Journal Entry For Written Off Bad Debts - Web a journal entry is made to write off a provision for bad debt expenditure. Web these are irrecoverable receivables considered an expense in a journal entry for bad debts. The allowance method estimates bad debt. If a receivable appears on your statement of financial position that you no longer deem. Web provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year. To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period. When the company writes off accounts receivable under the allowance method, it can make journal entry by. Web where bad debts were initially accounted for using allowance for bad debts, the reversal will be performed using the following journal entries: Web write off accounts receivable journal entry. Web journal entry for recovery of bad debts is as follows;

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

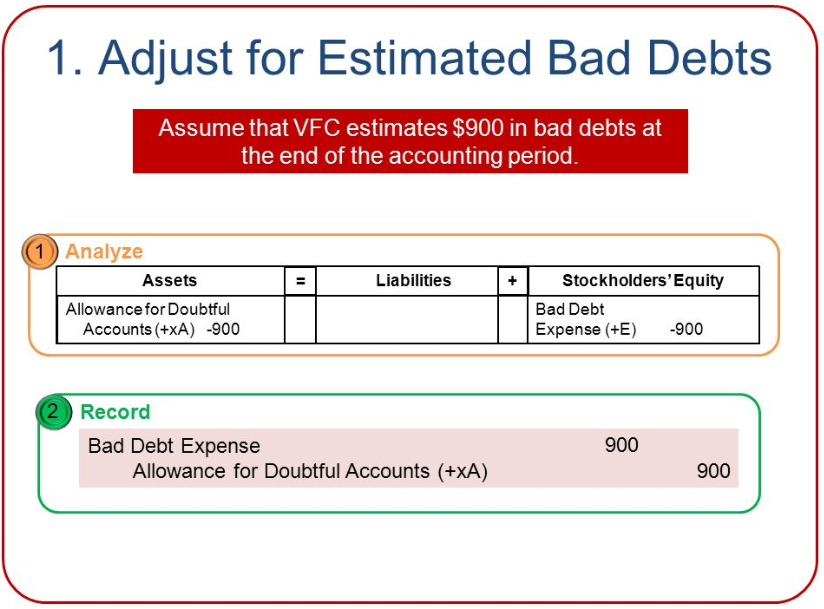

To recognize doubtful accounts or bad debts, an adjusting entry must be made at the end of the period. Web it estimates its bad debts.

Bad Debt Journal Entry Bad Debt Recovered 28 Journal Entries

Web journal entry for bad debts. Web provision for bad debts is the estimated percentage of total doubtful debt that must be written off during.

Solved How Do I Write This Account Off As A Bad Debt? I W...

Web write off accounts receivable journal entry. Rules applied as per modern or us style of accounting. It may also be necessary to reverse any.

How Do I Write Off Bad Debt Expense Journal Entry

Web a journal entry is made to write off a provision for bad debt expenditure. For example, in one accounting period, a company can experience.

How to calculate and record the bad debt expense QuickBooks

Web accounting for written off bad debts: Web these are irrecoverable receivables considered an expense in a journal entry for bad debts. Accounts receivable is.

Bad Debts Recovered Journal Entry CodyaxBray

Rules applied as per modern or us style of accounting. Web the correct bad debt expense journal entry depends on which method you’re using. The.

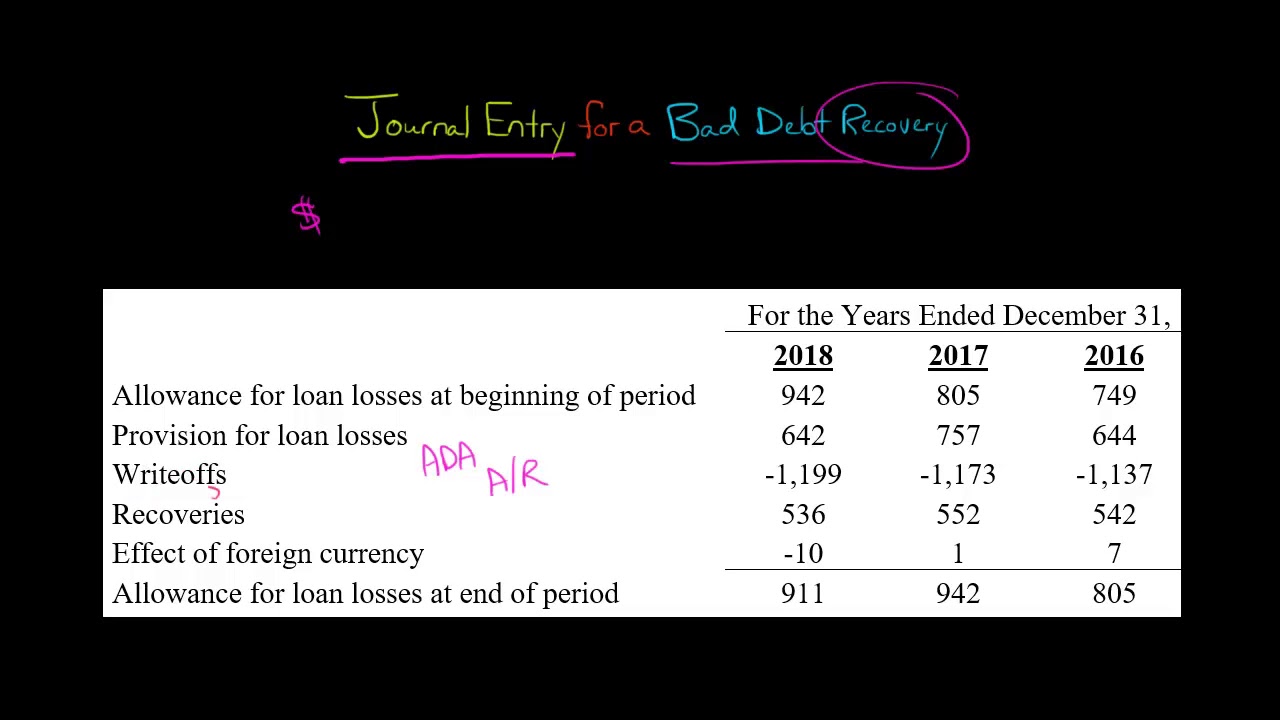

Journal Entry for a Bad Debt Recovery YouTube

Web when the company receives the cash payment from the customer’s account that had been written off, it needs to make two journal entries for.

How to Calculate Bad Debt Expense? Get Business Strategy

Web when the company receives the cash payment from the customer’s account that had been written off, it needs to make two journal entries for.

Accounting Q and A EX 914 Entries for bad debt expense under the

When the company writes off accounts receivable under the allowance method, it can make journal entry by. Web it estimates its bad debts expense to.

Web Bad Debt Entry In An Expense Journal (Definition And Steps) Indeed Editorial Team.

Web where bad debts were initially accounted for using allowance for bad debts, the reversal will be performed using the following journal entries: Debit (cash a/c) assuming the recovery was done in cash. The allowance method estimates bad debt. For example, in one accounting period, a company can experience large increases in.

Web A Journal Entry Is Made To Write Off A Provision For Bad Debt Expenditure.

Web journal entry for recovery of bad debts is as follows; Rules applied as per modern or us style of accounting. One method of recording the bad debts is referred to as the direct write off method which involves removing the. It may also be necessary to reverse any related sales.

It Is Done Because The Amount Of Loss Is.

Web journal entry for bad debts. Web when the company receives the cash payment from the customer’s account that had been written off, it needs to make two journal entries for the bad debt recovery. Web provision for bad debts is the estimated percentage of total doubtful debt that must be written off during the next year. Web accounting for written off bad debts:

Web Write Off Accounts Receivable Journal Entry.

When a business has payments it can't. The percentage of credit sales approach focuses on the income. If a receivable appears on your statement of financial position that you no longer deem. Web the journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account.