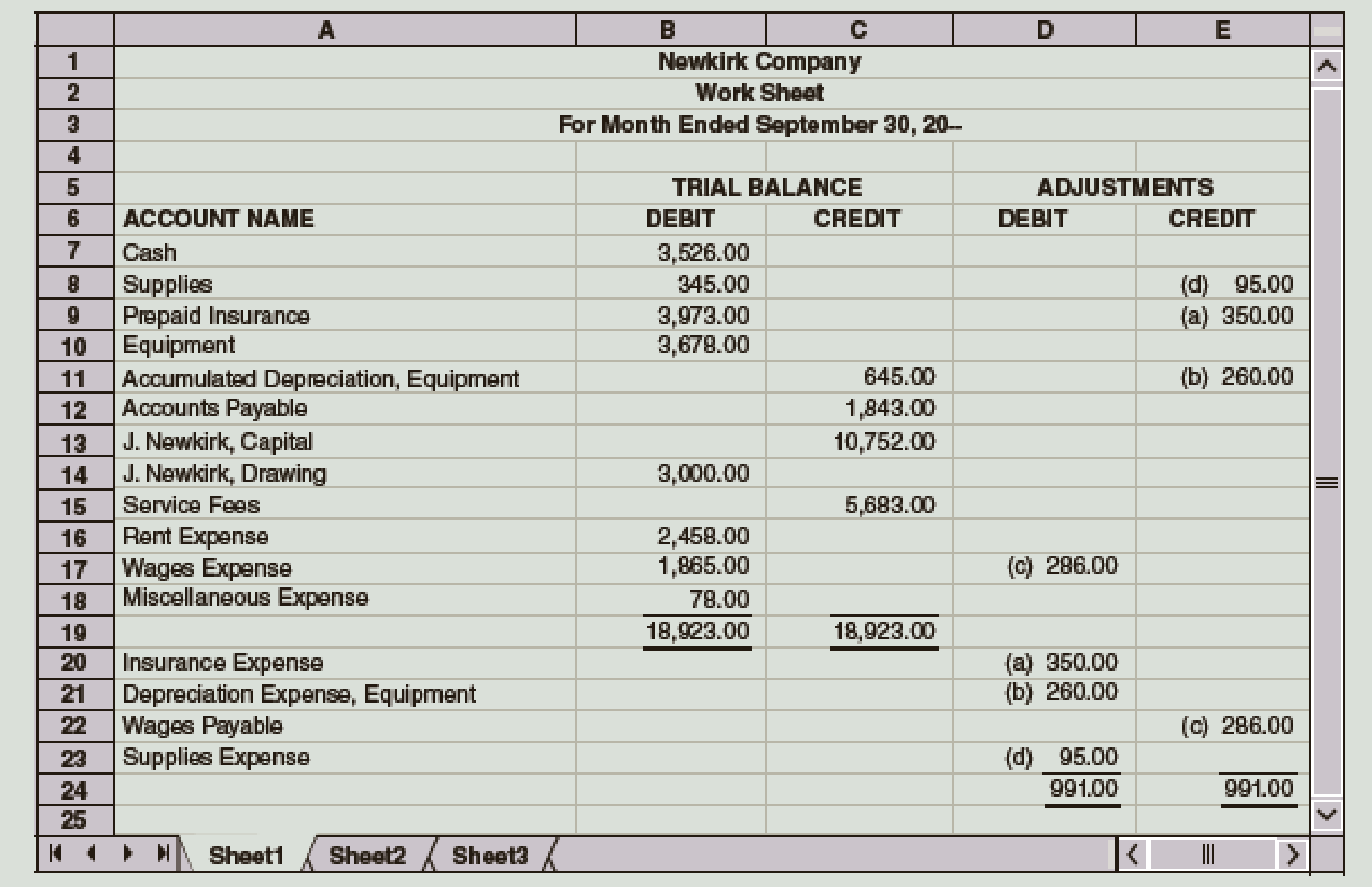

Adjusting Entries Examples Accountancy Knowledge

If this journal entry had been omitted, many errors on the financial statements would result. Accrual basis accounting requires that revenues and their associated costs.

Adjusting Entries Adjusting Entries With Examples

Accrual basis accounting requires that revenues and their associated costs be recorded in the same accounting period. Web what are adjusting journal entries? After preparing.

Adjusting Journal Entries Defined Accounting Play

Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any.

Solved 4. Journalize the adjusting entries using the

This is the fourth step in the accounting cycle. Let’s start by reviewing neatniks’s trial balance for the month of october: Web what are adjusting.

Print Out The Unadjusted Trial Balance.

Web what are adjusting journal entries? We are using the same posting accounts as we did for the unadjusted trial balance just adding on. This is a systematic way to prepare and post adjusting journal entries that accountants have been using for about 500 years. After preparing the journal entries, we have to post them to the ledgers.

Recall That An Original Source Can Be A Formal Document Substantiating A Transaction, Such As An.

Web journal entries are recorded when an activity or event occurs that triggers the entry. Some common types of adjusting journal entries are accrued expenses, accrued revenues, provisions, and deferred revenues. Usually the trigger is from an original source. The three most common types of adjusting journal entries are accruals, deferrals and estimates.

Web Adjusting Entries Are Made In Your Accounting Journals At The End Of An Accounting Period After A Trial Balance Is Prepared.

Web an adjusting journal entry is a financial record you can use to track unrecorded transactions. Web an adjusting journal entry is an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period. An adjusting journal entry is typically made just prior to issuing a company’s financial statements. Post the adjusting journal entries.

Web Adjusting Entries Are Accounting Journal Entries That Convert A Company’s Accounting Records To The Accrual Basis Of Accounting.

At the end of each month, the amount that has been earned during the month must be reported on the income statement. An income statement, a statement of retained earnings, a balance sheet, and the statement of cash flows. 125k views 9 years ago simplifying accounting principles. Web the adjusting entry ensures that the amount of insurance expired appears as a business expense on the income statement, not as an asset on the balance sheet.