Journal Entry To Remove Customer Credit - I have a client who using quickbooks desktop enterprise version. In each case the credit note journal entries show the debit and credit account together with a brief narrative. It's either linking it manually with the checks individually or create a journal entry. Need help with a journal entry to remove credits in accounts payable. Bad debt provision bookkeeping entries. Web journal entry for the bad debt provision. Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: I'm assuming these credits were accumulated in a prior fiscal year. At the end of 2017, they received several credits from a. Web i am tidying up the books for year end and have a lot of old (sometimes years old) client credit notes that have not been claimed against new purchases.

Sales Credit Journal Entry What Is It, Examples, How to Record?

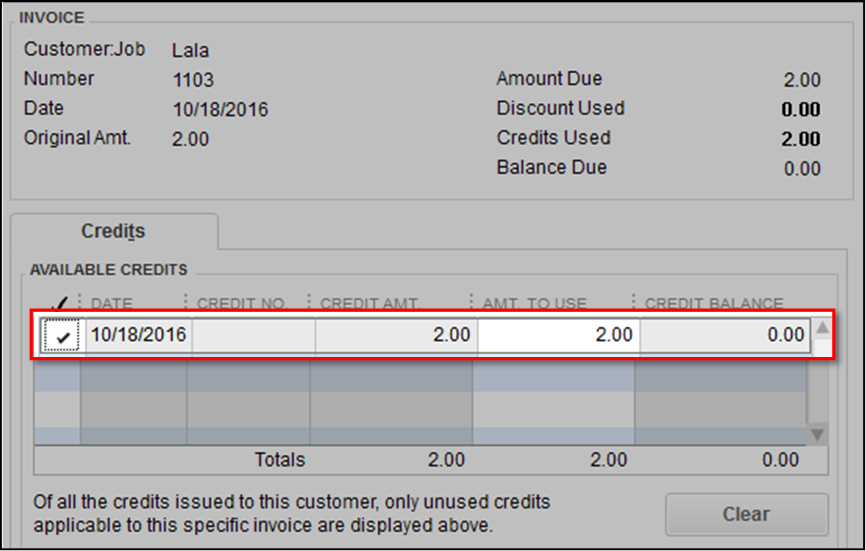

Mark the credit you want to apply, then click. I'm assuming these credits were accumulated in a prior fiscal year. Customer credit note journal entry..

Journal Entry Examples

In the first line, select accounts receivable a/r under the account column. A credit to accounts receivable (to remove the amount that will not. Bad.

Write off customer and vendor balances

Need help with a journal entry to remove credits in accounts payable. Web the bad debt written off is an expense for the business and.

Accounting for Sales Return Journal Entry Example Accountinguide

Web there are two ways to clear the credit memo. Apply the general journal entry to the existing credit/debit. Enter the name of the customer.

Sales Journal Entry Cash and Credit Entries for Both Goods and

General journal entries are different to other transactions in accountright. Base on the number of credit memos and the age. Therefore, at december 31 the.

Journal Entries Examples Format How To Use Explanation

Web the journal entry is debiting bad debt expenses and credit accounts receivable. Therefore, at december 31 the amount of services due to the customer.

Journal Entries Accounting

Web this requires the following adjusting entry: I'm assuming these credits were accumulated in a prior fiscal year. Web the journal entry is a debit.

Solved How to create Journal entry for credit note for a

In the record journal entry window ( accounts command. I'm assuming these credits were accumulated in a prior fiscal year. Web a separate journal entry.

How to use Excel for accounting and bookkeeping QuickBooks

Journal entries and credit memos will appear in the discount and credits window. The accounting records will show the following bookkeeping entries for the bad.

Web The Journal Entry Is Debiting Bad Debt Expenses And Credit Accounts Receivable.

Mark the credit you want to apply, then click. Web see changing or deleting a transaction. In each case the credit note journal entries show the debit and credit account together with a brief narrative. Web however, during the month the company provided the customer with $800 of services.

In The First Line, Select Accounts Receivable A/R Under The Account Column.

After this journal entry is recorded, gem’s july 31 balance sheet will report the net realizable value of its accounts receivables at. I'm assuming these credits were accumulated in a prior fiscal year. Web basic credit memo accounting entry; The accounting records will show the following bookkeeping entries for the bad debt write off.

Web A Separate Journal Entry In Your Liabilities Report Should Be Created For Credit Balances So You Can Easily See Your Liability Position And Make Appropriate Adjustments.

For customers with an overpayment, you can perform the. Web a credit note is issued to a customer; From the customers menu, select receive payments. General journal entries are different to other transactions in accountright.

Therefore, At December 31 The Amount Of Services Due To The Customer Is $500.

This is a pretty easy fix. Enter the name of the customer in the. Web when a specific customer’s account is identified as uncollectible, the journal entry to write off the account is: Most of these clients do.