Cash Received In Advance Journal Entry - In the journal entry, cash has a debit of $4,000. Debit the cash account and credit the customer advances (liability) account. Web the company can make the journal entry for rent received in advance by debiting the cash account and crediting the unearned rent. On january 9, 2019, receives $4,000 cash in advance from a customer for services not yet rendered. Advance payments should relate to a particular customer account. Web whenever an advance payment is made, the accounting entry is expressed as a debit to the asset cash for the amount received. Verify the amount of the unearned revenue. Web revenue received in advance journal entry. When a buyer pays the seller in cash before receiving or making a shipment, this payment method is known as received cash in. Web create a special journal entry for advance payments of any kind.

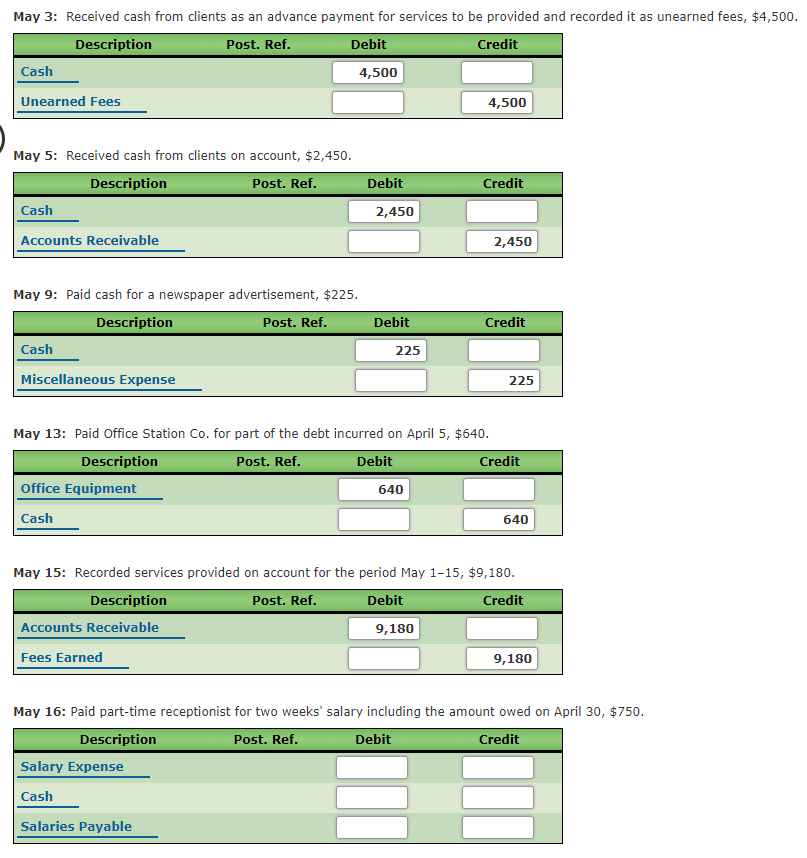

Solved May 3 Received cash from clients as an advance

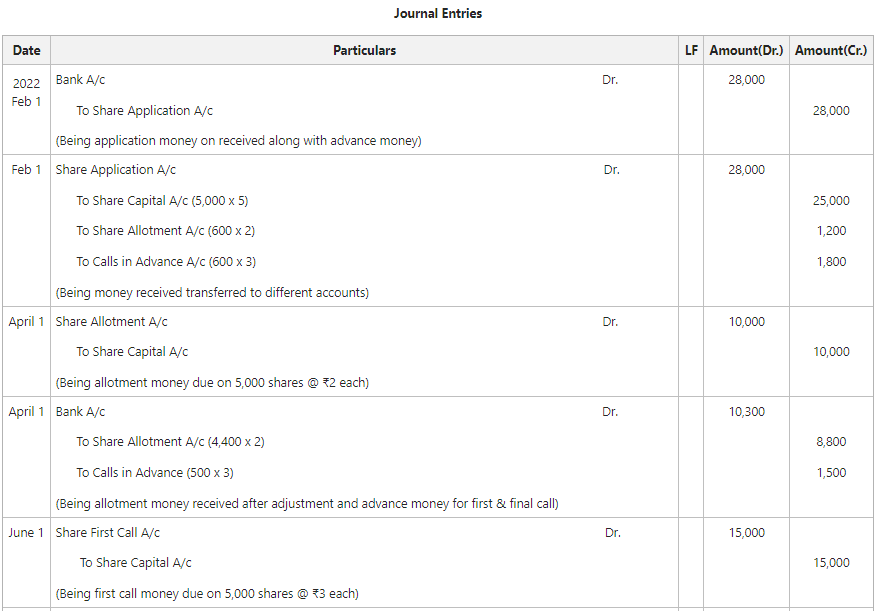

Journal entry for interest on capital. Web journal entry for cash paid in advance is the process of the company paying cash to the supplier.

Calls in Advance Accounting Entries on Issue of Shares

Verify the amount of the unearned revenue. Web when the company receives a cash advance from the customers, they need to record cash in but.

3.3 Use Journal Entries to Record Transactions and Post to TAccounts

Web received cash in advance journal entry. Web create a special journal entry for advance payments of any kind. Web the company can make the.

Cash Advance Received From Customer Double Entry Bookkeeping

Make accounting records for the. Web revenue received in advance journal entry. Web the company can make the journal entry for advance salary by debiting.

journal entry format accounting accounting journal entry template

Web a received cash on account journal entry is needed when a business has received cash from a customer and the amount is not allocated.

3.5 Use Journal Entries to Record Transactions and Post to TAccounts

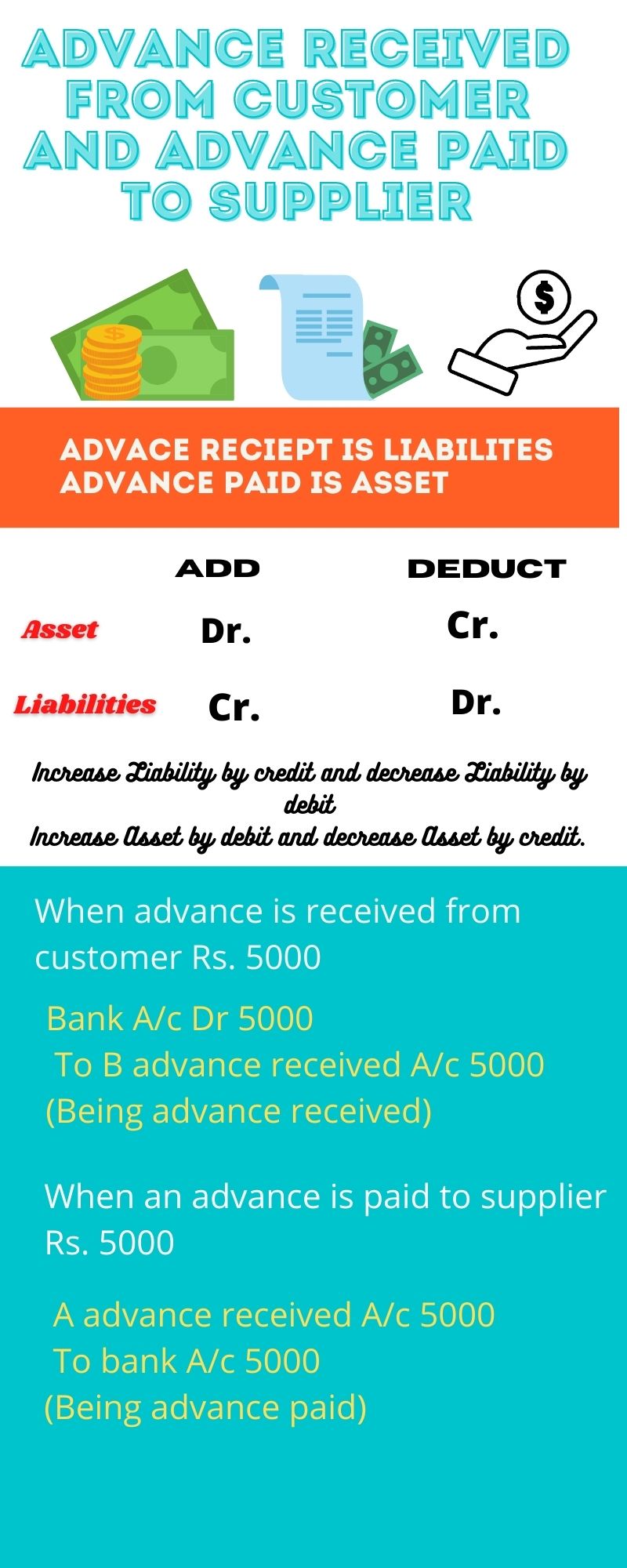

Customer advance account is shown on the liability side of the balance sheet as the related revenue is still unearned. Web revenue received in advance.

Journal entry of Advance received from Customer and advance paid to

Web journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or services..

Journal entries Meaning, Format, Steps, Different types, Application

Web journal entry for cash advance. This journal entry does not affect the. The cash paid in advance from the. Web under the income method,.

Recording Merchant Cash Advance Transactions deBanked

Verify the amount of the unearned revenue. Journal entry for amortization expense. The advance payment is classed as earned revenue if. The employees advance the.

Web Income Received In Advance Journal Entry.

Web revenue received in advance journal entry. Web the company can make the journal entry for rent received in advance by debiting the cash account and crediting the unearned rent. This depends on whether or not the goods or services have been delivered. Make accounting records for the.

Web The Company Can Make The Journal Entry For Advance Salary By Debiting The Advance Salary Account And Crediting The Cash Account.

Web when the company receives a cash advance from the customers, they need to record cash in but they cannot record the revenue as the goods/service are not yet provided. As per accrual based accounting the revenue is. This journal entry does not affect the. If a portion remains unearned at the end of the.

Customer Advance Account Is Shown On The Liability Side Of The Balance Sheet As The Related Revenue Is Still Unearned.

A credit also needs to be made to the liability. Web whenever an advance payment is made, the accounting entry is expressed as a debit to the asset cash for the amount received. Web under the income method, the entire amount received in advance is recorded as income using the following journal entry: The accounting records will show the following bookkeeping transaction entries to record the income received in advance.

The Company Needs To Record The Advance Received As The Liability On.

For instance, a company that receives $1,000 in. Web journal entry for cash paid in advance is the process of the company paying cash to the supplier before receiving the goods or services. Journal entry for accrued income. Journal entry for interest on capital.