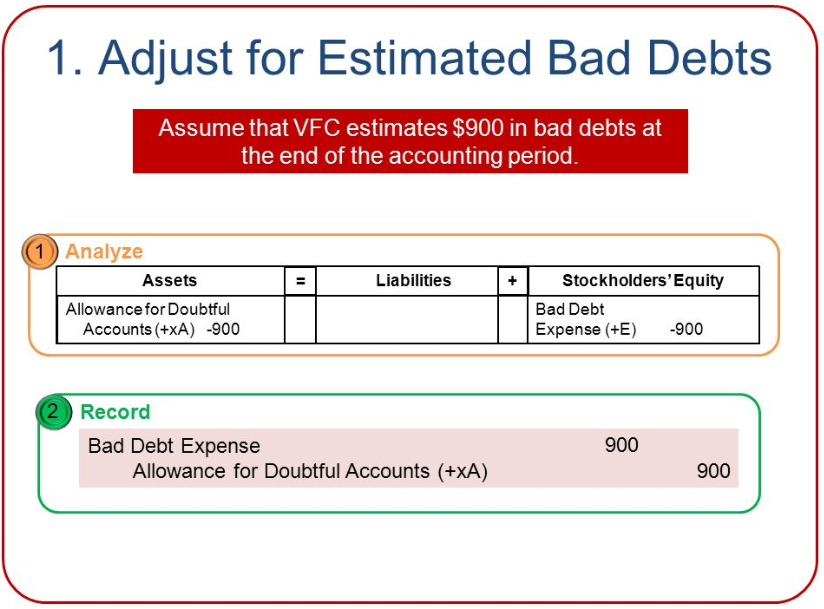

Journal Entry To Write Off Bad Debt - One method of recording the bad debts is referred to as the direct write off method which involves removing the specific uncollectible amount from accounts receivable and recording this as a bed debt expense in the income statement of the business. The journal entry is a debit to the bad debt expense account and a. Accounts receivable is an account in the balance sheet that represents the amount customers owe to a company. In this journal entry, the allowance for doubtful accounts is the contra account to accounts receivable in which its normal balance is on the credit side. Web when the company writes off accounts receivable under the allowance method, it can make journal entry by debiting allowance for doubtful accounts and crediting accounts receivable. What is a bad debt expense? The journal entry debits bad debt expense and credits allowance for bad debts. To record the collection of cash: Web pay the monthly minimums on all of your card debts (to avoid any late fees). This account holds all the receivable balances which may come from various customers.

Journal Entries for Bad Debts and Bad Debts Recovered YouTube

The closing journal entry for bad debts recovered would be as follows; Debit bad debts expense (to report the amount of the loss on the.

2024672 Bad Debt Provisions and Bad Debt WriteOffs Visma

What is the bad debt expense allowance method? The seller can charge the amount of an invoice to the bad debt expense account when it.

How Do I Write Off Bad Debt Expense Journal Entry

If a receivable appears on your statement of financial position that you no longer deem collectible, you must write it off. Web when the company.

How to calculate and record the bad debt expense QuickBooks

Journal entry for the allowance method for bad debt. Web when the company writes off accounts receivable under the allowance method, it can make journal.

How to Calculate Bad Debt Expense? Get Business Strategy

Nothing changes to the income statement. One method of recording the bad debts is referred to as the direct write off method which involves removing.

Accounting Q and A EX 914 Entries for bad debt expense under the

In this journal entry, the allowance for doubtful accounts is the contra account to accounts receivable in which its normal balance is on the credit.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

In this journal entry, the allowance for doubtful accounts is the contra account to accounts receivable in which its normal balance is on the credit.

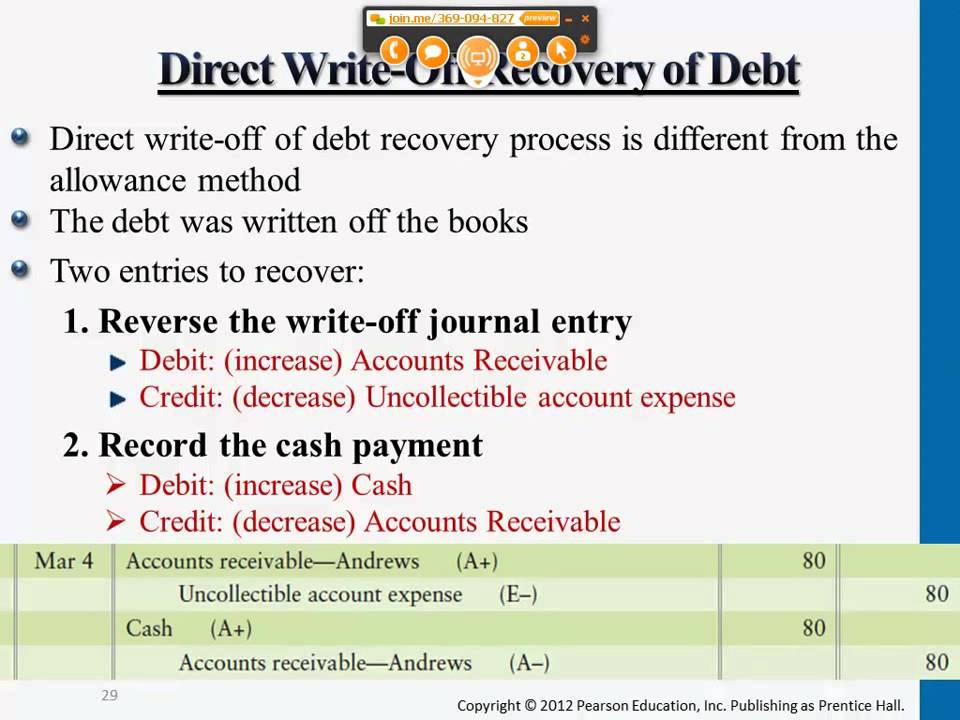

Direct Write Off Recovery of Debt Professor Victoria Chiu YouTube

The closing journal entry for bad debts recovered would be as follows; Web we can make the journal entry for bad debt written off under.

Bad Debt Journal Entry Bad Debt Recovered 28 Journal Entries

The account is removed from the accounts receivable balance and bad debt expense is increased. Nothing changes to the income statement. Web journal entry for.

What Is A Bad Debt Expense?

Accounts receivable is an account in the balance sheet that represents the amount customers owe to a company. Web it estimates its bad debts expense to be $1,500 (0.003 x $500,000) and records the following journal entry: Web we can make the journal entry for bad debt written off under the allowance method by debiting the allowance for doubtful accounts and crediting the accounts receivable. Web first, the company can make the journal entry for bad debt recovery by debiting the accounts receivable and crediting the allowance for doubtful accounts to reverse the entry that the company has previously made when writing off the customer’s account.

The Percentage Of Credit Sales Approach Focuses On The Income Statement And The Matching Principle.

Web accounting for written off bad debts: The journal entry debits bad debt expense and credits allowance for bad debts. The closing journal entry for bad debts recovered would be as follows; The account is removed from the accounts receivable balance and bad debt expense is increased.

The Seller Can Charge The Amount Of An Invoice To The Bad Debt Expense Account When It Is Certain That The Invoice Will Not Be Paid.

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. This account holds all the receivable balances which may come from various customers. Debit (cash a/c) assuming the recovery was done in cash. Web pay the monthly minimums on all of your card debts (to avoid any late fees).

One Method Of Recording The Bad Debts Is Referred To As The Direct Write Off Method Which Involves Removing The Specific Uncollectible Amount From Accounts Receivable And Recording This As A Bed Debt Expense In The Income Statement Of The Business.

Irrecoverable debts is the term that is used to describe this. Web journal entry for recovery of bad debts is as follows; Web direct write off method. To record the collection of cash: